Press release

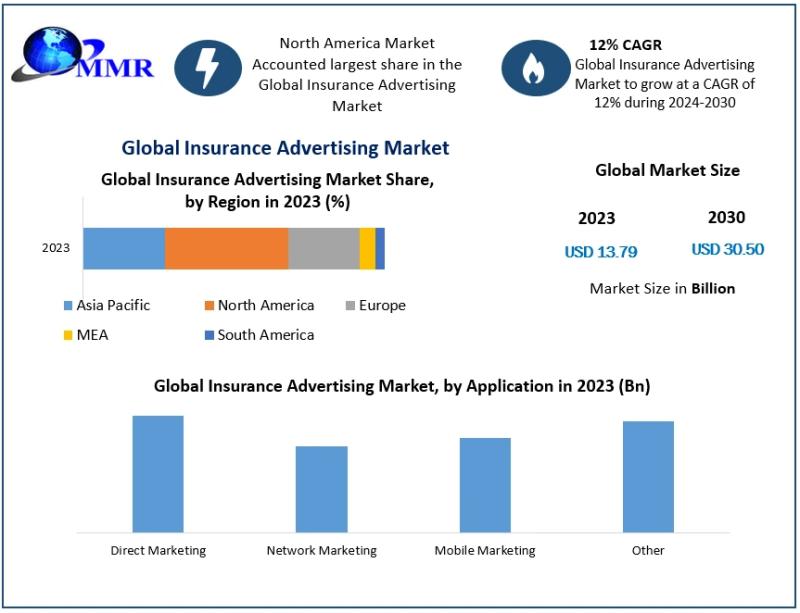

Insurance Advertising Market Forecasted to Reach USD 30.50 Bn by 2030, with a CAGR of 12% from 2024 to 2030

The Insurance Advertising Market was valued at USD 13.79 Bn. in 2023. Global Insurance Advertising Market size is expected to grow at a CAGR of 12 % through the forecast period.Insurance Advertising Market Overview:

Insurance advertising encompasses a range of promotional activities aimed at informing and persuading consumers about insurance products and services. With the proliferation of digital platforms, insurers are leveraging online channels to deliver targeted and personalized messages. This shift towards digital advertising is enabling companies to connect with a broader audience, optimize their marketing efforts, and achieve better returns on investment.

Download a Free Sample Report Today : https://www.maximizemarketresearch.com/request-sample/147736/

Insurance Advertising Market Dynamics

The market's growth is propelled by several factors, including the increasing penetration of the internet and mobile devices, advancements in data analytics, and the rising demand for personalized insurance solutions. However, challenges such as data privacy concerns and regulatory compliance continue to pose obstacles. To navigate these challenges, insurers are investing in robust data protection measures and adhering to stringent regulatory frameworks.

Insurance Advertising Market Outlook and Future Trends :

Looking ahead, the insurance advertising market is poised for sustained growth, with emerging technologies like artificial intelligence (AI) and machine learning playing a crucial role. These technologies are enabling insurers to analyze consumer behavior, predict preferences, and deliver highly personalized advertising content. Furthermore, the integration of interactive and immersive advertising formats, such as augmented reality (AR) and virtual reality (VR), is expected to redefine consumer engagement in the insurance sector.

Key Recent Developments

Vietnam and Thailand:

In Southeast Asia, countries like Vietnam and Thailand are witnessing a surge in digital insurance advertising, driven by increasing internet penetration and smartphone usage. Insurers in these markets are adopting mobile-first strategies and leveraging social media platforms to reach younger demographics and promote microinsurance products tailored to local needs.

Japan and South Korea:

Japan and South Korea are at the forefront of integrating advanced technologies into insurance advertising. Companies in these countries are utilizing AI and big data analytics to craft personalized marketing campaigns, enhancing customer engagement and retention. Additionally, collaborations between insurers and tech firms are fostering innovation in advertising strategies.

Singapore:

Singapore's insurance industry is embracing digital transformation, with a focus on data-driven advertising and customer-centric approaches. Regulatory support for fintech and insurtech initiatives is enabling insurers to experiment with innovative advertising formats and platforms, thereby expanding their reach and improving customer experiences.

United States:

In the United States, the insurance advertising landscape is characterized by intense competition and a strong emphasis on digital channels. Insurers are investing heavily in programmatic advertising, content marketing, and influencer partnerships to differentiate their offerings and connect with diverse consumer segments. The integration of AI and machine learning is further enhancing targeting precision and campaign effectiveness.

Europe:

European insurers are focusing on building trust and transparency through their advertising efforts. With stringent data protection regulations in place, companies are prioritizing ethical advertising practices and leveraging customer data responsibly to deliver relevant and compliant marketing messages. The adoption of omnichannel strategies is also enabling insurers to provide seamless and consistent customer experiences across various touchpoints.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report : https://www.maximizemarketresearch.com/request-sample/147736/

Insurance Advertising Market Segmentation

by Product

Life Insurance

Non-Health Insurance

by Advertisement Channels

Television

Sales Calls

Othe

by Application

Direct Marketing

Network Marketing

Mobile Marketing

Other

Some of the current players in the Insurance Advertising Market are:

1. Berkshire Hathaway

2. The Progressive Corporation

3. Allstate Corporation

4. GEICO

5. UnitedHealth Group

6. State Farm Mutual

7. Farmers Insurance Group

8. Admiral Group

9. Nationwide Mutua

10. American Family Mutual

For additional reports on related topics, visit our website:

♦ Global Reinsurance Market https://www.maximizemarketresearch.com/market-report/global-reinsurance-market/42133/

♦ Cyber Security Insurance Market https://www.maximizemarketresearch.com/market-report/global-cyber-security-insurance-market/31797/

♦ Global Property Insurance Market https://www.maximizemarketresearch.com/market-report/property-insurance-market/148698/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Advertising Market Forecasted to Reach USD 30.50 Bn by 2030, with a CAGR of 12% from 2024 to 2030 here

News-ID: 3990127 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

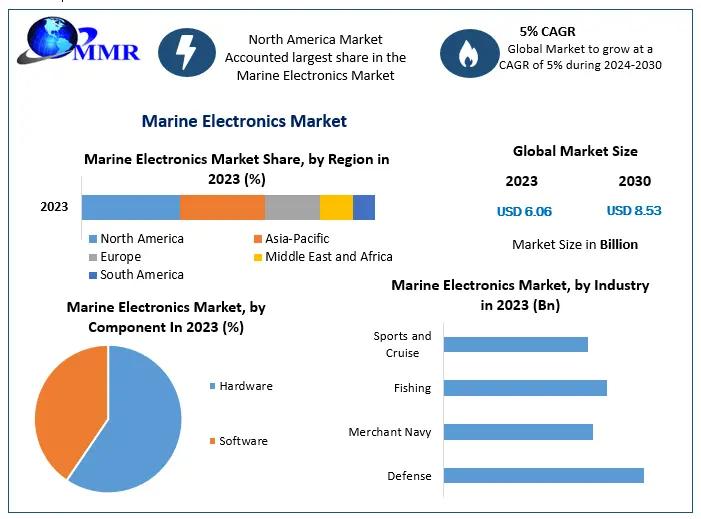

Marine Electronics Market Expected to Reach USD 8.53 Bn by 2030 - Growth Forecas …

Marine Electronics Market Size: According to Maximize Market Research, the Global Marine Electronics Market was valued at US$ 6.06 billion in 2023 and is expected to reach US$ 8.53 billion by 2030, growing at a CAGR of around 5% during 2024-2030.

Market Overview

The Global Marine Electronics Market encompasses electronic devices and systems designed specifically for marine environments. These include navigation systems, communication devices, safety equipment, sonar & radar, vessel management systems,…

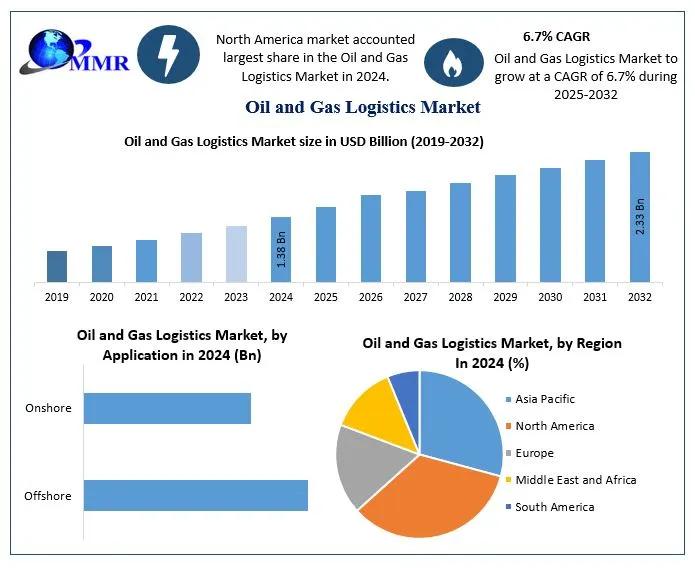

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

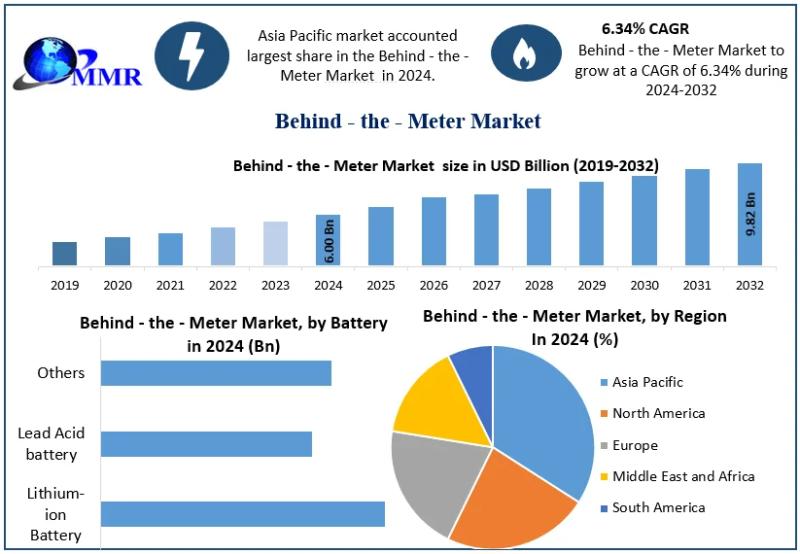

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

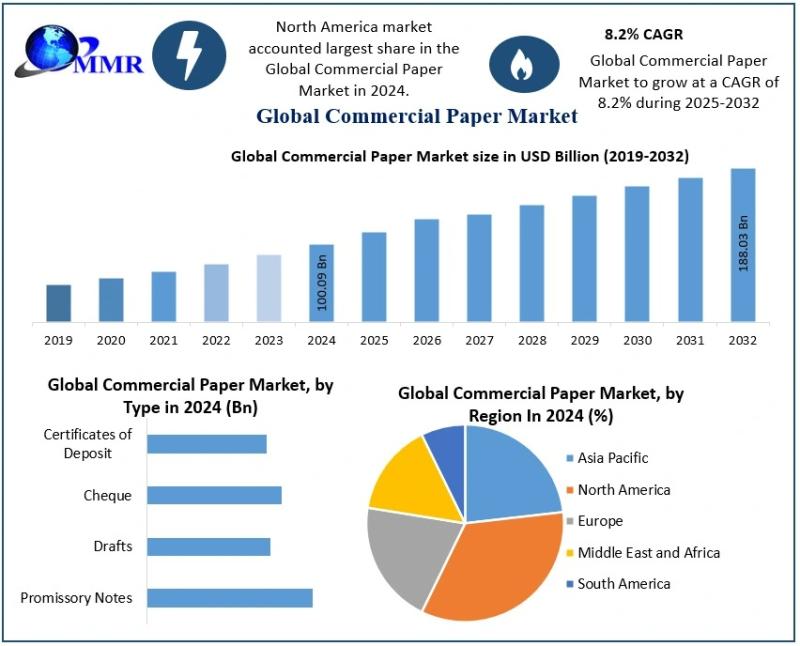

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…