Press release

Microfinance Market Anticipated to Hit USD 536.46 Billion by 2032, Growing at a 12.5% CAGR

The Microfinance Market size was valued at USD 209.08 Billion in 2024 and the total Microfinance Market revenue is expected to grow at a CAGR of 12.5 % from 2024 to 2032, reaching nearly USD 536.46 Billion.Microfinance Market Overview:

The global microfinance market is experiencing a transformative phase, driven by the imperative to enhance financial inclusion for underserved populations. As of 2024, the market was valued at approximately USD 209.08 billion and is projected to expand at a compound annual growth rate (CAGR) of 12.5%, reaching nearly USD 536.46 billion by 2032. This growth is largely attributed to the increasing demand for accessible financial services, particularly in developing regions where a significant portion of the population remains unbanked. Technological innovations, especially in mobile banking and fintech solutions, have revolutionized the delivery of microfinance services. These advancements have enabled microfinance institutions (MFIs) to extend their reach into remote areas, offering products such as microloans, microsavings, and micro-insurance.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/230628/

Microfinance Market Dynamics:

The surge in financial inclusion initiatives globally has been a significant driver for the microfinance sector. Governments and international organizations are increasingly recognizing the role of microfinance in poverty alleviation and economic development. Policies promoting access to finance for micro, small, and medium enterprises (MSMEs) have been instrumental in this growth. For instance, countries like Indonesia and Vietnam have implemented local policies that support MSME financing, contributing to the sector's expansion.

However, the sector faces challenges, particularly concerning risk management. Serving clients with limited credit histories and lack of collateral increases credit risk for MFIs. Operational risks, including infrastructure limitations and potential fraud, also pose threats to sustainability. Additionally, external factors such as political instability and economic downturns can impact the stability of microfinance operations. Addressing these challenges requires robust risk assessment frameworks and adaptive strategies.

Microfinance Market Outlook and Future Trends

The future of the microfinance market is closely tied to the continued adoption of digital technologies. The proliferation of mobile banking and digital wallets is expected to further enhance the accessibility of microfinance services. In regions like East Africa, where economic growth rates are projected at around 5.7% for 2025-2026, digital platforms are set to play a pivotal role in reaching unbanked populations.

Moreover, the integration of artificial intelligence (AI) for credit assessment is emerging as a transformative trend. AI technologies enable MFIs to analyze data more effectively, facilitating personalized loan products and improving risk management. This innovation is anticipated to streamline loan processing and enhance the overall efficiency of microfinance operations.

Key Recent Developments:

Vietnam

Vietnam's microfinance sector has witnessed a surge in digital lending platforms, significantly enhancing credit access for underserved populations. These platforms leverage technology to streamline loan applications and disbursements, contributing to the country's financial inclusion efforts.

Thailand

In 2016, Hattha Kaksekar Limited, a prominent Cambodian microfinance institution, was acquired by Krungsri Bank, a subsidiary of Thailand's Bank of Ayudhya and a member of Japan's MUFG Bank. This strategic acquisition facilitated Hattha Kaksekar's transformation into Hattha Bank, expanding its service offerings and operational capacity.

Japan

Japanese financial institutions have been actively investing in Southeast Asian microfinance markets. MUFG Bank's involvement in the acquisition of Hattha Kaksekar Limited underscores Japan's strategic interest in expanding its footprint in the region's microfinance sector.

South Korea

South Korea's fintech industry is experiencing rapid growth, leading to increased collaborations between traditional financial institutions and fintech startups. These partnerships are enhancing the delivery of microfinance services, particularly through mobile and digital platforms, thereby improving financial accessibility for underserved communities.

Singapore

Singapore has emerged as a hub for fintech innovation, with several startups focusing on microfinance solutions. The government's supportive regulatory environment has fostered the development of digital platforms that provide microloans and other financial services to small businesses and individuals across Southeast Asia.

United States

In the United States, microfinance institutions have been integrating AI technologies to refine credit evaluation and risk control. These tools gather data on potential borrowers to design specific loan products, reducing defaults and streamlining the loan process.

Europe

European microfinance markets are witnessing enhanced regulatory frameworks aimed at ensuring ethical lending practices and client protection. These regulations are increasing transparency, addressing risk, and fostering ethical behavior within the microfinance sector, thereby strengthening its reputation and overall viability.

Microfinance Market Segmentation

by Type

Banks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Fintech

Other

by Loan Type

Income-Generating Loans

Consumption Loans

Emergency Loans

Agricultural Loans

Others

by End User

Individual Borrowers

Micro, Small, and Medium Enterprises (MSMEs)

Women Entrepreneurs

Farmers and Rural Communities

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/230628/

Some of the current players in the Microfinance Market are:

1. Bandhan Bank

2. Kiva

3. BRAC

4. Bank Rakyat Indonesia

5. BSS Microfinance Private limited

6. FINCA International

7. Grameen Bank

8. Sva microfinance

9. Al Amana Microfinance

10. Grameen Foundation

11. Accion International

12. Opportunity International

13. Bharat Financial Inclusion Limited

14. Cashpor Micro Credit

15. Compartamos Banco

16. IndusInd Bank Limited

17. Manappuram Finance Ltd

18. Spandana

19. Women's World Banking

20. Sparkle Microfinance Bank

For additional reports on related topics, visit our website:

♦ MiddleEast Digital Transformation Market https://www.maximizemarketresearch.com/market-report/middle-east-digital-transformation-market/2954/

♦ Physical Security Information Management Market https://www.maximizemarketresearch.com/market-report/global-physical-security-information-management-market/55313/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market Anticipated to Hit USD 536.46 Billion by 2032, Growing at a 12.5% CAGR here

News-ID: 3964528 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

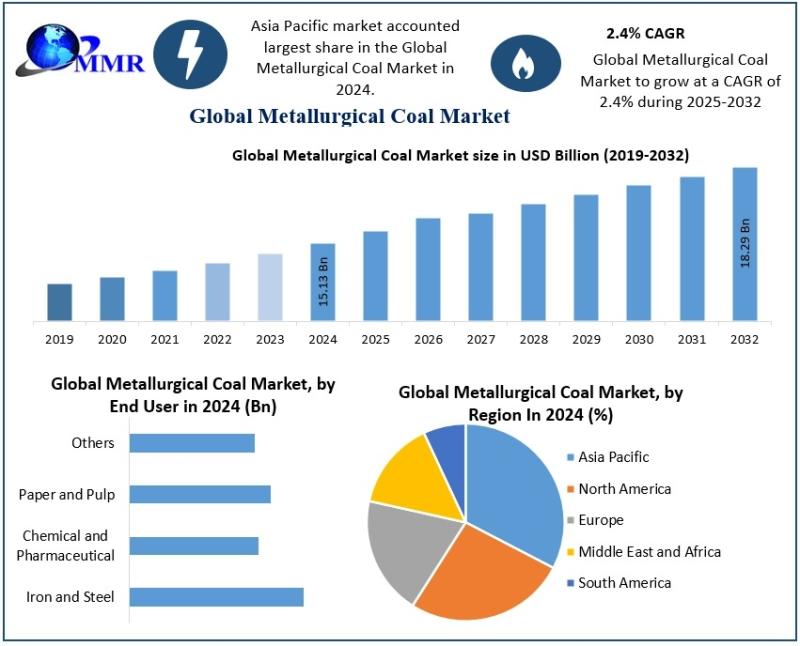

Metallurgical Coal Market Trends Shaping the Future of Steel and Infrastructure

The Metallurgical Coal Market size was valued at USD 15.13 Billion in 2024 and the total Metallurgical Coal revenue is expected to grow at a CAGR of 2.4% from 2025 to 2032, reaching nearly USD 18.29 Billion.

Metallurgical Coal Market Overview:

The Metallurgical Coal Market is deeply connected to the performance of the global steel sector, as metallurgical coal is an essential raw material used in blast furnace operations. Steel remains indispensable…

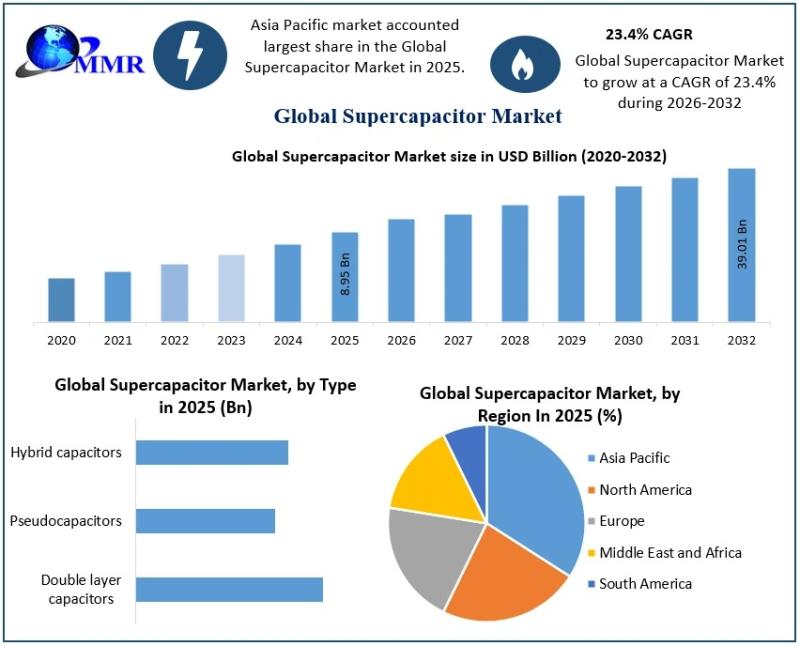

Supercapacitor Market Shows Strong Momentum as Energy Storage Innovation Acceler …

The Supercapacitor Market size was valued at USD 8.95 Billion in 2025 and the total Supercapacitor revenue is expected to grow at a CAGR of 23.4% from 2025 to 2032, reaching nearly USD 39.01 Billion by 2032.

Supercapacitor Market Overview:

The Supercapacitor Market is gaining significant attention as industries worldwide seek efficient, reliable, and sustainable energy storage solutions. Supercapacitors, also known as ultracapacitors, bridge the gap between conventional capacitors and batteries by…

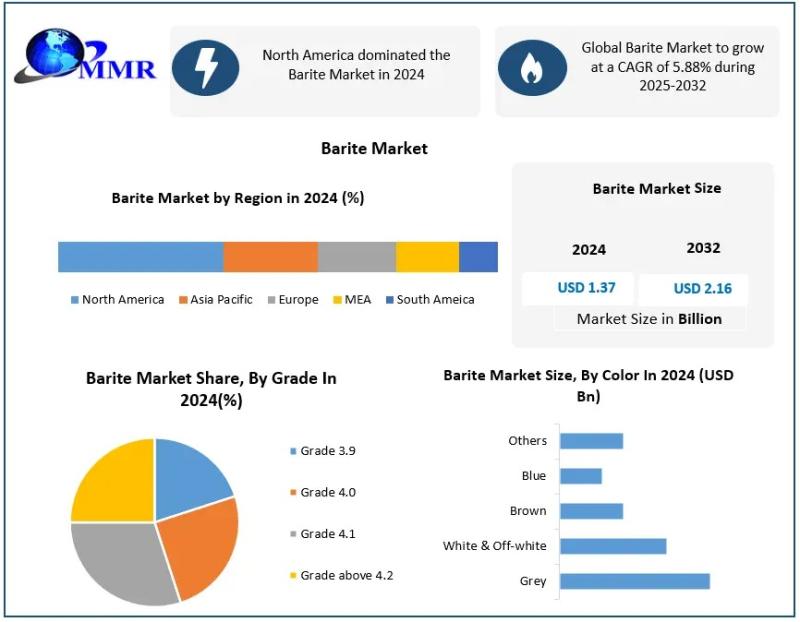

Barite Market Shows Strong Momentum Amid Industrial Expansion and Energy Demand

The Barite Market was valued at USD 1.37 billion in 2024, and total global Barite Market revenue is expected to grow at a CAGR of 5.88% from 2025 to 2032, reaching nearly USD 2.16 billion. Rising demand from the oil & gas industry.

Barite Market Overview:

The Barite Market is structured around diverse applications that depend on the mineral's exceptional physical properties. Barite is primarily used as a weighting agent in drilling…

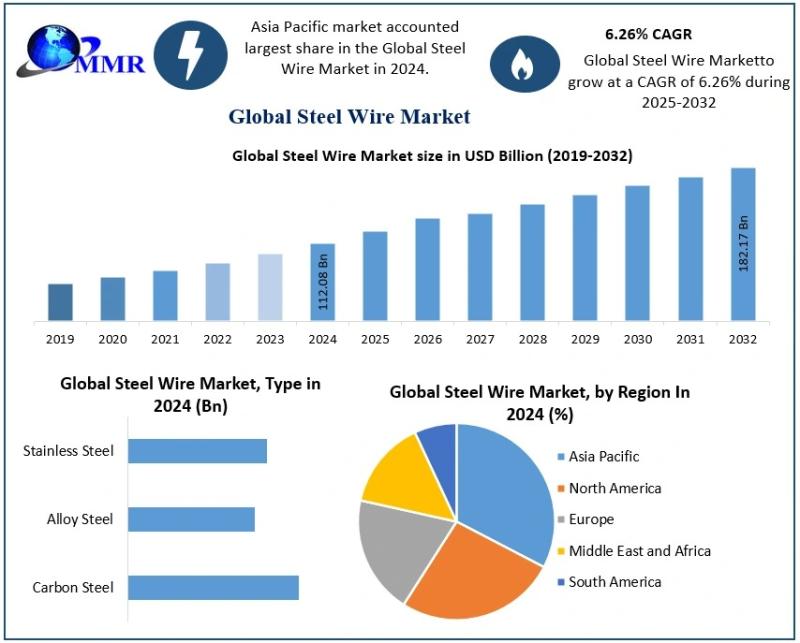

Steel Wire Market Analysis: Key Trends, Dynamics, and Future Outlook

The Steel Wire Market size was valued at USD 112.08 Billion in 2024 and the total Steel Wire revenue is expected to grow at a CAGR of 6.26% from 2025 to 2032, reaching nearly USD 182.17 Billion.

Steel Wire Market Overview:

The Steel Wire Market represents a highly diversified and application-driven industry, supplying essential materials for both heavy and light industrial operations. Steel wire is produced in various forms, including carbon steel…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…