Press release

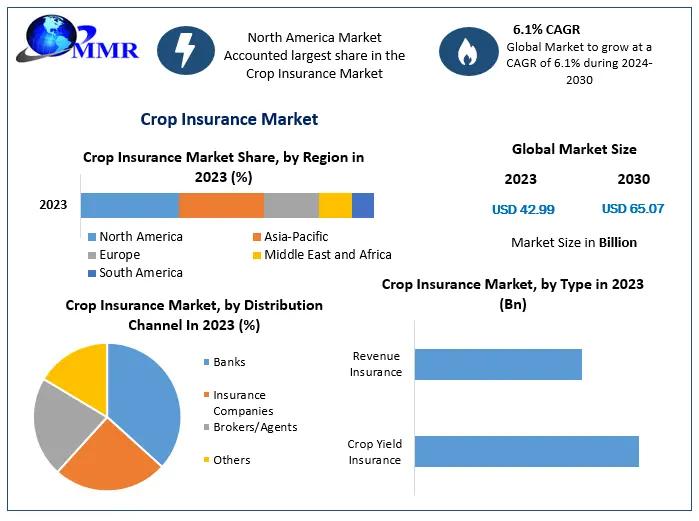

Crop Insurance Market Forecasted to Reach USD 65.07 Billion by 2030 at a CAGR of 6.1%

The Crop Insurance Market was valued at US$ 42.99 Bn in 2023 and is expected to reach US$ 65.07 Bn by 2030, at a CAGR of 6.1% during the forecast period.Crop Insurance Market Overview:

Agricultural producers worldwide are increasingly turning to crop insurance to safeguard against unpredictable weather patterns and market fluctuations. This surge is propelled by heightened awareness of climate-induced risks and the availability of tailored insurance products. Governments are playing a pivotal role by offering subsidies and implementing policies that make crop insurance more accessible to farmers, especially in regions prone to natural disasters.

In the Asia-Pacific region, countries like India and China are witnessing robust growth in the crop insurance sector. India's Pradhan Mantri Fasal Bima Yojana (PMFBY) has been instrumental, benefiting over 72.5 million farmers and covering 235.4 million hectares since its inception . Such initiatives underscore the critical role of crop insurance in ensuring food security and farmer resilience.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/148613/

Crop Insurance Market Dynamics:

The market dynamics are influenced by a confluence of factors, including technological integration and evolving risk landscapes. Innovations such as satellite imagery, AI-driven analytics, and blockchain are revolutionizing claim assessments and policy management, leading to increased efficiency and transparency.

Simultaneously, the frequency of extreme weather events has heightened the urgency for comprehensive risk mitigation strategies. Farmers are seeking insurance solutions that offer not just financial protection but also tools for proactive risk management. This shift is prompting insurers to develop products that are more aligned with the nuanced needs of modern agriculture.

Crop Insurance Market Outlook and Future Trends

Looking ahead, the crop insurance market is poised for transformative growth. The adoption of parametric and index-based insurance models is gaining traction due to their simplicity and rapid claim settlement processes . These models are particularly beneficial in regions where traditional loss assessments are challenging.

Moreover, the integration of digital platforms is enhancing policy distribution and farmer engagement. Mobile applications and online portals are making it easier for farmers to access information, enroll in policies, and file claims. This digital shift is expected to further democratize access to crop insurance, especially among smallholder farmers in developing nations.

Key Recent Developments:

Vietnam: In 2019, FWD Group acquired Vietcombank-Cardif Life Insurance, a joint venture between Vietcombank and BNP Paribas Cardif, for $400 million. This strategic move expanded FWD's footprint in Vietnam's insurance market.

Thailand: FWD Group's acquisition of SCB Life Assurance from Siam Commercial Bank in 2019 for $3 billion marked the largest insurance deal in Southeast Asia, significantly enhancing its presence in Thailand's insurance sector.

Japan: In 2016, FWD Group agreed to purchase AIG's Fuji Life Insurance Co., further solidifying its position in Japan's insurance market.

South Korea: While specific crop insurance mergers and acquisitions in South Korea are limited, the country continues to invest in agricultural insurance schemes to support its farming community.

Singapore: FWD Group expanded into Singapore by acquiring Shenton Insurance in 2016, enhancing its portfolio in the region.

United States: In December 2020, Sompo International Holdings Ltd. acquired Diversified Crop Insurance Services, consolidating its position as a leading crop insurance provider in the U.S. under the AgriSompo North America brand . Additionally, in April 2024, Farmers Mutual Hail Insurance Company of Iowa announced the acquisition of Global Ag Insurance Services, further expanding its crop insurance offerings.

Europe: European insurers are increasingly integrating advanced technologies into their crop insurance products. Companies like AXA XL and Zurich Insurance Group are leveraging AI and data analytics to enhance risk assessment and streamline claim processes .

Crop Insurance Market Segmentation

by Coverage Type

Multi-peril Crop Insurance (MPCI)

Crop-hail Insurance

by Distribution Channel

Banks

Insurance Companies

Brokers/Agents

Others

by Type

Crop Yield Insurance

Revenue Insurance

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/148613/

Some of the current players in the Crop Insurance Market are:

North America

1. American Finlands Group Inc

2. American International Group Inc

3. AmTrust Financial Services Inc

4. VANE (Insurance)

5. Duck Creek Technologies

Europe

6. axa insurance

7. Chubb Ltd

8. groupama assurances mutuelles

9. Zurich Insurance Co. Ltd

10. The Co-operators

APAC

11. Agriculture Insurance Co. of India Ltd.

12. ICICI Bank Ltd.

13. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

14. QBE Insurance Group Ltd

15. Sompo Holdings In

16. The New India Assurance Co. Ltd.

17. Tokio Marine Holdings Inc.

18. Zking Insurance

19. SBI

20. QBE Insurance Group

ME

21. Santam Ltd.

22. Royal Exchange General Insurance

23. Farmcrowdy

For additional reports on related topics, visit our website:

♦ Baby Wipes Market https://www.maximizemarketresearch.com/market-report/global-baby-wipes-market/70813/

♦ Household Vacuum Cleaners Market https://www.maximizemarketresearch.com/market-report/global-household-vacuum-cleaners-market/19977/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market Forecasted to Reach USD 65.07 Billion by 2030 at a CAGR of 6.1% here

News-ID: 3971619 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

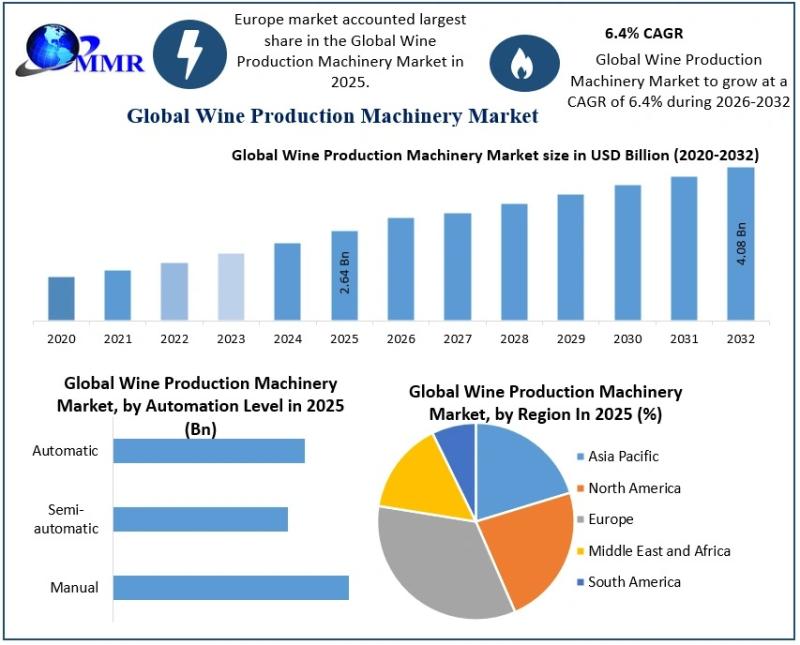

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

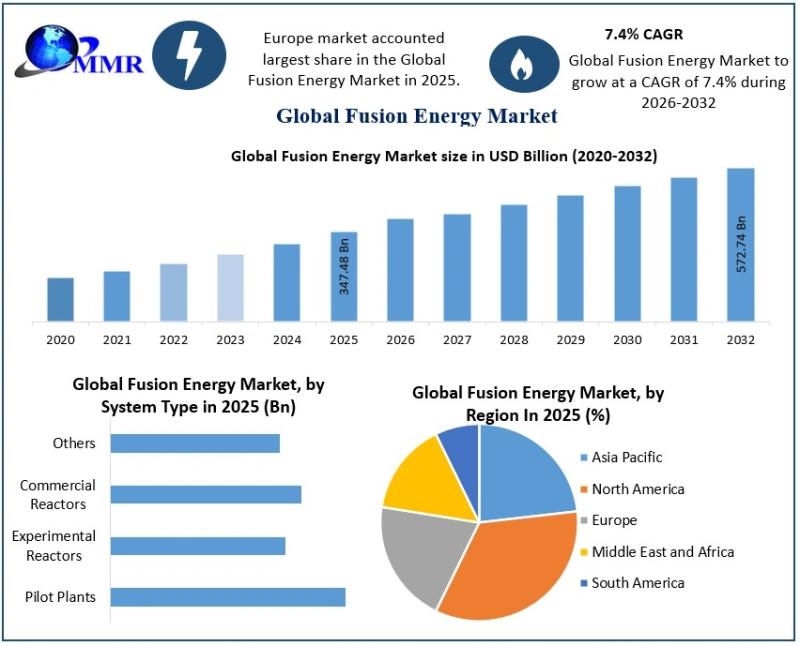

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…