Press release

Global Banking-As-A-Service (BaaS) Market Outlook 2025-2034: Trends, Innovations, And Future Outlook

The Banking-As-A-Service (BaaS) Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Banking-As-A-Service (BaaS) Market Size and Projected Growth Rate?

The Banking-As-A-Service (BaaS) Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Banking-As-A-Service (BaaS) Market Size and Projected Growth Rate?

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12627

What Are the Major Segments in the Banking-As-A-Service (BaaS) Market?

The banking-as-a-service (BaaS) market covered in this report is segmented -

1) By Type: API-Based Bank-As-A-Service, Cloud-Based Bank-As-A-Service

2) By Component: Platform, Services

3) By Enterprise: Large Enterprise, Small And Medium Enterprise

4) By End User: Banks, Non-Bank Financial Company (NBFC), Government, Other End-Users

Subsegments:

1) By API-Based Bank-As-A-Service: Payment Processing APIs, Account Management APIs, Compliance And Identity Verification APIs

2) By Cloud-Based Bank-As-A-Service: Core Banking Solutions, Digital Banking Platforms, Customer Relationship Management (CRM) Systems

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12627&type=smp

What Are The Driving Banking-As-A-Service (BaaS) Market Evolution?

The growth of the banking-as-a-service (BaaS) market is anticipated to be driven by the increasing embracement of digital banking. Digital banking pertains to the utilization of computers to gain access to banking services and features through the bank's online portal. The advent of digital banking has sparked expansion in the banking-as-a-service (BaaS) sector by responding to expanding customer demand for approachable and bespoke financial amenities. It also provides banks with smooth integration, faster time-to-market, and cost-effective scalability. The European Central Bank, based in Germany, reported in November 2023 that in the latter half of 2022, non-cash payments in the European region saw an 8.8% growth to 65.9 billion, when compared to the first six months of the year. The total monetary value of these transactions experienced a 2.8% increase, amounting to €118.8 ($128.55) trillion. Thus, the surging acceptance of digital banking is propelling the banking-as-a-service (BaaS) market.

Which Firms Dominate The Banking-As-A-Service (BaaS) Market Segments?

Major companies operating in the banking-as-a-service (BaaS) market include Banco Bilbao Vizcaya Argentaria S.A., PayPal Holdings Inc., Square Inc., Green Dot Corporation, Paytm Payments Bank, Marqeta Inc., Starling Bank Ltd., Cross River Bank, Mambu GmbH, 10x Future Technologies, ClearBank Ltd., Currency Cloud, Thought Machine, Railsbank Technology Ltd., FinXact, MatchMove Pay Pte. Ltd., Fidor Bank AG, Bnkbl Ltd., Treezor SAS, Bankable, Treasury Prime, Movencorp Inc., Bankifi, Solaris Bank LLC, Project Imagine Ltd.

What Trends Are Expected to Dominate the Banking-As-A-Service (BaaS) Market in the Next 5 Years?

There's an uptick in the interest in Cloud-native architecture within the realm of banking-as-a-service market. This pattern focuses on a method of creating and applying software that's specifically aimed to take advantage of the possibilities and rewards of cloud computing scenarios. Market players in banking-as-a-service (BaaS) are progressively turning towards applying Cloud-native architecture in formulating and providing their services to uphold their market share. For illustration, in February 2023, Oracle, an American cloud tech firm, introduced Oracle Banking Cloud Services, a fresh set of separable, congenial cloud-native services like banking accounts cloud service, banking payments cloud service, banking enterprise limits and collateral management cloud service, banking origination cloud service, banking digital experience cloud service, and banking APIs cloud service. Banks have the potential to utilize six novel services that assist in deployable organization demand deposit processing, company-wide limit and collateral management, instantaneous global payments, API administration, retail consumer onboarding, and autonomous digital experiences. These services aid in the swift and secure modernization of banking business functions via a microservices architecture.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/banking-as-a-service-baas-global-market-report

Which Is The Largest Region In The Banking-As-A-Service (BaaS) Market?

North America was the largest region in the banking-as-a-service (BaaS) market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the banking-as-a-service (BaaS) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Banking-As-A-Service (BaaS) Market?

2. What is the CAGR expected in the Banking-As-A-Service (BaaS) Market?

3. What Are the Key Innovations Transforming the Banking-As-A-Service (BaaS) Industry?

4. Which Region Is Leading the Banking-As-A-Service (BaaS) Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Banking-As-A-Service (BaaS) Market Outlook 2025-2034: Trends, Innovations, And Future Outlook here

News-ID: 3995689 • Views: …

More Releases from The Business Research Company

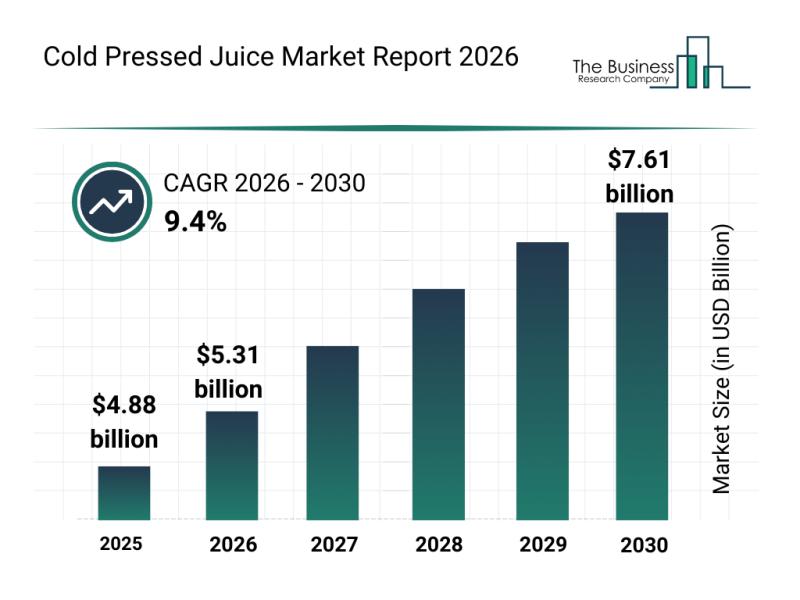

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

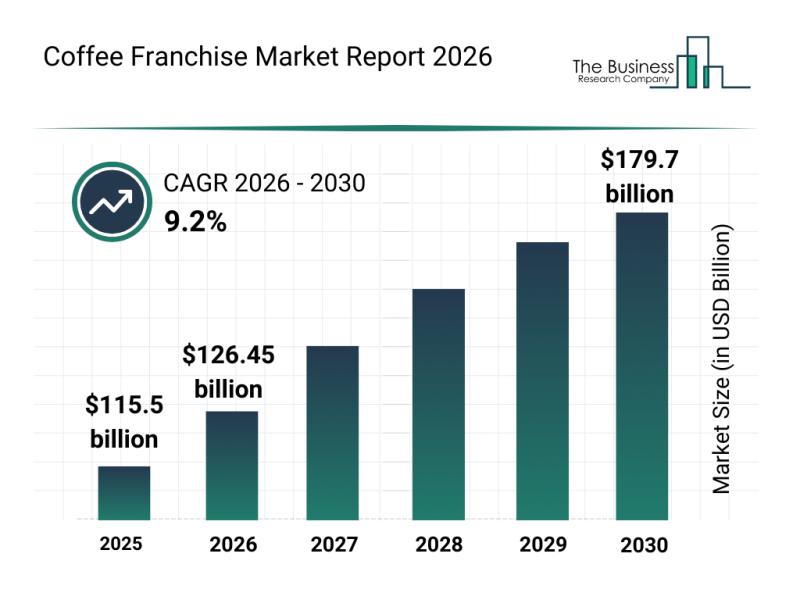

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

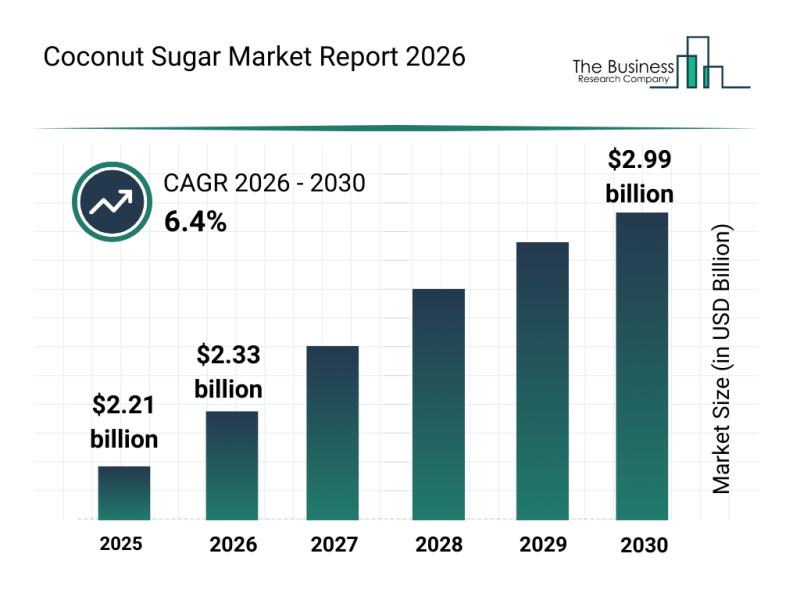

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

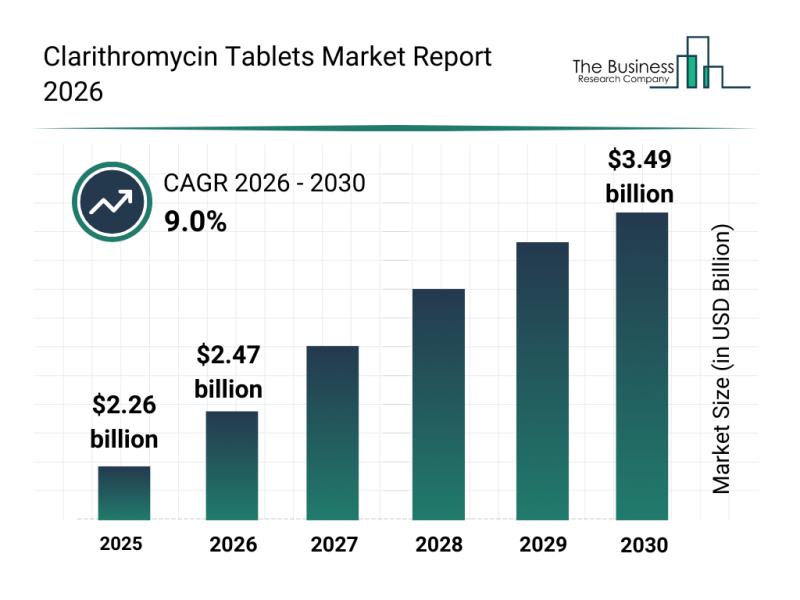

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…