Press release

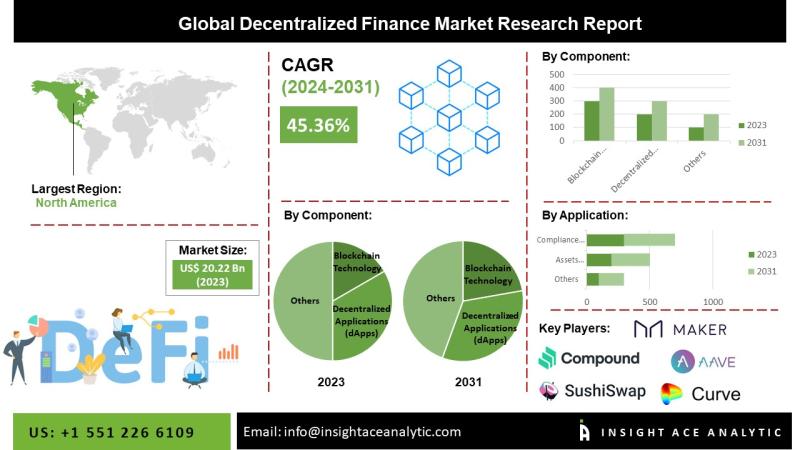

Decentralized Finance (DeFi) Market Top Players - Compound Labs, Inc.; Maker DAO; Agave; Unisa; Sushi Swap; Curve Finance.

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth USD 29.1 Billion in 2024 and is poised to reach USD 1250.7 Billion by the year 2034, growing at a 45.8% CAGR from 2025 to 2034 according to a new report by InsightAce Analytic.Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/1607

Latest Drivers Restraint and Opportunities Market Snapshot:

Key factors influencing the global Decentralized Finance (DeFi) Market are:

• Technological advancement

• Dominant financial organizations

• Popularity as blockchain genres

The following are the primary obstacles to the Decentralized Finance (DeFi) Market 's expansion:

• Risk to security

• Concerns regarding regulations

• Lack of awareness

Future expansion opportunities for the global Decentralized Finance (DeFi) Market include:

• Safety and openness

• International wire transfer

• Accelerating research and development efforts

Market Analysis:

The financial industry has undergone a significant transformation due to the widespread adoption of Decentralized Finance (DeFi), which has become a key driver of market growth. The integration of DeFi with decentralized blockchain technologies has gained substantial traction in recent years. Looking ahead, the introduction of blockchain-based prediction solutions is expected to create new opportunities for further market expansion.

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

List of Prominent Players in the Decentralized Finance (DeFi) Market:

• Cognizant

• Compound Labs, Inc.

• MakerDAO

• Aave

• Uniswap

• SushiSwap

• Curve Finance

• Synthetix

• Balancer

• Bancor Network

• Badger DAO

Recent Developments:

• In January 2024, Marker DAO activated GHO, the native decentralized over-collateralized asset of the Aave Protocol, after approving and executing the proposal. Launched on the Ethereum Mainnet, GHO allows users to mint GHO on the Aave Protocol's Ethereum V3 market using collateral they have previously supplied.

• In November 2023, BadgerDAO concentrated on developing the eBTC protocol and completed it. Additional audits were conducted traditional audits were conducted to ensure eBTC was secure, and Badger Treasury continued producing positive returns in Q3. Still, the decline in DeFi yields has reduced the size of such returns.

• In October 2023, Bancor introduced decentralized finance (DeFi); the Arb Fast Lane was one of the most significant breakthroughs in the field. As the pioneering protocol of its kind, it facilitates arbitrage across many decentralized exchanges (DEXes) by offering a unique blend of accessibility and intricacy.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/1607

Decentralized Finance (DeFi) Market Dynamics:

Market Drivers: Growing Popularity of Blockchain Technologies

DeFi aims to enhance market efficiency and transparency by leveraging blockchain technology, which enables real-time access to financial data and transactions. This decentralized platform allows users to audit and verify transactions, offering greater transparency compared to traditional financial systems. It facilitates decentralized financial services, investment decisions, and asset management. Industries such as banking, financial services, retail, media, and automotive increasingly recognize DeFi as a key driver for improved performance, which is expected to significantly accelerate market growth during the forecast period.

Challenges: Regulatory Concerns

The rapid evolution of DeFi projects and the use of new, untested protocols can expose blockchain networks to potential vulnerabilities, including security gaps in smart contracts and code exploits. These weaknesses could lead to significant financial losses. Moreover, DeFi operates in a regulatory gray area in many regions, and the potential for stricter regulations could impede market expansion. Regulatory measures that limit specific activities, complicate market entry, or impose additional compliance requirements could slow the growth of decentralized finance technologies.

Regional Trends: North America to Lead with Highest Growth Rate

The North American Decentralized Finance (DeFi) Market is anticipated to capture a substantial revenue share and experience rapid growth over the coming years. This is driven by the region's swift adoption of new technologies and strong economic performance. North America is home to numerous DeFi platforms and blockchain-based businesses. Key developments in the region include the rise of decentralized autonomous organizations (DAOs), advancements in regulatory frameworks, tokenization of assets, and solutions addressing scalability challenges, all of which present promising opportunities for further expansion in decentralized finance.

Segmentation of Decentralized Finance (DeFi) Market-

By Product-

• Blockchain Technology

• Decentralized Applications (DAPPS)

• Smart Contracts

By Application-

• Assets Tokenization

• Compliance & Identity

• Marketplaces & Liquidity

• Payments

• Data & Analytics

• Decentralized Exchanges

• Prediction Industry

• Stable coins

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Decentralized Finance (DeFi) Market Top Players - Compound Labs, Inc.; Maker DAO; Agave; Unisa; Sushi Swap; Curve Finance. here

News-ID: 3953681 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

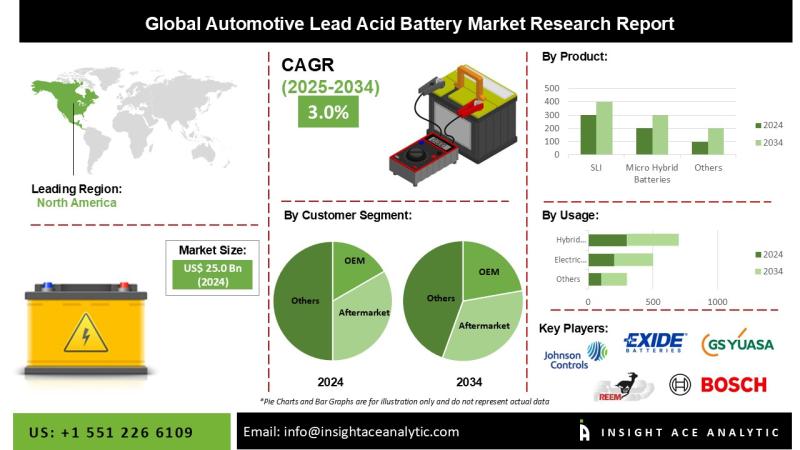

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

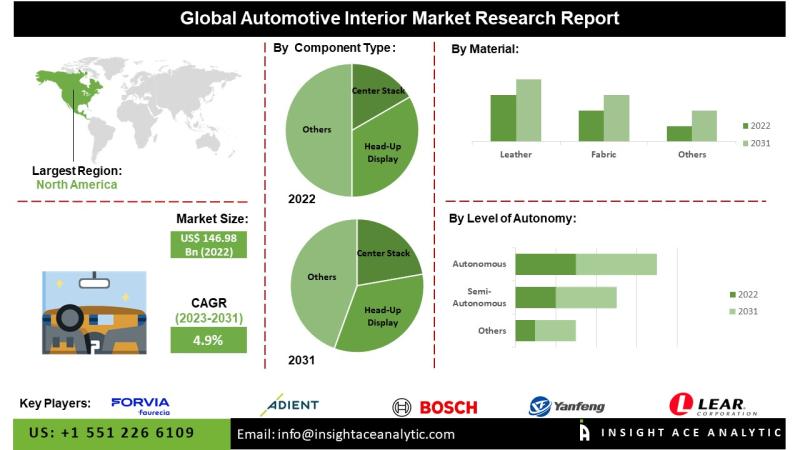

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

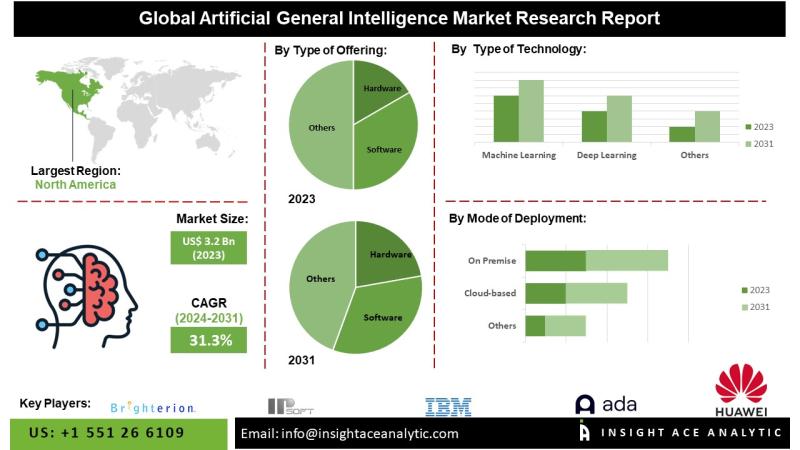

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

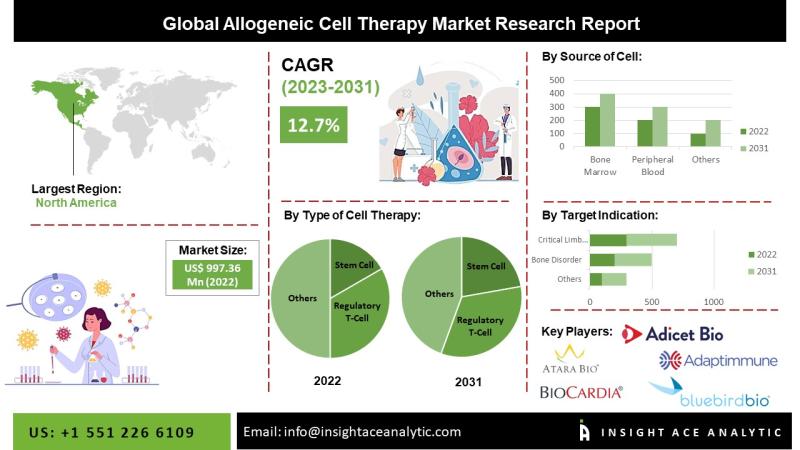

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for DeFi

IO DeFi User Base Surpasses 3 Million as Structured DeFi Participation Gains Glo …

IO DeFi has reached a significant milestone as its global user base surpasses 3 million accounts, reflecting growing interest in structured and simplified participation within the decentralized finance sector.

The expansion highlights a broader shift in how users engage with DeFi. As the ecosystem matures, participants are increasingly prioritizing stability, clarity, and reduced operational complexity over constant manual involvement.

A Milestone Reflecting Changing User Preferences

User growth in decentralized finance is no longer…

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Building Defi Staking Platform with PerfectionGeeks Technologies

With each investment-related research you undertake, whether in mutual funds, stocks or gold, you will likely find legal advice to make money by investing correctly.

Today, with one out of 10 investors investing their money into cryptocurrency, the old saying about holding assets over the long term extends to crypto-related investors. Many ways to look at it, more so considering the volatility of crypto that is frequently traded and bought, which…

DeFi (Decentralized Finance) Tool Market Still Has Room to Grow | MetaMask, Dapp …

The latest research study released by Stratagem Market Insights on the "DeFi (Decentralized Finance) Tool Market" with 100+ pages of analysis on business strategy taken up by emerging industry players, geographical scope, market segments, product landscape and price, and cost structure. It also assists in market segmentation according to the industry's latest and upcoming trends to the bottom-most level, topographical markets, and key advancement from both market and technology-aligned perspectives.…

Banking the Banked: Why Defi

“Bank the unbanked! Banking for the people! Upend the dominant paradigm!” Decentralized finance, or DeFi, is touted as the next big revolution in the world of banking and markets, just like Bitcoin was supposed to be the next big revolution in the world of currency. Oh, wait, one Bitcoin is currently worth over USD 10k, so maybe it isn’t going to replace the dollar, but it’s certainly been a revolution.…