Press release

Energy Trading and Risk Management (ETRM) Market to Reach USD 2.50 Bn by 2030, Driven by Digitalization and Risk Optimization

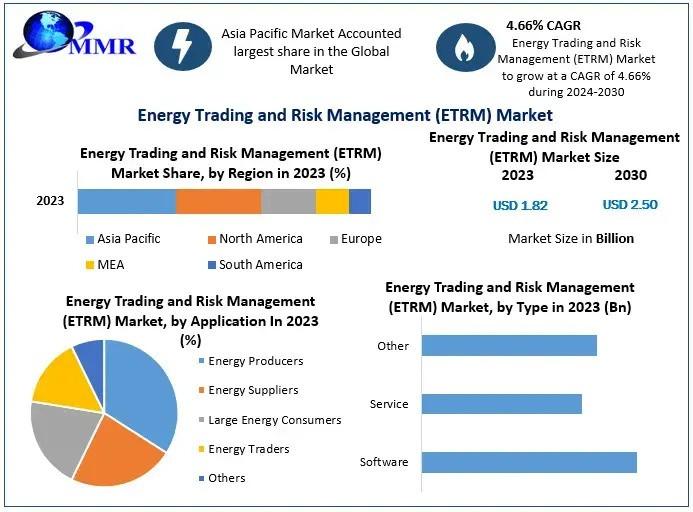

Energy Trading and Risk Management (ETRM) Market size is expected to reach USD 2.50 Bn by 2030, growing at a CAGR of 4.66 % during the forecast period.Energy Trading and Risk Management (ETRM) Market Overview:

The Energy Trading and Risk Management (ETRM) market is experiencing significant growth due to the increasing complexity of energy markets, regulatory changes, and the rising adoption of digital trading platforms. Companies across the energy sector are leveraging advanced ETRM solutions to optimize trading operations, enhance risk assessment capabilities, and ensure compliance with evolving market regulations. The demand for real-time analytics, automation, and cloud-based platforms is further driving the expansion of the ETRM market.

Download a Free Sample Report Today : https://www.maximizemarketresearch.com/request-sample/70529/

Energy Trading and Risk Management (ETRM) Market Outlook and Future Trends :

The future of the ETRM market is expected to be shaped by advancements in artificial intelligence, blockchain technology, and predictive analytics. As energy companies strive for greater efficiency, the adoption of AI-driven risk management tools and blockchain-enabled smart contracts is becoming more prevalent. Additionally, the shift towards renewable energy sources and decentralized trading models is pushing organizations to upgrade their risk management strategies and integrate more sophisticated ETRM solutions.

Energy Trading and Risk Management (ETRM) Market Key Recent Developments:

The ETRM market has witnessed several key developments, including strategic partnerships, mergers, and acquisitions among leading technology providers and energy firms. Companies are increasingly investing in AI-powered predictive analytics to enhance decision-making capabilities. Additionally, cloud-based ETRM solutions are gaining traction due to their scalability and cost-efficiency. Regulatory changes in energy markets across North America, Europe, and Asia-Pacific are also influencing the adoption of advanced ETRM software, ensuring greater transparency and risk mitigation for energy traders.

Energy Trading and Risk Management (ETRM) Market Segmentation:

by Application

Energy Producers

Energy Suppliers

Large Energy Consumers

Energy Traders

Others

by Operation

Front Office

Back Office

Middle Office

by Type

Software

Service

Other

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report : https://www.maximizemarketresearch.com/request-sample/70529/

Some of the current players in the Energy Trading and Risk Management (ETRM) Market are:

1. Allegro Development Corporation

2. Amphora Inc.

3. Triple Point Technology Inc.

4. Openlink LLC.

5. Eka Software Solutions

6. SAP

8. Sapient

9. Ventyx

10. Trayport

11. Calvus

12. FIS

13. Others

For additional reports on related topics, visit our website:

♦ Disposable Batteries Market https://www.maximizemarketresearch.com/market-report/disposable-batteries-market/66824/

♦ Fuel Injection Systems Market https://www.maximizemarketresearch.com/market-report/global-fuel-injection-systems-market/77631/

♦ Compressed Air Energy Storage Market https://www.maximizemarketresearch.com/market-report/compressed-air-energy-storage-market/77551/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading and Risk Management (ETRM) Market to Reach USD 2.50 Bn by 2030, Driven by Digitalization and Risk Optimization here

News-ID: 3955491 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for ETRM

Intellimachs Offers Targeted ETRM Services and Training Solutions for Energy Mar …

Image: https://www.globalnewslines.com/uploads/2025/11/1762411878.jpg

Intellimachs is a technology services company that supports businesses across software development, along with artificial intelligence and enterprise systems. The company works with energy trading firms and risk management teams that need reliable systems to track trades and manage exposure. Intellimachs focuses on delivering solutions that reduce complexity and help teams make better decisions faster. The company has built its reputation by solving real problems for organizations that cannot…

Global CTRM-ETRM Software Market Size, Share and Forecast By Key Players-Openlin …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global CTRM-ETRM Software market is projected to grow at a robust compound annual growth rate (CAGR) of 12.05% from 2024 to 2031. Starting with a valuation of 10.56 Billion in 2024, the market is expected to reach approximately 20.9 Billion by 2031, driven by factors such as CTRM-ETRM Software and CTRM-ETRM Software. This significant growth underscores the expanding demand for…

Energy Trading and Risk Management (ETRM) Market Size

According to a new market research report published by Global Market Estimates, the Global Energy Trading and Risk Management (ETRM) Market is projected to grow at a CAGR of 6.5% from 2023 to 2028.

Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, SAP, Sapient, Ventyx and Trayport among others, are some of the key players in the global energy trading and risk management (ETRM) market.…

INPEX ENERGY TRADING SINGAPORE PTE. LTD. selects ENTRADE® for ETRM

Singapore (November 2020) — Enuit, LLC announced today that INPEX ENERGY TRADING SINGAPORE PTE. LTD. (IETS) has begun implementing its flagship product, ENTRADE® to manage their trading risk and derivatives for crude oil.

INPEX CORPORATION (INPEX), the ultimate parent company of IETS, is a leading energy company that proactively undertakes oil & gas exploration, development and production activities to contribute to a stable and efficient supply of energy. INPEX is currently…

Energy Trading and Risk Management (ETRM) Market Trends, Insights, Analysis, For …

"Energy Trading and Risk Management (ETRM) Market Scope

“Energy Trading and Risk Management (ETRM) Market is expected to see huge growth opportunities during the forecast period, i.e., 2020 – 2027”, Says Decisive Markets Insights.

The report covers market size and forecast, market share, market share of the key players in the global market, current growth trends and future trends, market segmentation, value chain analysis, market dynamics which includes market drivers, restraints and…

Energy Trading and Risk Management (ETRM) Market 2020 Real Time Analysis And For …

This report studies the Energy Trading and Risk Management (ETRM) Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Energy Trading and Risk Management (ETRM) Market analysis segmented by companies, region, type and applications in the report.

“The final report will add…