Press release

Merchant Banking Services Market Report 2025-2034: Industry Overview, Trends, And Forecast Analysis

The Merchant Banking Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Current Merchant Banking Services Market Size and Its Estimated Growth Rate?

The Merchant Banking Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Merchant Banking Services Market Size and Its Estimated Growth Rate?

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=10664

How Are Emerging Segments Shaping the Merchant Banking Services Market Landscape?

The merchant banking services market covered in this report is segmented -

1) By Service Type: Trade Financing, Business Management, Portfolio Management, Credit Syndication, Initial Public Offering (IPO) Management, Project Management

2) By Service Provider: Banks, Non-Banking Financial Institutions

3) By End User: Business, Individuals

Subsegments:

1) By Trade Financing: Export Financing, Import Financing, Invoice Discounting, Trade Credit Insurance

2) By Business Management: Advisory Services, Strategic Planning, Financial Planning, Risk Management

3) By Portfolio Management: Equity Portfolio Management, Fixed Income Portfolio Management, Alternative Investment Management, Asset Allocation Services

4) By Credit Syndication: Debt Syndication, Loan Syndication, Structured Finance, Mezzanine Financing

5) By Initial Public Offering (IPO) Management: Underwriting Services, Valuation Services, marketing and Roadshow Management, Compliance Advisory

6) By Project Management: Feasibility Studies, Budget Management, Risk Assessment, Stakeholder Engagement

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10664&type=smp

Which Growth Factors Are Influencing Merchant Banking Services Market Expansion?

An increase in foreign investment is predicted to fuel the expansion of the merchant banking services market in the future. Foreign investment involves people or organizations from one nation investing capital into another in a variety of ways, including direct investment, portfolio investment, and foreign aid. By providing insights about the local market, identifying potential opportunities for investment, and securing funding, merchant banking services aid foreign investors. For example, the Bureau of Economic Analysis (BEA), a US government agency, stated in July 2024 that the position of foreign direct investment in the US had grown to $3.46 trillion in 2023 from $3.37 trillion in 2022. Consequently, the merchant banking services market's growth is being propelled by an increase in foreign investment.

Who Are the Dominant Players Across Different Merchant Banking Services Market Segments?

Major companies operating in the merchant banking services market include JPMorgan Chase & Co., Bank of America Corporation, DBS Bank Ltd., Morgan Stanley & Co. LLC, Credit Suisse Group AG, NIBL Ace Capital Limited, Bryant Park Capital, HSBC Bank USA N.A., Royal Bank of Canada Website, The USA Capital Advisors LLC, Deutsche Bank AG, Citigroup Inc., The Goldman Sachs Group Inc., UBS Group AG, Wells Fargo and Co., Barclays plc, BNP Paribas SA, Societe Generale Group, Mizuho Financial Group, Sumitomo Mitsui Financial Group, Nomura Holdings, Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Standard Chartered plc, PNC Financial Services, Toronto Dominion Securities Inc., Scotiabank, National Bank of Canada Financial Inc.

What Are the Latest Developing Trends in the Merchant Banking Services Market?

The rise of AI-powered digital banking platforms is a significant trend in the merchant banking service industry. Firms in this sector are incorporating AI-driven technologies to maintain their market standing. As an example, Wells Fargo, a financial services firm based in the US, launched the Vantage system in December 2022 for its commercial, corporate, and investment banking clients, which includes small to medium-sized enterprises. This system uses AI and machine learning (ML) to offer an enhanced, more personalized experience to cater to the financial requirements of businesses at any growth stage. Furthermore, ML is employed to progressively enhance personalization and scalability, supporting businesses' growth with the platform.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/merchant-banking-services-global-market-report

Which Geographic Regions Are Expected to Dominate the Merchant Banking Services Market in the Coming Years?

North America was the largest region in the merchant banking services market in 2024.Asia-Pacific is expected to be the fastest-growing region in the global merchant banking services market report during the forecast period. The regions covered in the merchant banking services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Merchant Banking Services Market?

2. What is the CAGR expected in the Merchant Banking Services Market?

3. What Are the Key Innovations Transforming the Merchant Banking Services Industry?

4. Which Region Is Leading the Merchant Banking Services Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Merchant Banking Services Market Report 2025-2034: Industry Overview, Trends, And Forecast Analysis here

News-ID: 3992393 • Views: …

More Releases from The Business Research Company

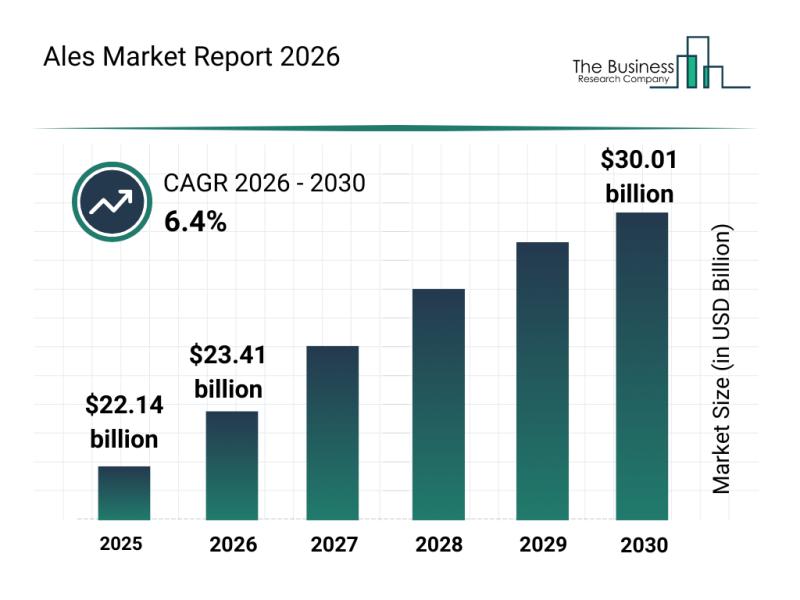

Competitive Landscape: Key Market Leaders and New Entrants in the Ales Market

The ales market is positioned for significant expansion in the coming years, driven by evolving consumer preferences and industry innovations. As demand for high-quality and unique alcoholic beverages grows, this sector continues to attract investment and creativity. Let's explore the market's size, key players, emerging trends, and the primary segments shaping its future.

Projected Growth and Size of the Ales Market by 2030

The ales market is anticipated to reach…

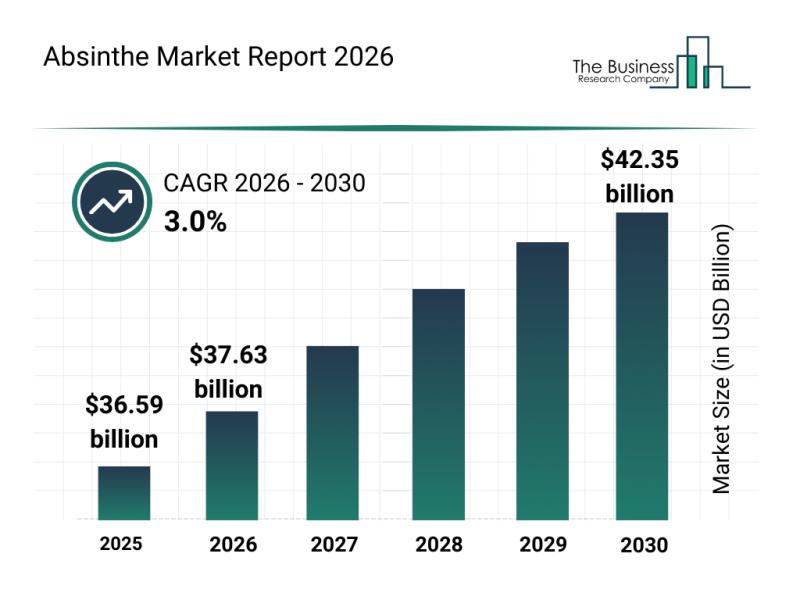

Future Perspective: Key Trends Shaping the Absinthe Market Up to 2030

The absinthe market is poised for steady expansion as consumer interest in unique and premium spirits grows. With evolving tastes and a surge in cocktail culture, the demand for absinthe is increasing, supported by innovations and a renewed appreciation for traditional and craft variants. The following analysis explores the market size forecast, leading companies, emerging trends, and segmentation details shaping this niche alcoholic beverage sector.

Projected Growth Trajectory of the Absinthe…

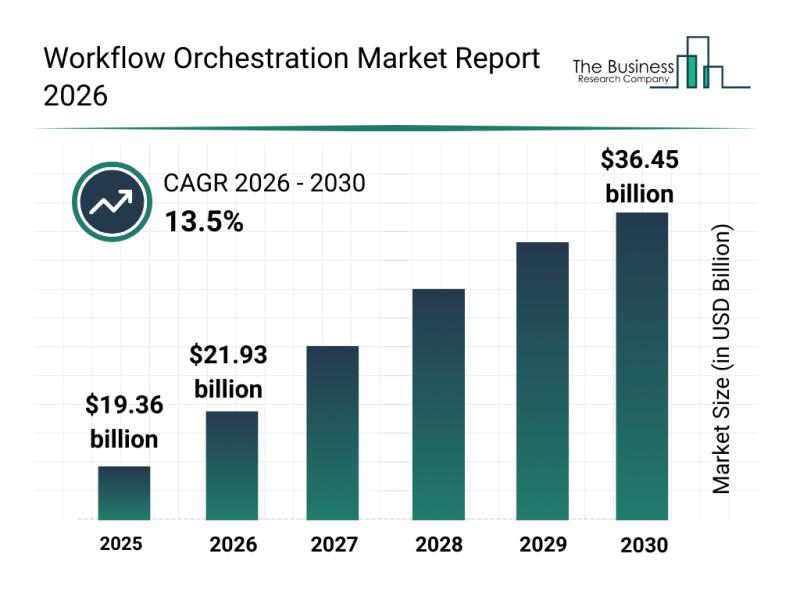

Analysis of Key Market Segments Driving the Workflow Orchestration Market

The workflow orchestration market is positioned for significant expansion over the coming years, driven by technological advancements and evolving business needs. As organizations increasingly seek to automate and streamline processes, this sector is attracting substantial investment and innovation. Let's explore the market's expected growth, key players, emerging trends, and main segments shaping its future.

Projected Market Value and Growth Drivers in the Workflow Orchestration Market

The workflow orchestration market is…

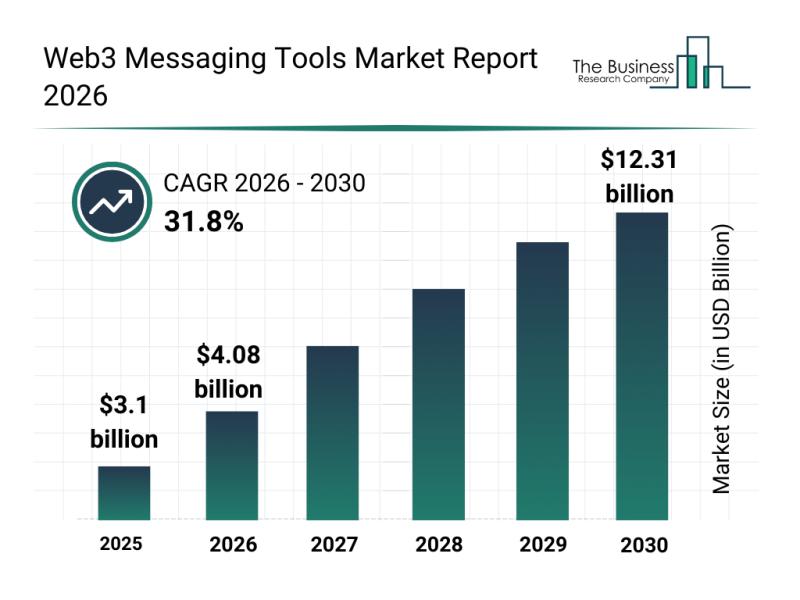

Market Trend Analysis: The Impact of Recent Advances on the Web3 Messaging Tools …

The Web3 messaging tools market is on the brink of remarkable growth, driven by the expanding use of decentralized communication technologies. As businesses and individual users increasingly seek secure, censorship-resistant messaging platforms, this sector is expected to undergo significant transformation. Let's explore the market size projections, leading companies, key trends, and the segmentation that define the future of Web3 messaging tools.

Projected Expansion of the Web3 Messaging Tools Market Size Through…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…