Press release

Crypto Asset Management Market Forecasted to Hit USD 2.28 Billion by 2031 | Persistence Market Research Study

The global crypto asset management market is witnessing strong growth, projected to expand from USD 1.1 billion in 2024 to USD 2.28 billion by 2031. With a robust CAGR of 22.4%, this market is driven by the increasing institutional adoption of cryptocurrencies, regulatory developments, and the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) for optimizing portfolio performance.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/34765

As digital assets become more mainstream, investors are seeking structured, compliant, and secure platforms for crypto asset management. The increasing need for risk mitigation, efficient trading, and transparency in blockchain transactions further contributes to the market's expansion.

Key Highlights of the Market

• Based on deployment, the cloud segment is set to dominate due to its scalability and flexibility.

• North America's market growth is fueled by regulatory clarity, institutional investment, and technological innovation.

• Asia Pacific is growing rapidly thanks to widespread crypto adoption among tech-savvy populations.

• Japan, South Korea, Singapore, and Australia are at the forefront of progressive crypto regulation.

• The custodian solution category is estimated to hold a 62% revenue share in 2024.

• Integration of AI and ML enhances portfolio management, trade automation, and fraud detection.

Market Segmentation

The crypto asset management market is segmented by deployment mode, solution type, end-user, and region. Deployment-wise, cloud-based solutions are increasingly favored due to cost-effectiveness, scalability, and seamless integration with other financial technologies.

In terms of solution, custodian solutions lead the market with a 62% share, offering secure storage and management of crypto assets. Investment management platforms and trading solutions are also gaining traction, particularly among hedge funds and high-net-worth individuals seeking diversified crypto portfolios.

Regional Insights

North America holds a significant share of the market, supported by a mature financial ecosystem, proactive regulatory frameworks, and strong institutional interest. The United States, in particular, has seen growing participation from traditional asset managers entering the crypto space.

Asia Pacific is emerging as a dynamic market, with countries like Japan, Singapore, and South Korea advancing supportive regulatory policies. Tech-driven adoption and increasing crypto-savvy retail investors are driving regional growth.

Market Drivers

Growing institutional investment in digital assets and improved regulatory clarity are key drivers for the market. Technological advancements, especially in AI and ML, support intelligent decision-making and real-time asset monitoring, improving investor confidence and operational efficiency.

Market Restraints

Volatile regulatory environments in certain countries, cybersecurity threats, and concerns over the custody of digital assets pose significant challenges. Market participants must navigate evolving compliance requirements and ensure robust security protocols.

Market Opportunities

There is considerable potential in developing region-specific platforms that comply with local regulations and offer localized user experiences. Opportunities also lie in expanding services such as decentralized finance (DeFi) integration, tokenized asset management, and AI-driven advisory solutions.

Frequently Asked Questions (FAQs)

How big is the Crypto Asset Management Market in 2024?

What is the projected CAGR for the market through 2031?

Who are the key players in the global crypto asset management space?

Which region dominates the crypto asset management industry?

What are the major technological trends in crypto asset management?

Company Insights

• Coinbase, Inc.

• Gemini Trust Company, LLC

• Crypto Finance AG

• BitGo, Inc.

• Fidelity Digital Assets

• Bakkt Holdings, Inc.

• Anchorage Digital

• Trustology

• Ledger Enterprise Solutions

• Hex Trust

Recent Developments:

1. In 2024, Fidelity Digital Assets expanded its custodial services to support a broader range of altcoins.

2. Anchorage Digital announced AI-based enhancements to its asset monitoring and compliance automation platform.

This report offers actionable insights for technology providers, institutional investors, and regulators seeking to understand and engage with the fast-evolving crypto asset management ecosystem.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Asset Management Market Forecasted to Hit USD 2.28 Billion by 2031 | Persistence Market Research Study here

News-ID: 3993948 • Views: …

More Releases from Persistence Market Research

Custom Leadership Development Program Market Set for Rapid Growth Through 2032

The global custom leadership development program market is witnessing strong momentum as organizations increasingly prioritize leadership excellence as a core driver of long-term success. In an era marked by rapid digital transformation, evolving workforce expectations, and heightened competitive pressure, organizations are moving away from standardized training models and embracing customized leadership solutions. According to recent market insights, the global custom leadership development program market is forecast to expand at a…

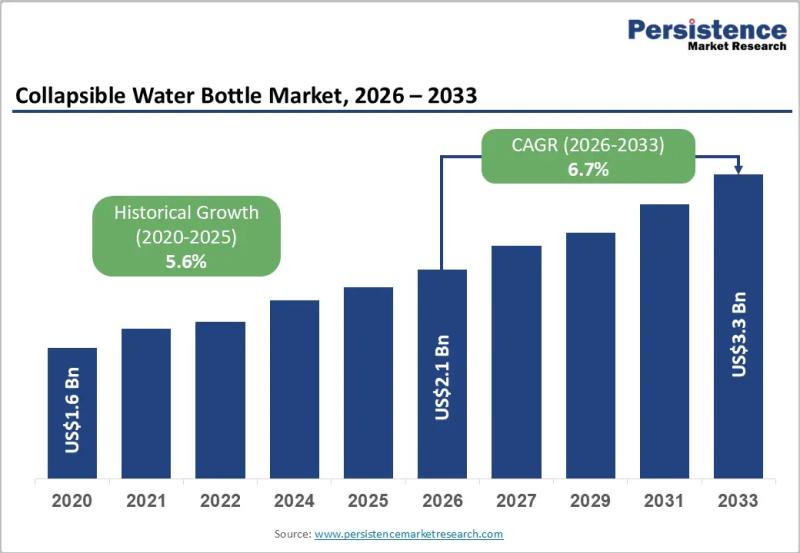

Collapsible Water Bottle Market Expected to Reach US$3.3 Billion by 2033 - Persi …

The collapsible water bottle market has evolved from a niche outdoor accessory category into a mainstream consumer product segment aligned with sustainability convenience and modern lifestyles. Collapsible water bottles are designed to reduce volume when empty making them easy to store carry and reuse across diverse environments. Their popularity has grown significantly as consumers seek alternatives to single use plastic bottles while maintaining portability for travel fitness work and outdoor…

UV-Protected Tarpaulin Sheets Market Size Worth US$5.4 Billion by 2033, Growing …

The UV-protected tarpaulin sheets market is a vital component of the global industrial and agricultural textiles landscape, supporting a wide range of applications that demand durability weather resistance and long service life. UV-protected tarpaulins are engineered to withstand prolonged exposure to sunlight moisture wind and mechanical stress making them indispensable across construction agriculture logistics transportation disaster relief and outdoor storage. Unlike conventional tarpaulins these sheets incorporate ultraviolet stabilizers and coatings…

Beer Packaging Market Size Expected to Reach US$35.9 Billion by 2033 - Persisten …

The beer packaging market plays a central role in the global alcoholic beverages industry, acting as both a functional necessity and a powerful brand differentiator. Packaging influences shelf appeal product freshness portability and consumer perception, making it a critical component of brewery strategy. Over the years, beer packaging has evolved from a largely standardized glass bottle format into a diverse ecosystem that includes aluminum cans kegs and innovative hybrid solutions.…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…