Press release

UAE Energy Drinks Market Size, Share, Growth & Forecast 2025-2033

Market Overview 2025-2033The UAE energy drinks market size reached USD 219 Million in 2023. Looking forward, IMARC Group expects the market to reach USD 376 Million by 2032, exhibiting a growth rate (CAGR) of 6.20% during 2024-2032. The market is expanding due to rising health consciousness, demand for functional beverages, and a growing young population. Innovation in flavors, marketing strategies, and increased availability across retail channels are driving growth. Lifestyle changes and fitness trends continue to shape a dynamic and competitive industry environment.

Key Market Highlights:

✔️ Strong market growth driven by increasing health consciousness and active lifestyle trends

✔️ Rising demand for functional beverages with natural and sugar-free formulations

✔️ Expanding retail presence and brand promotions targeting youth and fitness enthusiasts

Request for a sample copy of the report: https://www.imarcgroup.com/uae-energy-drinks-market/requestsample

UAE Energy Drinks Market Trends and Drivers:

The UAE energy drinks market is changing as consumers focus on health and wellness. They want products with less sugar, natural ingredients, and extra benefits. Brands are adjusting their offerings to meet these needs. They are launching sugar-free options, plant-based energy boosters like guarana and green tea, and drinks with added vitamins, electrolytes, or adaptogens. For example, big names like Red Bull and Monster now offer "zero-sugar" versions for the UAE market. Local brands like Power Horse promote "clean energy" with caffeine alternatives like taurine and B vitamins. This trend grew in 2024 due to stricter government rules on sugar. Strong marketing connects energy drinks to active lifestyles.

Urban fitness enthusiasts and professionals boost demand for healthy, performance-boosting drinks. Many consumers will pay 20-30% more for organic certifications, recyclable packaging, or added benefits like immune support. The UAE is a global hub for tourism and hospitality, which affects energy drink consumption. In 2024, the country expects over 16 million international tourists. This is a 12% increase from pre-pandemic levels. High visitor numbers in hotels, airports, and entertainment venues boost sales. Energy drinks are now seen as travel essentials. Brands team up with airlines, like Emirates, which offers Baiant Power on its in-flight menu. Luxury hotels also stock "energy bars" for guests fighting jet lag.

Events such as the Dubai Shopping Festival, Expo 2024, and the Formula 1 Abu Dhabi Grand Prix create seasonal demand spikes. Sales can increase by 18-25% during these events. The hot climate also affects sales. Convenience stores in tourist areas see a 30% rise in chilled energy drink sales during summer. To meet diverse tastes, companies launch region-specific flavors, like date-infused and saffron-blended options, combining local flavors with energy-boosting benefits.

The UAE's e-sports industry is booming, valued at $180 million in 2024. It drives energy drink sales, especially among Gen Z. Brands like G Fuel and Rockstar are sponsoring gaming tournaments and streaming. They promote their drinks as cognitive enhancers for focus.

Social media campaigns with influencers, like Dubai-based gamers, lead digital outreach. About 45% of UAE consumers aged 18-24 try energy drinks after seeing online endorsements. Augmented reality (AR) filters on Instagram and TikTok engage users. Gamified rewards through apps and limited-edition "gamer packs" with QR codes for in-game perks also attract attention. Direct-to-consumer (D2C) models are growing. Subscription services offer personalized bundles, like "Night Shift Packs" for workers or "Gamer Fuel Kits." This digital-first strategy matches the UAE's 95% smartphone penetration, making it key for market growth.

The UAE energy drinks market is dynamic and influenced by several factors. The population is young, with over 50% under 30. This, along with high disposable incomes, boosts demand, especially in cities like Dubai and Abu Dhabi. Here, fast-paced lifestyles lead to on-the-go consumption. Recently, the market has evolved due to various changes. In 2024, a federal front-of-pack labeling system was introduced. This requires brands to show sugar and caffeine content clearly. As a result, many brands are shifting toward healthier options.

Sustainability is also important. Aluminum cans now make up 70% of packaging because they are recyclable. Startups like Revo Energy are gaining attention for their carbon-neutral production claims. The post-pandemic recovery in nightlife has sparked impulse purchases. Bars and clubs have seen a 22% rise in energy drink-based cocktails. Looking ahead, analysts expect a 7.2% CAGR through 2030. This growth is fueled by hybrid work models that require alertness and the UAE's goal to be a regional hub for food and beverage innovation.

Checkout Now: https://www.imarcgroup.com/checkout?id=23530&method=1090

UAE Energy Drinks Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product:

• Non-organic

• Organic

• Natural

Breakup by Target Consumer:

• Teenagers

• Adults

• Geriatric Population

Breakup by Distribution Channel:

• Offline

o Supermarket/Hypermarket

o Mass Merchandiser

o Drug Store

o Food Service/Sports Nutrition Chain

o Others

• Online

Breakup by Region:

• Dubai

• Abu Dhabi

• Sharjah

• Others

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=23530&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UAE Energy Drinks Market Size, Share, Growth & Forecast 2025-2033 here

News-ID: 3988372 • Views: …

More Releases from IMARC Group

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

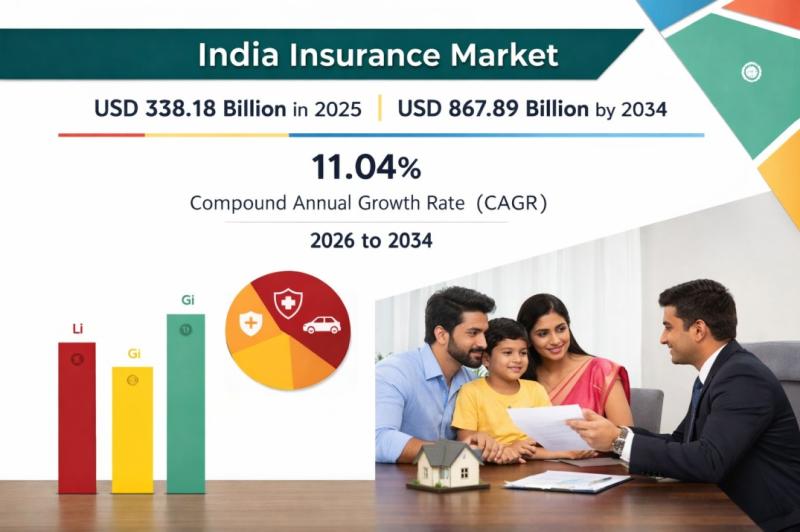

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

Titanium Prices, Index, Supply Factors & Uses | Jan 2026

North America Titanium Prices Movement Jan 2026

In January 2026, Titanium prices in North America reached USD 7.09/KG, reflecting a 3.1% increase. The upward movement was supported by firm demand from aerospace, automotive, and defense industries. Stable raw material supply and improving manufacturing activity strengthened market sentiment, contributing to positive pricing momentum across the region.

Regional Analysis: The price analysis can be extended to provide detailed Titanium price information for the following…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…