Press release

India Fintech Market Expected to Surpass US$ 769.5 Bn by 2031 - Persistence Market Research

The India fintech market is experiencing explosive growth, fueled by a combination of technology adoption, favorable regulatory reforms, and a large, underserved population. Estimated at US$106.2 Bn in 2024, the market is poised to surge to a remarkable US$769.5 Bn by 2031, growing at a robust CAGR of 32.7% during the forecast period. This exceptional growth is driven by increasing smartphone penetration, expanding digital infrastructure, and supportive government initiatives such as Digital India and Unified Payments Interface (UPI). Fintech services, ranging from digital payments and lending to wealth management and insurtech, are revolutionizing how financial services are delivered and consumed across urban and rural India alike.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response):

https://www.persistencemarketresearch.com/samples/34366

Digital payments continue to lead as the dominant segment in the India fintech market, largely driven by the surge in UPI transactions and mobile wallet adoption. Geographically, South India is emerging as the leading region, particularly cities like Bangalore and Hyderabad, due to their strong IT ecosystems, digital literacy, and innovative fintech startups. Meanwhile, North and West India are also catching up rapidly, creating a balanced nationwide fintech landscape that promises inclusive financial growth.

Key Highlights from the Report

➤ The India fintech market is projected to grow at a CAGR of 32.7% from 2024 to 2031.

➤ The market is expected to rise from US$106.2 Bn in 2024 to US$769.5 Bn by 2031.

➤ Digital payments remain the most dominant segment, driven by UPI and mobile wallet adoption.

➤ South India is the leading geographical region, with Bangalore being a fintech innovation hub.

➤ Regulatory reforms like RBI's sandbox framework are fostering innovation and compliance.

➤ Strategic partnerships and AI integration are transforming lending and investment solutions.

Market Segmentation

The Indian fintech market is segmented into several dynamic categories based on service type, technology, deployment mode, end-user, and geographical zones. On the basis of service type, the market includes payments, lending, banking, insurance, and wealth management and investment. Among these, digital payments lead the pack, followed by lending platforms that utilize alternative data to disburse credit efficiently.

Technology-wise, fintech companies are embracing AI & ML, blockchain, robotic process automation (RPA), and application programming interfaces (APIs) to streamline operations, mitigate risks, and personalize financial services. In terms of deployment, cloud-based solutions are preferred for scalability and cost-effectiveness, although on-premises systems still hold relevance for legacy institutions.

By end-user, fintech services cater to banks, non-banking financial companies (NBFCs), financial institutions, and investment firms. Finally, the market is also segmented geographically into North, South, East, and West India, reflecting regional diversity in digital adoption and fintech innovation.

Regional Insights

South India is the frontrunner in fintech innovation, with Karnataka, Tamil Nadu, and Telangana offering fertile ground due to their robust tech ecosystems. Bangalore, in particular, is a global startup hub and has been pivotal in driving the region's fintech leadership. Access to skilled talent and investor interest have bolstered the region's market dominance.

North India, including Delhi-NCR and Uttar Pradesh, is fast catching up by leveraging government digital initiatives and growing fintech startups. The region's large population and improving digital literacy contribute significantly to market expansion.

West India, led by Maharashtra and especially Mumbai, benefits from being India's financial capital. It attracts a high density of fintech investments, partnerships with banks, and regulatory engagement, positioning it as a key player in the national fintech ecosystem.

East India, although still in the early stages of fintech adoption, presents untapped potential, especially in rural financial inclusion and mobile banking. Efforts to improve digital infrastructure are expected to unlock growth in the coming years.

Market Drivers

India's fintech market is buoyed by several structural and behavioral drivers. A key enabler is the government's Digital India initiative, which has accelerated the penetration of digital services into semi-urban and rural areas. The Unified Payments Interface (UPI) has revolutionized digital payments by providing seamless interoperability and real-time transfer capabilities.

Another critical driver is smartphone and internet penetration. India boasts over 600 million smartphone users, enabling fintech applications to reach the masses. The tech-savvy millennial population, which is comfortable with digital interfaces, is further fueling demand for mobile-first financial solutions. The rise of neobanks and AI-driven personalization tools also enhances customer experience, encouraging widespread adoption.

Additionally, the growing availability of digital infrastructure such as Aadhaar-based e-KYC has simplified onboarding and verification processes, making fintech services more accessible and secure.

Market Restraints

Despite its rapid growth, the fintech market in India is not without its challenges. Regulatory ambiguity is a primary restraint, especially for startups that may struggle to navigate the complex and evolving compliance landscape governed by the Reserve Bank of India (RBI). Obtaining licenses and adhering to sector-specific regulations can be resource-intensive and slow down product development.

Another major concern is the lack of uniform digital infrastructure, particularly in remote and rural areas. Inconsistent internet connectivity and low digital literacy rates limit the effectiveness of fintech solutions in these regions. These gaps need to be addressed through strategic investments and public-private partnerships to ensure inclusive growth.

Cybersecurity risks also pose a significant threat. As fintech firms handle sensitive customer data, the need for robust security measures and data protection regulations becomes imperative to build consumer trust and ensure long-term market sustainability.

Market Opportunities

India's fintech landscape is ripe with opportunities that can transform the financial fabric of the nation. The digital payments revolution remains a standout opportunity, supported by a large unbanked population and high smartphone usage. Technologies such as QR codes, UPI, and mobile wallets are making transactions easier, faster, and more secure.

Another significant opportunity lies in alternative credit scoring. By using digital footprints, utility bill payments, and even social media behavior, fintech companies are redefining credit evaluation and enabling underserved individuals and MSMEs to access loans. This is especially transformative for rural areas and first-time borrowers.

Furthermore, wealth-tech platforms offering AI-based financial advisory and robo-advisory services are gaining popularity among millennials and Gen Z users. Partnerships with e-commerce companies and the rise of embedded finance further broaden the horizons for fintech companies to diversify revenue streams and scale operations.

Frequently Asked Questions (FAQs)

◆ How big is the India fintech market in 2024?

◆ What is the projected growth rate of the India fintech market through 2031?

◆ Who are the key players in the India fintech market?

◆ What are the main challenges facing fintech companies in India?

◆ Which region is estimated to dominate the India fintech industry during the forecast period?

Company Insights

• Paytm

• PhonePe

• Razorpay

• Policybazaar

• Zerodha

• CRED

• Lendingkart

• Bharat

• MobiKwik

• Google Pay

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Fintech Market Expected to Surpass US$ 769.5 Bn by 2031 - Persistence Market Research here

News-ID: 4005459 • Views: …

More Releases from Persistence Market Research

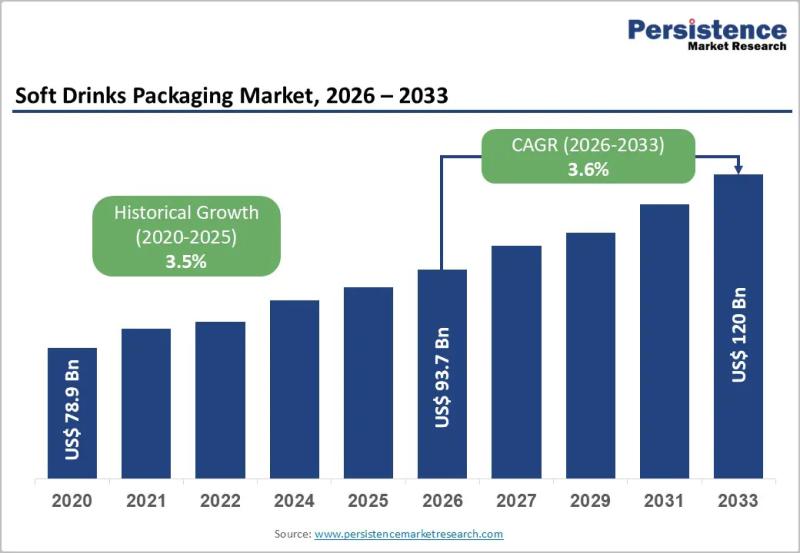

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

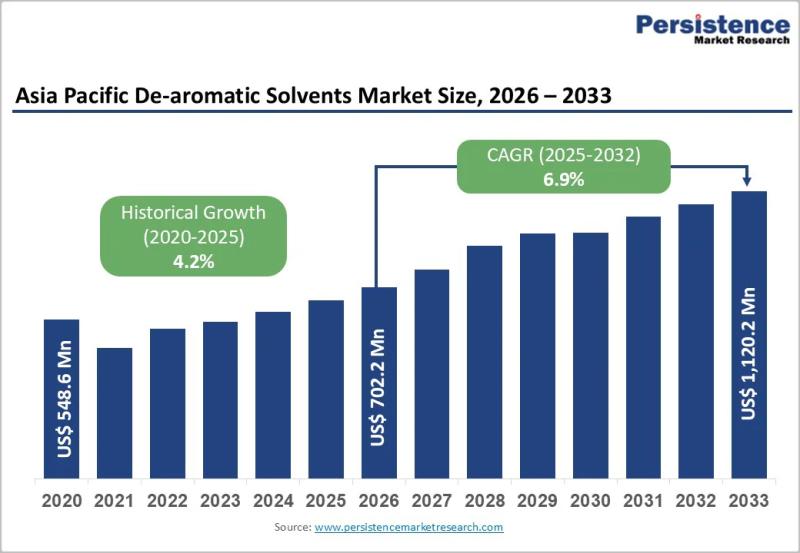

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…