Press release

Cyber (Liability) Insurance Market Statistical Forecast, Trade Analysis from 2024 - 2031 | American International Group (AIG), AXA Insurance Company, Travelers Companies Inc.

The Global Cyber (Liability) Insurance Market is expected to grow at a CAGR of 26.7% during the forecast period (2024-2031).Cyber (Liability) Insurance Market report, published by DataM Intelligence, provides in-depth insights and analysis on key market trends, growth opportunities, and emerging challenges. Committed to delivering actionable intelligence, DataM Intelligence empowers businesses to make informed decisions and stay ahead of the competition. Through a combination of qualitative and quantitative research methods, it offers comprehensive reports that help clients navigate complex market landscapes, drive strategic growth, and seize new opportunities in an ever-evolving global market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/cyber-insurance-market?rk

Cyber liability insurance protects businesses and individuals from financial losses due to cyberattacks, data breaches, and other digital threats. It covers costs related to data recovery, legal expenses, regulatory fines, and customer notification in case of a security breach. This type of insurance is crucial as cyber threats, including ransomware, phishing, and hacking, continue to rise. Businesses across various industries, especially those handling sensitive customer data, rely on cyber insurance for risk mitigation. With increasing digitalization, the demand for comprehensive cyber liability coverage is growing significantly.

List of the Key Players in the Cyber (Liability) Insurance Market:

American International Group (AIG), AXA Insurance Company, Travelers Companies Inc, AXIS Capital, Beazley Insurance Co., CNA Financial Corp., BCS Financial Corp., Liberty Mutual Insurance Company, XL Group.

For Direct Purchase: https://datamintelligence.com/buy-now-page?report=cyber-insurance-market?rk

Growth Forecast Projected:

The Global Cyber (Liability) Insurance Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the global Cyber (Liability) Insurance Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Make an Enquiry for purchasing this Report @ https://www.datamintelligence.com/enquiry/cyber-insurance-market?rk

Segment Covered in the Cyber (Liability) Insurance Market:

By First-party Cyber Insurance: Fraud and Theft, Forensic Work, Business Interruptions, Cover for Extortion and Blackmail, Loss of Data and Restorative Work.

Regional Analysis for Cyber (Liability) Insurance Market:

The regional analysis of the Cyber (Liability) Insurance Market covers key regions including North America, Europe, Asia Pacific Middle East and Africa and South America. The North America with a focus on the U.S., Canada, and Mexico; Europe, highlighting major countries like the U.K., Germany, France, and Italy, along with other nations in the region; Asia-Pacific, covering India, China, Japan, South Korea, and Australia, among others; South America, with emphasis on Colombia, Brazil, and Argentina; and the Middle East & Africa, which includes Saudi Arabia, the U.A.E., South Africa, and other countries. This comprehensive regional breakdown helps identify unique market trends and growth opportunities specific to each area.

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Top-down and bottom-up approach for regional analysis

➡ Porter's five forces model gives an in-depth analysis of buyers and suppliers, threats of new entrants & substitutes and competition amongst the key market players.

➡ By understanding the value chain analysis, the stakeholders can get a clear and detailed picture of this Market

Speak to Our Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/cyber-insurance-market?rk

People Also Ask:

➠ What is the global sales, production, consumption, import, and export value of the Cyber (Liability) Insurance market?

➠ Who are the leading manufacturers in the global Cyber (Liability) Insurance industry? What is their operational status in terms of capacity, production, sales, pricing, costs, gross margin, and revenue?

➠ What opportunities and challenges do vendors in the global Cyber (Liability) Insurance industry face?

➠ Which applications, end-users, or product types are expected to see growth? What is the market share for each type and application?

➠ What are the key factors and limitations affecting the growth of the Cyber (Liability) Insurance market?

➠ What are the various sales, marketing, and distribution channels in the global industry?

Browse More Reports: https://www.datamintelligence.com/research-report/cyber-insurance-market?rk

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber (Liability) Insurance Market Statistical Forecast, Trade Analysis from 2024 - 2031 | American International Group (AIG), AXA Insurance Company, Travelers Companies Inc. here

News-ID: 3944628 • Views: …

More Releases from DataM Intelligence 4market Research LLP

North America Surgical LED Lights Market Growth Outlook 2024-2031 | Top Companie …

The North America Surgical Led Lights market was reached at a high CAGR from 2024 to 2031.

Surgical LED Lights are specialized lighting devices used in operating rooms and surgical settings to provide bright, focused illumination during surgical procedures. These lights utilize Light Emitting Diode (LED) technology, which offers several advantages over traditional lighting sources, including improved energy efficiency, reduced heat generation, and longer lifespans. Surgical LED lights can be adjusted…

Respiratory Monitoring Devices Market to Reach US$38.14 Billion by 2033 at 8.2% …

The global respiratory monitoring devices market size was US$ 18.80 Billion in 2024 and is expected to reach US$ 38.14 Billion by 2033, growing at a CAGR of 8.2% from 2025 to 2033. as healthcare providers increase adoption of advanced monitoring solutions to improve diagnosis, management, and care of respiratory conditions.

Growth is supported by rising demand across key product types such as wearable sensors, capnography systems, spirometers, and…

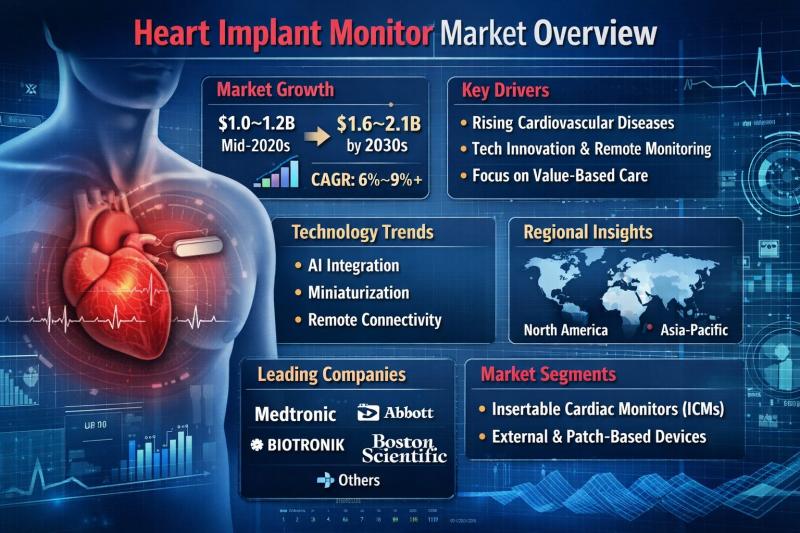

Heart Implant Monitor Market: Comprehensive Industry Analysis, Trends, and Futur …

The global Heart Implant Monitor Market, also known as the implantable cardiac monitor (ICM) or insertable cardiac monitor market, represents a rapidly evolving segment within the broader cardiac diagnostics industry. These devices are small, minimally invasive monitors implanted under the skin to continuously track heart rhythm abnormalities over extended periods. They play a critical role in detecting arrhythmias, unexplained syncope, atrial fibrillation (AF), and cryptogenic stroke.

With cardiovascular diseases (CVDs) remaining…

Cardiac Catheters and Guidewires Market to Reach US$64.09 Billion by 2033 at 7.7 …

The cardiac catheters and guidewires was valued at US$ 14.53 Billion. The global Cardiac Catheters and Guidewires market size reached US$ 15.54 Billion in 2024 and is expected to reach US$ 64.09 Billion by 2033, growing at a CAGR of 7.7% from 2025-2033. as the global burden of cardiovascular diseases rises and minimally invasive interventional procedures become more widely adopted.

Growth is supported by increasing demand across key product types such…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…