Press release

U.S. Pension Risk Transfer Market Size to Hit $102.38 Billion by 2030 - Arizton

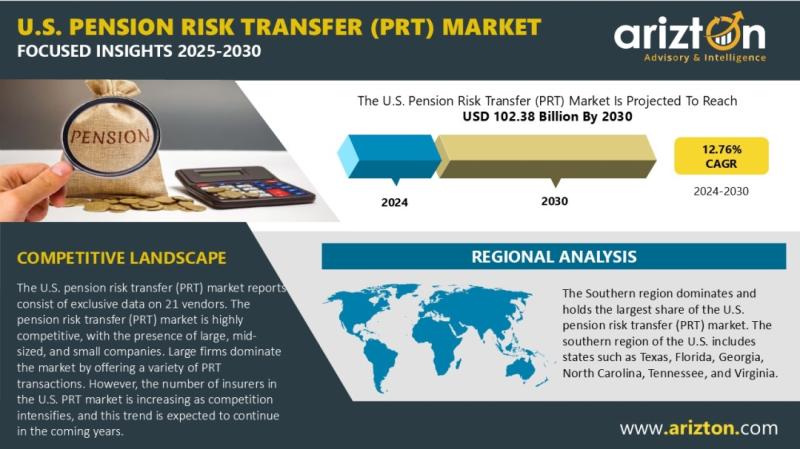

According to Arizton's latest research report, the US pension risk transfer (PRT) market [https://www.arizton.com/market-reports/united-states-pension-risk-transfer-market] is growing at a CAGR of 12.76% during 2024-2030.Looking for More Information? Click: [https://www.arizton.com/market-reports/united-states-pension-risk-transfer-market]

Report Scope:

Market Size (2030): $102.38 Billion

Market Size (2024): $49.81 Billion

CAGR (2024-2030): 12.76%

Historic Year:2021-2023

Base Year: 2024

Forecast Year: 2025-2030

Market Segmentation: Transaction, Plan Size, and Region

Geographical Analysis: United States (South, Northeast, Midwest, and West)

Growth of the US Pension Risk Transfer Market

The US pension risk transfer (PRT) market is experiencing rapid growth, fueled by regulatory changes, favorable economic conditions, and a heightened focus on reducing financial risks. Key trends include increased plan terminations, the growing adoption of de-risking strategies, rising interest in buy-ins, and the emergence of sidecar solutions. PRT transactions, which encompass lift-outs, plan terminations, and buy-ins, are available in various sizes, with small plan sizes seeing the most significant growth.

The evolving regulatory landscape is prompting companies to adopt PRT to mitigate pension plan risks while ensuring guaranteed pensions for employees. The South region leads the market, driven by the presence of Fortune 500 companies and widespread use of full plan terminations. Advances in technology, such as actuarial modeling and data analysis tools, are improving efficiency in PRT transactions. Rising pension plan funding levels, boosted by interest rates and strong equity markets, are also making PRT transactions more attractive to insurers and plan sponsors.

Recent Vendor Activities

* In 2024, Cuna Mutual Group Retirement rebranded to TruStage. It unifies under one brand. This includes both executive and retirement benefits. The rebrand will bring the customers to continue to navigate their required products or services. Is a company, that delivers insurance, investments, and technology solutions that are designed to help meet a diverse range of needs. It offers various pension risk transfer services in the U.S. market.

* In 2021, Lockheed Martin Corporation, a defense and aerospace manufacturer in the U.S., purchased group annuity contracts from Athene Holding, a leading retirement services company, to transfer approximately $4.9 billion of Lockheed Martin's pension obligations. It will be useful for around 18,000 retirees and beneficiaries.

U.S. Pension Risk Transfer Market Trends

Increased Plan Termination A growing trend in the U.S. pension risk transfer market is the rise in plan terminations. Companies are increasingly choosing to eliminate the risk and volatility associated with defined benefit pension plans by transferring responsibilities to insurers. This decision is driven by factors such as a focus on core business activities, the need to reduce risks related to longevity and investments, improved financial reporting, cost savings, and favorable market conditions. Plan terminations help companies achieve cost savings and risk reduction by selling benefits to annuity providers or offering lump-sum payouts to participants, reducing the administrative burden.

Rising Adoption of De-Risking Strategies The adoption of de-risking strategies is gaining momentum in the U.S. pension risk transfer market. De-risking involves actions like pension risk transfers, changes to investment strategies, and modifications to plan designs to protect investments and ensure long-term sustainability. By transferring pension obligations to insurers through buy-ins or buy-outs, companies reduce financial risks. Additionally, many plan sponsors are outsourcing pension plan management to better position themselves for success in a volatile economic environment. The growing use of tools like lift-outs is helping companies de-risk their pension plans and adapt to regulatory changes, unpredictability, and increasing pension costs.

Dominance of the Southern Region in the U.S. Pension Risk Transfer Market

The Southern region of the U.S. leads and holds the largest share of the pension risk transfer (PRT) market. This region, which includes states such as Texas, Florida, Georgia, North Carolina, Tennessee, and Virginia, is experiencing significant growth due to its robust base of Fortune 500 companies and a tech-savvy population. Economic expansion has positioned the South as an attractive hub for corporate headquarters, resulting in an increased likelihood of companies with defined pension plans opting for PRT transactions.

In addition, the healthcare sector in the South is expanding, supported by a strong manufacturing base and a high concentration of hospitals. Approximately 13% of the region's civilian workforce is employed in healthcare. The hospitality and leisure industries, particularly in Texas and Florida, are also thriving, along with a rise in event planning businesses. As these industries continue to grow, the demand for small and mid-sized PRT transactions in the South is expected to increase during the forecast period.

Looking for More Information? Click: [https://www.arizton.com/market-reports/united-states-pension-risk-transfer-market]

Key Vendors

* Aon plc.

* Athene Holding

* Legal & General Group plc

* MetLife Services and Solutions, LLC

* Prudential Financial, Inc.

* Willis Towers Watson (WTW)

* Reinsurance Group of America

* Fidelity & Guaranty

* Kohlberg Kravis Roberts & Co. L.P.

* Nationwide Mutual Insurance Company

* New York Life

* Pacific Life Insurance Company

* Principal Financial Services, Inc.

* Securian Financial Group, Inc.

* American National

* American United Mutual Insurance Holding Company

* Mutual of America

* Mutual of Omaha

* Sammons Financial Group, Inc.

* TruStage Financial Group, Inc.

* Western & Southern Financial Group

Segmentation & Forecasts

Transaction

* Lift-outs

* Plan Terminations

* Buy-ins

Plan Size

* Large

* Mid-Sized

* Small

Region

* South

* Northeast

* Midwest

* West

What Key Findings Will Our Research Analysis Reveal?

How big is the U.S. pension risk transfer (PRT) market?

which transaction segment has the largest share in the U.S. pension risk transfer (PRT) market?

Which plan size segment provides more business opportunities in the U.S. pension risk transfer (PRT) market?

Which region holds the largest share in the U.S. pension risk transfer (PRT) market?

Other Related Reports that Might be of Your Business Requirement

Financial Wellness Benefits Market in United States - Research Report 2020-2029

https://www.arizton.com/market-reports/financial-wellness-benefits-market-in-united-states

U.S. Corporate Wellness Market - Industry Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/us-corporate-wellness-market-analysis-2024

Why Arizton?

100%Customer Satisfaction

24x7availability - we are always there when you need us

200+Fortune 500 Companies trust Arizton's report

80%of our reports are exclusive and first in the industry

100%more data and analysis

1500+reports published till date

Post-Purchase Benefit

* 1hr of free analyst discussion

* 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=us-pension-risk-transfer-market-size-to-hit-10238-billion-by-2030-arizton]

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/united-states-pension-risk-transfer-market

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Pension Risk Transfer Market Size to Hit $102.38 Billion by 2030 - Arizton here

News-ID: 3937321 • Views: …

More Releases from ABNewswire

Marco Robinson Launches Public 'Proof of Work' Portal to Enable Independent Veri …

Primary-source documentation published to support independent review by media, partners and the public

LONDON - Feb. 27, 2026 - British entrepreneur, author and media producer Marco Robinson today opened a public Proof of Work portal containing primary-source documentation intended to enable independent verification of his business activities, media projects and legal record.

The portal, which is published on Robinson's official website, presents source documents rather than commentary, including solicitor correspondence, court outcomes…

Affordable James Taylor Tour 2026 Tickets - Cheap Seats + Promo Code CITY10 Capi …

James Taylor hits the road with his All-Star Band in 2026! Tour opens April 26 at Yaamava' Theater (Highland, CA), then The Rady Shell (San Diego, Apr 28), Tahoe Blue Event Center (Stateline, NV, May 1), BeachLife Festival (Redondo Beach, May 3), Santa Barbara Bowl (May 6), and continues through summer/fall with multi-night runs and East Coast/Midwest stops, wrapping September 26 in Hollywood, FL.

Folk-rock icon James Taylor [https://www.capitalcitytickets.com/James-Taylor-Tickets] returns with…

Clause Law Group Publishes "How to Choose the Best Wrongful Death Litigation Fir …

Clause Law Group today released a public guide outlining what families should look for when selecting the best wrongful death litigation firm, including evidence preservation, insurance-tower strategy, trial readiness, and resource capacity. The firm also announced expanded rapid-response capabilities to help families protect time-sensitive evidence in the first critical days after a fatal incident.

The Clause Law Group announced today the release of a public educational guide titled "How to Choose…

Roubic Tree & Landscape LLC Publishes Complete Tree Service Guide for Pepper Pik …

Greater Cleveland's Longest-Serving Family-Owned Tree Company Releases Region-Specific Resource for Cuyahoga County Homeowners as the Global Tree Services Market Grows 14.3% Year-Over-Year and Storm-Related Demand Drives Accelerating Industry Expansion Across Northeast Ohio

CHAGRIN FALLS, Ohio - Roubic Tree & Landscape LLC, a family-owned tree service company based in Chagrin Falls, Ohio, has published a community guide titled "Tree Service in Pepper Pike, Ohio: Complete Guide to Removal, Trimming & Stump Grinding,"…

More Releases for PRT

Personal Rapid Transit (PRT) Technology Market Set for Expansion Amid Urban Mobi …

The global personal rapid transit (PRT) technology market is witnessing notable growth as cities and private enterprises increasingly explore automated, on-demand transportation solutions. PRT systems, which provide small, driverless vehicles on dedicated guideways, offer a sustainable, flexible, and congestion-free alternative to conventional public transport. The rise of smart city initiatives and sustainable urban mobility plans is fueling adoption worldwide.

Download Full PDF Sample Copy of Market Report @ https://exactitudeconsultancy.com/request-sample/68521

Key Market Takeaways

• Growing…

Personal Rapid Transit PRT Technology Market Forecast: Strong Expansion Expected …

A new report from Prudent Markets, titled "Personal Rapid Transit PRT Technology Market 2025-2033," offers an in-depth examination of the industry, including valuable insights into the Personal Rapid Transit PRT Technology market's performance. The report covers competitor dynamics, regional trends, and the latest technological developments shaping the market.

This comprehensive analysis is complemented by a detailed table of contents, along with figures, tables, and charts, providing a thorough understanding of the…

Personal Rapid Transit PRT Technology Market Size & Trends To 2031

Personal Rapid Transit PRT Technology Market Overview 2024:

The Personal Rapid Transit PRT Technology Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the Personal Rapid Transit PRT Technology market. This report explores all the…

Personal Rapid Transit PRT Technology Market Size & Trends To 2031

Personal Rapid Transit PRT Technology Market Overview 2024:

The Personal Rapid Transit PRT Technology Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the Personal Rapid Transit PRT Technology market. This report explores all the…

Mobile Printing Device Market 2021 | Business Growth and Development Factors by …

The “Global Mobile Printing Device Market Analysis to 2027″ is a specialized and in-depth study of the industry with a special focus on the global market trend analysis. The report aims to provide an overview of the Mobile Printing Device market with detailed market segmentation by type, application, and geography. The global Mobile Printing Device market is expected to witness high growth during the forecast period. The report provides key…

Global Computer Peripherals Market By Manufacturers, Regions, Type and Applicati …

The Global Computer Peripherals Market Outlook to 2025, Capacity, Generation, Investment Trends, laws, and Company Profiles. The business examination pros that give exhaustive information and comprehension of the Computer Peripherals market inside the globe.

The report gives a top to bottom investigation of the global Computer Peripherals market with estimates up to 2025. The report analysis the market situation and gives a future viewpoint gauges up to 2025. The report features…