Press release

Open Banking Market Growth, Trends, and Opportunities in 2025 | Top key players - Plaid Inc., TrueLayer Ltd, Finleap Connect.

The Global Open Banking Market reached US$ 20.9 billion in 2022 and is expected to reach US$ 129.8 billion by 2030, growing with a CAGR of 25.7% during the forecast period 2024-2031.Open Banking Market report, published by DataM Intelligence, provides in-depth insights and analysis on key market trends, growth opportunities, and emerging challenges. Committed to delivering actionable intelligence, DataM Intelligence empowers businesses to make informed decisions and stay ahead of the competition. Through a combination of qualitative and quantitative research methods, it offers comprehensive reports that help clients navigate complex market landscapes, drive strategic growth, and seize new opportunities in an ever-evolving global market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/open-banking-market?sz

Open Banking is a financial system that allows third-party providers to securely access consumer banking data, with consent, through APIs. This innovation enhances competition, promotes personalized financial services, and offers more convenient payment solutions. By providing better transparency and control over financial data, Open Banking empowers consumers to make smarter decisions and enhances the overall banking experience.

List of the Key Players in the Open Banking Market:

Banco Bilbao Vizcaya Argentaria S.A, Plaid Inc., TrueLayer Ltd, Finleap Connect, Finastra, Tink, Jack Henry & Associates, Inc, Mambu, MuleSoft and NCR Corporation.

Industry Development:

On 21 February 2023, a white paper co-authored by NatWest and NAB was released. The white paper explores the similarities between the UK's Open Banking system and Australia's Consumer Data Right (CDR), shedding light on the growing importance of data-sharing frameworks in improving financial services and consumer access to information.

On 6 April 2023, Nuapay (the Open Banking business of EML Payments Limited) was awarded at the Merchant Payment Ecosystem Awards in Berlin, Germany. Nuapay received recognition for its Authenticated Mandates solution, winning the prestigious Best Use of Open Banking for Payments award. This accolade highlights the company's innovative approach to simplifying payments through Open Banking technology.

Growth Forecast Projected:

The Global Open Banking Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the global Open Banking Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Make an Enquiry for purchasing this Report @ https://www.datamintelligence.com/enquiry/open-banking-market

Segment Covered in the Open Banking Market:

By Service: Digital Currencies, Banking & Capital Markets, Payments, Value Added Services.

By Deployment: Cloud, On-premise.

By Distribution Channel: Bank Channels, App Markets, Distributors, Aggregators.

Regional Analysis for Open Banking Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Top-down and bottom-up approach for regional analysis

➡ Porter's five forces model gives an in-depth analysis of buyers and suppliers, threats of new entrants & substitutes and competition amongst the key market players.

➡ By understanding the value chain analysis, the stakeholders can get a clear and detailed picture of this Market

Speak to Our Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/open-banking-market

People Also Ask:

➠ What is the global sales, production, consumption, import, and export value of the Open Banking market?

➠ Who are the leading manufacturers in the global Open Banking industry? What is their operational status in terms of capacity, production, sales, pricing, costs, gross margin, and revenue?

➠ What opportunities and challenges do vendors in the global Open Banking industry face?

➠ Which applications, end-users, or product types are expected to see growth? What is the market share for each type and application?

➠ What are the key factors and limitations affecting the growth of the Open Banking market?

➠ What are the various sales, marketing, and distribution channels in the global industry?

Browse More Reports: https://www.datamintelligence.com/research-report/open-banking-market

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market Growth, Trends, and Opportunities in 2025 | Top key players - Plaid Inc., TrueLayer Ltd, Finleap Connect. here

News-ID: 3994377 • Views: …

More Releases from DataM Intelligence 4Market Research

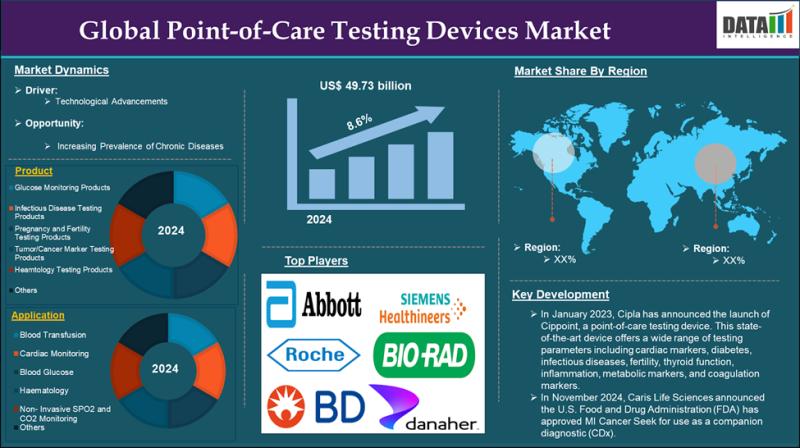

Point-of-Care Testing Devices Market is expected to reach US$ 101.51 billion by …

Market Size and Growth:

The Global Point-of-Care Testing Devices Market size reached US$ 49.73 billion in 2024 and is expected to reach US$ 101.51 billion by 2033, growing at a CAGR of 8.6% during the forecast period 2025-2033.

The Point-of-Care Testing Devices Market encompasses diagnostic tools and technologies that enable rapid, on-site medical testing near the patient, eliminating the need for centralized laboratories. These devices provide immediate results for various conditions, including…

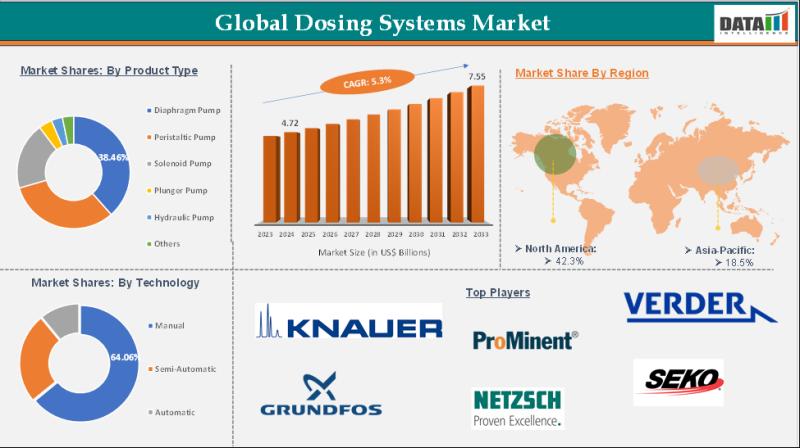

Dosing Systems Market is expected to reach US$ 7.55 Billion by 2033 | Major key …

Market Size and Growth:

The Dosing Systems Market size reached US$ 4.72 Billion in 2024 and is expected to reach US$ 7.55 Billion by 2033, growing at a CAGR of 5.3% during the forecast period 2025-2033.

The Dosing Systems Market encompasses the global industry involved in the development, manufacturing, and supply of precise fluid or chemical dosing equipment used across various sectors, including water treatment, chemicals, food & beverages, pharmaceuticals, and agriculture.…

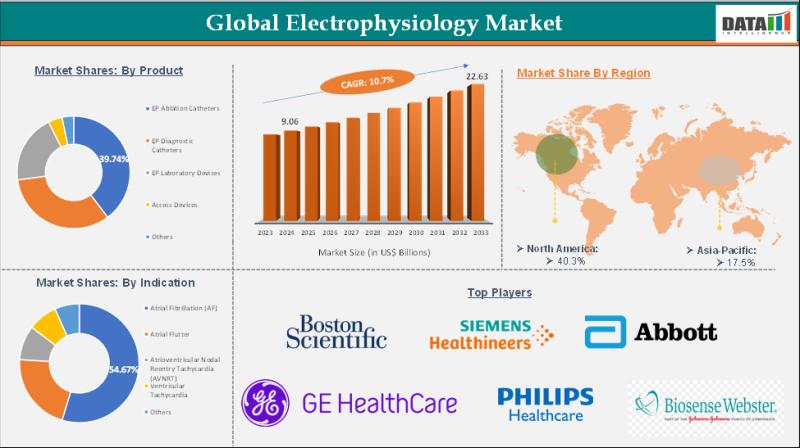

Electrophysiology Market is expected to reach US$ 22.63 Billion by 2033 | Major …

Market Size and Growth:

The Electrophysiology Market reached US$ 9.06 Billion in 2024 and is expected to reach US$ 22.63 Billion by 2033, growing at a CAGR of 10.7% during the forecast period 2025-2033.

The Electrophysiology Market encompasses the global industry focused on the diagnosis, monitoring, and treatment of heart rhythm disorders through advanced electrophysiology (EP) procedures, devices, and technologies. It includes EP catheters, mapping systems, ablation equipment, and implantable cardiac devices…

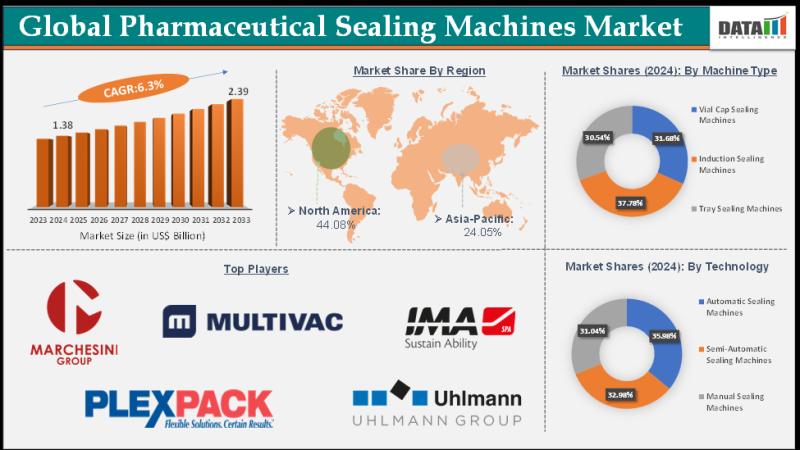

Pharmaceutical Sealing Machines Market is expected to reach US$ 2.39 Billion by …

Market Size and Growth:

The Pharmaceutical Sealing Machines Market size reached US$ 1.38 Billion in 2024 and is expected to reach US$ 2.39 Billion by 2033, growing at a CAGR of 6.3% during the forecast period 2025-2033.

The Pharmaceutical Sealing Machines Market encompasses the global industry involved in the manufacturing, distribution, and sale of machines designed to seal pharmaceutical products such as tablets, capsules, vials, bottles, and blister packs. These machines ensure…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…