Press release

Exchange Traded Fund Market to Reach USD 94.92 Trillion by 2032

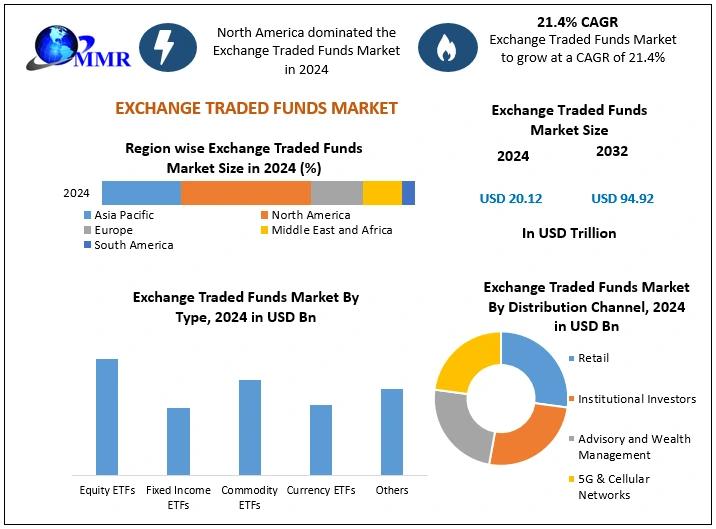

✦ Global Exchange Traded Fund (ETF) Market Poised to Reach USD 94.92 Trillion by 2032, Driven by Passive Investing TrendsThe global Exchange Traded Fund (ETF) market, valued at USD 20.12 trillion in 2024, is projected to expand at a CAGR of 21.4%, reaching approximately USD 94.92 trillion by 2032. This growth is fueled by the increasing shift towards passive investing, offering simplicity, cost-effectiveness, and diversification benefits over actively managed funds.

Curious to peek inside? Grab your sample copy of this report now:https://www.maximizemarketresearch.com/request-sample/199127/

✦ Competitive Landscape

Leading players in the ETF market include BlackRock, The Vanguard Group, State Street Corporation, Invesco Mutual Fund, Charles Schwab & Co. Inc., and Mitsubishi UFJ Financial Group Inc. These firms maintain their positions through comprehensive product offerings, brand strength, and strategic expansions.

✦ Regional Demand Highlights

North America holds the largest share of the global ETF market, driven by strong investor confidence and a supportive regulatory environment. The Asia-Pacific region is expected to witness rapid growth, fueled by rising wealth and a growing middle class seeking investment opportunities.

Growth Opportunities in Vietnam

Vietnam's ETF market is gaining traction from overseas investors. In 2021, ETFs trading on the Vietnamese market generated more than VND11.5 trillion (approximately $500 million), with significant contributions from funds like the Fubon FTSE Vietnam ETF and Bualuang Vietnam Equity Fund.

Trends in Thailand

Thailand is witnessing increased interest in ETFs, particularly those focusing on urbanization, technical advancements, and foreign investment flows. The Bualuang Vietnam Equity Fund, a subsidiary of Thailand-headquartered Bualuang Asset Management, filed for an initial public offering to capture Vietnam's lucrative stock market.

Consolidation in Japan

Japan's ETF market is mature, with a focus on consolidation and efficiency. Major financial institutions are streamlining their ETF offerings to cater to institutional investors seeking diversified and cost-effective investment options.

Updation in South Korea

South Korea is updating its financial infrastructure to accommodate the growing demand for ETFs. Regulatory bodies are working towards creating a more conducive environment for ETF trading and investment.

Opportunities in Singapore

Singapore's emphasis on becoming a financial hub has led to increased ETF offerings. The city-state is attracting global ETF providers aiming to tap into the Southeast Asian market.

Growth in the United States

The U.S. ETF market is experiencing significant growth, with assets under management reaching record highs. In February 2024, State Street Corporation reported a record $11.6 trillion in global ETF assets under management, a 15% increase from 2022.

Trends in China

China is considering granting access to Western firms like Citadel Securities, Jane Street, and possibly Optiver to operate as market makers in its $520 billion ETF market. This move could enhance trading efficiency and reduce costs due to the experience international firms bring in providing ETF liquidity.

Consolidation in Europe

Europe is witnessing a surge in active ETFs, with firms like Goldman Sachs Asset Management positioning themselves to become leading providers. The firm has invested heavily in ETF resources and plans to launch more active ETFs soon, amid high demand from wealth managers and private banks.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:https://www.maximizemarketresearch.com/request-sample/199127/

✦ Recent Developments and Mergers

In November 2021, Goldman Sachs Asset Management announced the launch of three new actively managed, fully transparent equity ETFs, including the Goldman Sachs Future Consumer Equity ETF (GBUY), the Goldman Sachs Future Health Care Equity ETF (GDOC), and the Goldman Sachs Future Real Estate and Infrastructure Equity ETF (GREI).

Citadel Securities has applied to establish a brokerage unit in China, aiming to operate as a market maker in the country's ETF market.

✦ Exchange Traded Fund Market Classifications

by Type

Equity ETFs

Fixed Income ETFs

Commodity ETFs

Currency ETFs

Others

by Asset Class

Stocks

Bonds

Commodities

Real Estate

Others

by Distribution Channel

Retail

Institutional Investors

Advisory and Wealth Management Firms

Interested to take a sneak peek? Request a sample copy of the report to see what's inside:https://www.maximizemarketresearch.com/request-sample/199127/

✦ The following companies are included in the market for Exchange Traded Fund :

1. BlackRock, Inc (USA)

2. Vanguard (USA)

3. State Street Global Advisors (SPDR) (USA)

4. Invesco (USA)

5. Charles Schwab Investment Management (USA)

6. Fidelity Investments (USA)

7. WisdomTree Investments (USA)

8. JP Morgan Asset Management (USA)

9. First Trust Portfolios (USA)

10. VanEck (USA)

11. Northern Trust Asset Management (USA)

12. Goldman Sachs Asset Management (USA)

13. UBS Asset Management (Switzerland)

14. DWS Group (Xtracker) (Germany)

15. PIMCO (USA)

16. Aberdeen Standard Investments (UK)

17. Global X ETFs (USA)

18. ProShares (USA)

19. Direxion (USA)

20. Schwab ETFs (USA)

21. Principal Global Investors (USA)

22. Hartford Funds (USA)

For deeper market insights, peruse the summary of the research report: https://www.maximizemarketresearch.com/market-report/exchange-traded-fund-market/199127/

✦ Get Market Research Latest Trends:

WLAN Market https://www.maximizemarketresearch.com/market-report/global-wlan-market/54503/

Small Satellite Market https://www.maximizemarketresearch.com/market-report/global-small-satellite-market/341/

Data Pipeline Tools Market https://www.maximizemarketresearch.com/market-report/data-pipeline-tools-market/182934/

Global Generative Design Market https://www.maximizemarketresearch.com/market-report/global-generative-design-market/26810/

Visual Effects (VFX) Market https://www.maximizemarketresearch.com/market-report/visual-effects-vfx-market-global-market/148265/

India Cloud Infrastructure as a Service (IaaS) Market https://www.maximizemarketresearch.com/market-report/india-cloud-infrastructure-as-a-service-iaas-market/44086/

Global Artificial Intelligence in Supply Chain Market https://www.maximizemarketresearch.com/market-report/global-artificial-intelligence-in-supply-chain-market/63829/

India NonLife Insurance Market https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

Europe Blockchain Market https://www.maximizemarketresearch.com/market-report/europe-blockchain-market/2951/

Retail Media Networks Market https://www.maximizemarketresearch.com/market-report/retail-media-networks-market/147754/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Exchange Traded Fund Market to Reach USD 94.92 Trillion by 2032 here

News-ID: 3970858 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Plant PheNotyping Market Industry: Current Status and Future Prospects

Plant PheNotyping Market is expected to grow at a CAGR of 11.14% throughout the forecast period, to reach US$ 331.14 Mn. by 2029.

Market Overview:

The Plant Phenotyping Market is gaining strong momentum as agriculture increasingly adopts data-driven and precision-based practices. Advanced phenotyping technologies enable detailed observation of plant traits such as growth patterns, stress tolerance, and yield potential under varying environmental conditions. The integration of imaging systems, sensors, drones, and automated…

Ride-hailing Market : A Breakdown of the Industry by Region and Segment

The Ride-hailing Market size was valued at USD 130.46 Billion in 2024 and the total Ride-hailing revenue is expected to grow at a CAGR of 14.36% from 2025 to 2032, reaching nearly USD 381.66 Billion.

Market Overview:

The ride-hailing market has transformed urban mobility by offering on-demand, app-based transportation that prioritizes convenience, flexibility, and real-time tracking. Driven by widespread smartphone adoption, GPS integration, and digital payment systems, ride-hailing platforms have become an…

Ultra HD TV Market : A Look at the Industry's Current and Future State

The Ultra HD (UHD) TV Market was valued at USD 254.61 billion in 2024. The market is expected to reach USD 639.47 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 12.2 % from 2025 to 2032.

Market Overview:

The Ultra HD TV Market is being driven by rapid advancements in display technologies, including 4K and 8K resolution panels, high dynamic range (HDR), OLED, QLED, and Mini-LED backlighting. Consumers…

Jaw Crusher Market : Analyzing the Industry's Growth and Challenges

The Jaw Crusher Market size was valued at USD 1.99 Billion in 2023 and the total Jaw Crusher revenue is expected to grow at a CAGR of 3.7% from 2024 to 2030, reaching nearly USD 2.56 Billion.

Market Overview:

The jaw crusher market plays a vital role in the global crushing and mining ecosystem, driven by rising demand from construction, mining, quarrying, and infrastructure development activities. Jaw crushers are widely preferred for…

More Releases for ETF

Market Makers Eye $0.40 for BlockDAG While Solana ETF Inflows Increase & Hedera …

The crypto market continues to draw strong institutional interest as both Solana (SOL) price momentum and the Hedera (HBAR) price outlook advance with major ETF inflows. Traders now study shifting liquidity patterns and search for the best crypto to buy right now, with data showing that sentiment is leaning toward networks with proven utility.

At the same time, BlockDAG (BDAG) https://blockdag.network/ is reshaping expectations through its ongoing presale progress. With a…

XRP Price Prediction: Momentum Builds While ETF Expectations Grow

XRP is back in the spotlight. After a period of subdued trading, the token is hovering around $2.26 with a market cap near $136 billion, as ETF chatter draws fresh capital into its orbit. With its significant market size and established function in cross‐border payments, the token remains a key barometer for crypto assets tied to actual utility. Each meaningful move in XRP's valuation tends to reignite speculation about revisiting…

XRP Price Prediction: Government Shutdown Delays Ripple ETF Approvals

The United States government shutdown is beginning to affect the cryptocurrency market, especially in areas that depend on regulatory decisions. Several XRP-linked ETF applications have now been delayed, creating uncertainty in the short term.

Despite the holdup, confidence in XRP remains strong. The REX-Osprey XRP ETF (XRPR) has officially passed 100 million dollars in assets under management, showing that institutional investors are continuing to accumulate exposure.

That growth supports a bullish XRP…

ETF Approval Sparks Institutional Mining Rush, PAIRMiner Scales Up

More offline retail inverter community can now participate in the mining economy without the hassle of hardware or technical knowledge using PAIRMiner, a UK-regulated cloud mining platform, as Bitcoin experiences a surge driven by growing institutional adoption and recent approval of spot Bitcoin ETFs.

Founded in 2009, PAIRMiner offers users remote access to hash power for mining Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and other cryptocurrencies. Interest in the platform sharply…

Title: What's the Difference Between Bitcoin Spot ETF and Bitcoin Futures ETF?

Bitcoin Exchange Traded Funds (ETFs) have developed as a financial innovation to bridge the divide between conventional investments and the digital frontier. These products give investors the chance to profit from fluctuations in the price of Bitcoin without having to deal with concerns related to direct cryptocurrency ownership. Financial gurus like BlackRock, Invesco, Ark Invest, and Fidelity, who have submitted proposals for their development, have shown much interest in Bitcoin…

X Fertilizers Potash Etf Market

Plant diseases are the cause of crop and plant damage which is caused by plant pathogenic (disease causing organism). Fungi are the most common pathogenic organism that damages the productivity of crop or plant. Other pathogenic organism causing damage to the crop and plants are viruses, nematodes and bacteria. Within the agricultural sector, manufacturers of fertilizers are the most important channel in the food supply chain. Quality fertilizers are responsible…