Press release

Saudi Arabia E-Health Market Report 2025 Edition: Industry Size, Share, Growth and Competitor Analysis

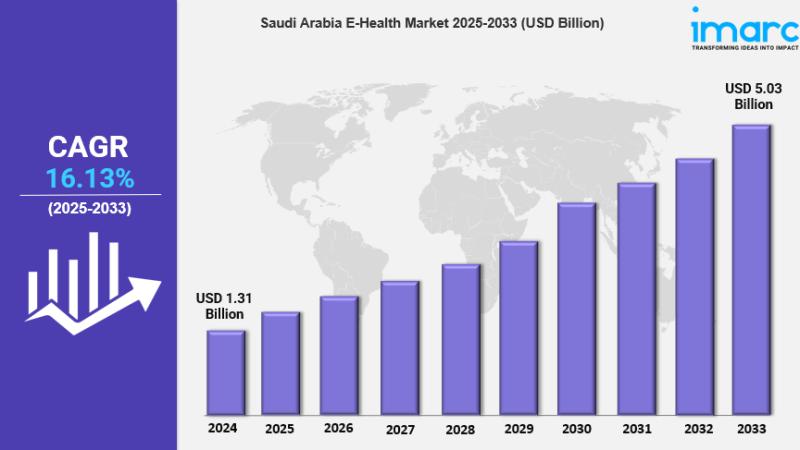

Market Overview 2025-2033The Saudi Arabia e-health market size reached USD 1.31 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.03 Billion by 2033, exhibiting a growth rate (CAGR) of 16.13% during 2025-2033. Positive government policies for digital health revolution, higher investments in healthcare, mounting demand for distant healthcare services, expanding internet coverage, and uptake of sophisticated technologies such as AI, telemedicine, and electronic health records (EHRs) are among the major determinants bolstering the market growth.

Key Market Highlights:

✔️ Rapid market expansion driven by digital transformation in healthcare

✔️ Growing demand for telemedicine and remote patient monitoring solutions

✔️ Increasing adoption of AI and data-driven healthcare innovations

Request for a sample copy of this report: https://www.imarcgroup.com/saudi-arabia-e-health-market/requestsample

Saudi Arabia E-Health Market Trends and Drivers:

Saudi Arabia's e-health market is undergoing rapid digital transformation, driven by government initiatives and investments in smart healthcare infrastructure. The Vision 2030 plan emphasizes digital health integration, aiming to enhance healthcare accessibility, efficiency, and patient outcomes. Hospitals and clinics across the country are adopting electronic health records (EHRs), cloud-based healthcare solutions, and AI-powered diagnostics to streamline medical processes.

Additionally, the growing use of Internet of Medical Things (IoMT) devices enables real-time health monitoring, reducing hospital visits and optimizing patient care. The expansion of 5G technology is further enhancing digital health capabilities, enabling faster data transmission and seamless integration of telehealth services. As the country continues to prioritize digital innovation in healthcare, the demand for advanced e-health solutions is expected to grow significantly in 2025.

The demand for telemedicine and remote patient monitoring in Saudi Arabia is rising due to increasing healthcare digitalization and patient preference for convenient medical consultations. The COVID-19 pandemic accelerated the adoption of virtual healthcare services, and this trend is expected to continue into 2025. Government support, including regulatory frameworks and telehealth reimbursement policies, is facilitating the expansion of online medical consultations, AI-driven diagnostics, and wearable health monitoring devices.

These solutions are particularly beneficial for managing chronic diseases such as diabetes and cardiovascular conditions, which are prevalent in the country. Moreover, rural and underserved areas are gaining improved access to healthcare services through telemedicine platforms, reducing geographical barriers to quality care. As digital health adoption continues to rise, telemedicine and remote monitoring will remain key growth drivers in Saudi Arabia's e-health market.

Artificial intelligence (AI) and big data analytics are revolutionizing Saudi Arabia's e-health sector, driving efficiency, accuracy, and personalization in healthcare services. AI-powered tools are being integrated into diagnostics, predictive analytics, and robotic-assisted surgeries, enhancing clinical decision-making and patient outcomes. Big data analytics is improving population health management by enabling early disease detection, real-time patient monitoring, and personalized treatment plans.

Additionally, AI-driven chatbots and virtual assistants are being deployed for automated patient support and administrative tasks, reducing operational costs and improving service delivery. The Saudi government and private healthcare providers are investing in AI research and development, further accelerating innovation in the sector. With the increasing adoption of AI and data-driven healthcare solutions, the e-health market in Saudi Arabia is expected to experience significant growth in 2025.

Buy Report Here: https://www.imarcgroup.com/checkout?id=28847&method=1315

Saudi Arabia E-Health Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Saudi Arabia E-Health market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Type Insights:

• Electronic Health Records

• e-Prescribing

• Telehealth & Telemedicine

• Mobile Health

• Others

Services Insights:

• Monitoring

• Diagnostic

• Healthcare Strengthening

• Others

End-User Insights:

• Healthcare Professionals

• Healthcare Consumers

• Public & Private Insurers

• Pharmacies

• Others

Regional Insights:

• Northern and Central Region

• Western Region

• Eastern Region

• Southern Region

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Speak to an analyst : https://www.imarcgroup.com/request?type=report&id=28847&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC's services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia E-Health Market Report 2025 Edition: Industry Size, Share, Growth and Competitor Analysis here

News-ID: 3983941 • Views: …

More Releases from IMARC Group

India Electric Vehicle Battery Market: Key Trends & Industry Forecast by 2034

The latest report by IMARC Group, "India Electric Vehicle Battery Market Size, Share, Trends and Forecast by Battery Type, Propulsion Type, Vehicle Type, and Region, 2026-2034", provides a comprehensive industry analysis. It delivers deep insights into the India electric vehicle battery market, highlighting growth drivers, competitive landscapes, and emerging segment trends for the 2026-2034 forecast period.

What is the India Electric Vehicle Battery Market Size, Share, Trends, and Growth Forecast (2026-2034)?

According…

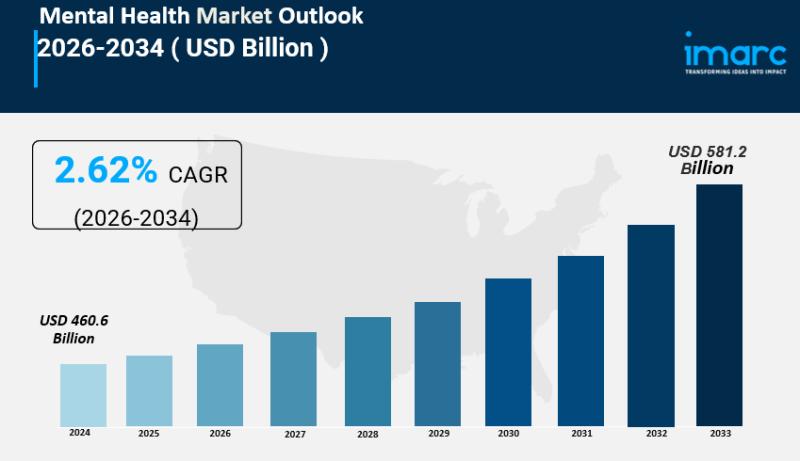

Global Mental Health Market Size, Share And Growth Report 2034

IMARC Group, a leading market research company, has recently released a report titled "Mental Health Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2026-2034."The study provides a detailed analysis of the industry, including the Mental Health market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Overview

The global…

India Inverter Market Set to Hit USD 2,383.18 Million by 2033, Driven by 15.68% …

India Inverter Market : Report Introduction

According to IMARC Group's report titled "India Inverter Market Size, Share, Trends, and Forecast by Type, Output Power Rating, Connection Type, End User, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights,…

Glass Bottle Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/ …

The global glass bottle manufacturing industry is witnessing robust growth driven by the rapidly expanding beverage sector and increasing demand for sustainable packaging solutions. At the heart of this expansion lies a critical packaging material: glass bottles. As consumer markets transition toward eco-friendly packaging and premium product presentation, establishing a glass bottle manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and packaging industry investors seeking to capitalize on…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…