Press release

Insurtech Market Size to Hit USD 152.9 Billion by 2033 | Grow CAGR by 31.51%

Market Overview:The Insurtech Market is experiencing rapid growth, driven by Emerging Markets Driving Global Expansion, Data-Driven Personalization and IoT Changing Insurance Models, and AI And Automation Improve Operations And Customer Service. According to IMARC Group's latest research publication, "Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033", The global insurtech market size was valued at USD 10.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.9 Billion by 2033, exhibiting a CAGR of 31.51% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/insurtech-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Factors Affecting the Growth of the Insurtech Industry:

● Emerging Markets Driving Global Expansion:

The insurtech sector is spreading its wings across the globe. The Asia-Pacific region, with India, China, and Southeast Asia, is growing fast. Rising insurance penetration and digital infrastructure are fueling this expansion. With a large underinsured population, opportunities abound for innovation. Finsall's impressive ₹15 crore funding in 2024 shows rising regional confidence. Also, Europe's secondary markets are gaining attention due to smart regulatory reforms. These changes create a competitive and inclusive global insurtech landscape.

● Data-Driven Personalization and IoT Changing Insurance Models:

IoT devices-think telematics and wearables-are revolutionizing risk assessment. They offer real-time insights that shape usage-based pricing. Vehicle telematics generate dynamic auto insurance rates, customizing premiums for each driver. At the same time, health wearables make personalized wellness-linked life insurance options possible. Get ready for a massive amount of data! IoT information is expected to reach 2.5 quintillion bytes every day. This wealth of data benefits insurers in many ways. It helps refine underwriting, reduces fraud, and increases claims efficiency. In the end, it leads to highly customized products. This sets new industry benchmarks.

● AI And Automation Improve Operations And Customer Service:

AI chatbots, automated claims processing, and blockchain smart contracts cut costs by 30-40% and boost efficiency. Predictive analytics help insurers manage risks, while AI underwriting speeds up policy issuance. Today, over 25% of insurers use AI to personalize customer interactions. Additionally, parametric insurance and on-demand coverage are becoming more popular. As a result, insurance is becoming more accessible to people and more profitable.

Buy Full Report:- https://www.imarcgroup.com/checkout?id=3636&method=1670

Leading Companies Operating in the Global Insurtech Industry:

● Damco Group

● DXC Technology Company

● Insurance Technology Services

● Majesco (Aurum PropTech Limited)

● Oscar Insurance Corporation

● Quantemplate

● Shift Technology

● Travelers Companies, Inc.

● Wipro

● ZhongAn Online P&C Insurance Co. Ltd.

Insurtech Market Report Segmentation:

By Type:

● Auto

● Business

● Health

● Home

● Specialty

● Travel

● Others

Based on the type, the market has been classified into auto, business, health, home, specialty, travel, and others.

By Service:

● Consulting

● Support and Maintenance

● Managed Services

On the basis of the service, the market has been divided into consulting, support and maintenance, and managed services.

By Technology:

● Blockchain

● Cloud Computing

● IoT

● Machine Learning

● Robo Advisory

● Others

Cloud computing accounts for the largest market share due to its scalability, cost-efficiency, and ability to provide insurers with seamless access to data and applications, enabling streamlined operations and enhanced customer experiences.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America's dominance in the insurtech market is attributed to its robust technological infrastructure, high adoption rates of digital solutions, and well-established insurance industry, making it a fertile ground for the growth of insurtech companies.

Ask Analyst For Sample Report:- https://www.imarcgroup.com/request?type=report&id=3636&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market Size to Hit USD 152.9 Billion by 2033 | Grow CAGR by 31.51% here

News-ID: 3992177 • Views: …

More Releases from IMARC Group

Latest Lithium Metal Price Trend January 2026 Highlights Price Movements

Northeast Asia Lithium Metal Prices January 2026

In January 2026, lithium metal prices in Northeast Asia rose to USD 11.66/kg, reflecting a 10.3% increase. The upward movement was driven by strong demand from battery manufacturers. Supply constraints and regional production adjustments influenced the price trend, with the price index showing steady growth.

Price Trend Analysis

The lithium metal price trend in Northeast Asia during January 2026 indicated significant upward momentum. Increased consumption in…

Latest Lithium Hydroxide Price Trend: Understanding Price Movements and Outlook

North America Lithium Hydroxide Price Trends in Q4 2025:

United States Lithium Hydroxide Price Overview:

In Q4 2025, lithium hydroxide prices in the USA averaged USD 10,800/MT. Strong demand from battery manufacturing and electric vehicle production supported stable pricing. Supply chain management and raw material availability influenced regional prices, while energy costs played a role in production expenses. Tracking the lithium hydroxide price trend helped manufacturers and procurement teams plan sourcing and…

Rhinoplasty Market Outlook: Key Trends, Growth Drivers, and Opportunities To 203 …

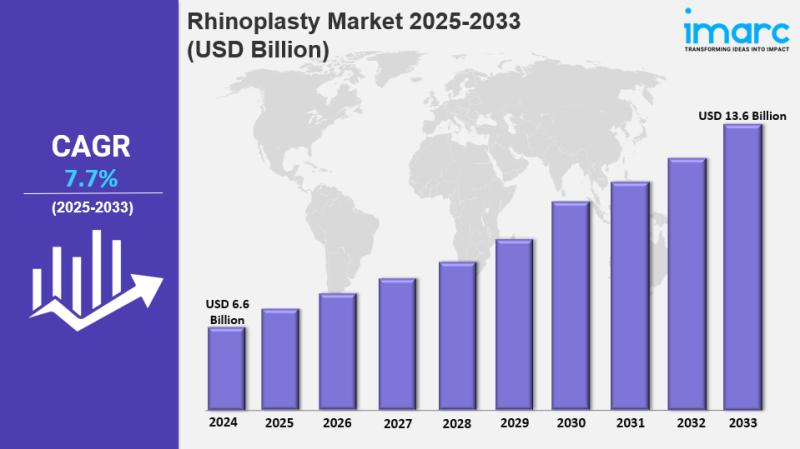

IMARC Group has recently released a new research study titled "Rhinoplasty Market Report by Treatment Type (Augmentation, Reduction, Post-Traumatic, Reconstructive, Revision, and Others), Technique (Open Rhinoplasty, Closed Rhinoplasty), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The global Rhinoplasty Market reached a size of USD 6.6 Billion in 2024. It is projected…

Electrical Steel Price Index Highlights Recent Movements

North America Electrical Steel Prices Movement Q4 2025:

Electrical Steel Prices in USA:

USA electrical steel prices in Q4 2025 averaged USD 5,316/MT, supported by strong automotive and industrial demand. The electrical steel price trend remained firm amid tight domestic supply. The electrical steel price index showed notable strength, while the electrical steel price chart reflected steady upward movement. The electrical steel price forecast indicates continued stability with moderate firmness ahead.

Get the…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…