Press release

Venture Capital Investment Market Size, Share, Growth And Forecast 2025-2033

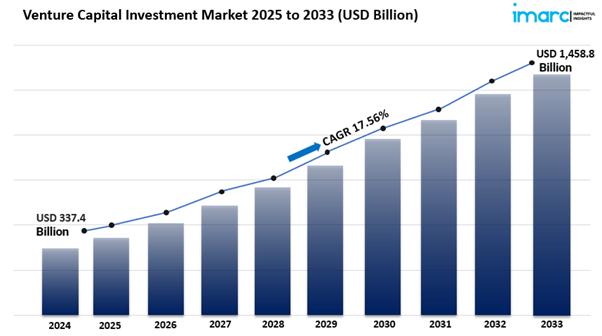

IMARC Group, a leading market research company, has recently released a report titled "Venture Capital Investment Market Report by Sector (Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, and Others), Fund Size (Under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, Above $1 B), Funding Type (First-Time Venture Funding, Follow-on Venture Funding), and Region 2025-2033". The study provides a detailed analysis of the industry, including the global venture capital investment market trends, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.The global venture capital investment market size reached USD 337.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,458.8 Billion by 2033, exhibiting a growth rate (CAGR) of 17.56% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/venture-capital-investment-market/requestsample

The Impact of 5G on the Venture Capital Investment Market

The rollout of 5G technology is set to revolutionize various sectors, creating unprecedented opportunities for venture capital investment. As the fifth generation of wireless technology promises faster speeds, lower latency, and greater connectivity, it is expected to drive innovation across industries such as healthcare, transportation, and entertainment. By 2025, the demand for startups that leverage 5G capabilities will surge, as businesses seek to enhance their operations and customer experiences. Venture capitalists are likely to focus on companies developing applications that utilize 5G for real-time data processing, smart city infrastructure, and IoT solutions. This influx of investment will not only accelerate the growth of these startups but also foster a competitive environment where technological advancements can thrive.

Additionally, the integration of 5G will enable new business models, such as remote healthcare services and autonomous vehicles, further attracting venture capital interest. As the market adapts to these changes, the venture capital landscape will be significantly influenced by the innovations stemming from 5G technology, shaping the future of investment strategies and opportunities.

Market Dynamics of Venture Capital Investment Market

Evolving Investment Strategies

The venture capital investment landscape is undergoing significant transformation, driven by the need for adaptability and innovation. As emerging technologies continue to disrupt traditional industries, investors are increasingly adopting a diversified approach to their portfolios. This shift is characterized by a focus on sectors such as artificial intelligence, biotechnology, and renewable energy. By 2025, venture capitalists are expected to prioritize investments in startups that demonstrate not only technological advancement but also sustainability and social impact. This evolving strategy reflects a growing recognition of the importance of environmental, social, and governance (ESG) criteria in investment decisions.

Furthermore, the rise of hybrid investment models, combining equity and debt financing, is gaining traction as firms seek to mitigate risks while maximizing returns. As competition intensifies, VC firms will need to leverage data analytics and market intelligence to identify high-potential opportunities, ensuring they remain at the forefront of innovation.

Increased Globalization of Venture Capital

The venture capital market is becoming increasingly globalized, with investors seeking opportunities beyond their domestic borders. By 2025, this trend is expected to accelerate, as startups in emerging markets gain prominence and attract significant funding. Investors are recognizing the potential for high returns in regions such as Southeast Asia, Africa, and Latin America, where entrepreneurial ecosystems are rapidly developing. This globalization of venture capital not only diversifies risk but also enhances the potential for discovering groundbreaking innovations that may not yet be present in more mature markets.

Additionally, cross-border collaborations between venture capital firms and local investors are likely to become more common, fostering knowledge exchange and resource sharing. As a result, the venture capital landscape will be characterized by a more interconnected and collaborative approach, creating a rich tapestry of investment opportunities that span across continents.

The Role of Technology in Investment Processes

Technology is playing a pivotal role in reshaping the venture capital investment process, enhancing efficiency and decision-making. By 2025, we can expect to see significant advancements in the use of artificial intelligence and machine learning to analyze market trends, assess startup viability, and predict potential returns. These technologies will enable venture capitalists to make more informed investment decisions, reducing the reliance on traditional methods of due diligence.

Moreover, the rise of blockchain technology is anticipated to streamline transactions and improve transparency in investment dealings. This technological integration not only accelerates the investment process but also fosters a more data-driven approach to venture capital, allowing firms to identify high-potential startups with greater accuracy. As technology continues to evolve, it will redefine the competitive landscape of venture capital, compelling firms to innovate continuously or risk obsolescence.

Buy Now: https://www.imarcgroup.com/checkout?id=2336&method=1670

Venture Capital Investment Market Report Segmentation:

By Sector:

· Software

· Pharma and Biotech

· Media and Entertainment

· Medical Devices and Equipment

· Medical Services and Systems

· IT Hardware

· IT Services and Telecommunication

· Consumer Goods and Recreation

· Energy

· Others

Software emerged as the largest segment, driven by the growing adoption of digital technologies and the rising need for innovative software solutions across various industries.

By Fund Size:

· Under $50 M

· $50 M to $100 M

· $100 M to $250 M

· $250 M to $500 M

· $500 M to $1 B

· Above $1 B

Funds with a size ranging from $500 million to $1 billion held the largest market share, as they offer significant capital required to scale operations and drive growth in more mature startups.

By Funding Type:

· First-Time Venture Funding

· Follow-on Venture Funding

Follow-on venture funding accounted for the largest segment, as it provides ongoing financial support to help promising startups scale their operations, advance to later stages of growth, and successfully enter the market.

Regional Insights:

· North America

· Asia Pacific

· Europe

· Others

North America leads the venture capital investment market thanks to its strong venture capital ecosystem, advanced infrastructure, and large presence of fast-growing technology companies.

Competitive Landscape With Key Players:

The report takes a close look at the competitive landscape of the venture capital investment market, offering detailed profiles of the leading players driving the industry.

Some of These Key Players Include:

· Accel

· Andreessen Horowitz

· Benchmark

· Bessemer Venture Partners

· First Round Capital LLC

· Founders Fund LLC

· Ggv Management L.L.C.

· Index Ventures

· Sequoia Capital Operations LLC

· Union Square Ventures LLC

Speak to An Analyst:

https://www.imarcgroup.com/request?type=report&id=2336&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

USA: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Venture Capital Investment Market Size, Share, Growth And Forecast 2025-2033 here

News-ID: 3962164 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Venture

Venture Solar Rebrands As Venture Home, Expanding Mission To Be Customers' Lifel …

After 11 years and 15,000+ solar installations, company evolves to meet growing demand for comprehensive home energy solutions

Venture Solar, a leading solar installation company serving the Northeast and Mid-Atlantic, today announced it is rebranding as Venture Home, reflecting the company's evolution from a solar-focused installer to a comprehensive home electrification partner.

The rebrand comes as the company enters its 11th year in business and marks a strategic shift to address the…

1752VC Launches 14th Venture Fellow & Emerging Angel Cohort, Training the Next G …

1752VC has launched the 14th cohort of its Venture Fellow and Emerging Angel program, an eight-week, hands-on experience designed to help aspiring investors, founders, and professionals gain real-world venture capital skills and access early-stage deal flow.

Santa Monica, CA - November 4, 2025 - 1752VC [http://www.1752.vc] announced the launch of its 14th Venture Fellow cohort, further expanding its nationwide network of more than 250 Fellows-a dynamic community of founders, operators, and…

Announcing G2C Venture Partners

Over a decade of Collaboration Transforms into a Venture Vision

We are thrilled to announce what we have been building behind the scenes - G2C Venture Partners is officially launching today!

As three founders-turned-investors - Sunil Grover, Amar Chokhawala, and Vik Ghai - we are bringing our combined decades of experience and co-investment partnerships to a new kind of venture fund.

We are combining our battle-tested experience, relationship networks, and investment…

Gary Fowler's GSD Venture Studios Redefines Venture Building Through Direct Lead …

GSD Venture Studios is an operational family office that created a 360-degree entrepreneurial ecosystem, taking a laser-precise approach to venture building from early stage to Series C companies.

Image: https://www.getnews.info/uploads/d9f450b06da75bff3aa844e08748b0ef.png

While many startups scrounge for capital, resources, and ideas wherever they can, those poised for success turn to Gary Fowler's GSD Venture Studios [https://www.gsdvs.com/]. With a proven track record of success, a forward-thinking actionable approach, a network of avenues connecting capital…

CleanTech Venture Capital Interest

Keynote speaker to share the vision for CleanTech and Venture Capital Funding at EngEx 2010

SAN DIEGO – CleanTech start-ups are grabbing increased interest and investments from venture capital groups that placed almost $2 billion into eco-friendly companies last year and increased the funding pace with another $773 million during the first quarter of 2010. Clean energy business owners and industry professionals attending EngEx 2010 will hear more about the…

Sep. 5th Venture Capital Event

(EMAILWIRE.COM, July 31, 2007)- New York - Argyle Executive Forum is pleased to present its 2007 Leadership in Venture Capital Forum. The event, to take place in Manhattan, will bring together 135–150 CEOs & Board members of public and private large cap and mid cap corporations, complementary areas of executive leadership (CFOs & COOs), members of the endowment, foundation, and family office community, select advisory firms, and select founders /…