Press release

Digital Payment Market Challenges Include Lack of Cross-Border Standards and Diverse Regulatory Requirements in Emerging Economies

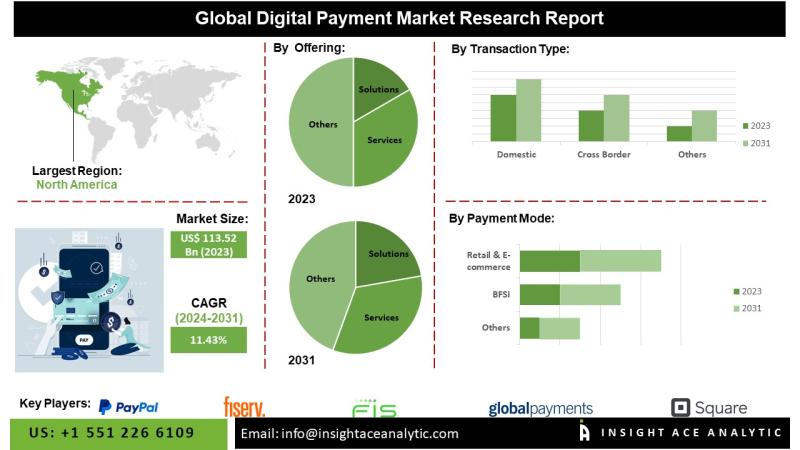

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Digital Payment Market- (By Offering (Solutions (Payment Gateway, Payment Processors, Payment Wallet, Point of Sale, and Other Solutions), Services (professional services (Consulting, Implementation, Support & Maintenance), Managed Services), By Transaction Type (Domestic and Cross Border), Payment Mode (Cards, Digital Wallet, ACH Transfer), By Vertical (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, IT & ITeS, Telecom, Transportation & Logistics, Media & Entertainment, Other Verticals)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Global Digital Payment Market is valued at US$ USD 124.8 Billion in 2024, and it is expected to reach USD 357.7 Billion by the year 2034, with a CAGR of 11.2% during a forecast period of 2023-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2168

Digital payments refer to the electronic transfer of funds or the exchange of monetary value conducted by individuals, businesses, or organizations. These transactions encompass a wide range of methods, including online payments, mobile payments, contactless payments, and digital wallets. Facilitated through digital platforms, such payments leverage technologies such as internet connectivity, mobile devices, and secure payment gateways to ensure seamless and secure financial transactions. In recent years, the digital payments landscape has undergone significant growth and transformation, fundamentally altering how consumers and enterprises engage in financial exchanges.

The digital payments market is characterized by intense competition, with a diverse mix of participants including traditional financial institutions, technology conglomerates, and fintech startups. Market evolution is largely driven by the rapid expansion of e-commerce and increasing adoption of technology-driven initiatives. Prominent players such as Samsung Pay, Google Pay, Alipay, and Apple Pay have established dominant positions within the global digital payments ecosystem. These companies have made substantial investments in innovation and technological advancement to expand their digital payment offerings. For instance, Alibaba Group developed Alipay to streamline financial transactions between merchants and consumers, thereby enhancing operational efficiency and customer engagement.

List of Prominent Players in the Digital Payment Market:

• PayPal (US)

• Fiserv (US)

• FIS (US)

• Global Payments (US)

• Square (US)

• Stripe (US)

• VISA (US)

• Mastercard (US)

• Worldline (France)

• Adyen (Netherlands)

• ACI Worldwide (US)

• Temenos (Switzerland)

• PayU (Netherlands)

• Apple (US)

• JPMorgan Chase (US)

• WEX (US)

• FLEETCOR (US)

• Aurus (US)

• PayTrace (US)

• Stax by FattMerchant (US)

• Verifone(US)

• Spreedly (US)

• Dwolla (US)

• BharatPe (India)

• Payset (UK)

• PaySend (UK)

• MatchMove (Singapore)

• Ripple (US)

• EBANX (Brazil)

• Others

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Market Dynamics:

Drivers:

Consumers are increasingly embracing non-cash payment solutions that offer a more efficient and convenient method for transferring funds between bank accounts. This trend is expected to accelerate, with the growing use of cost-effective terminals and asset-light alternatives such as QR codes. Millennials, in particular, are driving the rapid adoption of digital payment systems. Additionally, the demand for enhanced user experiences is playing a crucial role in fostering business growth. As payment services evolve, the ability to deliver superior customer experiences has become a competitive differentiator. Providers are leveraging these services to strengthen engagement with their customer base, marking a significant development in the digital payment landscape.

Challenges:

The digital payment market faces several challenges that may hinder its growth. The lack of standardized global cross-border payment systems and the limited expertise in emerging economies are notable obstacles. As global trade continues to expand, businesses are increasingly sourcing goods and services internationally. However, the absence of universally adopted payment standards, coupled with disparate government regulations across countries, complicates the efficiency of cross-border payments. These regulatory differences, along with varying data storage and payment rules, create inefficiencies in the system. Furthermore, domestic payment infrastructures are often not designed to accommodate international transactions, leading to significant challenges in achieving streamlined global payments.

Regional Trends:

The Asia Pacific (APAC) region is expected to capture a significant share of the global digital payment market in terms of revenue and is projected to experience a robust compound annual growth rate (CAGR) in the coming years. Mobile payments and digital wallets are anticipated to be particularly popular in this region, fueled by the large populations of India and China and the high penetration of smartphones, which present substantial opportunities for growth in the digital payments sector. In parallel, North America remains a major player in the global digital payment market. The region benefits from advanced technological infrastructure, high internet penetration rates, and a large, tech-savvy consumer base, all of which contribute to the ongoing expansion of digital payment adoption among businesses and consumers.

Recent Developments:

• In Sept 2023, Temenos contributed cutting-edge payment functionalities to IBM Cloud, thereby facilitating the transformation of financial institutions with an emphasis on security and adherence to regulations. Availability was extended to the Temenos Payments Hub on IBM Cloud for Financial Services throughout IBM's hybrid cloud infrastructure, powered by LinuxONE and Red Hat OpenShift with IBM Power.

• In Aug 2023, PayPal Holdings Inc introduced stablecoin, making it the first major financial company. This action has the potential to greatly enhance the sluggish acceptance of digital tokens for transactions.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2168

Segmentation of Digital Payment Market-

By Offering-

• Solutions

o Payment Gateway Solutions

o Payment Processor Solutions

o Payment Wallet Solutions

o Point of Sale (POS) Solutions

o Others

• Services

o Professional Services

Consulting

Implementation

Support & Maintenance

o Managed Services

By Transaction Type-

• Domestic

• Cross Border

By Payment Mode-

• Cards

• ACH Transfer

• Digital Wallet

• Others

By Vertical-

• BFSI

• Retail & E-Commerce

• IT & ITeS

• Telecom

• Healthcare

• Travel & Hospitality

• Transportation & Logistics

• Media & Entertainment

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market Challenges Include Lack of Cross-Border Standards and Diverse Regulatory Requirements in Emerging Economies here

News-ID: 3962504 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

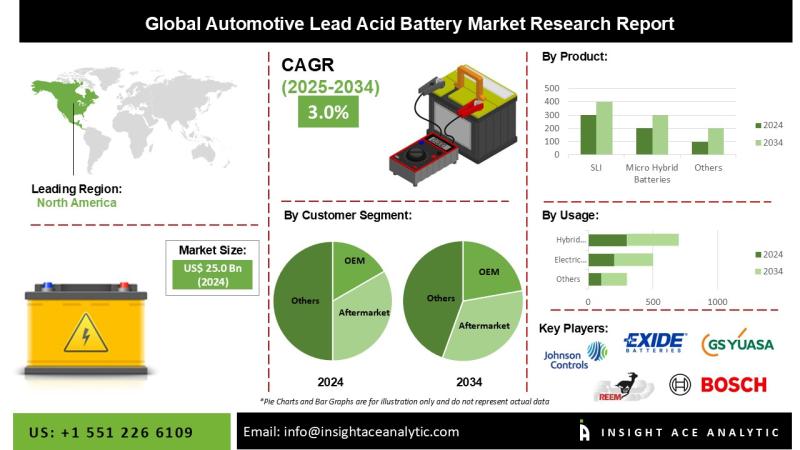

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

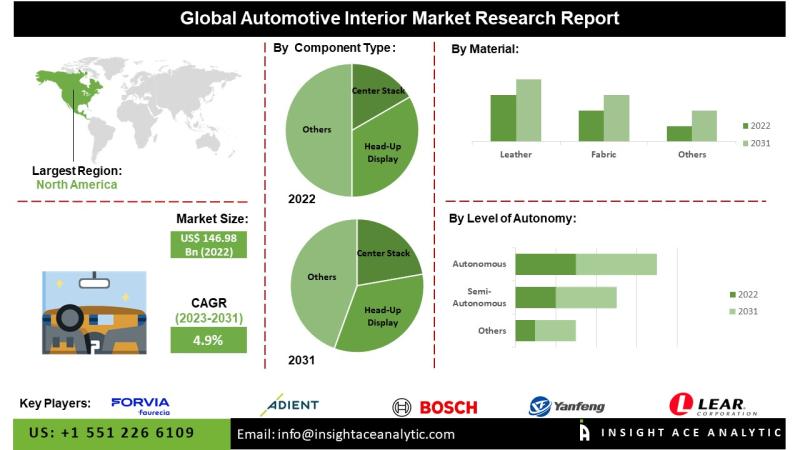

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

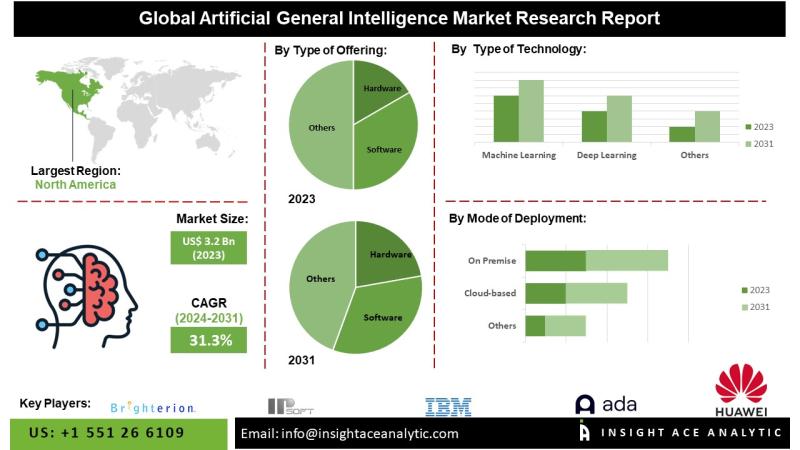

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

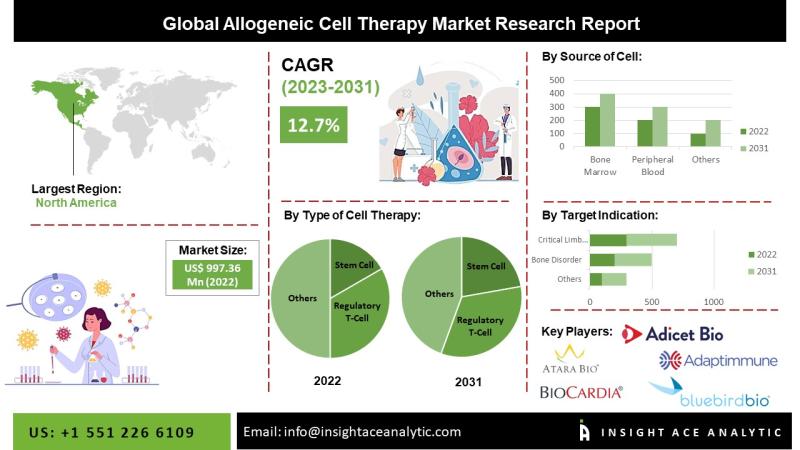

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…