Press release

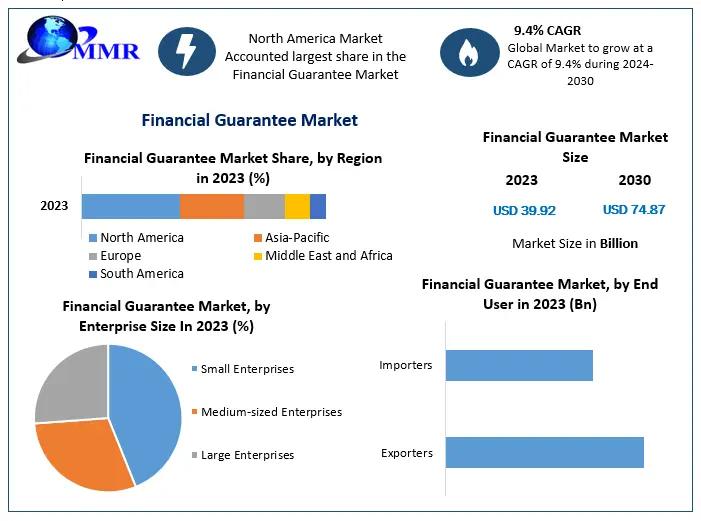

Financial Guarantee Market Expected To Reach USD 74.87 Bn by 2030, Expanding at a CAGR of 9.4% from 2024 to 2030

The Financial Guarantee Market size was valued at USD 39.92 billion in 2023 and the total Financial Guarantee Market revenue is expected to grow at a CAGR of 9.4 % from 2024 to 2030, reaching nearly USD 74.87 billion.Financial Guarantee Market Overview:

The global financial guarantee market is experiencing significant growth, driven by increasing demand for credit enhancement and risk mitigation solutions. Financial guarantees, which serve as a promise by a third party to cover a borrower's debt in case of default, are becoming essential tools in facilitating complex financial transactions. Their application spans various sectors, including infrastructure, real estate, and public finance, providing lenders with the confidence to extend credit in uncertain economic climates. The market's expansion is further propelled by the integration of digital technologies, enhancing the efficiency and accessibility of guarantee services.

Download a Free Sample Report Today : https://www.maximizemarketresearch.com/request-sample/221883/

Financial Guarantee Market Dynamics

Several factors are influencing the dynamics of the financial guarantee market. The rise in cross-border trade and investment activities necessitates robust risk management tools, with financial guarantees playing a pivotal role in securing international transactions. Additionally, stringent regulatory frameworks, such as Basel III and Solvency II, compel financial institutions to adopt guarantees to maintain compliance and manage capital adequacy. The increasing complexity of financial instruments and the need for credit enhancement in structured finance further drive the demand for financial guarantees. Moreover, the growing awareness of environmental, social, and governance (ESG) considerations is leading to the development of guarantees that support sustainable and socially responsible projects.

Financial Guarantee Market Outlook and Future Trends :

Looking ahead, the financial guarantee market is poised for continued expansion, with emerging economies presenting significant growth opportunities. The emphasis on infrastructure development, particularly in Asia-Pacific and Africa, is expected to fuel the demand for guarantees to secure funding for large-scale projects. Technological advancements, including blockchain and artificial intelligence, are anticipated to revolutionize the issuance and management of financial guarantees, enhancing transparency and reducing operational risks. Furthermore, the customization of guarantee products to cater to specific industry needs and the incorporation of ESG criteria are likely to become standard practices, aligning with global sustainability goals.

Key Recent Developments

Vietnam and Thailand: Both countries are focusing on strengthening their financial sectors, with initiatives aimed at enhancing the availability and accessibility of financial guarantees to support small and medium-sized enterprises (SMEs) and infrastructure projects.

Japan and South Korea: These nations are exploring advanced financial instruments, including guarantees, to bolster their export industries and facilitate international trade. Collaborations between government agencies and financial institutions are underway to develop innovative guarantee schemes that cater to the evolving needs of exporters.

Singapore: As a leading financial hub, Singapore is integrating digital technologies into its financial services sector, including the automation of guarantee processes. The Monetary Authority of Singapore (MAS) is actively promoting fintech solutions to enhance the efficiency and reliability of financial guarantees.

United States: The U.S. financial guarantee market is witnessing increased activity, particularly in the infrastructure and municipal bond sectors. Government-sponsored entities and private insurers are expanding their guarantee offerings to support large-scale public projects and stimulate economic growth.

Europe: European countries are emphasizing the role of financial guarantees in facilitating green investments and sustainable development. The European Investment Bank (EIB) and other institutions are implementing guarantee programs to de-risk investments in renewable energy and environmentally friendly infrastructure.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report : https://www.maximizemarketresearch.com/request-sample/221883/

Financial Guarantee Market Segmentation

by Product

Bank Guarantees

Financial Bank Guarantee

Performance-Based Guarantee

Foreign Bank Guarantees

Documentary Letter of Credit

Standby Letter of Credit (SBLC)

Receivables Financing

Others

by Enterprise Size

Small Enterprises

Medium-sized Enterprises

Large Enterprises

by End User

Exporters

Importers

Some of the current players in the Financial Guarantee Market are:

1. Asian Development Bank

2. Bank of Montreal

3. Barclays

4. BNP Paribas

5. Citibank

6. HSBC

7. ICBC

8. National Bank of Canada

9. Scotia Bank

10. SINOSURE

For additional reports on related topics, visit our website:

♦ Microfinance Market https://www.maximizemarketresearch.com/market-report/microfinance-market/230628/

♦ Human Capital Management Market https://www.maximizemarketresearch.com/market-report/global-human-capital-management-market/7234/

♦ Payment Security Market https://www.maximizemarketresearch.com/market-report/global-payment-security-market/24755/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Guarantee Market Expected To Reach USD 74.87 Bn by 2030, Expanding at a CAGR of 9.4% from 2024 to 2030 here

News-ID: 4001276 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

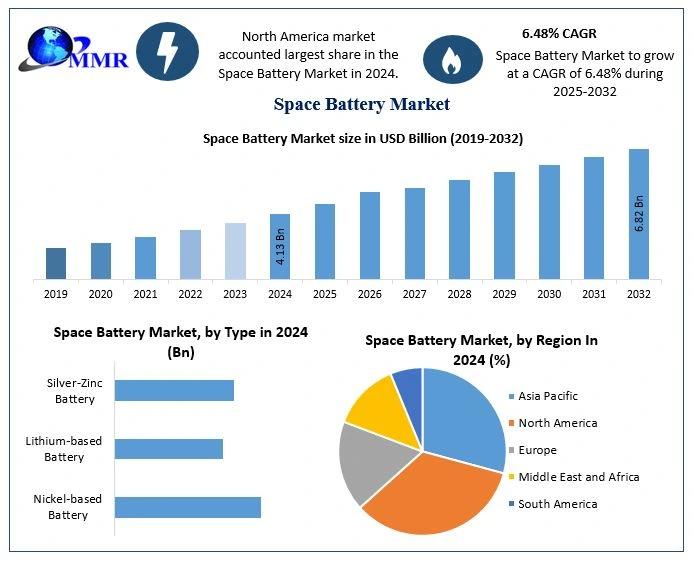

Space Battery Market to Surge to USD 6.82 Billion by 2032 | Size, Key Drivers, C …

The Global Space Battery Market was valued at approximately USD 4.13 Billion in 2024 and is projected to reach USD 6.82 Billion by 2032, expanding at a CAGR of 6.48% during 2025-2032.

Market Overview

The Global Space Battery Market is experiencing robust growth driven by the escalating number of space missions, increased satellite deployments, and rapid commercialization of space technologies. Batteries play a mission-critical role in powering satellites, spacecraft, launch vehicles, and…

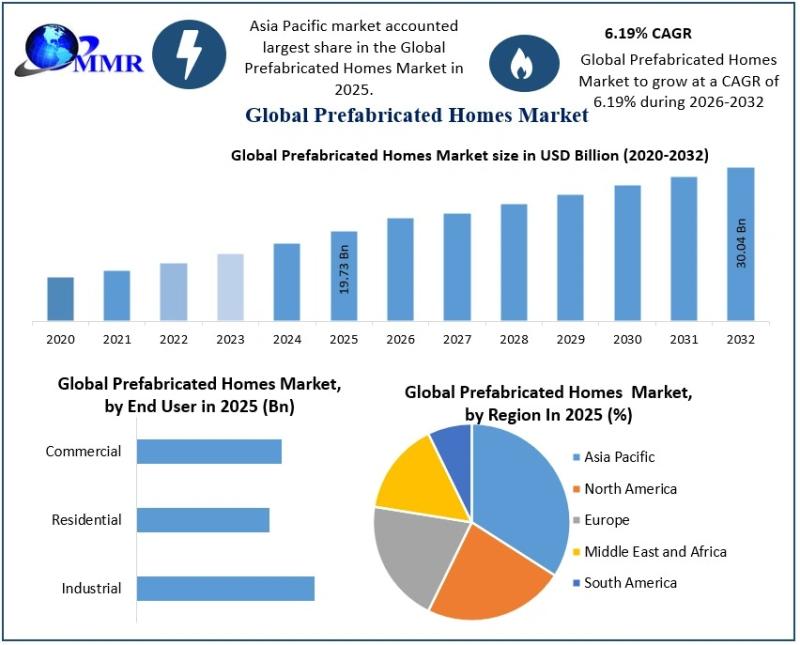

Prefabricated Homes Market Size, Outlook 2032: Rising Demand for Cost-Effective …

The Prefabricated Homes Market size was valued at USD 19.73 Billion in 2025 and the total Prefabricated Homes revenue is expected to grow at a CAGR of 6.19% from 2025 to 2032, reaching nearly USD 30.04 Billion by 2032.

Prefabricated Homes Market Poised for Accelerated Growth with Rising Demand for Affordable and Sustainable Housing

The Prefabricated Homes Market is expected to witness strong expansion during the forecast period, driven by increasing demand…

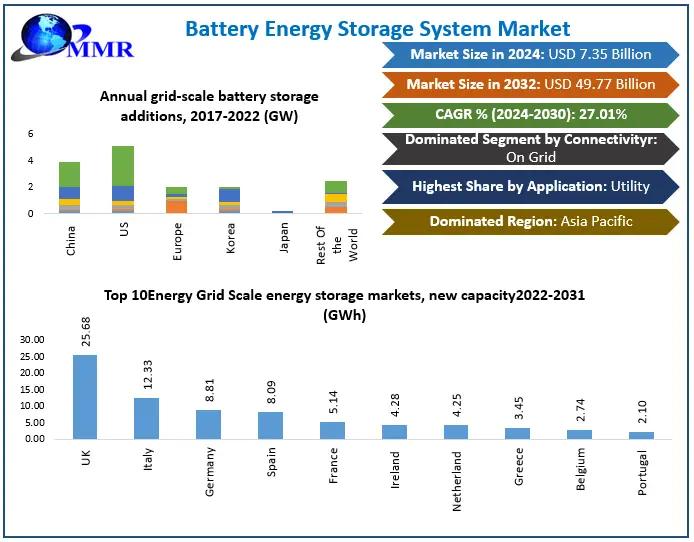

Battery Energy Storage System Market Set to Surge to USD 49.77 Billion by 2032 - …

The Battery Energy Storage System Market was valued at USD 7.35 Billion in 2024 and is projected to expand to USD 49.77 Billion by 2032, growing at a CAGR of 27.01% between 2025 and 2032.

Market Overview

The Battery Energy Storage System Market is experiencing exponential growth as global energy strategies increasingly focus on renewable integration, grid modernization, and decarbonization. BESS solutions enable utilities, industries, and residential consumers to store intermittent renewable…

Water Electrolysis Market Size, Trends, and Growth Drivers Shaping the Hydrogen …

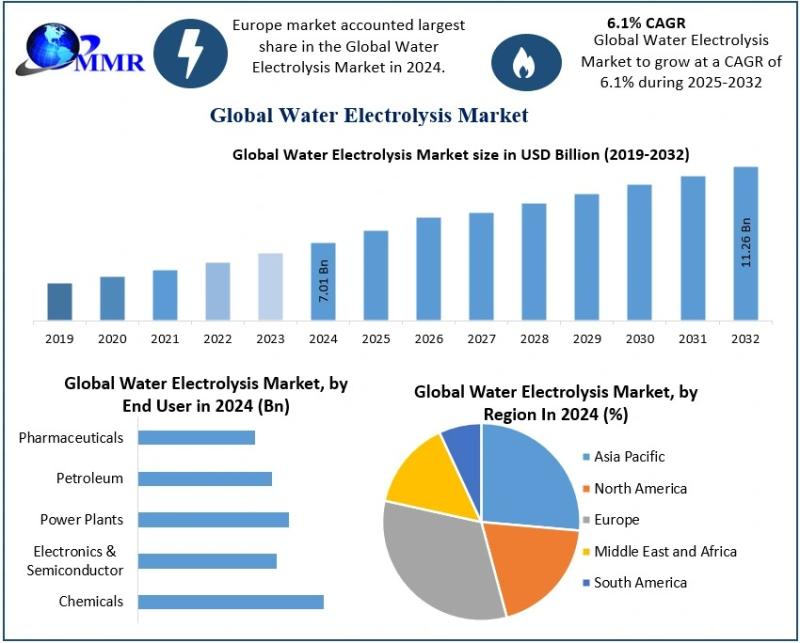

The Water Electrolysis Market size was valued at USD 7.01 Billion in 2024 and the total Water Electrolysis revenue is expected to grow at a CAGR of 6.1% from 2025 to 2032, reaching nearly USD 11.26 Billion. Market Outlook 2032 Rising Green Hydrogen Demand Accelerates Market Expansion

Want deeper insights? Download a sample copy now: https://www.maximizemarketresearch.com/request-sample/221915/

The Water Electrolysis Market is gaining strong momentum as global decarbonization goals and green hydrogen…

More Releases for Guarantee

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

Khaleej Times Introduces Money-Back Guarantee for Advertisers

Khaleej Times, UAE's leading newspaper has announced an initiative designed to enhance advertisers' confidence and deliver measurable results. Under the new Brand Increase Guarantee Program, marketers who invest a minimum of $50,000 in display advertising on khaleejtimes.com over 60 days are assured of achieving an increase in brand lift-or they will receive a complete refund.

To ensure credibility, Khaleej Times has partnered with Readwhere Digital, a third-party research firm, to conduct…

Financial Guarantee Market to Reach $71.93 Bn, Globally

Allied Market Research recently published a report, titled, "Financial Guarantee Market By Product Type (Bank Guarantees, Documentary Letter of Credit, Standby Letter of Credit (SBLC), Receivables Financing, and Others), Enterprise Size (Small Enterprises, Medium-sized Enterprises, and Large Enterprises), and End User (Exporters and Importers): Global Opportunity Analysis and Industry Forecast, 2021-2030". As per the report, the global financial guarantee industry was accounted for $28.70 billion in 2020, and is expected…

Does Flexibility Guarantee Worklife Balance in 2022?

"We are living at work and working at home, it's all blurred, and it's a huge challenge for everybody. No one's having an easy time with it", says Barbara Corcoran, the founder of The Corcoran Group, a real estate brokerage group in New York City.

Most remote working professionals are in the same pool, just like her. Bacancy's insights on would your organization let you work from home in 2022…

Rakhi.Giftalove.com Offers 100% Guarantee Rakhi Gifts Delivery Worldwide

New Delhi, India: First-time buyers of rakhi gifts online wonder how the internet-based stores cater to worldwide delivery of their orders. Rakhi.Giftalove.com clears the air with its 100% assured gifts delivery guarantee for all major destinations across the world.

Rakhi.Giftalove.com recently claimed assured delivery of all types of rakhi orders placed at the store for the recipients located in different countries worldwide. The store goes to the…

Eye-catching advertising featuring misleading guarantee promises

Advertising featuring a guarantee can be misleading if the guarantee promise is linked to conditions that are not clearly visible to consumers. That was the verdict of the Landgericht (LG) Frankfurt [Regional Court of Frankfurt].

GRP Rainer Lawyers and Tax Advisors in Cologne, Berlin, Bonn, Düsseldorf, Frankfurt, Hamburg, Munich, Stuttgart and London conclude: Clear guidelines relating to what is termed “Blickfangwerbung” (attention-grabbing/eye-catching advertising) had already been set out by the Bundesgerichtshof…