Press release

Asset Tokenization Market Size Worth US$ 30.21 Billion With an Impressive CAGR 18.4% From 2025 To 2034

The global asset tokenization market is projected to expand from USD 5.60 billion in 2024 to USD 30.21 billion by 2034. It is expected to register a CAGR of 18.4% from 2025 to 2034.Market Introduction:

Asset tokenization indicates a procedure of registering the entitlement to a provided asset into a digital token that can be held, disbursed, or negotiated on a blockchain. The engendered tokens showcase a spike of ownership in the rudimentary asset. Almost any asset, be it tangible, such as real estate, or intangible, such as a stock in a corporation, can be tokenized. Converting these assets into digital tokens makes them divisible, permitting dispersed ownership that sanctions more people to fund, which makes the market liquid.

Get Exclusive Sample Pages of This Report:

https://www.polarismarketresearch.com/industry-analysis/asset-tokenization-market/request-for-sample

These tokenized assets empower funding possibilities while sustaining pertinent safeguards. Conventionally, asset classes such as fine art and commercial real estate have been the domain of the ultra-wealthy, with high barriers for entry. Thus, asset tokenization disrupts these barriers by enabling shared ownership of assets, indicating that the investors can possess tokens showcasing a small share of those assets.

Market Growth Drivers:

Growing Usage of Smartphones: The digital platforms and applications have been made accessible due to the usage of smartphones rendering it easier for persons to contest in asset tokenization systems. For instance, as per the Groupe Speciale Mobile Association (GSMA) yearly State of Mobile Internet Connectivity Report 2023, a partial global population possesses a smartphone. The progressive security attributes of smartphones, such as encryption and biometric authentication, boosting the asset tokenization market demand.

Technological Innovations:

Advancements such as enhanced conformity, Layer 2 scaling solutions, and smart contracts sanction more productive and smooth tokenization procedures. These advancements cause rapid transactions, decreased prices, and superlative integration with prevailing systems, making it more alluring to investors and businesses.

Leading Market Players

The market is excessively competitive and fragmented, essentially driven by the existence of prominent players.

Major companies are noted below:

• Antier Solutions

• BlockchainX

• Fireblocks

• Maticz

• Securitize

• SoluLab

• Stobox

• Tether

• Tokeny Solutions

• Vertalo

Request for a Discount on this Report Before Purchase:

https://www.polarismarketresearch.com/industry-analysis/asset-tokenization-market/request-for-discount-pricing

Asset Tokenization Market Report Highlights:

• In terms of asset type, the financial instruments segment held the largest asset tokenization market share in 2024 due to the increasing demand for secure and efficient ways to trade securities, bonds, and equities.

• Based on end user, the retail investors segment is expected to grow at a robust pace in the coming years owing to the ability of asset tokenization to enable fractional ownership, allowing individuals to invest in high-value assets such as real estate, commodities and fine art with lower capital requirements.

• In the global market, North America held the largest asset tokenization market share in 2024 due to strong regulatory frameworks, a well-established financial ecosystem, and the increasing adoption of blockchain technology.

• The market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, owing to rapid digitalization, government initiatives, and increasing investor interest in tokenized real estate and financial instruments.

Segmental Analysis:

By Asset Type Outlook (Revenue, USD Billion, 2020-2034)

• Real Estate

• Art and Collectibles

• Commodities

• Intellectual Property

• Financial Instruments

• Luxury Goods

• Others

By Technology Outlook (Revenue, USD Billion, 2020-2034)

• Blockchain Networks

• Smart Contract Platforms

• Tokenization Protocols

• Custody and Security Solutions

• Others

By End User Outlook (Revenue, USD Billion, 2020-2034)

• Institutional Investors

• Retail Investors

• Asset Managers

• Fundraisers and Issuers

• Others

Explore The Complete Comprehensive Report Here:

https://www.polarismarketresearch.com/industry-analysis/asset-tokenization-market

Regional Analysis:

North America maintained asset tokenization market leadership in 2024 owing to the region's robust regulatory frameworks, a well-established financial ecosystem, and the growing adoption of blockchain technology. The US dominated the region with prominent financial bodies, fintech, and technology firms digitally funding tokenized assets.

Asia Pacific is projected to grow at a rapid pace during the forecast period due to speedy digitalization, government enterprise, and growing investor inclination in tokenized real estate and fiscal instruments, making it an attractive market for expansion. Nations such as Singapore, Japan, and Hong Kong are setting up clear regulatory frameworks that reinforce blockchain-dependent securities, captivating global investors and financial bodies.

• North America

o Asset Type Outlook

• Real Estate

• Art and Collectibles

• Commodities

• Intellectual Property

• Financial Instruments

• Luxury Goods

• Others

o Technology Outlook

• Blockchain Networks

• Smart Contract Platforms

• Tokenization Protocols

• Custody and Security Solutions

• Others

o End User Outlook

• Institutional Investors

• Retail Investors

• Asset Managers

• Fundraisers and Issuers

• Others

• Asia Pacific

o Asset Type Outlook

• Real Estate

• Art and Collectibles

• Commodities

• Intellectual Property

• Financial Instruments

• Luxury Goods

• Others

o Technology Outlook

• Blockchain Networks

• Smart Contract Platforms

• Tokenization Protocols

• Custody and Security Solutions

• Others

o End User Outlook

• Institutional Investors

• Retail Investors

• Asset Managers

• Fundraisers and Issuers

• Others

More Trending Latest Reports by Polaris Market Research:

Bluetooth LE Audio Market:

https://www.polarismarketresearch.com/industry-analysis/bluetooth-le-audio-market

Zero Energy AI Systems Market:

https://www.polarismarketresearch.com/industry-analysis/zero-energy-ai-systems-market

Healthcare Mobile Application Market:

https://www.polarismarketresearch.com/industry-analysis/healthcare-mobile-application-market

Fiber Optic Components Market:

https://www.polarismarketresearch.com/industry-analysis/fiber-optic-components-market

Contact:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

About Polaris Market Research & Consulting, Inc:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset Tokenization Market Size Worth US$ 30.21 Billion With an Impressive CAGR 18.4% From 2025 To 2034 here

News-ID: 3981709 • Views: …

More Releases from Polaris Market Research & Consulting

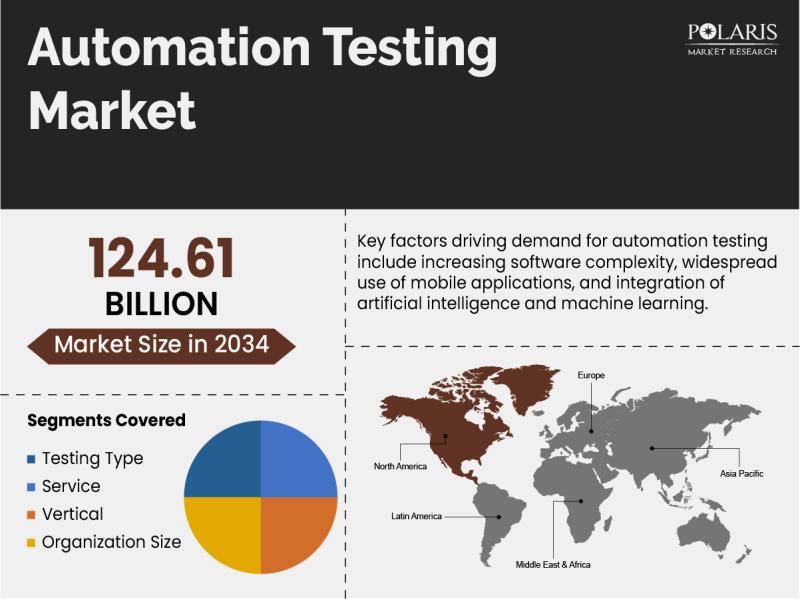

Automation Testing Market Growing Trends and Demands Analysis Forecast 2026 to 2 …

Market Size and Share:

Global Automation Testing Market is currently valued at USD 36.44 Billion in 2025 and is anticipated to generate an estimated revenue of USD 124.61 Billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 14.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034

Polaris Market Research has introduced the latest market research…

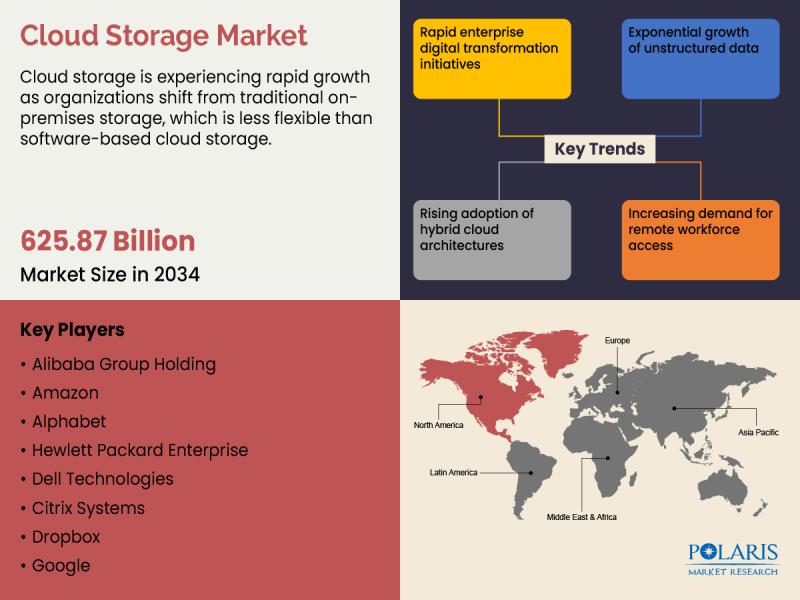

Global Cloud Storage Market Expected to Hit USD 625.87 Billion by 2034 with 18.5 …

The quantitative market research report published by Polaris Market Research on Cloud Storage Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Cloud Storage Market size, financial data, and projected future growth. All the information presented…

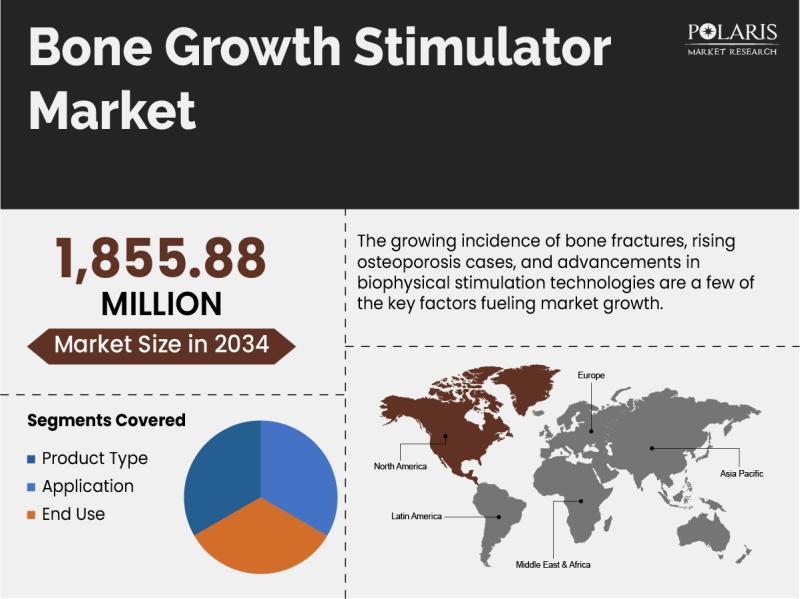

Bone Growth Stimulator Market Outlook: USD 1,855.88 Million Market Size by 2034, …

The quantitative market research report published by Polaris Market Research on Bone Growth Stimulator Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Bone Growth Stimulator Market size, financial data, and projected future growth. All the…

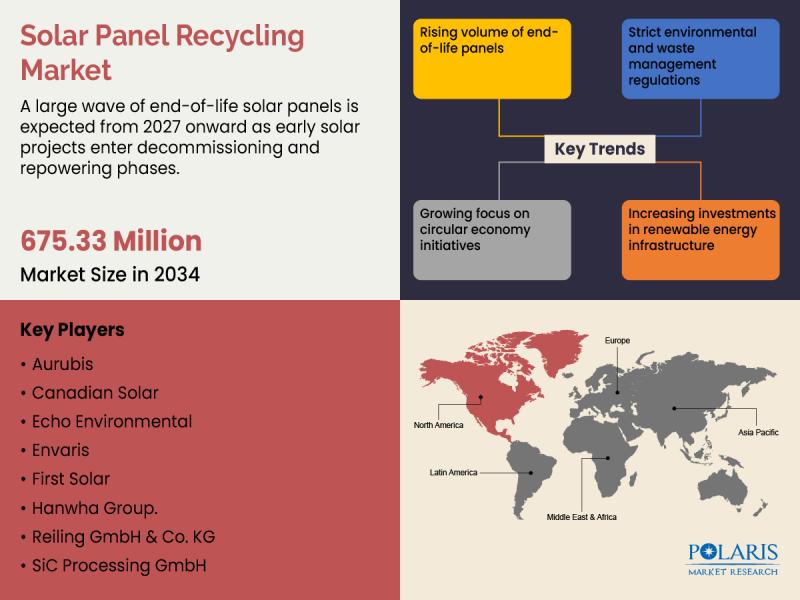

Outlook for the Solar Panel Recycling Market Through 2034: Key Trends, Investmen …

Market Size and Share:

Global Solar Panel Recycling Market is currently valued at USD 353.88 million in 2025 and is anticipated to generate an estimated revenue of USD 675.33 million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 7.5% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034

Polaris Market Research has introduced the latest market…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…