Press release

Burial Insurance Market Expected to Hit USD 449.4 Billion by 2032 - Persistence Market Research

Overview of the Burial Insurance MarketThe global burial insurance market size is projected to rise from US$ 312 million in 2025 to US$ 449.4 million by 2032, growing at a compound annual growth rate (CAGR) of 5.4% from 2025 to 2032. This growth is primarily driven by the aging population, rising funeral expenses, and an increasing need for financial security in the face of unforeseen death-related costs. The market encompasses various regions and offers diverse policies tailored to different needs, helping individuals and families cope with the financial burden associated with funerals and related expenses.

North America is expected to dominate the global burial insurance market, with a market share of 37.4% in 2025. This dominance can be attributed to the high awareness of financial planning for funeral expenses and the widespread adoption of burial insurance policies. In particular, the United States stands as a key player in the burial insurance sector, where nearly 60% of individuals over the age of 50 are considering burial insurance to alleviate the financial pressures associated with end-of-life costs. The modified death benefits segment is also anticipated to hold the largest share in the global market, driven by its flexibility in premium adjustments and comprehensive coverage.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/35169

Key Highlights from the Report

• The global burial insurance market is expected to grow at a CAGR of 5.4% from 2025 to 2032.

• The modified death benefits segment is predicted to dominate the market in 2025, holding 44.7% of the share.

• The over 70 age group is projected to capture 34.6% of the market share in 2025.

• North America is expected to dominate the global burial insurance market with a 37.4% share in 2025.

• Insurance brokers are projected to represent 48.7% of the global market share in 2025.

• The demand for burial insurance is expected to rise due to the increasing cost of funerals and related expenses.

Market Segmentation

Product Type

The burial insurance market is segmented based on the type of insurance coverage, with key categories including level death benefits, guaranteed acceptance, and modified or graded death benefits. Among these, the modified death benefits segment is projected to account for the largest share of the market in 2025. These plans are appealing due to their flexibility, offering premium adjustments after 5 to 10 years. Unlike level death benefit policies, which maintain fixed premiums, modified plans provide partial coverage in the first few years before reaching full benefits. This structure attracts policyholders seeking flexibility in their insurance policies.

Guaranteed acceptance policies are gaining popularity, particularly among individuals with pre-existing health conditions. These plans provide coverage without requiring medical exams, making them an attractive choice for seniors who may otherwise face difficulties obtaining insurance due to health concerns. Level death benefit policies, which offer fixed coverage from the start and require lower premiums, also see growing demand as they offer immediate financial security.

End-User Insights

The market is also segmented based on the age demographics of the policyholders. The over 70 age group is expected to hold a significant portion of the global market share, driven by the high prevalence of chronic illnesses, including cardiovascular diseases and cancer, among this demographic. Seniors in this age group are more likely to seek comprehensive burial insurance policies to ensure that funeral costs are covered without putting additional financial strain on their families.

Another important segment is the over 50 age group, as many individuals begin planning their funeral expenses in their later years. Insurers offer simplified issue policies with lower premiums and health-based underwriting to cater to this group. The over 60 demographic is particularly inclined to purchase guaranteed acceptance burial insurance due to increased medical conditions and health concerns.

Regional Insights

North America

North America is poised to hold a dominant position in the global burial insurance market, accounting for 37.4% of the market share in 2025. This dominance is attributed to the high level of awareness regarding the financial burden of funerals and the widespread adoption of pre-need funeral plans in the region. The U.S. funeral costs, averaging between US$ 7,000 to US$ 12,000, make burial insurance a necessary financial planning tool for many households. Companies like Mutual of Omaha and Colonial Penn offer flexible burial insurance policies tailored to the needs of seniors, further bolstering market growth.

Digital platforms and insurtech companies have also contributed to the market expansion in North America by making policies more accessible. Over 15,000 funeral homes across the region offer pre-need insurance plans, which have significantly increased burial insurance adoption in the area.

Europe

In Europe, burial insurance is gaining traction, especially with the rise of group funeral insurance plans. These plans, which offer cost-effective coverage for funeral-related expenses, have seen widespread adoption in countries like Germany, France, and the U.K. Funeral costs in these countries range from €3,500 to €6,500, making group policies a popular choice for families looking to ease the financial burden of funerals. Companies like AXA, Allianz, and Aviva lead the market with affordable group policies tailored to businesses, unions, and senior citizen organizations. Spain and the Netherlands stand out for their high adoption rates of pre-planned funeral insurance, offering a model for other European nations to follow.

Market Drivers

The main drivers behind the growth of the burial insurance market include the rising funeral costs, particularly in developed regions like North America and Europe, and the increasing awareness of the financial burden that funeral expenses impose on families. In the U.S., for example, the average funeral cost in 2021 was US$ 7,848, and this is expected to rise in the coming years. This has led many seniors to seek burial insurance plans to avoid leaving their families with financial difficulties.

Insurance companies are also promoting burial insurance policies to raise awareness and provide financial relief to families. Leading firms like Mutual of Omaha and AARP offer burial insurance plans with no medical exam required, making coverage more accessible to seniors. The promotion of prepaid funeral plans by funeral homes further contributes to the market's growth.

Market Restraints

Despite its growth, the burial insurance market faces some challenges. One of the primary restraints is the prevalence of deceptive marketing tactics targeting elderly individuals. Misleading advertisements, such as "pennies a day" plans, often result in seniors purchasing inadequate coverage. Some insurers, like Colonial Penn, offer policies with much lower coverage than anticipated, leaving consumers vulnerable to financial shortfalls.

Market Opportunities

The growing adoption of digital platforms presents a significant opportunity for market players to expand their reach. Online insurance platforms offer instant quotations, flexible coverage options, and simplified application processes, making it easier for consumers to compare and purchase burial insurance policies. Companies like Colonial Penn and Mutual of Omaha have embraced digital marketing to enhance accessibility and raise consumer awareness.

Furthermore, the expansion of burial insurance products in underserved regions, such as Asia-Pacific and parts of Africa, offers an opportunity for market players to diversify their offerings and cater to emerging markets. Insurtech firms, such as Ethos and Bestow, are leading the charge in providing online burial insurance solutions, making them an attractive option for tech-savvy consumers seeking instant coverage.

Reasons to Buy the Report

✔ Gain a comprehensive understanding of the global burial insurance market dynamics.

✔ Identify the key drivers, restraints, and opportunities influencing market growth.

✔ Access detailed insights into market segmentation and regional trends.

✔ Understand the competitive landscape and leading players in the industry.

✔ Benefit from actionable strategies for businesses looking to enter or expand in the burial insurance market.

Frequently Asked Questions

1. How Big is the Global Burial Insurance Market?

2. Who are the Key Players in the Global Burial Insurance Market?

3. What is the Projected Growth Rate of the Burial Insurance Market?

4. What is the Market Forecast for the Burial Insurance Market by 2032?

5. Which Region is Estimated to Dominate the Burial Insurance Market through the Forecast Period?

Company Insights

Key players in the global burial insurance market include:

1. Baltimore Life Insurance Company

2. United Home Life Insurance Company

3. Allianz Life

4. State Farm Mutual Automobile Insurance Company

5. New York Life Insurance

6. Gerber Life Insurance Company

7. AAA Life Insurance Company

8. Sagicor Life Insurance Company

9. Globe Life and Accident Insurance Company

10. Assurity Life Insurance Company

Recent Developments

• December 2024: The National Guardian Life Insurance Company launched a dedicated funeral home support phone line.

• October 2024: Sanlam Life Insurance Uganda introduced the Sanlam Comprehensive Life Program, offering various benefits for families aged 18 to 65.

Conclusion

The burial insurance market presents significant opportunities for growth, driven by an aging population, rising funeral expenses, and increasing consumer awareness. With key players offering flexible policies and innovative digital platforms, the market is poised to continue expanding globally. As the demand for financial security grows, particularly in North America, Europe, and Asia-Pacific, the burial insurance industry will play a pivotal role in ensuring peace of mind for families during one of the most difficult times.

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Burial Insurance Market Expected to Hit USD 449.4 Billion by 2032 - Persistence Market Research here

News-ID: 3949040 • Views: …

More Releases from Persistence Market Research

Cryogenic Storage Tanks Market Predicted to Hit US$ 12.8 Billion by 2033 Driven …

According to the latest study by Persistence Market Research, the global cryogenic storage tanks market is likely to be valued at US$ 8.6 billion in 2026 and is projected to reach US$ 12.8 billion by 2033, expanding at a CAGR of 5.8% during the forecast period 2026-2033. Rising demand for liquefied gases across energy, healthcare, food processing, and industrial manufacturing sectors is emerging as a key driver shaping the market's…

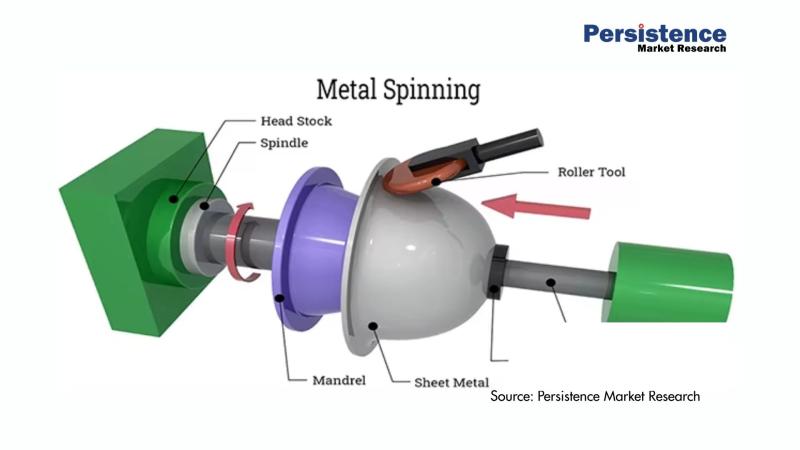

Metal Spinning Products Market Projected to Grow to US$ 4.0 billion by 2033 - Pe …

The global metal spinning products market is poised for substantial growth in the coming years. According to a recent study by Persistence Market Research, the market size is anticipated to reach US$ 4.0 billion by 2033, growing at a robust compound annual growth rate (CAGR) of 4.2% from its current valuation of US$ 3.0 billion in 2026. Metal spinning, a process of shaping metal into precise and symmetrical shapes, is…

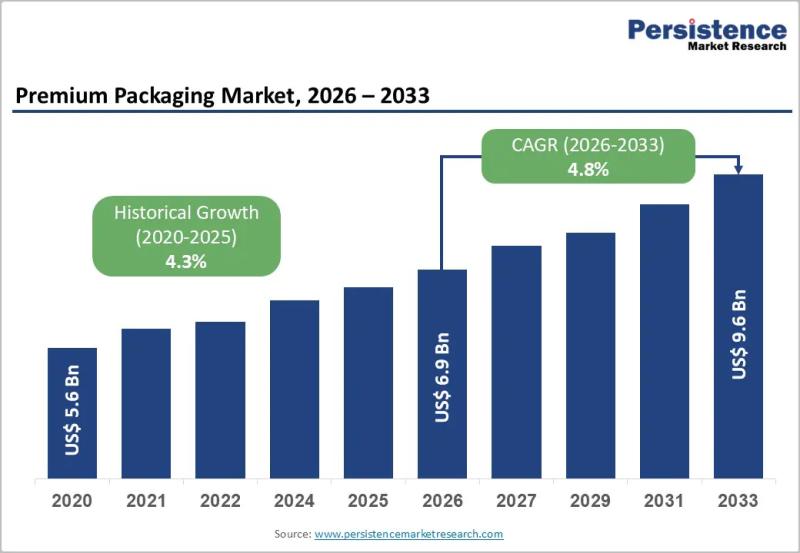

Premium Packaging Market Size Worth US$9.6 Billion by 2033 - Persistence Market …

The premium packaging market has evolved into a critical strategic element for brand differentiation across multiple high value consumer industries. Premium packaging goes beyond basic containment and protection to deliver enhanced aesthetics tactile appeal storytelling and emotional connection. Brands increasingly view packaging as an extension of their identity and a powerful marketing tool that influences purchasing decisions at the point of sale and during the unboxing experience. This shift is…

Power MOSFET Market Growth Driven by EVs Renewable Energy and Smart Automation

The global Power MOSFET market is entering a phase of sustained expansion, driven by the accelerating need for energy-efficient and high-performance power management components across industries. In 2026, the market is expected to be valued at US$ 9.45 billion and is forecast to reach US$ 14.9 billion by 2033, registering a healthy CAGR of 6.7% during the forecast period. Power MOSFETs are essential semiconductor devices that enable efficient switching and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…