Press release

AI Rides The Surge In Mobile Banking Demand: A Significant Driver Propelling The AI in Banking Market In 2025

The AI in Banking Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the AI in Banking Market Size and Projected Growth Rate?

In recent times, the market size for AI in banking has been on a significant increase. It is projected to rise from $11.71 billion in 2024 to $15.37 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 31.3%. The strong growth during the historical period is due to factors such as increased data in banking, improved customer service, successful fraud detection and prevention, a reduction in costs via automation, and competitive stress.

In the coming years, the AI in banking market size is anticipated to witness significant expansion. The market's value is projected to reach $50.63 billion by 2029, with a compound annual growth rate (CAGR) of 34.7%. Factors fuelling this growth throughout the forecast period include the broadening applications of AI in areas such as credit scoring, multichannel support chatbots, AI-led wealth management, open banking endeavours, and the implementation of explainable AI for greater transparency. The upcoming period's key trends encompass voice and chatbot interfaces for customer communication, the use of predictive analytics to tailor banking services, AI solutions ensuring regulatory compliance, security and transparency reinforcement through blockchain incorporation, and the emergence of robo-advisors in the wealth management sector.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=10506

What Are the Major Segments in the AI in Banking Market?

The AI in banking market covered in this report is segmented -

1) By Component: Solution, Service

2) By Technology: Machine Learning And Deep Learning, Natural Language Processing (NLP), Computer Vision, Other Technologies

3) By Organization Size: Small And Medium Sized Banks, Large Overseas Banks

4) By Application: Risk Management Compliance And Security, Customer Service, Back Office or Operations, Financial Advisory, Other Applications

Subsegments:

1) By Solution: Chatbots and Virtual Assistants, Fraud Detection and Prevention Solutions, Risk Management Solutions, Customer Analytics Solutions, Automated Wealth Management Solutions

2) By Service: Consulting Services, Implementation Services, Maintenance and Support Services, Training and Education Services, Managed Services

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10506&type=smp

What Are The Driving AI in Banking Market Evolution?

The burgeoning need for mobile banking facilities is projected to be a catalyst for the advancement of AI in the banking ecosystem. Essentially, mobile banking, facilitated by financial bodies, permits customers to execute monetary transactions digitally via mobile gadgets such as tablets or smartphones. By capitalizing on mobile handsets and banking applications, individuals can manage their financial undertakings anytime and anywhere. This escalating interest in mobile banking platforms has spurred the assimilation of AI within banking infrastructures, a movement likely to persist. For instance, data from E-commerce Tips, a US-centric e-commerce analysis firm, from January 2024, exhibit an uptick in digital payment engagements from 51% in 2021 to 62% in 2022. Moreover, e-commerce, constituting the majority of the worldwide digital payments market, represented approximately $6.31 trillion in 2023 and is anticipated to reach $6.913 trillion in 2024. The emergence of digital wallets such as PayPal, Venomo, and ApplePay has not displaced the usage of credit cards and checks in B2B transactions in the US, still accounting for 39% and 26%, respectively. Consequently, the growing appeal for mobile banking facilities is propelling the development of AI in banking markets.

Which Firms Dominate The AI in Banking Market Segments?

Major companies operating in the AI in banking market include Google LLC, Intel Corporation, Hewlett Packard Enterprise Development LP, accenture* plc, International Business Machines Corporation., Cisco Systems Inc., Oracle Corporation, SAP SE, Infosys Limited, Ally Financial Inc., Fair Isaac Corporation, SAS Institute Inc., International Business Machines Corporation, IPsoft Inc., Nuance Communications, Inc., HighRadius Corporation, Vectra AI, Inc., Amazon Web Services Inc., Kreditech Holding SSL GmbH, Kensho Technologies, Inc., RapidMiner Inc., BigML Inc., Lingxi Technology Co. Ltd.

What Trends Are Expected to Dominate the AI in Banking Market in the Next 5 Years?

The adoption of cutting-edge technologies is a prominent trend emerging in the AI in banking industry. To maintain their market position, firms in this sector are incorporating novel technologies. As an illustration, the Jordan Ahli Bank, a financial firm based in Jordan, initiated a technology named ahliGPT, powered by AI in April 2023. This technology facilitates quick and precise responses to customer queries or problems related to banking and financial services, thereby saving time and effort for both the bank's customers and employees.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/ai-in-banking-global-market-report

Which Is The Largest Region In The AI in Banking Market?

Asia-Pacific was the largest region in the AI in banking market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global AI in banking market report during the forecast period. The regions covered in the AI in banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the AI in Banking Market?

2. What is the CAGR expected in the AI in Banking Market?

3. What Are the Key Innovations Transforming the AI in Banking Industry?

4. Which Region Is Leading the AI in Banking Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI Rides The Surge In Mobile Banking Demand: A Significant Driver Propelling The AI in Banking Market In 2025 here

News-ID: 4007296 • Views: …

More Releases from The Business Research Company

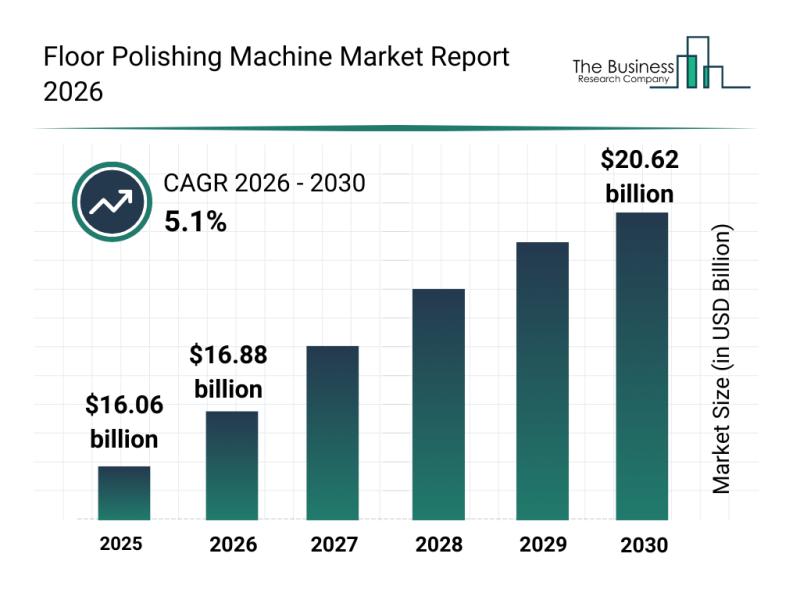

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Fl …

The floor polishing machine industry is on the verge of significant expansion as advancements in technology and growing demand from various sectors drive market momentum. This report will explore the current market valuation, key players, prominent trends, and notable segments shaping the future of floor polishing machinery.

Market Valuation Outlook for Floor Polishing Machines by 2030

The floor polishing machine market is poised for substantial growth in the coming years, expected…

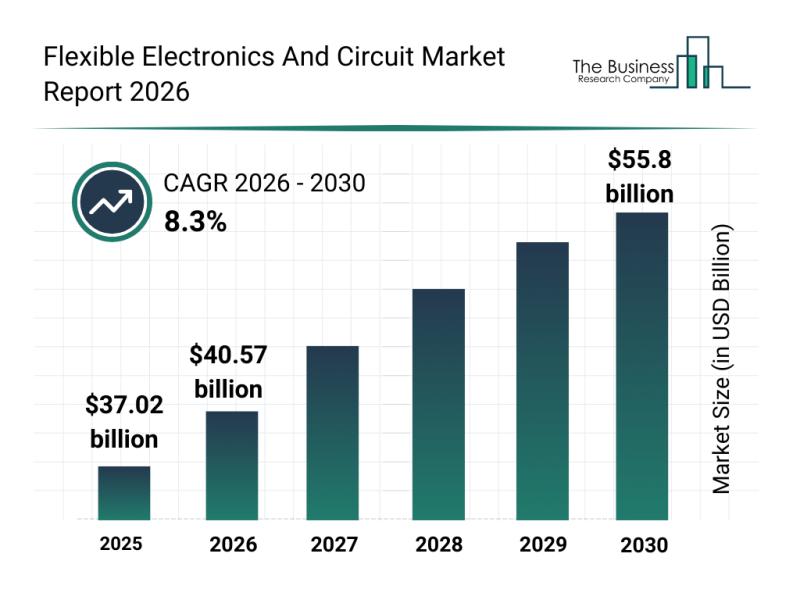

Competitive Landscape: Key Market Leaders and New Entrants in the Flexible Elect …

The flexible electronics and circuit sector is positioned for impressive expansion in the coming years, driven by rapid technological advancements and increasing applications across various industries. As innovation pushes the boundaries of what flexible technology can do, this market is set to experience significant growth and transformation.

Projected Market Valuation and Growth in Flexible Electronics and Circuit Market

The flexible electronics and circuit market is anticipated to reach a valuation of…

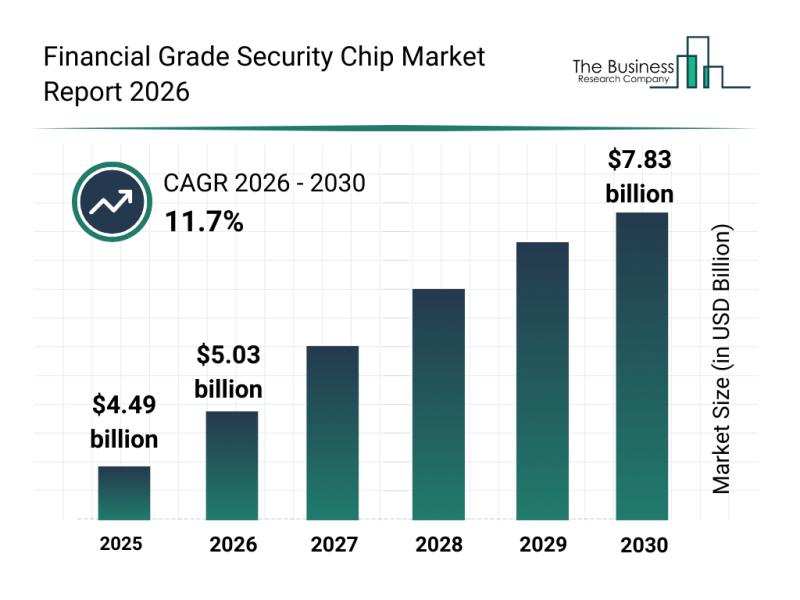

Financial Grade Security Chip Market Overview: Major Segments, Strategic Develop …

The financial grade security chip market is on a trajectory of significant expansion, driven by the increasing demand for robust digital security solutions in an evolving technological landscape. As digital transactions and connected devices become more prevalent, the market is set to experience substantial growth fueled by innovation and heightened security standards.

Financial Grade Security Chip Market Size and Long-Term Growth Outlook

The market for financial grade security chips is projected…

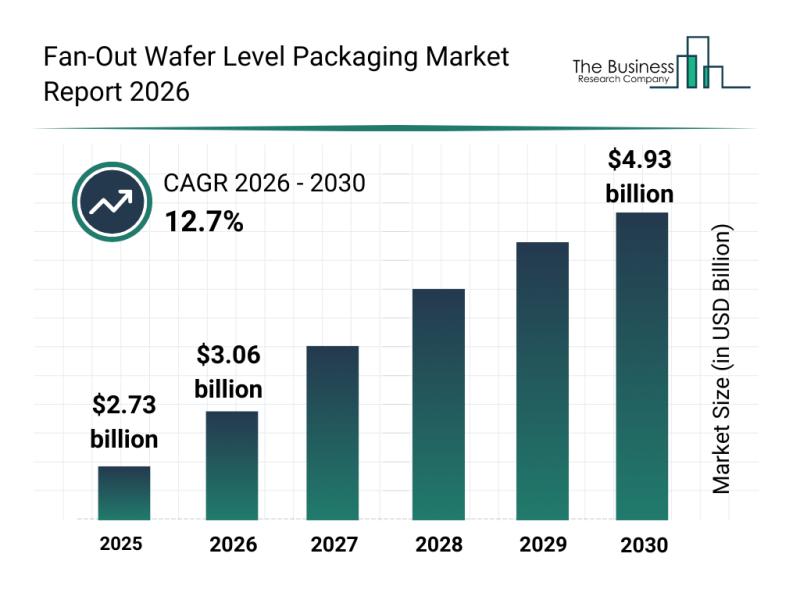

Analysis of Key Market Segments Influencing the Fan-Out Wafer Level Packaging Ma …

The fan-out wafer level packaging sector is set to experience significant expansion in the coming years, driven by growing demand across various high-tech industries. With advancements in semiconductor integration and increasing needs in automotive and communication technologies, this market is positioned for impressive growth and innovation. Here, we explore the market size projections, leading companies, key trends, and segment dynamics shaping the future of fan-out wafer level packaging.

Forecasted Market Size…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…