Press release

Surge In Accidents Fuels Growth Of Automotive Insurance Carrier Market: Key Factor Driving The Growth In The Automobile Insurance Carriers Market

The Automobile Insurance Carriers Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Expected Automobile Insurance Carriers Market Size During the Forecast Period?

The size of the automobile insurance carriers market has seen a swift expansion in recent years. It is projected to increase from $936.62 billion in 2024 to $1033.01 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 10.3%. The growth witnessed in the historical period can be linked to the rise in motorization and vehicle ownership, legal mandates and regulatory adherence, demographic and urbanization trends, an increase in the number of traffic accidents and collisions, as well as economic prosperity and affordability.

The market size of automobile insurance carriers is predicted to experience a swift expansion in the coming years. By 2029, it is anticipated to increase to $1611.72 billion with a compound annual growth rate (CAGR) of 11.8%. The anticipated expansion during this forecast period can be credited to factors such as the ongoing growth in vehicle ownership, modifications in legal and regulatory environments, urban mobility issues, shifts in consumer behavior and preferences, and economic patterns and affordability considerations. Key trends expected within this period include a focus on cybersecurity, considerations for the impact of climate change and catastrophe modeling, customer-oriented services, regulatory adherence and changes, and the incorporation of big data analytics.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9742

What Are the High-Growth Segments in the Automobile Insurance Carriers Market?

The automobile insurance carriers market covered in this report is segmented -

1) By Coverage: Third-Party Liability Coverage, Collision Or Comprehensive Or Other Optional Coverages

2) By Vehicle Type: Passenger Cars, Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV) Or Trucks And Buses

3) By Distribution Channel: Insurance Agents, Direct Response, Banks, Other Distribution Channels

Subsegments:

1) By Third-Party Liability Coverage: Bodily Injury Liability, Property Damage Liability

2) By Collision Or Comprehensive Or Other Optional Coverages: Standard Collision Coverage, High-Deductible Collision Coverage Or Standard Comprehensive Coverage, High-Deductible Comprehensive Coverage, Uninsured Or Underinsured Motorist Coverage, Rental Reimbursement Coverage, Gap Insurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9742&type=smp

What Key Drivers Are Expected to Influence Future Automobile Insurance Carriers Market Growth?

The anticipated surge in the automotive insurance carrier market is attributed to the increasing rate of accidents. Traffic or road mishaps, which may result in damage, harm, or death unexpectedly, are defined as such events. Financial protection is offered by automotive insurance carriers to their clients when their vehicles are involved in accidents or mishaps, by compensating for the damages. Hence, the upturn in accidents propels the growth of this market sector. A January 2024 report by the Road Safety Authority, a state government agency of Ireland, supports this notion. The report details an increase in road fatalities in Ireland across various categories when compared to 2022. There were increases in deaths amongst drivers (+13), passengers (+12), motorcyclists (+4), pedal cyclists (+2), pedestrians (+1), and other road users (+1). It is noteworthy that the monthly average death toll in 2022 was 13, escalating to 16 deaths per month in 2023. Hence, the escalating accident number triggers demand in the automotive insurance carrier market.

Which Companies Hold the Largest Share Across Different Automobile Insurance Carriers Market Segments?

Major companies operating in the automobile insurance carriers market include State Farm Mutual Automobile Insurance Company, Government Employees Insurance Company, The Allstate Corporation, People's Insurance Company Of China, China Pacific Insurance Co., Universal Sompo General Insurance Company Limited, Ping An Insurance (Group) Company of China Ltd., Berkshire Hathaway Inc., Admiral Group plc, Tokio Marine Group, Allianz SE, Progressive Casualty Insurance Company, Zurich Insurance Group plc, Farmers Insurance Group, Liberty Mutual Holding Company Inc., RAC Motoring Services Ltd., Clements & Company and later Clements International, National Farmers' Union Mutual Insurance Society Limited (NFU Mutual), United Services Automobile Association, RSA Insurance Group Ltd., American International Group Inc., Assicurazioni Generali S.p.A., AXA Cooperative Insurance Company, Bajaj Allianz General Insurance Company Limited, Mitsui Sumitomo Insurance Co. Ltd., Reliance General Insurance Company Limited, The Hanover Insurance Group Inc., American Family Mutual Insurance Company, AmTrust North America Inc., Automobile Club MI Group, Auto-Owners Insurance Co., CSAA Insurance, Erie Insurance Co., Mapfre SA, Mercury General Corp., Nationwide Mutual Insurance Company, Security National Insurance Company, Sentry Insurance Group, Technology Insurance Company, Hartford Financial Services Group Inc., Travelers Companies Inc.

What Trends Are Driving Growth in The Automobile Insurance Carriers Market?

Advancements in product development are becoming increasingly prevalent trends in the automotive insurance carriers market. Firms in this market are turning to innovation to consolidate their market standing. To illustrate, New India Assurance (NIA), a general insurance corporation based in India, unveiled the Pay as You Drive (PAYD) policy in January 2023. This PAYD policy includes a clause for cash-saving through rebates on renewal premiums, on the condition that the vehicle stays within a prescribed kilometer range. Moreover, even if the vehicle crosses the set limit, the policy coverage will persist for the remaining time period of the policy.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/automobile-insurance-carriers-global-market-report

What Are the Emerging Geographies for The Automobile Insurance Carriers Market Growth?

North America was the largest region in the automobile insurance carriers' market in 2024. The regions covered in the automobile insurance carriers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Automobile Insurance Carriers Market?

2. What is the CAGR expected in the Automobile Insurance Carriers Market?

3. What Are the Key Innovations Transforming the Automobile Insurance Carriers Industry?

4. Which Region Is Leading the Automobile Insurance Carriers Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surge In Accidents Fuels Growth Of Automotive Insurance Carrier Market: Key Factor Driving The Growth In The Automobile Insurance Carriers Market here

News-ID: 3977598 • Views: …

More Releases from The Business Research Company

Future of the Vertical Video Templates Marketplaces Market: Key Innovations and …

What Market Value Will the Vertical Video Templates Marketplaces Industry Achieve by 2025?

The market for vertical video templates has experienced substantial expansion lately, projected to move from a valuation of $1.24 billion in the year 2024 to reach $1.45 billion by 2025, reflecting a compound annual growth rate (CAGR) of 16.7%. This historical upward trajectory is primarily fueled by several key factors: a widespread embrace of brief video formats, the…

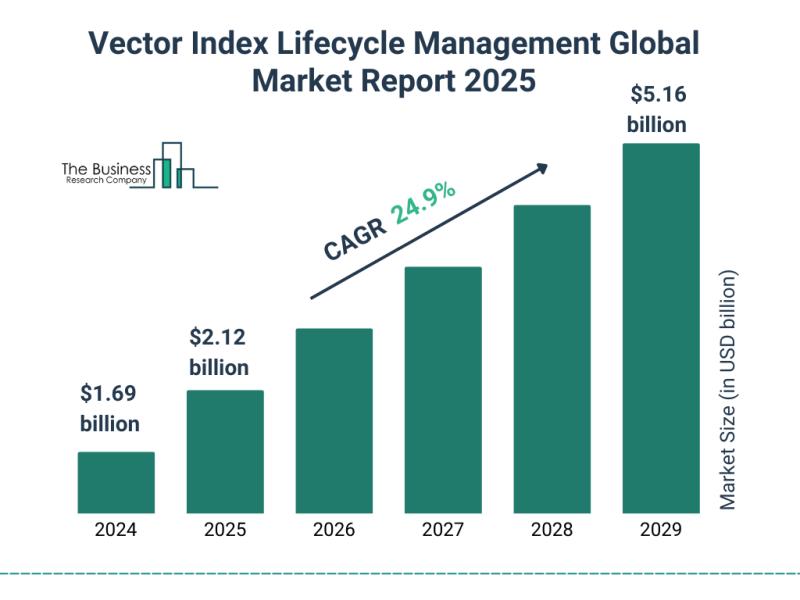

Global Vector Index Freshness Management Market Expected to Grow at 22.5% CAGR, …

What Will the Vector Index Freshness Management Market Size Reach by 2025?

The market valuation for vector index freshness management has experienced rapid expansion lately, escalating from a figure of $1.35 billion in 2024 to an anticipated $1.65 billion just one year later in 2025, reflecting a compound annual growth rate (CAGR) of 22.8%; this substantial historical uplift is primarily fueled by the amplified deployment of large language models, heightened attention…

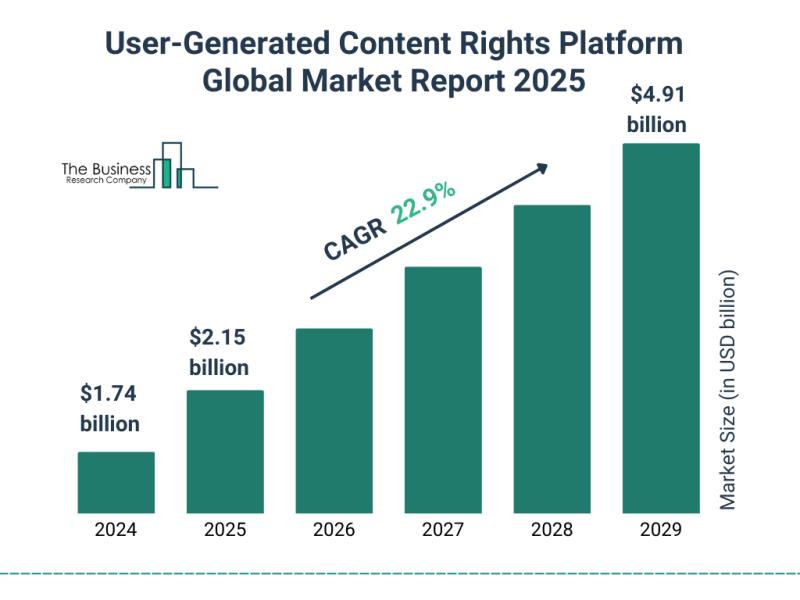

2025-2034 User-Generated Content Rights Platform Market Evolution: Emerging Oppo …

"What Is the Projected Size of the User-Generated Content Rights Platform Market by 2025?

The market encompassing platforms for user-generated content rights has seen rapid expansion lately, projected to increase its valuation from 1.74 billion US dollars in 2024 to 2.15 billion US dollars the subsequent year, reflecting a compound annual growth rate (CAGR) of 23.3%. This historical expansion primarily stems from several contributing factors, notably the surge in digitally produced…

Truck Scale Market Poised for Robust Growth, Projected to Hit $3.43 Billion by 2 …

How Much Is the Truck Scale Market Expected to Expand by 2025?

The truck scale market has experienced robust expansion lately, projected to ascend from its 2024 valuation of $2.48 billion to attain $2.66 billion by 2025, reflecting a compound annual growth rate (CAGR) of 7.0%. This past growth trajectory has been fueled by several key factors, notably the escalating requirement for precise gross vehicle weight determinations, the wider integration of…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…