Press release

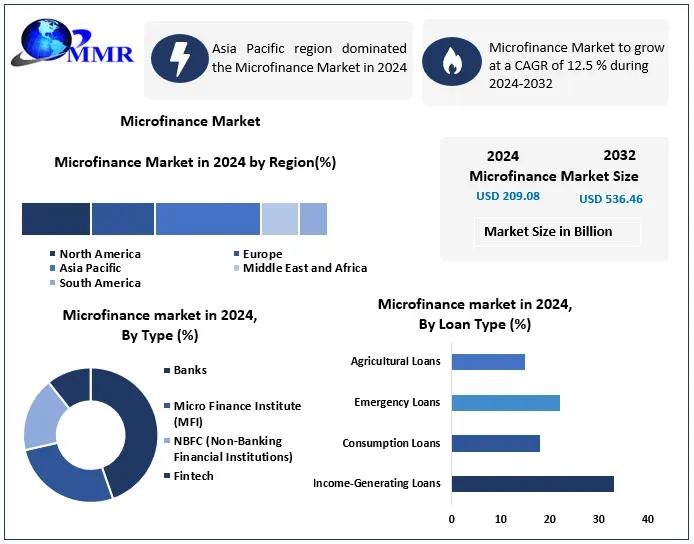

Microfinance Market to Hit USD 536.46 Billion by 2032, Growing at 12.5% CAGR

The Microfinance Market size was valued at USD 209.08 Billion in 2024 and the total Microfinance Market revenue is expected to grow at a CAGR of 12.5 % from 2024 to 2032, reaching nearly USD 536.46 Billion.Microfinance Market Overview:

The global microfinance market has seen tremendous growth, driven by the increasing need for financial inclusion. As the unbanked population in developing regions seeks access to formal financial services, microfinance institutions (MFIs) have become crucial in bridging the gap. Technological innovations, including mobile banking and fintech solutions, have revolutionized access to credit, especially in rural areas, allowing MFIs to offer a diverse range of products from savings accounts to insurance. With an expected market growth of 12.5% CAGR by 2032, the market is poised to reach over USD 536 billion.

As more individuals and small businesses in low-income regions embrace microfinance, the sector plays an essential role in reducing poverty, promoting entrepreneurship, and fostering social change. The focus on improving financial literacy, supported by favorable regulatory frameworks, has significantly boosted market demand. Moreover, financial technology has made the sector more accessible, reducing operational costs and creating new business models for MFIs to operate more efficiently and sustainably.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/230628/

Microfinance Market Dynamics:

The key drivers of the microfinance market are centered around expanding financial inclusion and integrating technology. Increasing government support for microfinance initiatives in various countries, combined with improved regulatory environments, has led to a rise in both institutional growth and customer participation. Through collaborations with fintech, MFIs have been able to offer affordable credit to previously underserved populations. These digital transformations have not only reduced barriers to entry for new borrowers but have also made credit delivery systems more streamlined and scalable.

However, challenges such as managing credit risk, fraud, and liquidity remain significant concerns. Microfinance institutions face higher risks due to the lack of collateral and a short credit history among borrowers. Despite these challenges, MFIs continue to expand their reach by utilizing alternative data for credit scoring and focusing on providing customized financial solutions that meet the specific needs of their target populations.

Microfinance Market Outlook and Future Trends

Looking ahead, the future of the microfinance market will be shaped by increasing investments in mobile banking and digital finance solutions. The shift towards mobile platforms allows MFIs to reach underserved populations in remote regions at a fraction of the cost of traditional banking infrastructure. This trend is expected to be a game-changer, particularly in regions with limited physical banking networks, such as rural parts of Asia, Africa, and Latin America.

Additionally, sustainability and social impact investing are becoming more prominent in the microfinance sector. Investors are keen on balancing financial returns with positive social outcomes, which further encourages the growth of microfinance institutions. As microfinance institutions continue to innovate with flexible loan products and risk management techniques, their ability to serve diverse customer segments will increase, solidifying their role as a key pillar of financial inclusion.

Key Recent Developments:

Vietnam: The microfinance sector in Vietnam has been growing steadily, with increased government support for financial inclusion programs. Mergers between local MFIs have enhanced their operational reach, offering low-interest loans to SMEs and women entrepreneurs in rural areas.

Thailand: Thailand's microfinance institutions have increasingly turned to digital solutions to enhance accessibility. Recent regulatory changes have encouraged new startups to enter the market, promising to increase competition and reduce costs for borrowers.

Japan: Japan's microfinance market is expanding with increased focus on rural and marginalized populations. New collaborations between traditional banks and fintech companies aim to enhance the delivery of microcredit to underserved communities.

South Korea: South Korea is witnessing an uptick in the microfinance sector as fintech platforms grow in prominence. These platforms are allowing MFIs to reach more borrowers in urban and remote areas, reducing the need for physical branches.

Singapore: Singapore has emerged as a hub for microfinance investments, with both local and international funds increasing their portfolios in Southeast Asia. The government continues to support innovation in financial services to foster inclusive economic growth.

Microfinance Market Segmentation

by Type

Banks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Fintech

Other

by Loan Type

Income-Generating Loans

Consumption Loans

Emergency Loans

Agricultural Loans

Others

by End User

Individual Borrowers

Micro, Small, and Medium Enterprises (MSMEs)

Women Entrepreneurs

Farmers and Rural Communities

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/230628/

Some of the current players in the Microfinance Market are:

1. Bandhan Bank

2. Kiva

3. BRAC

4. Bank Rakyat Indonesia

5. BSS Microfinance Private limited

6. FINCA International

7. Grameen Bank

8. Sva microfinance

9. Al Amana Microfinance

10. Grameen Foundation

11. Accion International

12. Opportunity International

13. Bharat Financial Inclusion Limited

14. Cashpor Micro Credit

15. Compartamos Banco

16. IndusInd Bank Limited

17. Manappuram Finance Ltd

18. Spandana

19. Women's World Banking

20. Sparkle Microfinance Bank

For additional reports on related topics, visit our website:

♦ Process Mining Software Market https://www.maximizemarketresearch.com/market-report/global-process-mining-software-market/76082/

♦ 5G Base Station Market https://www.maximizemarketresearch.com/market-report/global-5g-base-station-market/111943/

♦ Physical Security Information Management Market https://www.maximizemarketresearch.com/market-report/global-physical-security-information-management-market/55313/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market to Hit USD 536.46 Billion by 2032, Growing at 12.5% CAGR here

News-ID: 3976137 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

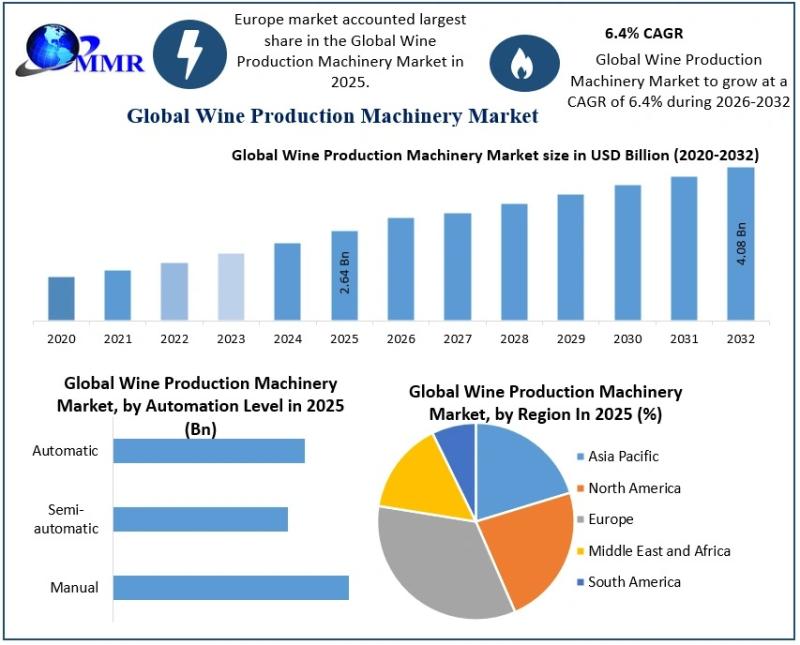

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

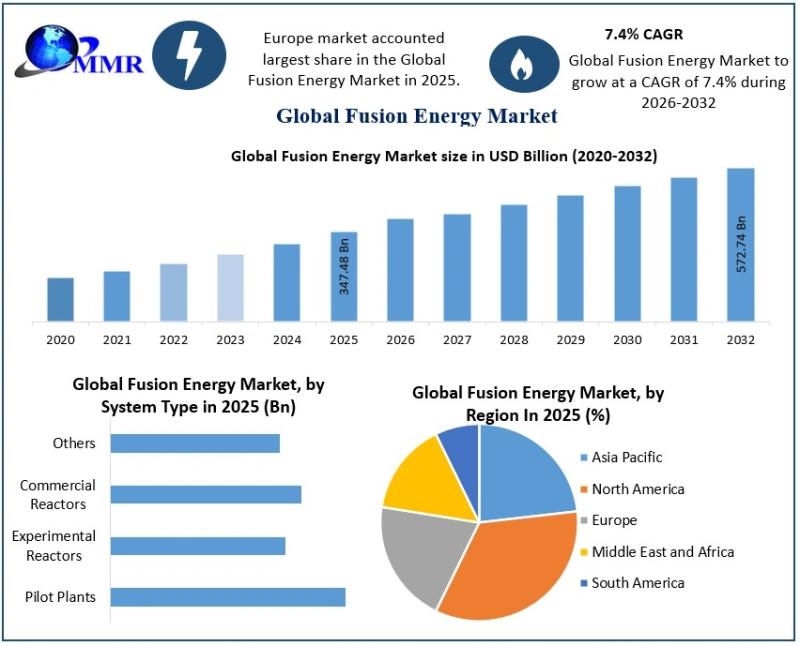

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…