Press release

Insurance Brokerage Market Forecast to Cross USD 524.80 Billion by 2030

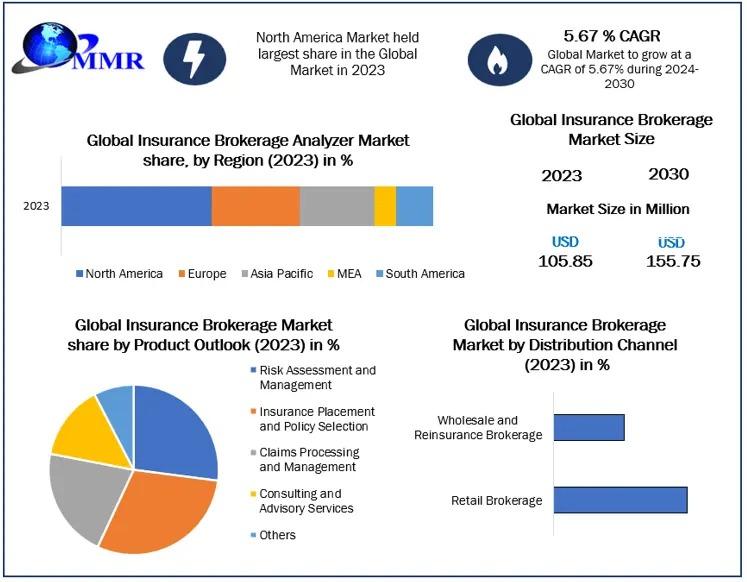

• The global Insurance Brokerage Market is set to reach an estimated USD 524.80 billion by 2030, growing from USD 287.40 billion in 2023, at a compound annual growth rate (CAGR) of 9.2%. The industry's expansion is powered by the increasing complexity of insurance products, rising demand for personalized policies, and the accelerated adoption of digital platforms across life, property & casualty, and health insurance sectors.• Competitive Landscape and Regional Demand Trends

Top industry players such as Marsh & McLennan Companies, Inc., Aon plc, Willis Towers Watson, Arthur J. Gallagher & Co., and Brown & Brown, Inc. are strengthening their positions through innovation, acquisitions, and a shift to digital-first strategies.

The Asia Pacific region has emerged as the highest demand region, fueled by the growing middle-class population, economic development, and increased insurance penetration in emerging economies.

• Want to know more? Request your sample report today : https://www.maximizemarketresearch.com/request-sample/215727/

• United States: Consolidation and Growth in a Mature Market

The United States continues to lead the global market with strong institutional infrastructure and a high concentration of both global and local insurance brokerage firms. The demand for risk advisory services, cyber insurance, and employee benefits solutions is driving continuous innovation.

• Key Consolidation:

Arthur J. Gallagher & Co. recently expanded its footprint by acquiring Woodruff Sawyer, strengthening its position in cyber risk, real estate, and financial lines.

The U.S. market is also witnessing rapid digital transformation, with brokerage firms integrating AI and data analytics to enhance client engagement and streamline operations.

• Asia Pacific: Opportunities Fuel Market Expansion

The Asia Pacific region shows remarkable potential, especially in countries like India, China, and Indonesia, where insurance literacy and digital accessibility are on the rise. The market is responding well to mobile-based insurance platforms and app-based policy servicing.

• Regional Opportunities:

Startups and digital-first brokers are offering microinsurance products and bundling life and health coverage for underserved rural populations.

Insurtech growth in cities like Shanghai, Mumbai, and Jakarta is reshaping consumer access to personalized insurance solutions.

• Europe: Trends and Strategic Updation

Europe remains a robust player in the insurance brokerage space, with an emphasis on sustainable insurance products and digital compliance systems. Insurers and brokers are focusing on value-added services like ESG-aligned insurance and behavioral risk pricing models.

• Key Developments:

The acquisition of a major UK insurer by a European group has repositioned the player among the top three in the motor and home insurance categories.

Germany and France are leading innovation in embedded insurance and cross-border regulatory harmonization.

• Middle East and Africa: Growth and Emerging Opportunities

The Middle East and Africa (MEA) region is gaining traction due to economic diversification efforts and increasing awareness of risk coverage among SMEs and individuals. Governmental reforms and fintech collaboration are further boosting insurance uptake.

• Recent Opportunities:

Gulf nations are integrating digital insurance platforms into national healthcare and labor programs.

African startups are partnering with global reinsurers to introduce affordable insurance bundles for agriculture, logistics, and small business continuity.

♦ Gain Valuable Market Insights by Exploring the Sample Report :https://www.maximizemarketresearch.com/request-sample/215727/

♦ Breaking Down the Insurance Brokerage Market: Key Segments Shaping the Industry

• by Product

Property and Casualty Insurance

Life and Health Insurance

Specialty Insurance

Others

The insurance brokerage market is divided into various segments based on product, including specialty insurance, life and health insurance, and property and casualty insurance. Commercial property, general liability insurance, and services pertaining to liability and property damage risks are all included in property and casualty insurance. Medical needs such as disability, health, and life insurance are covered by life and health insurance policies. Specialty insurance, such as professional indemnity insurance and cyber insurance, is insurance that is associated with certain markets and risks. With a 2023 valuation of USD 46929.17 million, Property and Casualty Insurance maintained its leading position in the insurance brokerage industry.

• by Services

Risk Assessment and Management

Insurance Placement and Policy Selection

Claims Processing and Management

Consulting and Advisory Services

Others

The insurance brokerage market is divided into various end-user segments, including healthcare, manufacturing, construction, and automobiles. In 2023, the healthcare industry dominated with a value of 29002.77 million. Over the course of the forecast period, it is anticipated to increase at a CAGR of 5.69%. With a valuation of 24397.75 million, the manufacturing sector occupied the second-largest position in the insurance brokerage market.

• by Distribution Channel

Retail Brokerage

Wholesale and Reinsurance Brokerage

The insurance brokerage market is divided into retail, wholesale, and reinsurance brokerages based on the distribution channel. With a 2023 valuation of USD 73699.44 million, the retail brokerage held the largest market share in the insurance brokerage industry. It has direct interaction with small business and individual clients, which fosters loyalty and personal ties. It is anticipated that the retail brokerage service will provide a selection of insurance products that will help meet the needs of its clients. Due to the large number of individual and small business clients, they have a high volume of transactions.

• by Customers

Individuals and Families

Small and Medium-sized Enterprises (SMEs)

Large Corporations and Institutions

The market for insurance brokerage is divided into three customer segments: individuals and families, small and medium-sized businesses (SMEs), and large corporations and institutions. In 2023, the SMEs segment held the largest share of the insurance brokerage market, with a value of USD 41440.98 million. The number of SMEs is anticipated to drive the adoption of insurance brokerage, as many of these businesses need a range of insurance coverages, such as property and casualty insurance, life and health insurance, and specialty insurance.

• by Industry Verticals

Healthcare

Manufacturing

Construction

Automotive

Others

◄ Unlock Exclusive Market Insights with a Single Click @https://www.maximizemarketresearch.com/request-sample/215727/

◄ Meet the Industry Leaders Revolutionizing the Insurance Brokerage Market

1. Aon plc (United States)

2. Marsh & McLennan Companies, Inc. (United States)

3. Willis Towers Watson (United States)

4. Arthur J. Gallagher & Co. (United States)

5. Hub International Ltd. (United States)

6. Brown & Brown, Inc (United States)

7. Lockton Companies, LLC (United States)

8. Gallagher Bassett Services, Inc. (United States)

9. Integro Insurance Brokers (United States)

10. USI Insurance Services LLC (United States)

11. The Hylant Group (United States)

12. AssuredPartners, Inc. (United States)

13. Oswald Companies (United States)

14. Jardine Lloyd Thompson Group Ltd. (United Kingdom)

15. Ed Broking Group Ltd. (United Kingdom)

16. BMS Group Ltd. (United Kingdom)

17. JLT Specialty Limited (United Kingdom)

18. Bluefin Insurance Services Limited (United Kingdom)

19. Al Futtaim Willis (UAE)

20. Howden Insurance Brokers (South Africa)

21. Alexander Forbes Group Holdings Limited (South Africa)

22. AJG International B.V. (South Africa)

23. Griffiths & Armour (South Africa)

◄ Uncover Key Insights Answering the Biggest Questions in the Insurance Brokerage Market

What is Insurance Brokerage ?

What is the growth rate of the Insurance Brokerage Market?

Which are the factors expected to drive the Insurance Brokerage market growth?

What is the CAGR at which the Insurance Brokerage market will grow during the forecast period?

What are the different segments of the Insurance Brokerage Market?

Which is the fastest growing region in the Insurance Brokerage market?

What growth strategies are the players considering to increase their presence in Insurance Brokerage ?

What are the upcoming opportunities and trends for the Insurance Brokerage Market?

What are the recent industry trends that can be implemented to generate additional revenue streams for the Insurance Brokerage Market?

Who are the leading companies and what are their portfolios in Insurance Brokerage Market?

What segments are covered in the Insurance Brokerage Market?

Who are the key players in the Insurance Brokerage market?

◄ Gain a Competitive Edge - Access Market Insights Through the Sample Link @https://www.maximizemarketresearch.com/market-report/insurance-brokerage-market/215727/

◄ Explore the Revolutionary Products Powering Market Success

Past Size and Competitive Landscape

• Past Pricing and price curve by region

• Size, Share, Size Forecast by different segment

• Dynamics Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Segmentation A detailed analysis by segment with their sub-segments and Region

• Competitive Landscape Profiles of selected key players by region from a strategic perspective

Explore Our Trending Reports to Stay Ahead of Industry Shifts :

♦ Global Cold Patch Market https://www.maximizemarketresearch.com/market-report/global-cold-patch-market/91038/

♦ Oil and Gas Custody Metering System Market https://www.maximizemarketresearch.com/market-report/oil-and-gas-custody-metering-system-market/70148/

♦ Polyethylene Insulation Materials Market https://www.maximizemarketresearch.com/market-report/polyethylene-insulation-materials-market/148748/

♦ Global Biodiesel Catalyst Market https://www.maximizemarketresearch.com/market-report/global-biodiesel-catalyst-market/102332/

♦ Kairomones Market https://www.maximizemarketresearch.com/market-report/kairomones-market/200430/

♦ Global Electrical Resistors Market https://www.maximizemarketresearch.com/market-report/global-electrical-resistors-market/99673/

♦ Crustacean Market https://www.maximizemarketresearch.com/market-report/global-crustacean-market/70740/

♦ Electrolarynx Market https://www.maximizemarketresearch.com/market-report/electrolarynx-market/148564/

♦ Flocculant and Coagulant Market https://www.maximizemarketresearch.com/market-report/flocculant-coagulant-market/2495/

♦ Paraben Market https://www.maximizemarketresearch.com/market-report/paraben-market-overview-market/199865/

• About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

• Contact Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokerage Market Forecast to Cross USD 524.80 Billion by 2030 here

News-ID: 3973562 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…