Press release

Algorithmic Trading Market Expected to Reach USD 65.2 Billion by 2032

According to the report published by Allied Market Research, The Algorithmic Trading Market Expected to Reach USD 65.2 Billion by 2032. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.The market is growing rapidly, fueled by advancements in AI, machine learning, and big data analytics. Institutional investors and hedge funds are increasingly adopting algorithmic trading to enhance trading efficiency, reduce transaction costs, and capitalize on market opportunities in real-time. Regulatory support and the rise of high-frequency trading are further boosting market expansion.

Request Sample Report (Get Full Insights in PDF - 200 Pages) at: https://www.alliedmarketresearch.com/request-sample/A08567

The global algorithmic trading market was valued at $17.0 billion in 2023, and is projected to reach $65.2 billion by 2032, growing at a CAGR of 15.9% from 2024 to 2032.

The algorithmic trading market size is segmented on the basis of component, type, deployment mode, type of trader, and region. On the component, it is categorized into solution and services. On the basis of type, it is classified into stock markets, FOREX, ETF, bonds, cryptocurrencies, and others. As per the deployment mode, it is classified into cloud and on-premises. Depending on type of trader, it is divided into institutional investors, long-term traders, short-term traders, and retail investors. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the algorithmic trading market include Software AG, Metaquotes Software Corp., Argo SE, Tata Consultancy Services, Symphony Fintech Solutions Pvt Ltd., and Refinitiv Ltd. Other players in algorithmic trading market include 63moons, Algo Trader AG, Virtu Financial, Tethys and others.

Access the full summary at: https://www.alliedmarketresearch.com/algorithmic-trading-market-A08567

Recent Key Strategies and Developments

● For instance, in September 2022, Coin Shares, Europe's largest and longest standing full-service digital asset investment and trading group, launched HAL, a leading crypto-assets trading strategies platform. HAL aims to simplify and democratize crypto trading. It is designed to enable more users to boost their trading with professional algorithms, a simple user experience, fair and transparent pricing, and educational content.

● For instance, in March 2021, Cowen, an American multinational independent investment bank and financial services company launched an algorithmic trading solution to help institutional clients navigate algo trading market dynamics caused by increased? volumes of? retail? trading.

If you have any questions, Please feel free to contact our analyst at: https://www.alliedmarketresearch.com/connect-to-analyst/A08567

Regional/Country Market Outlook

Nearly 80% of equity trades in the U.S. are run by algorithms. Ever since India embraced algorithmic trading in 2008, there has been growing interest to raise this profile for investors and balance out the algorithmic trading market share. This practice is widely referred to as algorithmic trading, where a pre-programmed automated machine executes trade orders. According to several study, algorithmic trading accounted for 60-73% of equity trading in the U.S. Globally, the U.S. financial algo trading industry is the largest and most liquid.

Machine-driven trading has been around since the 1970s in the U.S. and has many benefits, faster order processing with lesser scope for errors, trade execution at the best price and low transaction costs. Moreover, in 2008, the Securities & Exchange Board of India issued a circular that Indian exchanges were being opened to algorithmic trading with the introduction of Direct Market Access, which meant institutional investors could trade without human intervention for the first time. The percentage of equities being traded via algorithms went up from 10% in 2011 to 50% by 2019.

● In February 2024, China's securities regulator tightened scrutiny of derivative businesses in the stock market and announced punishment of a hedge fund company for excessive, high-frequency trading in share index futures. The announcements represent the latest of a series of measures by the watchdog to revive investor confidence in a stock market wallowing near five-year lows. In addition, The China Securities Regulatory Commission (CSRC) will strengthen supervision of derivatives including DMA-Swap products.

● In July 2023, CAC, the National Development and Reform Commission, the Ministry of Education (MOE) , the Ministry of Science and Technology (MST) , the MIIT, and the MPS jointly published the Generative AI Regulation, came into force on August 15, 2023, targeting a broader scope of generative AI technologies.

● In 2010, SEBI approved the launch of Smart Order Routing for investors to place their trades with the confidence of getting the best price possible from exchanges. This was followed by the NSE offering Tick by Tick data and Co Location servers to members.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A08567

Industry Trends

● In September 2023, the Shanghai Stock Exchange, the Shenzhen Stock Exchange and the Beijing Stock Exchange, under the guidance of the China Securities Regulatory Commission, respectively formulated and issued the notice on matters related to the Reporting of the Stock Algorithm Trading and the notice on strengthening the regulation of algorithm trading to put the use of algorithm trading under closer scrutiny.

● In April 2023, the MST published the Draft Ethical Review Measure for public consultation, focusing on the ethical review of science and technology activities that have ethical risks, such as the research and development (R&D) of AI technologies.

Buy Now & Get Exclusive Discount on this Report (200 Pages PDF with Insights, Charts, Tables, and Figures) at: https://www.alliedmarketresearch.com/algorithmic-trading-market/purchase-options

Thanks for reading this article you can also get individual chapter-wise sections or region-wise report versions like North America Europe or Asia.

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Lastly this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles Avenue. An e-access library is accessible from any device anywhere and at any time for entrepreneur's stakeholder's researchers and students at universities. With reports on more than 60000 niche markets with data comprising of 600000 pages along with company profiles on more than 12000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients' requirements is complemented with analyst support and customization requests.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Expected to Reach USD 65.2 Billion by 2032 here

News-ID: 4008917 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

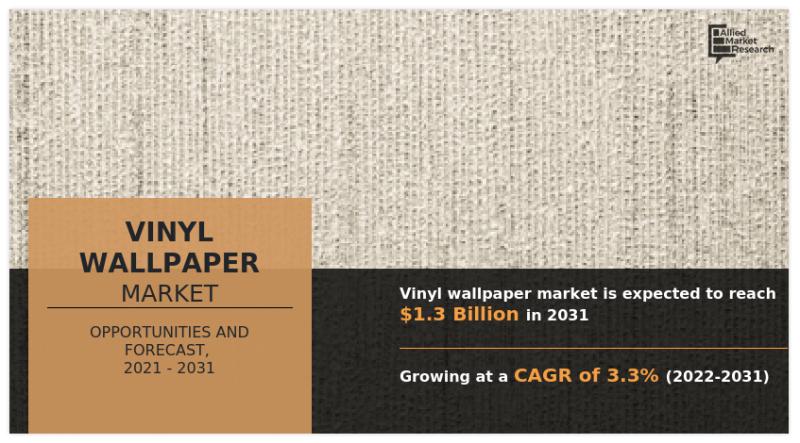

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

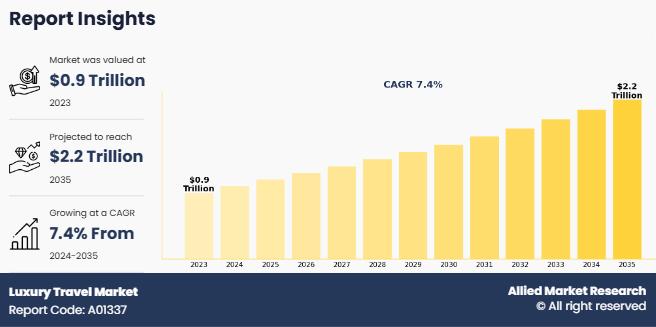

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Algo

Best Crypto To Explode : Algorand (ALGO) vs Pepeto

Algorand identifies itself as a scalable pure proof-of-stake blockchain with ALGO trading at $0.13 and market capitalization of $1B based on January 2026 CoinMarketCap data. Recently, the network declared to re-enter the U.S. market with a relocation of the headquarters to Delaware, which is an indication of fresh attention towards domestic institutional adoption in the use cases of payments and asset tokenization.

Technical analysts see the opportunity to rise to…

TrustStrategy Expands AI Capabilities to Strengthen Algo Crypto Trading Infrastr …

United States, 14th Oct 2025 - TrustStrategy, an AI-powered investment plan, has announced an infrastructure enhancement focused on improving its algo crypto performance and system precision. The update reflects the platform's continued focus on advancing automation, analytics, and scalability within the digital asset sector.

As trading volumes across global exchanges continue to grow, efficiency and data accuracy remain core challenges for institutional and individual participants. TrustStrategy's latest update integrates advanced AI…

Algo Trading Software Market Future Business Opportunities 2025-2032

The research report on the Algo Trading Software Market provides detailed statistics, trends, and analyses that clarify the current and future landscape of the industry. It identifies key growth drivers, constraints, trends, and opportunities, along with assessments of the competitive landscape and detailed company profiles. The report presents year-over-year growth rates along with the compound annual growth rate (CAGR), offering crucial insights for decision-makers through a detailed pricing analysis. Additionally,…

MasterQuant Introduces Next-Generation Automation in Algo Trading

The world is changing and so is the financial landscape as AI and automation reshape trading strategies. At the heart of this change, MasterQuant has released new updates to its trading technology to improve accuracy, flexibility, and speed in traditional and digital asset markets.

The latest system upgrade focuses on autotrade performance and algorithmic decision-making. By combining advanced analytics, deep learning, and real-time data modelling, MasterQuant wants to provide consistency across…

Momentum Algo Pro: Advancing Investment Strategies with Superior Client Engageme …

Momentum Algo Pro (MAP), a pioneer in algorithmic investing, is excited to unveil new client engagement initiatives that are set to redefine the investment experience. These initiatives reflect MAP's unwavering commitment to delivering exceptional service and personalized support to its esteemed clients.

Empowering Investors through Enhanced Interaction and Insight

Sal Habibi, the visionary lead advisor and investor at MAP, emphasizes the importance of a personalized investment journey. "We believe in fostering a…

At 10.1% CAGR Automated Algo Trading Market Expected to Reach $35 Billion by 203 …

According to the report published by Allied Market Research, the global automated algo trading market generated $13.5 billion in 2021, and is projected to reach $35 billion by 2031, growing at a CAGR of 10.1% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂

https://www.alliedmarketresearch.com/request-sample/A19438

The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities,…