Press release

Invoice Factoring Industry to Double in Size with Projected 10.11% CAGR

Invoice Factoring Market was valued at USD 2.32 Billion in 2023 and is expected to reach USD 4.55 Billion by 2030, exhibiting a CAGR of 10.11 % during the forecast period (2024-2030).Invoice Factoring Market Overview:

The invoice factoring market has gained traction as a valuable financial tool for businesses seeking to improve cash flow without taking on traditional debt. By selling accounts receivable to a third-party factoring company, businesses can access immediate funds to support operations, growth, or manage working capital needs. This financial service is particularly popular among small and medium enterprises (SMEs) that may face delays in payment cycles. With increasing awareness of alternative financing options, invoice factoring is becoming a mainstream solution across various industries including manufacturing, logistics, and retail.

Download a Free Sample Report Today : https://www.maximizemarketresearch.com/request-sample/168342/

Invoice Factoring Market Dynamics:

Several factors are driving the expansion of the invoice factoring market. On the demand side, the need for efficient cash flow management and access to quick liquidity remains a critical concern for many businesses, especially in uncertain economic climates. On the supply side, technological advancements in financial services have made it easier for factoring companies to assess credit risk and streamline the transaction process. However, challenges such as the high cost of factoring and concerns around customer relationships in disclosed factoring agreements can limit broader adoption. Regulatory changes and evolving fintech solutions are also reshaping market dynamics.

Invoice Factoring Market Outlook and Future Trends :

The future of the invoice factoring market looks optimistic, with anticipated growth fueled by digital transformation and the increasing adoption of financial technology platforms. Automation and artificial intelligence are being integrated into factoring services to enable faster approvals and reduce manual processing. Additionally, the rise of online marketplaces and B2B e-commerce is creating new opportunities for invoice financing solutions. As businesses continue to prioritize flexibility in their funding strategies, invoice factoring is expected to play a central role in supporting liquidity, particularly in emerging markets where access to traditional finance remains limited.

Key Recent Developments:

Recent developments in the invoice factoring industry highlight an ongoing shift toward digital innovation and strategic partnerships. Fintech firms are entering the space with platform-based solutions that offer faster processing times and lower costs compared to traditional factoring models. Some major financial institutions have also expanded their offerings by incorporating invoice factoring into their business banking services. Meanwhile, regulatory bodies in various regions are beginning to establish clearer frameworks for alternative lending practices, which could enhance transparency and foster growth. These developments suggest a more competitive and technologically advanced landscape in the years ahead.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report : https://www.maximizemarketresearch.com/request-sample/168342/

Invoice Factoring Market Segmentation:

by Type

Recourse Factoring

Non-recourse Factoring

by Application

Domestic

International

by Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises

by Provider

Banks

NBFCs

by Industry

Vertical Construction

Manufacturing

Healthcare

Transportation and Logistics

Energy and Utilities

IT and Telecom

Staffing

Others

Some of the current players in the Invoice Factoring Market are:

1.Porter Capital

2. Adobe

3. Barclays Bank UK PLC

4. ICBC

5. Intuit Inc.

6. American Express Company

7. Lloyds Bank

8. Sonovate

9. Waddle

10. Velotrade

11. eCapital

12. Triumph Business Capital

13. Breakout Capital

14. Nav

15.altLINE

16. Riviera Finance

17. RTS Financial

18. Fundbox

19.Paragon Financial Group

For additional reports on related topics, visit our website:

♦ Blu ray Players Market https://www.maximizemarketresearch.com/market-report/global-blu-ray-players-market/63184/

♦ Asia Pacific Portable Battery Pack Market https://www.maximizemarketresearch.com/market-report/asia-pacific-portable-battery-pack-market/10467/

♦ Board Mount Pressure Sensor Market https://www.maximizemarketresearch.com/market-report/global-board-mount-pressure-sensor-market/86663/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Invoice Factoring Industry to Double in Size with Projected 10.11% CAGR here

News-ID: 4006860 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

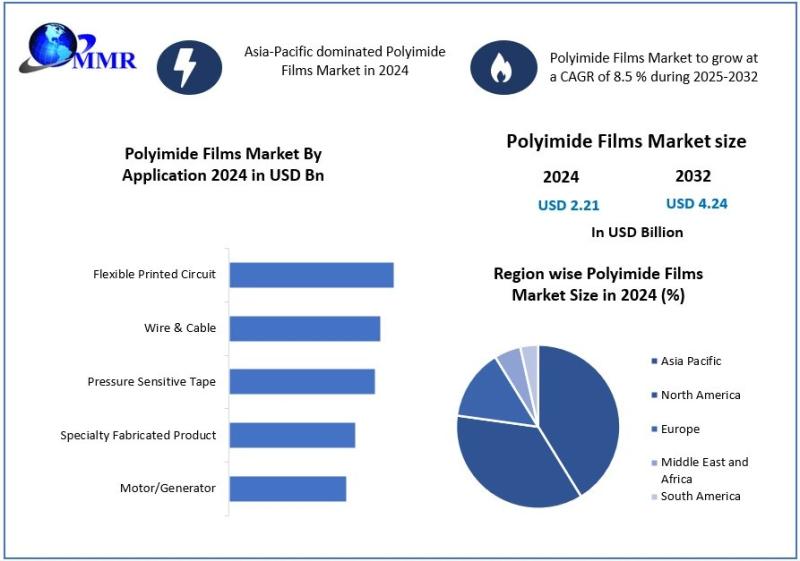

Polyimide Films Market Outlook: USD 2.21 Billion in 2024, Projected Growth to US …

Polyimide Films Market size was valued at USD 2.21 Billion in 2024 and the total Polyimide Films Market revenue is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching nearly USD 4.24 Billion.

Polyimide Films Market Overview:

The polyimide films market is experiencing robust growth due to the increasing demand for high-performance materials in industries such as electronics, automotive, aerospace, and renewable energy. Polyimide films are known for…

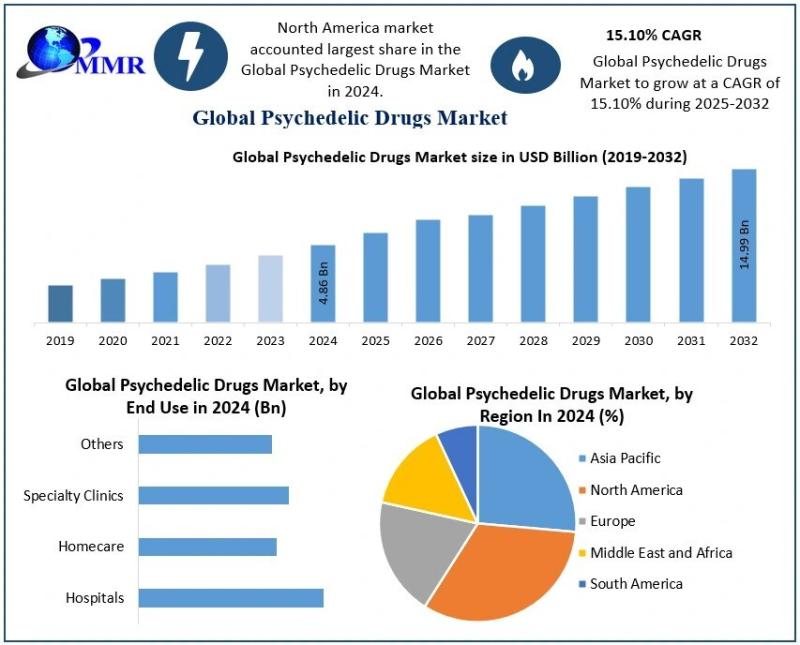

Psychedelic Drugs Market: Expected to Grow from USD 4.86 Billion in 2024 to USD …

Psychedelic Drugs Market size was valued at USD 4.86 Billion in 2024 and the total Psychedelic Drugs revenue is expected to grow at a CAGR of 15.10% from 2025 to 2032, reaching nearly USD 14.99 Billion.

Psychedelic Drugs Market Overview:

The psychedelic drugs market is emerging as a transformative sector in the global pharmaceutical and mental health industries. Psychedelic substances, such as psilocybin (found in magic mushrooms), MDMA, LSD, and DMT, are…

Parcel Delivery Market Projected Growth: USD 5.55 Billion in 2025 to USD 7.40 Bi …

Parcel Delivery Market size was valued at USD 5.55 Billion in 2025 and the total Parcel Delivery revenue is expected to grow at a CAGR of 4.2% from 2025 to 2032, reaching nearly USD 7.40 Billion by 2032.

Parcel Delivery Market Overview:

The parcel delivery market has seen rapid growth, largely driven by the rise of e-commerce, changing consumer behaviors, and increasing demand for fast, reliable shipping solutions. As more consumers shop…

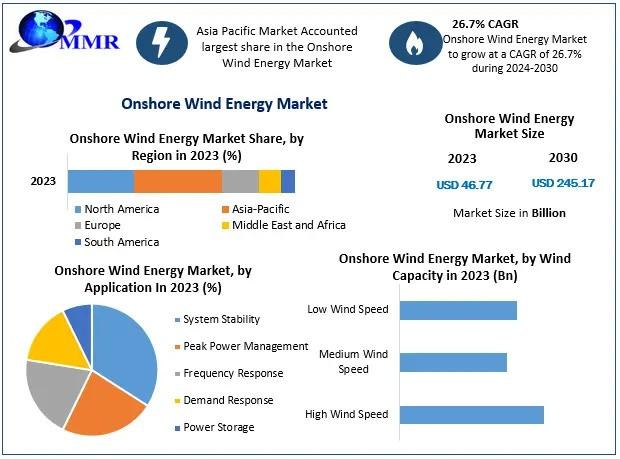

Onshore Wind Energy Market Projected to Hit USD 245.17 Bn by 2030 with 26.7% CAG …

Onshore Wind Energy Market is expected to reach USD 245.17 Bn. at a CAGR of 26.7 % during the forecast period 2030.

Onshore Wind Energy Market Overview:

The onshore wind energy market is one of the fastest-growing segments in the global renewable energy sector. With increasing concerns over climate change and the transition to clean energy, onshore wind energy has become a key solution to meet the world's growing energy demands sustainably.…

More Releases for Factoring

Growing Reverse Factoring Adoption Boosts Market Growth: Critical Driver Shaping …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Reverse Factoring Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the reverse factoring market has seen significant growth. It is expected to increase from $539.41 billion in 2024 up to $592.1 billion in 2025, representing a compound annual growth rate…

Factoring Market Next Big Thing | Major Giants BNP Paribas, HSBC, Deutsche Facto …

HTF MI just released the Global Factoring Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Factoring Market are:

BNP Paribas, HSBC, Deutsche Factoring Bank, Eurobank,…

What's Driving the Reverse Factoring Market 2025-2034: Growing Reverse Factoring …

What Are the Projections for the Size and Growth Rate of the Reverse Factoring Market?

The market size of reverse factoring has seen significant growth over the last few years. It is projected to expand from $539.41 billion in 2024 to $592.1 billion in 2025, displaying a compound annual growth rate (CAGR) of 9.8%. The growth trajectory in the past can be linked to the increased awareness of supply chain finance…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Factoring Market Outlook 2024-2030: Trends and Opportunities|BNP Paribas, Deutsc …

Infinity Business Insights is providing qualitative and informative knowledge by adding the title factoring Market to recognize, describe and forecast the global market. The report provides systematic consideration analysis along with forecasts for market players. The report aims to facilitate understanding of the global factoring market forecast through statistical and numerical data in the form of tables, graphs, and charts. The study provides a calculated assessment of new recent developments,…

Factoring Services Market is Booming Worldwide | Deutsche Factoring Bank, Euroba …

The Latest Released Factoring Services market study has evaluated the future growth potential of Global Factoring Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers,…