Press release

Online Payment Fraud Detection Market to Witness Remarkable Growth with ACI Worldwide, Experian, Accertify, Feedzai

The global online payment fraud detection market is witnessing a rapid surge in growth as the demand for secure online transactions continues to rise. With the increasing shift towards digital payments and e-commerce, businesses and consumers alike face heightened risks from cyber fraud. Fraud detection solutions are becoming essential for preventing unauthorized transactions, protecting sensitive data, and maintaining trust in online payment systems. According to projections by Persistence Market Research, the global market size for online payment fraud detection is expected to rise from US$ 8,090.8 million in 2025 to US$ 19,997.9 million by 2032, exhibiting a strong CAGR of 13.8% during the forecast period from 2025 to 2032.This remarkable growth can be attributed to several factors, including the surge in online shopping, the increase in mobile transactions, and the need for businesses to protect customer information and maintain regulatory compliance. Additionally, the rise in digital banking, fintech innovations, and the adoption of cloud-based solutions are contributing to the need for more advanced fraud detection systems. North America leads the market due to the presence of key players and high adoption of payment security technologies, while regions like East Asia and South Asia are witnessing rapid growth due to increased digital payment adoption in emerging economies.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/33078

Key Highlights from the Report:

➤ The global online payment fraud detection market is expected to reach US$ 19,997.9 million by 2032.

➤ The market is anticipated to grow at a robust CAGR of 13.8% during the forecast period from 2025 to 2032.

➤ Solutions segment leads the market in terms of revenue generation.

➤ Cloud-based deployment is expected to dominate the market due to its scalability and cost-effectiveness.

➤ BFSI (Banking, Financial Services, and Insurance) is the leading vertical for fraud detection solutions.

➤ North America holds the largest share of the market, driven by technological advancements and the high adoption rate of digital payments.

Market Segmentation of Online Payment Fraud Detection

The online payment fraud detection market is segmented based on components, deployment types, verticals, and regions. The components segment is divided into solutions and services. Among these, the solutions segment is expected to hold the largest share of the market. This segment includes fraud detection and prevention tools that help identify and prevent fraudulent transactions in real time. Solutions such as machine learning-based fraud detection systems, rule-based engines, and behavior analytics are widely adopted across various industries due to their efficiency and ability to detect evolving fraud tactics.

The services segment encompasses the professional services, including consulting, integration, and training, that help organizations implement and optimize fraud detection solutions. These services are critical for ensuring that businesses can effectively integrate advanced fraud prevention systems into their operations.

In terms of deployment, the market is divided into on-premises and cloud-based solutions. Cloud-based deployment is expected to dominate the market owing to its scalability, flexibility, and lower upfront costs compared to on-premises solutions. Cloud-based systems allow organizations to easily scale their fraud detection capabilities and offer more real-time updates, which is crucial in detecting fraud across a wide range of digital platforms.

The market is also segmented by verticals, which include BFSI (Banking, Financial Services, and Insurance), IT and Telecom, Retail and Consumer Packaged Goods, Government, Real Estate and Construction, Energy and Utilities, and others. Among these, the BFSI vertical is the largest contributor to market revenue, driven by the increasing number of online financial transactions, digital banking services, and mobile payment systems.

Regional Insights: Key Market Trends

Geographically, the online payment fraud detection market shows strong regional differences in growth trends. North America holds the largest market share, driven by the high adoption of digital payment technologies, the presence of leading fraud detection solution providers such as ACI Worldwide, and stringent data protection regulations like GDPR and CCPA. In the U.S., the high volume of online transactions and the increasing sophistication of fraud tactics have made fraud detection a critical priority for businesses, particularly in the financial sector.

On the other hand, East Asia and South Asia are witnessing rapid growth in online payment fraud detection solutions due to the increasing adoption of digital payment platforms, mobile wallets, and e-commerce in countries such as China, India, and Japan. With a large unbanked population moving toward digital banking, these regions are experiencing a surge in digital fraud, creating a robust demand for advanced fraud detection solutions. The adoption of mobile payment systems, particularly in emerging markets like India and Southeast Asia, further fuels this growth.

Market Drivers

The online payment fraud detection market is primarily driven by the rise in online transactions and digital payment systems. As e-commerce grows globally, fraudsters are becoming increasingly adept at exploiting vulnerabilities in payment systems. Consequently, businesses are investing in advanced fraud detection solutions to safeguard customer data, prevent fraudulent activities, and ensure compliance with regulations. The surge in mobile payment adoption, particularly in emerging economies, is another major driver, as mobile platforms often present unique vulnerabilities for fraud.

Additionally, the increasing implementation of advanced technologies like artificial intelligence (AI), machine learning (ML), and big data analytics is revolutionizing fraud detection. These technologies allow for real-time monitoring, behavioral analysis, and predictive modeling, all of which are crucial in identifying and preventing fraud. The increasing sophistication of fraud tactics and regulatory pressures are also motivating businesses to adopt advanced fraud detection systems.

Market Restraints

Despite the market's promising growth, several challenges hinder its expansion. One of the main restraints is the high cost of advanced fraud detection solutions, particularly for small and medium-sized enterprises (SMEs). These organizations often find it difficult to justify the significant investment required for top-tier fraud detection systems, limiting the widespread adoption of these technologies in certain sectors.

Another challenge is the complexity of integrating fraud detection systems with existing infrastructure. Many businesses have legacy payment systems that are not compatible with modern fraud detection technologies, leading to integration issues and delays. Moreover, the constantly evolving nature of fraud techniques means that fraud detection systems need continuous updates, which can be resource-intensive and require ongoing investments from businesses.

Market Opportunities

The online payment fraud detection market offers substantial opportunities for growth. One of the key opportunities lies in the increasing demand for cloud-based fraud detection solutions. As organizations shift to cloud computing, there is a growing need for scalable, flexible, and cost-effective fraud prevention systems. Cloud-based platforms also offer real-time monitoring and updates, which are essential in combating rapidly evolving fraud tactics.

Additionally, the growing awareness about cybersecurity and the increasing adoption of mobile payments in emerging markets create significant opportunities for solution providers. Businesses in regions like India, Latin America, and Southeast Asia are actively seeking affordable fraud detection systems to protect their expanding digital payment infrastructure. There is also potential for innovation in AI and machine learning-based fraud detection, as these technologies can significantly improve the accuracy and speed of fraud detection.

Frequently Asked Questions (FAQs)

➤ How Big is the Online Payment Fraud Detection Market?

➤ Who are the Key Players in the Global Online Payment Fraud Detection Market?

➤ What is the Projected Growth Rate of the Online Payment Fraud Detection Market?

➤ What is the Market Forecast for the Online Payment Fraud Detection Market for 2032?

➤ Which Region is Estimated to Dominate the Online Payment Fraud Detection Market Through the Forecast Period?

Company Insights:

✦ ACI Worldwide

✦ Experian

✦ Accertify

✦ Feedzai

✦ CaseWare

✦ FRISS

✦ MaxMind

Recent Developments:

■ Feedzai has partnered with a major bank in Europe to provide advanced AI-driven fraud detection tools for mobile banking services.

■ Accertify recently launched a cloud-based fraud detection platform designed to enhance real-time transaction monitoring for e-commerce businesses.

The online payment fraud detection market is set for robust growth driven by increasing digital payment adoption, technological advancements, and rising concerns over fraud and cybersecurity. As businesses and consumers continue to demand secure, efficient payment systems, the market will likely see increased investment in AI-powered, cloud-based fraud detection solutions, making it a key area for innovation and growth.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Fraud Detection Market to Witness Remarkable Growth with ACI Worldwide, Experian, Accertify, Feedzai here

News-ID: 3983784 • Views: …

More Releases from Persistence Market Research

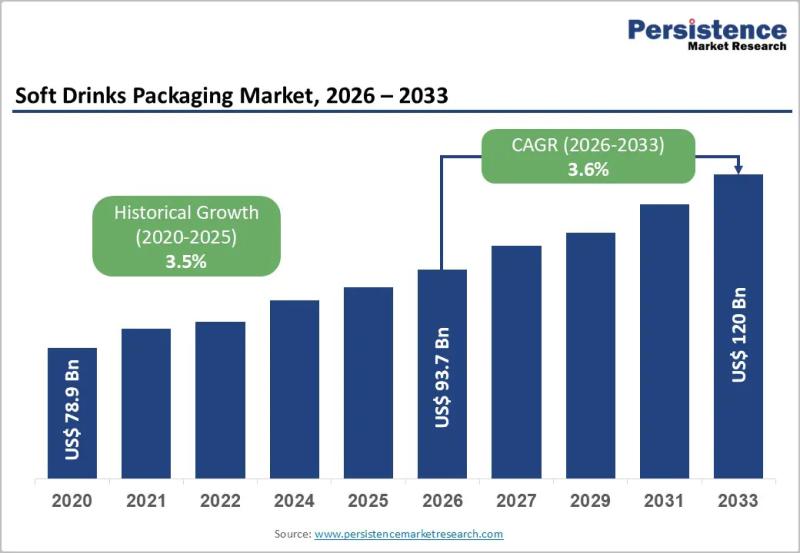

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

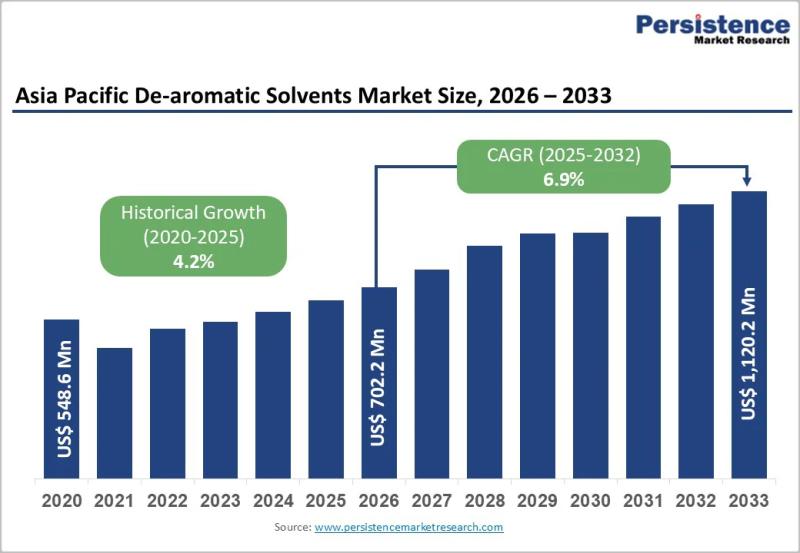

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…