Press release

Mobile Payment Transaction Market to Reach USD 60.8 Trillion by 2035, Growing at a CAGR of 13.2%

The mobile payment transaction market is poised for explosive growth, expected to reach USD 20.4 trillion by 2025 and projected to surge to USD 60.8 trillion by 2035, reflecting a remarkable compound annual growth rate (CAGR) of 13.2% during the forecast period. Several factors are catalyzing this upward momentum, including the rapid adoption of blockchain technology, advancements in security features, and the tightening regulation of digital payment platforms worldwide.Furthermore, developing economies are witnessing a strong shift toward cashless transactions, further propelling the industry's size, influencing global trade patterns, and enhancing cross-border financial integration. Mobile payments are not just a convenience anymore but are becoming a crucial pillar of modern financial systems.

Request Your Sample and Stay Ahead with Our Insightful Report!

https://www.futuremarketinsights.com/report-sample#5245502d47422d323632

With the explosion of smartphone penetration, the increasing reliance on contactless payments, and the growing adoption of mobile wallets, the mobile payment ecosystem is undergoing significant transformation. Key verticals such as retail, transportation, healthcare, and government services are embracing mobile payment systems to streamline transactions, enhance consumer experiences, and foster digital economies.

Leading financial institutions and fintech companies are innovating aggressively, offering a wider array of services that range from QR-code based payments to sophisticated biometric authentication methods. These trends, combined with government initiatives promoting digital finance, are positioning mobile payments as the future norm for businesses and consumers alike.

Key Takeaways

The mobile payment transaction market is accelerating at an unprecedented pace, reshaping the global financial landscape. Contactless payments are becoming standard practice, with QR code and Near Field Communication (NFC) technologies leading the charge.

Digital wallets are increasingly integrating loyalty programs, lending services, and investment platforms, offering users a one-stop-shop for their financial needs. Emerging markets in Asia-Pacific, Africa, and Latin America are witnessing rapid adoption, driven by improved internet connectivity and smartphone affordability. Simultaneously, the integration of blockchain for secure, transparent transactions and the growth of Central Bank Digital Currencies are redefining the structure and dynamics of the mobile payment industry.

Emerging Trends in Global Market

Several emerging trends are propelling the mobile payment transaction market into its next phase of evolution. Biometric authentication, including fingerprint scanning, facial recognition, and voice identification, is becoming the preferred method for securing mobile transactions, addressing consumer concerns around fraud and identity theft.

The advent of super apps-platforms combining messaging, e-commerce, banking, and payments-is particularly prominent in Asia and starting to gain traction globally. Furthermore, the application of Artificial Intelligence (AI) in payment processing is improving fraud detection capabilities and providing personalized financial management tools. Another key trend is the rise of embedded payments, where payment functionality is seamlessly integrated into non-financial applications, enabling frictionless commerce experiences.

Significant Developments in Global Sector: Trends and Opportunities in the Market

In the past few years, the mobile payment sector has seen critical developments that offer significant growth opportunities. Government-backed initiatives promoting financial inclusion, such as India's Digital India campaign and Brazil's PIX payment system, have accelerated mobile payment adoption among the unbanked and underbanked populations.

Strategic collaborations between fintech companies, telecom operators, and retailers are creating new ecosystems that make mobile payments more accessible and attractive. The emergence of cross-border mobile payment systems is facilitating easier international trade and tourism by minimizing currency conversion hassles. Meanwhile, merchant adoption of mobile point-of-sale (mPOS) terminals is growing steadily, even among small and medium-sized enterprises (SMEs), creating new business efficiencies and customer experiences.

Recent Developments in the Market

Recent market developments have emphasized innovation, security, and regulatory readiness. Several major tech firms and banks have launched or upgraded digital wallets that support cryptocurrency transactions, showcasing the sector's shift toward embracing digital assets. Companies are increasingly investing in tokenization and encryption technologies to fortify transaction security. Governments across Europe, Asia, and North America have begun enforcing stringent data privacy regulations, compelling mobile payment providers to prioritize compliance and transparency.

Mobile payment systems now commonly include value-added services such as budgeting tools, micro-lending, and insurance offerings, turning simple transaction apps into comprehensive financial platforms. Moreover, the integration of 5G networks is enhancing the speed, security, and scalability of mobile payment services, enabling real-time processing and opening new avenues for innovation.

Detailed Market Study: Full Report and Analysis

https://www.futuremarketinsights.com/reports/global-mobile-payment-transaction-market

Competition Outlook

The mobile payment transaction market is highly competitive, characterized by a mix of established financial institutions, technology giants, fintech disruptors, and regional players. Innovation, user experience, security, and interoperability are key competitive factors, with companies racing to capture market share through strategic partnerships, product differentiation, and geographic expansion.

Key players in the market include:

• Apple Inc.

• Google LLC

• Samsung Electronics Co., Ltd.

• Alibaba Group Holding Limited (Alipay)

• Tencent Holdings Limited (WeChat Pay)

• PayPal Holdings, Inc.

• Visa Inc.

• Mastercard Incorporated

• Square, Inc. (now Block, Inc.)

• Ant Group

Key segmentations of the market include:

By Payment Type: Proximity Payment, Remote Payment

By Technology: Near Field Communication (NFC), QR Code, Digital Wallets, Direct Carrier Billing, SMS-Based Transactions

By End-User: Retail, Hospitality and Transportation, Healthcare, Education, Entertainment and Media

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Digital Transformation Industry Analysis Reports

Card-Based Electronic Access Control Systems Market Outlook 2025 to 2035 https://www.futuremarketinsights.com/reports/card-based-electronic-access-control-systems-market

Cyber Crisis Management Market Outlook 2025 to 2035 https://www.futuremarketinsights.com/reports/cyber-crisis-management-market

Cloud-based Backup Services Market Outlook 2025 to 2035 https://www.futuremarketinsights.com/reports/cloud-based-backup-services-market

Cryptojacking Solution Market Outlook from 2025 to 2035 https://www.futuremarketinsights.com/reports/cryptojacking-solution-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Transaction Market to Reach USD 60.8 Trillion by 2035, Growing at a CAGR of 13.2% here

News-ID: 3994578 • Views: …

More Releases from Future Market Insights Inc

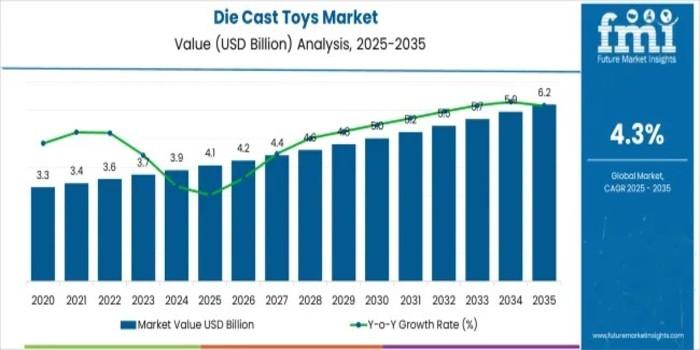

Global Die Cast Toys Market Forecast to Reach USD 6.2 Billion by 2035 Driven by …

The global die cast toys market is forecasted to expand from an estimated USD 4.1 billion in 2025 to USD 6.2 billion by 2035, exhibiting a steady compound annual growth rate (CAGR) of 4.3% over the next decade, according to the latest market analysis. This growth reflects a sustained consumer interest in collectible, high-quality die cast toys, particularly in niche markets targeting both children and adult hobbyists.

Between 2025 and 2030,…

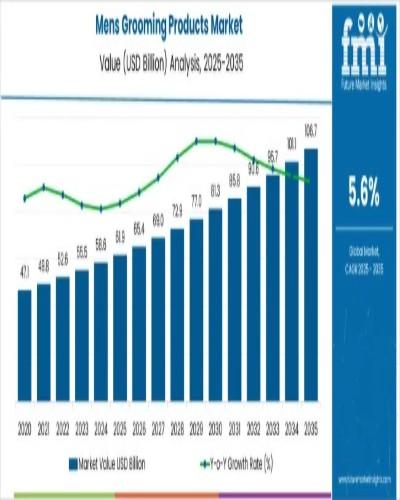

Global Men's Grooming Products Market Forecast to Reach USD 106.7 billion by 203 …

The global men's grooming products market is poised for substantial growth over the next decade, with its valuation expected to rise from USD 61.9 billion in 2025 to USD 106.7 billion by 2035. This growth reflects a robust compound annual growth rate (CAGR) of 5.6%, driven by shifting cultural norms, increased disposable incomes, and heightened consumer awareness of grooming and personal care.

The men's grooming market is set to cross two…

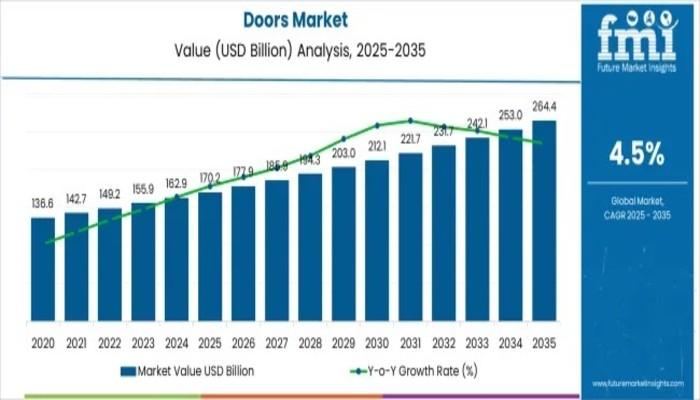

Doors Market Forecast Projects Steady 4.5% CAGR to USD 264.4 Billion by 2035 Ami …

The global doors market is poised for sustained growth, with a projected increase from USD 170.2 billion in 2025 to USD 264.4 billion by 2035, according to the latest market analysis. Registering a compound annual growth rate (CAGR) of 4.5%, the industry reflects stable demand across residential, commercial, and institutional sectors worldwide. This forecast underscores consistent procurement trends shaped by urban expansion, evolving building regulations, and advances in material and…

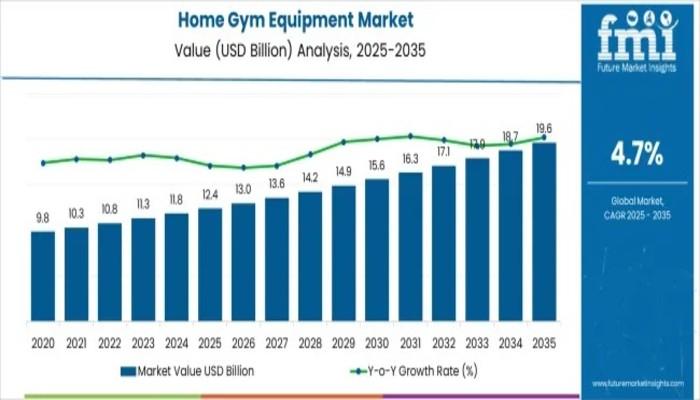

Home Gym Equipment Market Set to Reach USD 19.6 billion by 2035 Amid Rising Heal …

The Home Gym Equipment Market is forecasted to grow from an estimated value of USD 12.4 billion in 2025 to USD 19.6 billion by 2035, exhibiting a steady compound annual growth rate (CAGR) of 4.7%, according to the latest market analysis. This decade-long growth reflects evolving consumer preferences towards health and fitness, accelerated adoption of home-based workout solutions, and continuous innovation in smart fitness technologies.

Market Overview:

The global market for…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…