Press release

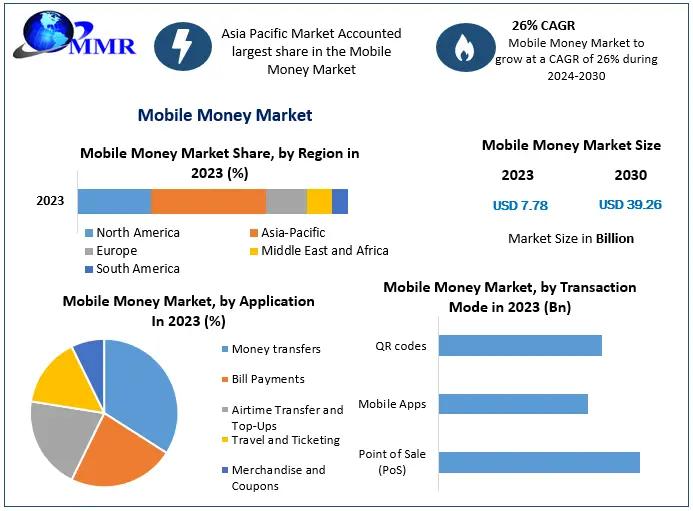

Mobile Money Market Size to Expand at a CAGR of 26% During the Forecast Period of 2024 to 2030

Mobile Money Market size was valued at US$ 7.78 Bn. in 2023 and the total revenue is expected to grow at 26 % through 2024 to 2030, reaching nearly US$ 39.26 Bn.Mobile Money Market Overview:

The mobile money market is experiencing a transformative phase, driven by the increasing adoption of digital wallets and contactless payment solutions. As consumers prioritize convenience and speed, platforms like Apple Pay, Google Wallet, and Samsung Pay have become central to the mobile money ecosystem. This shift is further accelerated by the proliferation of smartphones and a growing preference for cashless transactions, especially in the wake of the COVID-19 pandemic. Enhanced security features, such as biometric authentication and tokenization, have bolstered consumer confidence, while the integration of loyalty programs within digital wallets has enhanced user engagement .

Download a Free Sample Report Today : https://www.maximizemarketresearch.com/request-sample/7166/

Mobile Money Market Dynamics

The market's dynamics are influenced by several factors, including the surge in mobile phone users, which expands the potential for mobile-based monetary transactions. Online financial service providers are leveraging mobile money systems to tap into large, unexplored markets, developing digital financial capabilities that open avenues in micropayments, data-based financial services, and digital markets. The rise in transaction efficiency, propelled by technologies like NFC/smart cards, has led to increased spending and encouraged companies to enhance mobile banking services. However, challenges such as limited accessibility to financial institutions, reliability issues, and regulatory constraints, including those related to blockchain and decentralization, are impacting market growth .

Mobile Money Market Outlook and Future Trends :

Looking ahead, the mobile money market is poised for robust growth, with significant investments in research and infrastructure. Emerging applications in sectors like healthcare, travel, and hospitality are anticipated to open new avenues for mobile money utilization. Collaborations between industry players and research institutions are likely to yield innovative products, enhancing the market's appeal. As industries continue to seek efficient and secure payment alternatives, mobile money's role as a versatile and user-friendly solution is set to become increasingly prominent.

Key Recent Developments

Vietnam: The Digital Wallet Group, a Japanese AI and fintech company, expanded its operations to Vietnam, establishing satellite offices to cater to the growing demand for mobile remittance services. Their Smiles Mobile Remittance app has been instrumental in facilitating international money transfers for Vietnamese migrants.

Thailand: Ant Group, the parent company of Alipay, has partnered with Ascend Group in Thailand to enhance mobile payment solutions, reflecting the country's increasing adoption of digital financial services .

Wikipedia

Japan: In February 2024, Digital Wallet Group acquired Seven Global Remit, a subsidiary of Seven Bank, thereby expanding its ATM network to over 77,000 locations nationwide. This acquisition underscores Japan's commitment to advancing mobile money infrastructure.

South Korea: Ant Group's collaboration with KakaoPay signifies South Korea's progressive stance on integrating mobile payment systems, enhancing the country's digital financial ecosystem.

Singapore: Nium, a Singapore-based fintech company, acquired Socash Pte Ltd, focusing on non-traditional physical outlets. This acquisition provided Nium with the International Remittance Hub license from Bank Negara Malaysia, enabling real-time payments in Malaysia and expanding its global reach.

United States: Digital Wallet Group extended its services to the U.S., establishing offices and offering its Smiles Mobile Remittance app to cater to the international money transfer needs of migrants and expatriates.

Europe: Ant Group has significantly expanded its presence in Europe by acquiring the British international money transfer services provider WorldFirst. Additionally, partnerships with various European digital wallet apps have facilitated the widespread acceptance of Alipay across the continent .

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report : https://www.maximizemarketresearch.com/request-sample/7166/

Mobile Money Market Segmentation

by Payment Type

Remote Payments

Proximity Payments

by Industry

BFSI

Telecom and IT

Media and entertainment

Healthcare

Travel and hospitality

Transportation

Others

by Transaction Mode

Point of Sale (PoS)

Mobile Apps

QR codes

by Nature of Payment

Person to Person (P2P)

Person to Business (P2B)

Business to Person (B2P)

Business to Business (B2B)

by Application

Money transfers

Bill Payments

Airtime Transfer and Top-Ups

Travel and Ticketing

Merchandise and Coupons

Some of the current players in the Mobile Money Market are:

1. Vodafone

2. Google

3. Orange

4. FIS

5. PayPal

6. MasterCard

7. Fiserve

8. Airtel

9. Gemalto

10. Alipay

For additional reports on related topics, visit our website:

♦ Mobile Security Market https://www.maximizemarketresearch.com/market-report/global-mobile-security-market/15333/

♦ Mobile Gaming Market https://www.maximizemarketresearch.com/market-report/global-mobile-gaming-market/63745/

♦ Global Enterprise Search Market https://www.maximizemarketresearch.com/market-report/global-enterprise-search-market/55102/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Money Market Size to Expand at a CAGR of 26% During the Forecast Period of 2024 to 2030 here

News-ID: 4000999 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

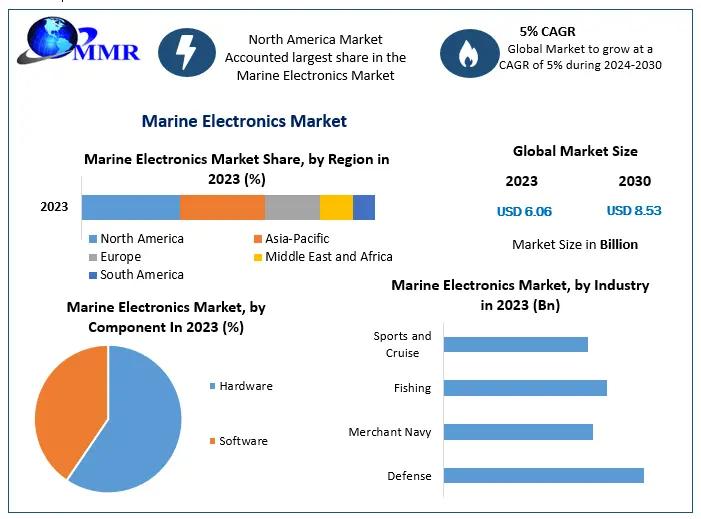

Marine Electronics Market Expected to Reach USD 8.53 Bn by 2030 - Growth Forecas …

Marine Electronics Market Size: According to Maximize Market Research, the Global Marine Electronics Market was valued at US$ 6.06 billion in 2023 and is expected to reach US$ 8.53 billion by 2030, growing at a CAGR of around 5% during 2024-2030.

Market Overview

The Global Marine Electronics Market encompasses electronic devices and systems designed specifically for marine environments. These include navigation systems, communication devices, safety equipment, sonar & radar, vessel management systems,…

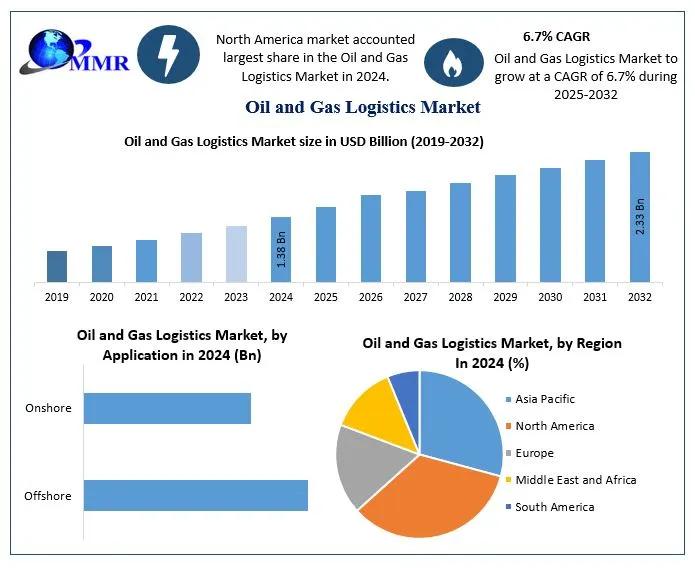

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

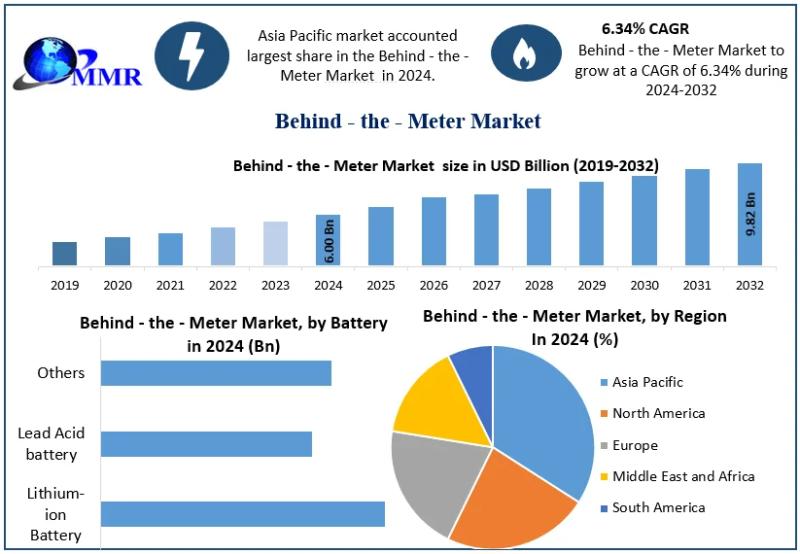

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

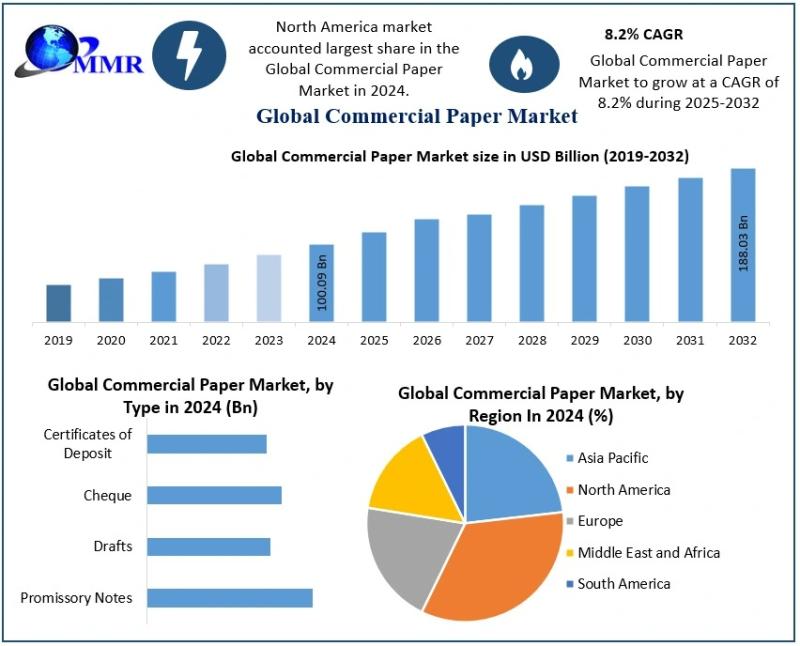

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…