Press release

Voice Banking Market Poised for 16.7 % Growth, Set to Hit $3.49 Billion by 2029

Get 20% OFF on all 2025 Global Market Reports until March 31st! Apply code FY25SAVE and grab your savings today!How Are the key drivers contributing to the expansion of the voice banking market?

The rising demand for voice assistance-enabled devices is expected to propel the growth of the voice banking market. Voice assistance-enabled devices, such as smart speakers, smartphones, and home hubs, offer hands-free interaction and convenience. The demand for these devices is growing due to improvements in voice recognition technology and their compatibility with smart home systems. Voice banking enables users to create custom digital voice profiles for these devices, improving personalization and user experience. In 2022, the adoption of smart home devices in Canada increased to 47%, with smart speakers being particularly popular. This trend of increasing demand for voice assistance-enabled devices is expected to drive the voice banking market.

Get Your Voice Banking Market Report Here:

https://www.thebusinessresearchcompany.com/report/voice-banking-global-market-report

What growth opportunities are expected to drive the voice banking market's CAGR through 2034?

The voice banking market has grown rapidly, increasing from $1.61 billion in 2024 to $1.88 billion in 2025, at a CAGR of 17.1%. Key drivers include the adoption of IoT and smart home devices, the rise of multilingual voice assistants, increasing smartphone penetration, improved security features, and digital transformation in banking services.

The voice banking market is forecasted to expand significantly, reaching $3.49 billion by 2029 at a CAGR of 16.7%. Growth drivers include the rising integration of AI-powered virtual assistants, the increasing popularity of smart speaker devices, growing consumer preference for convenience, the widespread adoption of AI, and the incorporation of telehealth services. Key trends expected during the forecast period include advancements in voice synthesis technologies, rising demand for personalized voice banking solutions, ongoing research to improve voice quality and fidelity, increasing adoption of voice banking technologies, and the use of AI and machine learning for further innovation.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16822&type=smp

What are the emerging trends shaping the future of the voice banking market?

In the voice banking market, companies are focusing on AI-powered solutions to enhance banking services for people with cognitive disabilities. In April 2023, Glia launched an AI-driven voice banking feature within its Glia Interaction Platform. This allows users to access banking services through voice commands, enabling seamless and personalized customer interactions, especially in financial services, and offering continuous support across multiple channels.

Which growth-oriented segments of the voice banking market are leading the industry's development?

The voice banking market covered in this report is segmented -

1) By Component: Solution, Services

2) By Technology: Machine Learning, Deep Learning, Natural Language Processing, Other Technologies

3) By Deployment Mode: On-Premise, Cloud

4) By Application: Banks, Non-Banking Financial Companies (NBFCs), Credit Unions, Other Applications

Subsegments:

1) By Solution: Voice Recognition Software, Speech-to-Text Systems, Voice Authentication And Security Solutions, Voice Analytics Tools

2) By Services: Consulting Services, Integration And Implementation Services, Training And Support Services, Managed Services

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16822

What regions are leading the charge in the voice banking market?

North America was the largest region in the voice banking market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the voice banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What companies are at the forefront of innovation in the voice banking market?

Major companies operating in the voice banking market are Hongkong and Shanghai Banking Corporation Limited, NatWest Group, U.S. Bank, Lloyds Bank plc, ICICI Bank, Ally Financial Inc., Emirates NBD Bank, NCR Corporation, IndusInd Bank, Axis Bank, Verbio Technologies S.L, DBS Bank India Limited, Uniphore, Central 1 Credit Union, SoundHound AI Inc., Acapela Group, kasisto, BankBuddy, Vibepay, United Bank of India

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=16822&type=smp

What Is Covered In The Voice Banking Global Market Report?

•Market Size Forecast: Examine the voice banking market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the voice banking market for a structured understanding.

•Key Players Overview: Analyze major players in the voice banking market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the voice banking market.

•Segment Contributions: Evaluate how different segments drive overall growth in the voice banking market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the voice banking market.

•Industry Challenges: Identify potential risks and obstacles affecting the voice banking market.

•Competitive Landscape: Review strategic developments in the voice banking market, including expansions, agreements, and new product launches.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ"

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market Poised for 16.7 % Growth, Set to Hit $3.49 Billion by 2029 here

News-ID: 3940561 • Views: …

More Releases from The Business research company

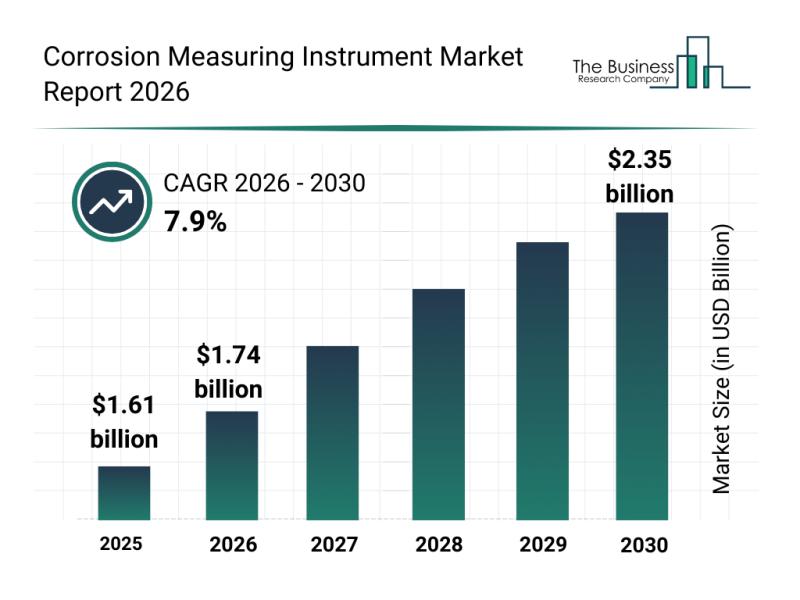

Global Factors Influencing the Rapid Development of the Corrosion Measuring Inst …

Understanding the future trajectory of the corrosion measuring instrument market reveals promising growth driven by technological advancements and expanding industry demands. As sectors increasingly prioritize asset integrity and maintenance efficiency, this market is set to experience substantial development through 2030. The following sections explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Growth Outlook for the Corrosion Measuring Instrument Market Size Until 2030

The corrosion measuring instrument…

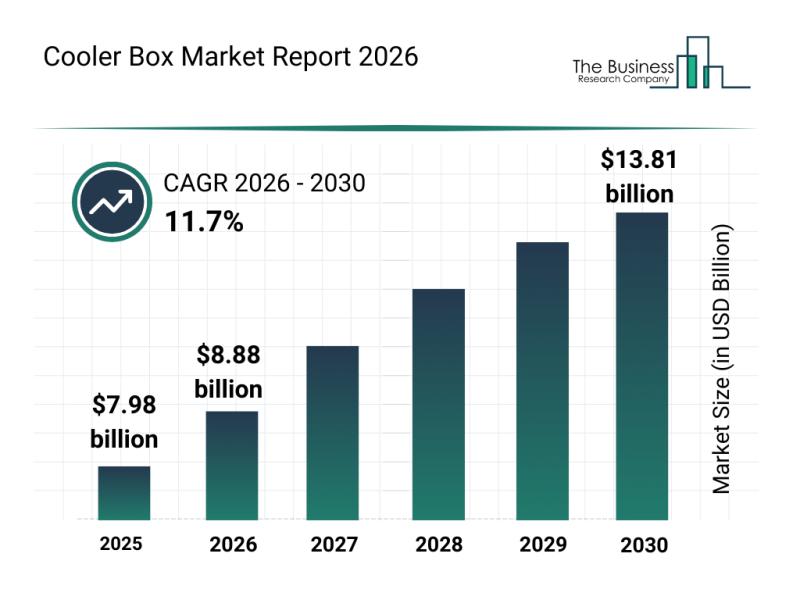

Segmentation Analysis, Market Trends, and Competitive Landscape of the Cooler Bo …

The cooler box market is positioned for substantial expansion over the coming years, driven by evolving consumer needs and innovations in temperature control. As demand rises for efficient and sustainable cooling solutions, this sector is set to transform significantly, supported by advances in materials and technology. Here's an in-depth look at the market size projections, key players, and emerging trends shaping the cooler box industry.

Projected Growth and Size of the…

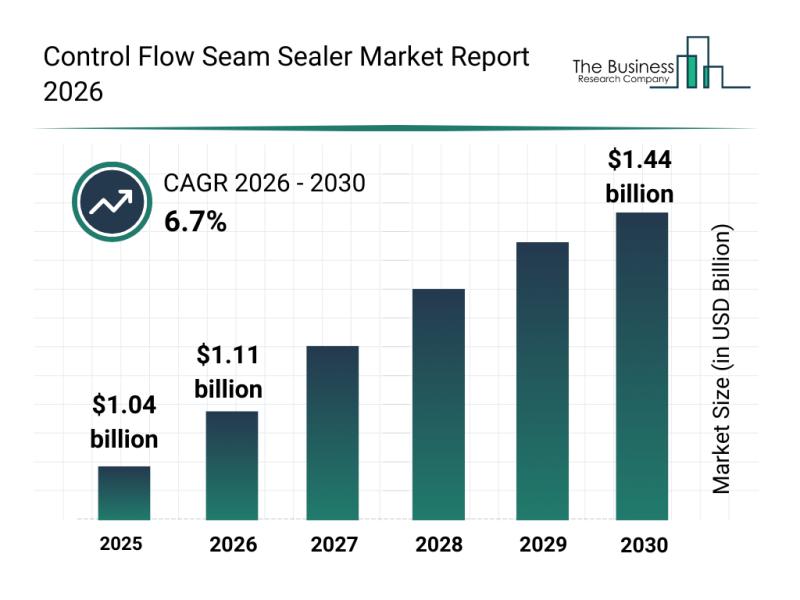

Analysis of Key Market Segments Influencing the Control Flow Seam Sealer Market

The control flow seam sealer market is poised for significant expansion over the coming years, driven by advancements in automotive and aerospace manufacturing along with evolving material requirements. As industries seek more efficient and specialized sealing solutions, this segment is attracting heightened attention from manufacturers and end users alike. Below, we explore the market's anticipated growth, leading players, and segmentation details to provide a clear understanding of the current landscape…

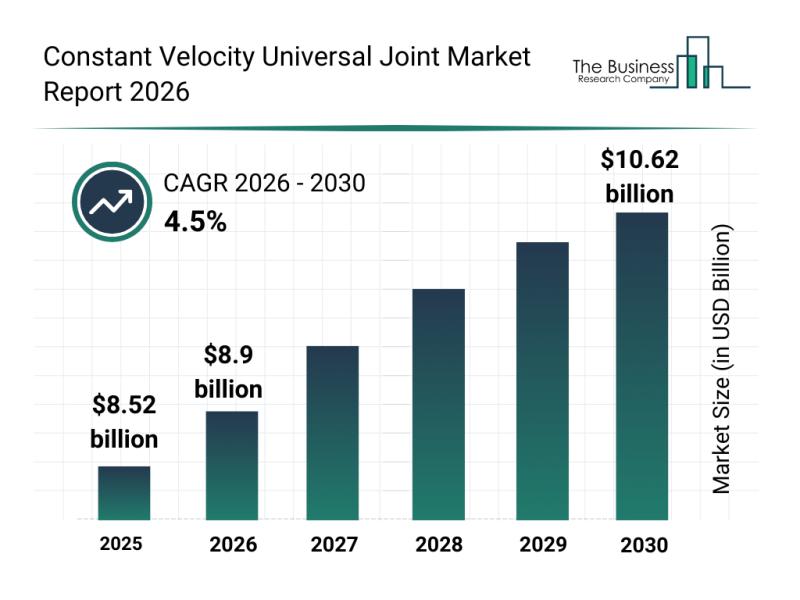

Top Players and Competitive Dynamics in the Constant Velocity Universal Joint Ma …

The constant velocity universal joint market is poised for consistent growth in the coming years, driven by advancements in automotive technologies and evolving industry demands. This sector is witnessing increasing integration with electric and hybrid vehicles, along with a focus on improving driveline efficiency and durability. Let's explore the market's projected expansion, key industry players, emerging trends, and segmentation details.

Forecasted Market Expansion for the Constant Velocity Universal Joint Market by…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…