Press release

New Jersey Bankruptcy Attorney Daniel Straffi Explains When One Spouse Can File for Bankruptcy

When financial distress affects a household, couples often consider bankruptcy as a means of relief. A common question that arises is whether one spouse can file for bankruptcy without involving the other. New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-one-spouse-file-bankruptcy/) addresses this important issue in a recent article, helping individuals and couples navigate financial recovery.In New Jersey, bankruptcy laws allow an individual to file without their spouse, offering a potential path for targeted debt relief. As a New Jersey bankruptcy attorney, Daniel Straffi discusses how filing individually can impact not only the person seeking relief but also the financial status of the household. Understanding how these laws apply to shared assets and obligations is essential when choosing between individual or joint filings.

According to Daniel Straffi, a New Jersey bankruptcy attorney at Straffi & Straffi Attorneys at Law, "Filing alone may offer relief from overwhelming debt, but it's important to consider how this choice could impact jointly held assets and the financial responsibilities of the non-filing spouse." The article emphasizes that although an individual filing is legally allowed, both spouses' financial situations should be carefully evaluated before moving forward.

Bankruptcy law protects the right of any individual to file on their own, regardless of marital status. However, household income-including that of the non-filing spouse-must still be disclosed to the court to assess eligibility and repayment ability under Chapter 7 or Chapter 13 bankruptcy. Daniel Straffi explains that while the non-filing spouse is not legally part of the case, their financial role within the household can influence the overall outcome.

There are many reasons one spouse might choose to file alone. For example, the debt may be held solely in one spouse's name, or one partner may want to preserve their credit profile. In other instances, joint filing may not be an option if one spouse has already filed bankruptcy in recent years. In these scenarios, Daniel Straffi notes that individual filing could provide a more strategic outcome for the household, especially when access to financing or credit is needed by the non-filing spouse.

Joint bankruptcy may offer more comprehensive benefits in certain cases. According to the article, if most debts are shared, filing jointly can simplify the legal process, reduce overall costs, and shield both spouses from creditor actions such as wage garnishments or foreclosure proceedings. The joint filing also allows married couples to double their federal bankruptcy exemptions in New Jersey, which can help protect a larger amount of property from liquidation.

However, Daniel Straffi cautions that joint filing is not ideal for everyone. If one spouse owns significant separate property or the couple is managing substantial priority debts like taxes or alimony, individual filing may offer more favorable outcomes. The article explores how excessive property or income limitations may influence whether filing jointly or separately is best.

The impact of an individual bankruptcy on a non-filing spouse's credit is another key concern. The article notes that credit histories are maintained separately. A bankruptcy filing by one spouse generally does not appear on the other's credit report, unless they share joint debts. If both names are associated with the same financial obligations, the non-filing spouse may still be pursued by creditors and could see a negative impact on their credit score if payments are missed.

Daniel Straffi also explains what happens to shared property when only one spouse files. In a Chapter 7 bankruptcy, the court may permit the liquidation of the debtor's portion of jointly owned assets, even if the other spouse objects. The non-filing spouse is entitled to receive their share of any proceeds from the sale, though the court may need to intervene in challenging cases involving indivisible property or disagreements about ownership.

Asset protection is an essential factor in New Jersey bankruptcy proceedings. Filers can choose between state and federal exemption schemes. While New Jersey's state laws offer limited exemptions, federal laws provide more robust protection for home equity, personal property, and other assets. Daniel Straffi recommends a thorough review of both systems to determine which offers the best protection for each couple's unique financial profile.

Bankruptcy may also influence how joint debts are handled. When one spouse files individually, creditors may still pursue the other spouse for repayment on any joint obligations. Straffi points out that creditors can continue lawsuits or garnishments, which highlights the importance of evaluating all joint financial responsibilities before deciding to file.

New Jersey follows common law when it comes to marital property. Property owned solely by the non-filing spouse is generally shielded from creditors. Additionally, married couples who own property as tenants by the entirety may benefit from added protection, as creditors cannot force the sale of such property without the agreement of both spouses.

Daniel Straffi emphasizes that while bankruptcy offers a path forward, the decision to file individually or jointly should be made with careful consideration of assets, debts, and legal protections. The process can be challenging, but informed guidance can help couples navigate the situation and protect their financial well-being.

Those considering bankruptcy are encouraged to seek professional guidance to understand how individual filing may affect both spouses' financial standing. Straffi & Straffi Attorneys at Law provides support for individuals and couples in New Jersey facing debt-related challenges. Daniel Straffi and his team help clients evaluate their financial position and determine the most appropriate strategy for moving forward.

For those navigating debt and considering their legal options, taking the first step can make a difference. Understanding the pros and cons of individual versus joint bankruptcy filing is crucial for making a decision that protects both assets and financial stability.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a legal practice serving individuals and families throughout New Jersey. The firm handles a wide range of bankruptcy matters and is committed to helping clients understand their rights and options when facing financial hardship.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=sZw11dIbOps

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: familyclient@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-bankruptcy-attorney-daniel-straffi-explains-when-one-spouse-can-file-for-bankruptcy]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Bankruptcy Attorney Daniel Straffi Explains When One Spouse Can File for Bankruptcy here

News-ID: 3964021 • Views: …

More Releases from ABNewswire

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

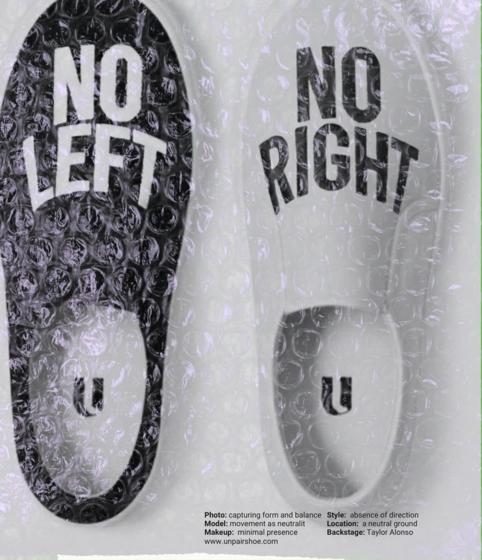

Unpair Introduces a Patent-Pending Symmetrical Footwear System That Eliminates L …

Founded by Taiwanese fashion designer turned inventor Hui Min Yang, Unpair reimagines footwear through symmetry, interchangeability, and universal form.

Houston, TX - February 19th, 2026 - Unpair officially announces a patent-pending symmetrical footwear system that challenges centuries of left-right shoe design. For centuries, footwear has followed a fixed rule: one shoe for the left foot and one for the right.

Image: https://www.abnewswire.com/upload/2026/02/5a16a00cab1f11dd06faa474a3674865.jpg

Unpair challenges that convention by introducing a patent-pending symmetrical footwear system…

Top Realtor in Vienna, VA, Marks 18th Year Serving Northern Virginia Market

Vienna, VA - Andrea Woodhouse, an associate broker at Maple Ave Living, celebrates a significant milestone in 2026, marking 18 years since obtaining her real estate license in 2009. Her journey began when frustration with her own home sale sparked a passion for helping others navigate the real estate process with greater ease and success.

Over nearly two decades, Andrea Woodhouse has distinguished herself as a real estate agent in Vienna,…

Rett Syndrome Clinical Trial Pipeline Appears Robust With 20+ Key Pharma Compani …

DelveInsight's, "Rett Syndrome Pipeline Insight 2026" report provides comprehensive insights about 20+ companies and 20+ pipeline drugs in Rett Syndrome pipeline landscape. It covers the Rett Syndrome pipeline drug profiles, including clinical and nonclinical stage products. It also covers the Rett Syndrome pipeline therapeutics assessment by product type, stage, route of administration, and molecule type. It further highlights the inactive pipeline products in this space.

Curious about the latest updates in…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…