Press release

According to the 2025 Edition, The eSIM Market is Projected to Reach USD 45.39 Billion by 2033, exhibiting a CAGR of 15.81%.

IMARC Group's latest research report, titled "eSIM Market Size, Share, Trends and Forecast by Type, Solution, Application, Industry Vertical, and Region, 2025-2033," offers a comprehensive analysis of the eSIM market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. the global eSIM market size was valued at USD 11.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.39 Billion by 2033, exhibiting a CAGR of 15.81% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.2% in 2024. This dominance can be attributed to early 5G adoption, high smartphone penetration, strong presence of telecom giants, and favorable regulatory support. The region also benefits from growing IoT applications across automotive, healthcare, and industrial sectors.Request Free Sample Report (Exclusive Offer on this report): https://www.imarcgroup.com/esim-market/requestsample

The Expanding Ecosystem of eSIM-Enabled Devices and Interoperability:

The eSIM market is experiencing robust growth driven by the rapidly expanding ecosystem of compatible devices and the increasing emphasis on seamless interoperability across various platforms and applications. Initially prevalent in smartphones and tablets, eSIM technology is now being integrated into a diverse range of connected devices, including smartwatches, laptops, automotive telematics systems, IoT (Internet of Things) devices, and even industrial machinery. This proliferation across different device categories is a significant driver of market expansion, as it unlocks new use cases and applications for embedded SIM technology. For instance, in the automotive sector, eSIMs facilitate seamless connectivity for navigation, infotainment, emergency services, and over-the-air software updates. In the IoT domain, eSIMs offer a streamlined and secure way to connect and manage a vast network of devices, from smart sensors in industrial settings to connected home appliances.

Furthermore, the growing focus on interoperability is crucial for enhancing the user experience. Efforts are underway to standardize eSIM provisioning and management processes across different mobile network operators (MNOs) and device manufacturers, aiming to eliminate the complexities associated with traditional physical SIM cards, such as manual insertion and the need for physical swapping when changing service providers or traveling internationally. Initiatives promoting remote SIM provisioning (RSP) standards are simplifying the activation and management of eSIM profiles, allowing users to easily switch between different mobile plans and operators without the need for physical SIM cards. This enhanced flexibility and convenience are significant advantages driving consumer adoption and encouraging MNOs to embrace eSIM technology. The development of robust and standardized platforms for managing eSIM profiles across different devices and operators is essential for realizing the full potential of this technology and fostering widespread adoption across various industries and consumer segments. The increasing availability of eSIM-enabled devices across diverse categories, coupled with advancements in interoperability and standardized provisioning processes, is creating a powerful synergy that fuels the growth and future demand for eSIM solutions.

The Catalytic Role of Enhanced Connectivity and Global Mobility:

The escalating demand for seamless and reliable connectivity, coupled with the increasing prevalence of global mobility, is acting as a significant catalyst for the growth of the eSIM market. In an increasingly interconnected world, users expect their devices to remain connected regardless of their location. eSIM technology offers a compelling solution to the challenges associated with traditional SIM cards when traveling internationally. Instead of having to purchase and physically swap SIM cards in different countries, users with eSIM-enabled devices can easily download and activate local mobile plans remotely, often through user-friendly interfaces or dedicated applications. This eliminates the inconvenience and potential costs associated with roaming charges and the need to find and purchase local SIM cards. The ability to maintain continuous connectivity while traveling for business or leisure is a significant advantage driving consumer adoption of eSIM-enabled devices.

Furthermore, the inherent flexibility of eSIMs allows users to easily manage multiple mobile profiles on a single device, enabling them to have separate personal and work numbers or to take advantage of different data plans for cost optimization. This is particularly appealing to frequent travelers and individuals who require multiple phone numbers for various purposes. The advancements in network technologies, such as 5G, are further amplifying the importance of seamless connectivity and driving the adoption of eSIMs, as these embedded SIMs can readily support the enhanced speeds and capabilities of next-generation networks. The ability to remotely provision and manage cellular connectivity through eSIMs also offers significant advantages for enterprises with globally distributed workforces and IoT deployments, simplifying device management and reducing logistical complexities. As global travel and the demand for ubiquitous connectivity continue to rise, eSIM technology is poised to become an increasingly essential component of the mobile communication landscape, offering a convenient, cost-effective, and future-proof solution for staying connected across borders and managing multiple mobile subscriptions.

The Strategic Imperative for Mobile Network Operators and Device Manufacturers:

The eSIM market is being significantly shaped by the strategic imperatives of both mobile network operators (MNOs) and device manufacturers, who recognize the transformative potential of this technology to enhance user experience, streamline operations, and unlock new revenue streams. For MNOs, eSIMs offer opportunities to simplify subscriber onboarding and management processes. Remote SIM provisioning can reduce the costs associated with distributing and activating physical SIM cards, and it can also facilitate the seamless acquisition of new subscribers, particularly in the growing market for connected devices beyond smartphones. eSIMs can also enable MNOs to offer more flexible and innovative subscription models, such as on-demand connectivity and tailored data plans for specific devices or usage scenarios. Furthermore, eSIM technology can play a crucial role in enabling MNOs to expand their reach into new markets and device segments, such as the automotive and IoT sectors. For device manufacturers, the integration of eSIMs offers several advantages. It can lead to sleeker and more compact device designs by eliminating the need for a physical SIM card tray, freeing up valuable internal space for other components or larger batteries. eSIMs also enhance the security of devices by making it more difficult to physically remove or tamper with the SIM.

Moreover, embedding the SIM directly into the device can simplify the manufacturing process and improve the overall durability of the device. The ability to remotely provision connectivity also opens up new possibilities for device manufacturers to offer value-added services and enhance the out-of-box experience for consumers. The collaborative efforts between MNOs and device manufacturers to develop and implement robust eSIM standards and infrastructure are crucial for the continued growth and success of the market. Both parties recognize the strategic importance of eSIM technology in shaping the future of mobile connectivity and are actively investing in its development and deployment to capitalize on the numerous benefits it offers to consumers, enterprises, and the broader connected ecosystem.

Leading key Players Operating in the eSIM Industry:

• Apple Inc

• Arm Limited

• AT&T Inc

• Deutsche Telekom AG

• Giesecke+Devrient GmbH

• IDEMIA

• Infineon Technologies AG

• NTT Docomo Inc. (Nippon Telegraph and Telephone Corporation)

• NXP Semiconductors N.V.

• Samsung Electronics Co. Ltd

• Sierra Wireless

• STMicroelectronics

• Telefónica S.A

• Thales Group

• Vodafone Group Plc

eSIM Market Trends:

The current landscape of embedded SIM technology reveals a strong momentum towards wider adoption across a multitude of connected devices, moving beyond its initial stronghold in smartphones and tablets. A key trend is the increasing integration of these embedded chips into a diverse array of consumer electronics, including smartwatches and wearable technology, where their compact size and flexibility offer significant design advantages. The automotive industry is also witnessing a significant uptake, with embedded SIMs becoming integral for connected car services, enhancing safety, navigation, and infotainment capabilities. Furthermore, the burgeoning Internet of Things ecosystem is heavily relying on this technology for seamless and secure connectivity of a vast network of sensors and devices across various industrial and consumer applications. The ability to remotely manage and provision connectivity is a significant driver, simplifying deployment and maintenance for IoT solutions. From a user perspective, there is a growing expectation for seamless transitions between mobile networks and devices, with embedded SIMs facilitating easier switching of service providers and the management of multiple mobile profiles on a single device.

This enhanced flexibility and convenience are becoming increasingly valued by consumers, particularly those who travel frequently or require separate personal and work numbers. The development of more user-friendly interfaces and standardized processes for managing embedded SIM profiles is crucial for mainstream adoption. The collaborative efforts among mobile network operators, device manufacturers, and technology providers are focused on creating a more interoperable and seamless experience for end-users. This collaborative approach aims to unlock the full potential of embedded SIM technology, paving the way for a future where connectivity is embedded, flexible, and effortlessly managed across a wide spectrum of devices and applications, ultimately enhancing the user experience and driving innovation in the connected world.

Ask Analyst for Instant Discount and Download Full Report with TOC & List of Figure: https://www.imarcgroup.com/esim-market

Key Market Segmentation:

Breakup by Type:

• Data-Only eSIM

• Voice, SMS and Data eSIM

Data-only eSIMs represent the largest segment by type due to their widespread use in devices that require data connectivity without the need for traditional voice services, such as tablets and laptops.

Breakup by Solution:

• Hardware

• Connectivity Services

Hardware holds the largest segment by solution in the eSIM market, as the physical component is essential for enabling the connectivity and functionality of eSIM technology in various devices.

Breakup by Application:

• Connected Car

• Smartphone and Tablet

• Wearable Device

• M2M

• Others

Machine-to-Machine (M2M) communication leads the application segment, driven by the increasing adoption of IoT devices and the need for efficient, uninterrupted connectivity in industrial and consumer applications.

Breakup by Industry Vertical:

• Automotive

• Consumer Electronics

• Manufacturing

• Telecommunication

• Transportation and Logistics

• Others

The automotive industry emerges as the largest segment by industry vertical, due to the rising integration of eSIMs in vehicles for enhanced connectivity, infotainment, and telematics services.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

North America is the largest market by region, attributed to the early adoption of advanced telecommunications technologies, including eSIM, and the presence of key market players in the region.

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Porter's Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release According to the 2025 Edition, The eSIM Market is Projected to Reach USD 45.39 Billion by 2033, exhibiting a CAGR of 15.81%. here

News-ID: 3999334 • Views: …

More Releases from IMARC Group

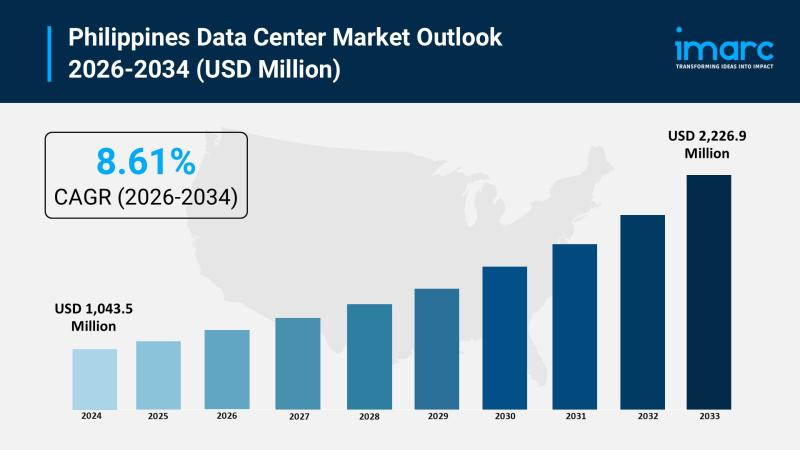

Philippines Data Center Market Surge to Hit USD 2,226.9 Million During 206-2034

Market Overview

The Philippines data center market reached a size of USD 1,043.5 Million in 2025 and is projected to expand to USD 2,226.9 Million by 2034. The market is set to grow at a CAGR of 8.61% between 2026 and 2034, driven by digital transformation creating massive data volumes, rising frequency and sophistication of cybersecurity threats, and accelerating cloud computing adoption. The demand is fueled by government digital infrastructure initiatives,…

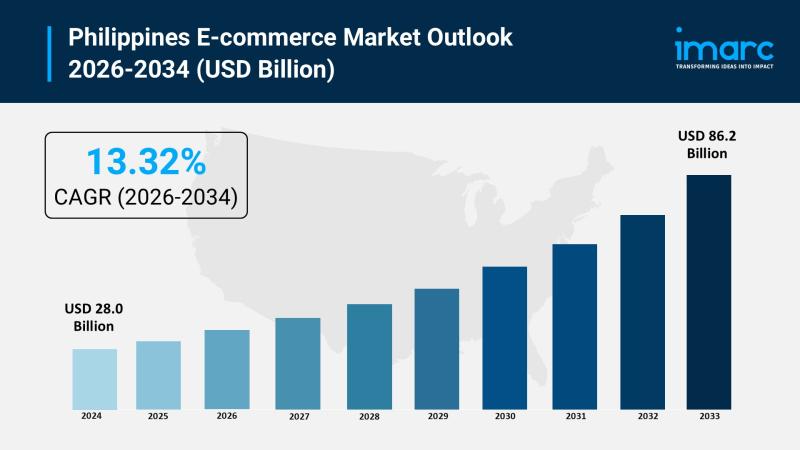

Philippines E-commerce Market 2026 | Expected Surge to USD 86.2 Billion by 2034

Market Overview

The Philippines e-commerce market reached a size of USD 28.0 Billion in 2025 and is projected to expand to USD 86.2 Billion by 2034. The market is set to grow at a CAGR of 13.32% between 2026 and 2034, driven by increasing internet penetration, extensive smartphone adoption, and growing consumer trust in online payments. The demand is fueled by urbanization, hectic lifestyles, and the convenience of digital shopping. Both…

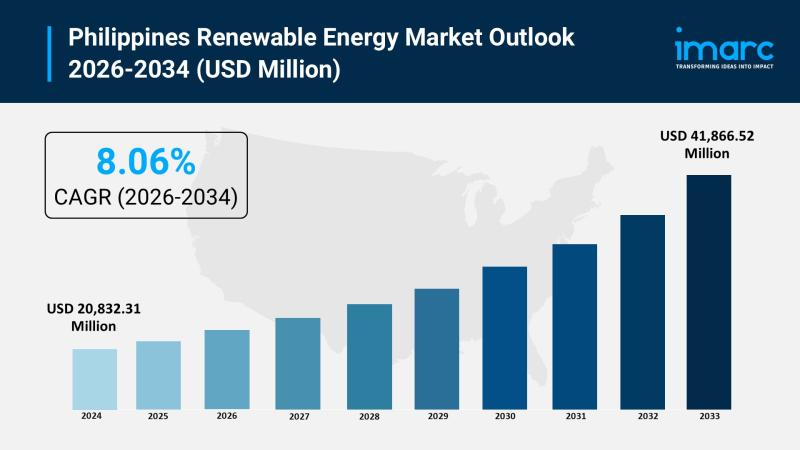

Philippines Renewable Energy Market 2026 | Worth USD 41,866.52 Million by 2034

Market Overview

The Philippines renewable energy market size was valued at USD 20,832.31 Million in 2025 and is projected to reach USD 41,866.52 Million by 2034, growing at a compound annual growth rate of 8.06% from 2026-2034, driven by supportive government incentives, increasing energy demand, and ongoing technological advancements. The demand is fueled by declining costs of renewable technologies, growing environmental awareness, and the nation's abundant natural resources including solar, wind,…

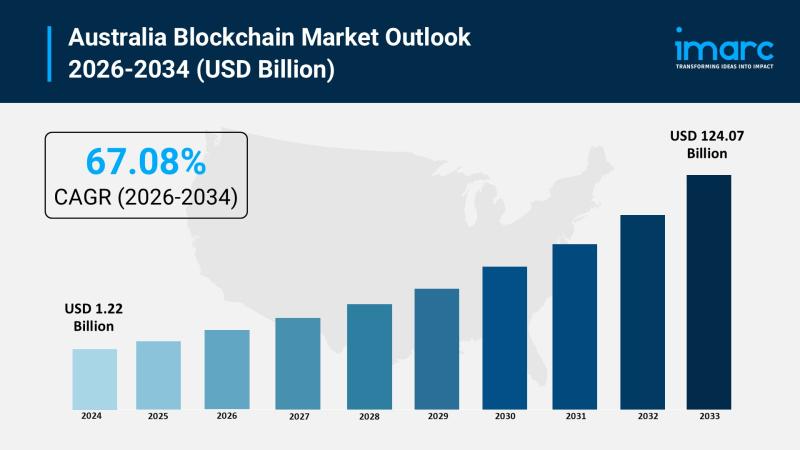

Australia Blockchain Market 2026 | Projected to Reach USD 124.07 Billion by 2034

Market Overview

The Australia blockchain market reached a size of USD 1.22 Billion in 2025 and is projected to expand to USD 124.07 Billion by 2034. The market is set to grow at a CAGR of 67.08% between 2026 and 2034, driven by strategic government support through comprehensive policy frameworks, financial sector digital transformation, and rising demand for transparent supply chain solutions. The demand is fueled by increasing cryptocurrency adoption with…

More Releases for SIM

TM SIM Registration 2026 - Register Your TM SIM Online

TM SIM registration is mandatory in the Philippines under the SIM Registration Act. If your TM SIM is not registered, it may get deactivated, which means no calls, no texts, and no mobile data. Many users face issues during registration because they don't understand the process properly or miss small requirements.

I've personally gone through the SIM registration TM https://tmsimsregister.com/ process, checked official portals, and reviewed common user problems.…

Embedded SIM IC Market

Embedded SIM IC Market Overview

Embedded SIM chip refers to embedding the SIM card into the device and updating its configuration through wireless remote download. Compared with the traditional pluggable SIM card, the embedded SIM card greatly reduces the card space on the device, and its volume is reduced to 10% of the traditional SIM card. In addition, it is directly embedded in the device in form, realizing the card-free nature…

E-SIM Card (Embedded SIM) Market Size, Share, Growth & Trends, Analysis by 2029

This comprehensive report thoroughly assesses various regions, estimating the volume of the global E-SIM Card (Embedded SIM) market within each region during the projected timeframe. The report is meticulously crafted and includes valuable information on the current market status, historical data, and projected outlook. Furthermore, it presents a detailed market analysis, segmenting it based on regions, types, and applications. The report closely monitors key trends that play a crucial role…

E-Sim Market

According to the Market Statsville Group, the global e-sim market size is expected to grow from USD 702.2 million in 2021 to USD 6673.8 million by 2030, at a CAGR of 32.5% from 2022 to 2030. Embedded Subscriber Identity Module (eSIM) or Embedded Universal Integrated Circuit Card (eUICC) is a reprogrammable chip that can be soldered or removed. It's a small chip that the user uses to verify their identity…

MRRSE : Current Market Scenario of E-SIM Card Market |Key Players - Apple Inc., …

An insightful study, titled “E-SIM Card Market” has been freshly broadcasted to the vast research repository of Market Research Reports Search Engine (MRRSE). The research study provides detailed comprehensions and forecasts future growth of the global market with an in-depth study of the factors impacting revenue growth throughout the mentioned forecast period. Further, a deep analysis on the major players from diverse regions is also present in the report.

Get Report…

E-SIM Card Market |Key Players - Apple Inc., Samsung, Gemalto NV, Giesecke & Dev …

An insightful study, titled “E-SIM Card Market” has been freshly broadcasted to the vast research repository of Market Research Reports Search Engine (MRRSE). The research study provides detailed comprehensions and forecasts future growth of the global market with an in-depth study of the factors impacting revenue growth throughout the mentioned forecast period. Further, a deep analysis on the major players from diverse regions is also present in the report.

Get Free…