Press release

Finance Cloud Market Set to Surge from USD 44.6 Billion in 2023 to USD 102.5 Billion by 2030 | Persistence Market Research

The global finance cloud market is experiencing robust growth, driven by several key factors and technological advancements. This market is expected to expand at a compound annual growth rate (CAGR) of 12.6%, increasing from a value of USD 44.6 billion in 2023 to USD 102.5 billion by 2030. The financial services sector, known for its reliance on secure data management and operational efficiency, is increasingly adopting cloud solutions to streamline operations, enhance customer experience, and improve scalability. The finance cloud market encompasses a wide range of services, from data storage and analytics to software applications that enable financial institutions to manage their operations more effectively.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/33634

Key growth drivers behind this market expansion include increasing digital transformation across financial institutions, the growing adoption of artificial intelligence (AI) and machine learning (ML) for data analytics, and the shift towards more secure, cost-efficient, and scalable cloud solutions. The need for real-time processing, enhanced data security, and regulatory compliance is also contributing to the rapid adoption of finance cloud solutions. The leading segment in this market is the software segment, as organizations increasingly seek solutions to optimize their financial processes. Geographically, North America leads the market due to the presence of a large number of financial institutions, technology companies, and strong digital infrastructure.

Key Highlights from the Report

• The finance cloud market is forecast to grow from USD 44.6 billion in 2023 to USD 102.5 billion by 2030.

• The market is expected to expand at a CAGR of 12.6% from 2023 to 2030.

• The software segment is currently the leading segment in the finance cloud market.

• North America is the leading geographical region in the finance cloud market.

• Cloud-based finance solutions are essential for enhancing real-time data analytics and improving regulatory compliance.

• Increasing adoption of AI and ML technologies in financial institutions is fueling market growth.

Market Segmentation

The finance cloud market can be segmented based on product types, end-users, and deployment models. Product types primarily include software solutions, such as accounting software, budgeting software, financial planning software, and payment processing systems. These solutions are designed to provide financial institutions with enhanced analytics, better compliance management, and streamlined operations. Additionally, deployment models of finance cloud solutions are commonly available in public, private, and hybrid clouds, with each model offering unique benefits in terms of data security, scalability, and cost efficiency.

End-user segmentation is another crucial aspect, with the finance cloud market serving a wide range of industries, including banking, insurance, and wealth management. Banks are the leading end-users, as they leverage finance cloud solutions to manage customer data, streamline lending processes, and improve customer service. The insurance sector is also heavily investing in finance cloud technologies to enhance claims processing, risk management, and underwriting processes. As digital transformation continues to accelerate, more financial institutions are expected to adopt cloud-based solutions to maintain a competitive edge and improve operational efficiency.

Regional Insights

In terms of regional trends, North America is the dominant region in the global finance cloud market. The strong presence of leading financial institutions, along with the extensive adoption of digital technologies, makes North America a key player in the market. The region's advanced digital infrastructure, high investment in cloud technologies, and supportive regulatory environment further accelerate market growth. Additionally, the United States, with its large number of banks, insurance companies, and financial services firms, remains a focal point for cloud-based finance solutions.

In contrast, the Asia-Pacific (APAC) region is expected to experience the highest growth rate during the forecast period. The rapid digitalization of financial services, particularly in emerging markets like China and India, is contributing to the adoption of finance cloud solutions in the region. Increasing internet penetration, mobile banking, and government initiatives aimed at promoting digital financial services are further boosting the demand for cloud-based solutions in the APAC region.

Market Drivers

Several factors are driving the growth of the finance cloud market. First, the digital transformation of financial institutions has become a significant driver, with banks and other financial services firms increasingly adopting cloud solutions to modernize their operations. Cloud-based platforms enable real-time data access, enhanced analytics, and improved customer service, making them an attractive option for financial institutions looking to stay competitive in the digital age.

Second, the growing demand for data security and regulatory compliance is pushing financial institutions toward cloud adoption. Cloud platforms offer advanced security features such as encryption, secure data storage, and compliance with regulatory standards, making them essential tools for mitigating risks and ensuring compliance with financial regulations. Additionally, the scalability of cloud-based finance solutions allows financial organizations to grow without worrying about infrastructure limitations.

Market Restraints

Despite its rapid growth, the finance cloud market faces certain restraints. One of the primary challenges is data privacy concerns. Financial institutions deal with highly sensitive customer data, and moving such data to the cloud raises concerns about unauthorized access, data breaches, and cyberattacks. Even though cloud providers invest in security measures, some financial institutions remain cautious about entrusting their data to third-party platforms.

Additionally, the high initial costs of implementing cloud-based solutions can deter some smaller financial institutions from making the transition. While the long-term benefits of cloud adoption are clear, the upfront investment required for infrastructure setup, training, and migration to cloud platforms can be a barrier for smaller players in the market. Overcoming these challenges will require continued advancements in cloud security technologies and a focus on reducing implementation costs.

Market Opportunities

The finance cloud market presents several opportunities for growth and innovation. One key opportunity lies in the adoption of AI and machine learning in finance cloud platforms. AI-driven solutions can significantly improve predictive analytics, fraud detection, and decision-making processes, enabling financial institutions to provide personalized services and make data-driven decisions.

Another opportunity is the increased adoption of blockchain technology in finance cloud solutions. Blockchain can offer enhanced security and transparency for financial transactions, making it an attractive addition to cloud-based platforms. Financial institutions exploring blockchain-based finance solutions can improve operational efficiency and reduce the risk of fraud, leading to significant growth in the sector.

Frequently Asked Questions (FAQs)

How Big is the Finance Cloud Market?

Who are the Key Players in the Global Finance Cloud Market?

What is the Projected Growth Rate of the Finance Cloud Market?

What is the Market Forecast for the Finance Cloud Industry by 2030?

Which Region is Estimated to Dominate the Finance Cloud Market through the Forecast Period?

Company Insights

The finance cloud market is highly competitive, with several key players offering innovative solutions. Leading companies in this space include:

• Amazon Web Services (AWS)

• Microsoft Azure

• Google Cloud

• IBM Corporation

• Oracle Corporation

• Salesforce

Recent Developments

1. Amazon Web Services (AWS) announced the launch of its new finance cloud platform, designed to provide scalable solutions for banks and financial institutions, enhancing security and compliance.

2. Salesforce recently introduced AI-powered analytics features in its finance cloud suite, allowing organizations to gain deeper insights into financial data and improve decision-making processes.

The finance cloud market is poised for continued growth, fueled by the increasing demand for digital solutions and enhanced security in financial operations. As financial institutions continue to embrace cloud technologies, they are likely to experience improved operational efficiency, cost savings, and better customer experiences, driving further adoption in the coming years.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Finance Cloud Market Set to Surge from USD 44.6 Billion in 2023 to USD 102.5 Billion by 2030 | Persistence Market Research here

News-ID: 3963250 • Views: …

More Releases from Persistence Market Research

Scented Candles Market to Reach US$3.5 Billion by 2033 Amid Rising Demand for We …

The global scented candles market is witnessing steady growth as consumers increasingly prioritize wellness, relaxation, and home ambience. According to industry estimates, the market is projected to be valued at US$2.5 billion in 2026 and is expected to reach US$3.5 billion by 2033, expanding at a CAGR of 5.2% from 2026 to 2033. The growing integration of scented candles into self-care routines, home décor, and gifting culture is driving sustained…

Freezer, Beverage and Wine Cooler Market to Reach US$5.5 Billion by 2033 Amid Sm …

The global freezer, beverage and wine cooler market is entering a phase of steady expansion driven by lifestyle shifts, premium kitchen trends, and increasing commercial refrigeration demand. According to industry analysis, the market is projected to reach US$3.4 billion by 2026 and grow to US$5.5 billion by 2033, registering a compound annual growth rate (CAGR) of 7.1% from 2026 to 2033. This growth trajectory reflects rising consumer preference for specialized…

Cryogenic Storage Tanks Market Predicted to Hit US$ 12.8 Billion by 2033 Driven …

According to the latest study by Persistence Market Research, the global cryogenic storage tanks market is likely to be valued at US$ 8.6 billion in 2026 and is projected to reach US$ 12.8 billion by 2033, expanding at a CAGR of 5.8% during the forecast period 2026-2033. Rising demand for liquefied gases across energy, healthcare, food processing, and industrial manufacturing sectors is emerging as a key driver shaping the market's…

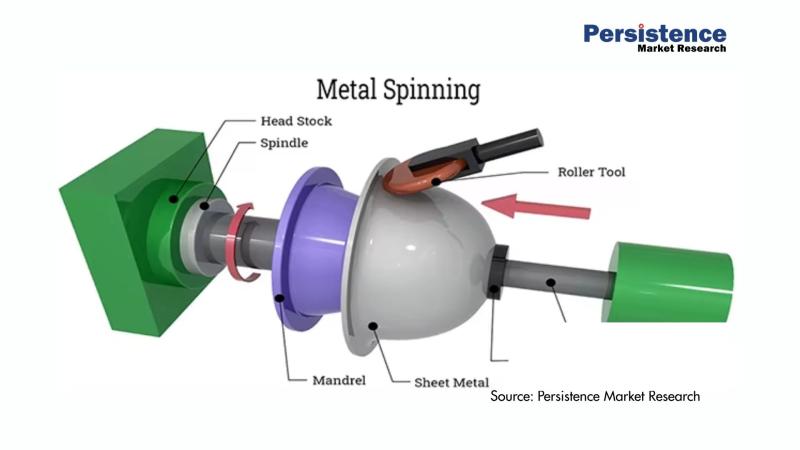

Metal Spinning Products Market Projected to Grow to US$ 4.0 billion by 2033 - Pe …

The global metal spinning products market is poised for substantial growth in the coming years. According to a recent study by Persistence Market Research, the market size is anticipated to reach US$ 4.0 billion by 2033, growing at a robust compound annual growth rate (CAGR) of 4.2% from its current valuation of US$ 3.0 billion in 2026. Metal spinning, a process of shaping metal into precise and symmetrical shapes, is…

More Releases for Cloud

Government Service Cloud Market SWOT Analysis by Leading Key Players: Google Clo …

HTF MI just released the Global Government Service Cloud Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Government Service Cloud Market are:

Amazon Web…

Cloud Model Hosting Platform Market Size, Status, Global Outlook 2025 To 2033 | …

New Jersey, United States: The latest research study by Infinity Business Insights, titled 'Global Cloud Model Hosting Platform Market,' 118 analysis on business strategies adopted by key and emerging industry players. It provides insights into current market developments, trends, technologies, drivers, opportunities, and overall market outlook. Understanding various segments is crucial for identifying the factors that drive market growth. Some of the major companies featured in this report include Amazon Web…

AI Supercomputing Cloud Market to Witness Huge Growth by 2029 | AWS, Oracle, Mic …

The AI Supercomputing Cloud Market a detailed study added to provide most recent insights about critical reports of the Global AI Supercomputing Cloud market. This report provides a detailed overview of key factors in the AI Supercomputing Cloud Market and factors such as driver, limitation, past and current trends, guiding scenarios, and technology development. In addition, AI Supercomputing Cloud Market attractiveness according to country, end-user, and other measures is also…

Open Cloud Services Market Size in 2023 To 2029 | Google Cloud - T-Systems - IBM …

The Open Cloud Services market report includes market-driving factors, major obstacles, and restraining factors impeding market growth. The report assists existing manufacturers and start-ups in developing strategies to combat challenges and capitalize on lucrative opportunities to gain a foothold in the global market. Moreover, the report provides thorough information about prime end-users and annual forecast during an estimated period.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 + 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐓𝐎𝐂 ➡️ https://www.reportsnreports.com/contacts/requestsample.aspx?name=6778415

𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐩𝐫𝐨𝐟𝐢𝐥𝐞𝐝…

Mini Program Development Services Market Size in 2023 To 2029 | Tencent Cloud, A …

The Mini Program Development Services market report provides valuable insights for new entrants and stakeholders, offering a comprehensive understanding of market dynamics. It analyzes the competitive landscape and future market scenarios using tools like Porter's five forces and parent/peer market analysis. The report evaluates the product portfolios and services of key market players in detail. It also examines the impact of government regulations during the Covid-19 pandemic and provides market…

Customized Cloud Service Market May See a Big Move | IBM Cloud, Oracle Cloud, Al …

Global Customized Cloud Service Market Growth (Status and Outlook) 2023-2029 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Customized Cloud Service Market. Some of the key players profiled in the study are Google…