Press release

Micro-Investing Platforms Market to Witness Strong Growth, Expected to Reach USD 20.5 Billion by 2030 with a 6.2% CAGR | Persistence Market Research

The global micro-investing platforms market is on a steady rise, driven by the growing demand for accessible and affordable investment opportunities. With the increasing interest in wealth-building strategies among younger demographics and those new to investing, micro-investing platforms are providing an attractive alternative to traditional investment methods. This trend is expected to continue, with the market forecasted to reach USD 20.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.2%.Micro-investing refers to the practice of investing small amounts of money, often through mobile apps or online platforms, which makes it accessible to individuals who might not have the capital or expertise to engage in traditional investing. With minimal starting capital requirements, micro-investing allows users to invest spare change or small amounts, often through automated round-up features on purchases. The growth of this market is closely linked to the proliferation of smartphone apps, enhanced digital financial tools, and growing awareness of financial literacy, especially among millennials and Gen Z.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/33656

Key Highlights from the Report

➤ The global micro-investing platforms market is expected to grow from USD 11.9 billion in 2024 to USD 20.5 billion by 2030.

➤ The market is expected to grow at a CAGR of 6.2% during the forecast period.

➤ The increasing adoption of smartphone apps and digital tools is a key driver of market growth.

➤ Millennials and Gen Z are the primary demographic driving demand for micro-investing platforms.

➤ The rise of robo-advisors and automated investment tools is contributing to the growth of the market.

➤ North America is expected to dominate the market, driven by a high level of financial literacy and technology adoption.

Market Segmentation

The micro-investing platforms market can be segmented based on platform type, investment type, end-user demographics, and geography. One of the key segments is the platform type, which includes mobile apps and web platforms. Mobile apps are gaining significant traction due to their ease of use, accessibility, and ability to provide real-time notifications and updates. These apps often provide users with the ability to track their investments, set goals, and receive personalized investment recommendations, which makes investing more convenient for the younger, tech-savvy population.

In terms of investment types, micro-investing platforms typically offer options such as stocks, ETFs (exchange-traded funds), cryptocurrencies, and other low-cost investment vehicles. ETFs are particularly popular as they offer diversified investment opportunities with lower risks compared to individual stocks. Moreover, many micro-investing platforms also allow users to invest in fractional shares, making it easier for them to access expensive stocks and other assets that they otherwise might not be able to afford. This flexibility plays a crucial role in attracting a diverse range of users, from first-time investors to those looking to diversify their portfolios.

Regional Insights

The North American region is expected to hold the largest share of the micro-investing platforms market, with the United States leading the charge. The high level of financial literacy, coupled with widespread access to smartphones and digital tools, has made North America a hotbed for micro-investing adoption. In addition, several key market players, including Robinhood, Acorns, and Stash, are based in the region, further driving the market's growth. The increasing trend of young individuals participating in investment activities and building wealth early in life is significantly contributing to the region's dominance.

In contrast, the Asia-Pacific (APAC) region is also experiencing rapid growth, albeit at a slightly slower pace. The growing middle class, rising disposable incomes, and increasing smartphone penetration are key factors propelling the adoption of micro-investing platforms in countries like India, China, and Japan. Additionally, financial education is on the rise in APAC countries, making micro-investing an attractive option for new investors who are looking for low-risk ways to grow their savings.

Market Drivers

One of the key drivers of the micro-investing platforms market is the rising interest in financial independence and wealth-building among younger generations. Millennials and Gen Z are particularly focused on long-term financial growth, and micro-investing offers them an easy and low-barrier entry point into the investment world. Many young people are seeking ways to make their money work for them, but they lack the substantial capital or expertise required for traditional investing methods, making micro-investing the perfect solution.

Another significant driver is the increasing availability of automated tools, such as robo-advisors, that make investing simpler and more accessible. These tools offer low-cost investment management services, helping users make data-driven decisions based on algorithms rather than relying on human advisors. This automation, combined with low minimum investment amounts, appeals to a broader audience and accelerates the growth of the micro-investing market.

Market Restraints

Despite its strong growth potential, the micro-investing platforms market faces some challenges. One major restraint is the potential lack of regulation and oversight in certain regions. While micro-investing platforms are generally considered low-risk, the absence of standardized regulations can lead to concerns about transparency, user protection, and data security. For users who are new to investing, these concerns could prevent them from fully embracing micro-investing platforms.

Another restraint is the limited investment options available on certain platforms. While many micro-investing platforms provide access to stocks and ETFs, they often have a limited range of investment opportunities, especially compared to traditional brokerage services. As a result, more experienced investors may find these platforms less appealing if they want to access a broader range of investment products, such as bonds, real estate, or international assets.

Market Opportunities

The growing popularity of socially responsible investing (SRI) and environmental, social, and governance (ESG) factors presents a significant opportunity for the micro-investing platforms market. More investors, especially younger ones, are looking for ways to align their financial portfolios with their values. Platforms that offer socially responsible investment options or ESG-focused funds are likely to see an increase in demand as users seek to make a positive impact with their investments.

Furthermore, as mobile payments and digital wallets continue to gain traction, there is an opportunity for micro-investing platforms to integrate these tools with their offerings. By enabling users to round up their purchases and automatically invest the spare change, platforms can make investing even more seamless and convenient. This integration of financial services could attract a wider range of users and significantly increase the adoption rate of micro-investing platforms.

Reasons to Buy the Report

✓ Comprehensive analysis of the micro-investing platforms market, including current trends, growth drivers, and market dynamics.

✓ Detailed segmentation and insights on various platform types, investment types, and user demographics.

✓ Forecast of market growth, including projections up to 2030, to help companies plan for future expansion.

✓ In-depth analysis of key players and their strategies for growth in the micro-investing space.

✓ Key recommendations for investors, startups, and businesses looking to enter or expand within the micro-investing sector.

Company Insights

✦ Robinhood Markets, Inc.

✦ Acorns

✦ Stash Financial

✦ Betterment

✦ Wealthfront

■ Robinhood introduced fractional share trading in 2023, enabling users to invest smaller amounts in expensive stocks.

■ Acorns partnered with several fintech companies to expand its user base and offer new investment opportunities, including ESG-focused funds.

The micro-investing platforms market is poised for strong growth over the next few years, driven by increasing financial literacy, a shift toward digital finance, and a growing demand for low-cost investment solutions. As more consumers, particularly younger generations, seek accessible ways to invest, the micro-investing market presents ample opportunities for businesses to innovate and capitalize on these trends. With a projected market size of USD 20.5 billion by 2030, micro-investing platforms are well-positioned to play a key role in shaping the future of personal finance.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro-Investing Platforms Market to Witness Strong Growth, Expected to Reach USD 20.5 Billion by 2030 with a 6.2% CAGR | Persistence Market Research here

News-ID: 3978409 • Views: …

More Releases from Persistence Market Research

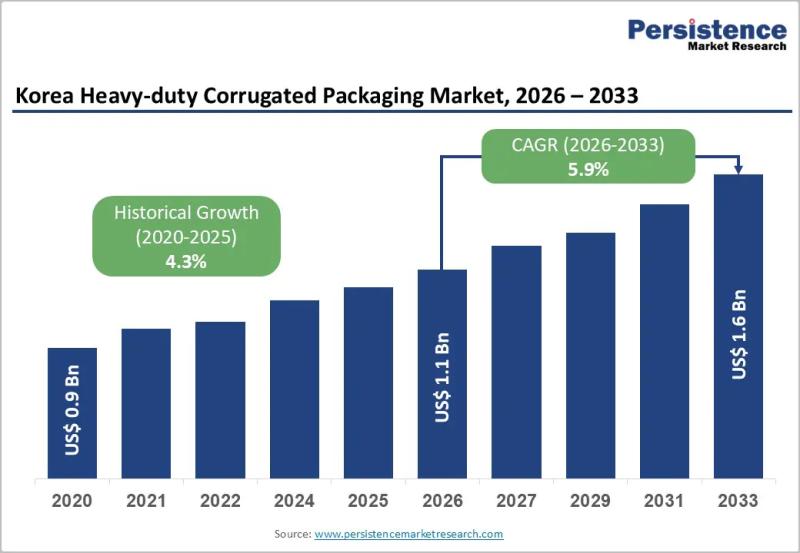

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Platforms

Best Link Building Platforms

The number and quality of backlinks have a substantial impact on a website's ranking in search engines. Outreach, or guest posting, is one of the most effective ways to strengthen your backlink profile. The only challenge is finding reliable platforms for collaboration, and that's where link-building platforms come in. They save you the time you'd otherwise spend searching for suitable websites, analyzing their metrics, and negotiating placements. Link-building marketplaces become…

Bioinformatics Platforms Market Size Analysis by Application, Type, and Region: …

According to Market Research Intellect, the global Bioinformatics Platforms market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The bioinformatics platforms market is witnessing robust growth, fueled by the rising demand for advanced data analytics in…

Mock Interview Platforms Market

According to Market Research Intellect, the global Mock Interview Platforms market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The mock interview platforms market is expanding rapidly, driven by the increasing emphasis on career readiness and…

Global Photosharing Platforms Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global Photosharing Platforms market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The market for photosharing platforms is expanding quickly due to the rise in social media usage and the demand for visual material. The need for…

Get The Best Trading Platforms In The UK Here At Trading Platforms UK!

Trading Platforms UK (https://tradingplatformsuk.com/) is dedicated to providing traders with information and resources about the best day trading platforms UK wide. This resource offers an extensive list of trading platforms along with expert advice and tips on how to use them effectively.

Whether someone's a seasoned trader or just starting out, it's important to find the right trading platform. That's why Trading Platforms UK is here to help! They offer…

Aerial Work Platforms Market

The global AERIAL WORK PLATFORMS market report offers the complete market share, size, and the growth rate of different segments at both the country and regional levels. It provides an in-depth study of the market subtleties such as the current trends, drivers, opportunities, and even the restraining factors. The report also highlights the qualitative aspects in the study. Additionally, the unit takes in the key findings, in terms of market…