Press release

Understanding Travel Insurance: Market to Surpass $106.8 Billion with 20.1% CAGR | Coverage & Claims Analysis

The value of global travel insurance premiums is expected to be almost seven times higher than in 2022 to reach $107 billion in 2032, attaining a growth rate of 20.1%. The report titled "Travel Insurance Market" reflects on the current growth of travel insurance, emphasizing notable trends and opportunities on a global scale as well as across different regions. Business leaders and companies can harness these insights to engage with this significantly growing sector.The global travel insurance market is experiencing significant growth owing to the increasing number of people traveling for business and vacations purposes which is significantly driving to the expansion of the market. The rising awareness of the potential risks associated with travel, such as medical emergencies and trip insurance, fueled the demand for travel insurance as a means of protection.

Claim Your Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/1610

The travel insurance market trends include regulatory requirements in certain countries mandating travel insurance, further boosted market growth. However, the market face challenges, including low awareness and price sensitivity among the travelers. Moreover, the adoption of digital technologies such as AI and ML by key providers for prompt response and customized plans is providing numerous opportunities for market growth. Travel health insurance emphasis on healthcare protection and COVID-19 coverage reassures travelers, fueling demand and expanding the travel insurance market.

Allied Market Research published a report, titled, "Travel Insurance Market by Insurance Cover (Single-Trip Travel Insurance, Annual Multi-Trip Travel Insurance, and Long-Stay Travel Insurance), Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators), End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and Age Group (1-17 Years Old, 18-30 Years Old, 31-49 Years Old, and Above 50 Years): Global Opportunity Analysis and Industry Forecast, 2022-2031, and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032."

The long-stay travel insurance segment to maintain its leadership status throughout the forecast period.

By insurance cover, the single-trip travel insurance segment held the largest market share in 2022, accounting for more than three-fifths of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to its comprehensive coverage for a single journey, including trip cancellations, medical emergencies, and baggage loss, providing travelers with peace of mind. However, the long-stay travel insurance segment is projected to manifest the highest CAGR of 23.8% from 2023 to 2032, owing to the increasing number of long-term travelers seeking comprehensive insurance coverage for extended stays abroad.

The insurance aggregators segment to maintain its leadership status throughout the forecast period.

By distribution channel, the insurance intermediaries segment held the largest market share in 2022, accounting for nearly one-third of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to its wide network, personalized services, and strong customer relationships, which cater to the diverse needs of travelers efficiently. However, the insurance aggregators segment is projected to manifest the highest CAGR of 23.0% from 2023 to 2032, owing to its ability to offer a wide range of insurance options from different providers, providing customers with greater choice and convenience in selecting suitable policies.

Buy This Extensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3CkKQOF

The business travelers segment to maintain its leadership status throughout the forecast period.

By end user, the family travelers segment held the largest market share in 2022, accounting for nearly one-third of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to the rising number of families opting for travel insurance to protect their loved ones against unforeseen events such as medical emergencies and trip cancellations. However, the business travelers segment is projected to manifest the highest CAGR of 22.6% from 2023 to 2032, owing to the increasing globalization of businesses, rising frequency of business trips, and the need for comprehensive coverage against travel-related risks for employees on corporate travel.

The 18-30 years old segment to maintain its leadership status throughout the forecast period.

By age group, the 31-49 years old segment held the largest market share in 2022, accounting for more than one-third of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to its active participation in travel activities, higher disposable income, and a growing awareness of the importance of travel insurance, especially for longer trips. However, the 18-30 years old segment is projected to manifest the highest CAGR of 23.0% from 2023 to 2032, owing to the increasing number of young travelers seeking adventurous and experiential travel experiences, leading to a higher demand for travel insurance among this demographic.

Asia-Pacific region to maintain its dominance by 2032.

By region, the Europe segment held the largest market share in terms of revenue in 2022, accounting for nearly two-fifths of the travel insurance market revenue, owing to the region's robust tourism industry, high awareness about travel risks, and the availability of a wide range of travel insurance products tailored to different traveler needs, which is boosting the growth of the market in this region. The Asia-Pacific region is expected to witness the fastest CAGR of 22.1% from 2023 to 2032, owing to the increasing awareness about travel insurance, rising disposable incomes, and a growing number of outbound travelers, particularly from countries like China and India, driving the demand for travel insurance policies in the region.

Key Market Players: Assicurazioni Generali S.p.A., Just Travel Cover, Zurich Insurance Group, Staysure, PassportCard, Trailfinders Ltd., AXA, American International Group, Inc., Aviva, Insurefor.com

Get Your Personalized Sample Report & TOC Now! @ https://www.alliedmarketresearch.com/request-for-customization/1610

Travel Insurance Market Report Highlights

By Age Group

Above 50

1-17 Years Old

18-30 Years Old

31-49 Years Old

By Insurance Cover

Single-Trip Travel Insurance

Annual Multi-Trip Travel Insurance

Long-Stay Travel Insurance

By Distribution Channel

Insurance Intermediaries

Insurance Companies

Banks

Insurance Brokers

Insurance Aggregators

By End User

Senior Citizens

Education Travelers

Business Travelers

Family Travelers

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Norway, Netherlands, Spain, Italy, Switzerland, Finland, Belgium, Russia, Sweden, Austria, Rest of Europe)

Asia-Pacific (China, Japan, Australia, Hong Kong, South Korea, Malaysia, Singapore, New Zealand, Rest of Asia-Pacific)

LAMEA (Brazil, Argentina, Rest of Latin America, Middle East, Africa)

Explore Before Buying: Insider's Guide to Purchase@ https://www.alliedmarketresearch.com/request-for-customization/1610

Innovations and Future Landscape

Rise in innovation demonstrates the travel insurance industry's ability to adapt to changing consumer needs and new trends in the global travel industry. Advancements in technology and changing travel patterns lead to new innovations aimed at improving the availability, flexibility and reliability of travel insurance products and services.

Digitalization and Online Platforms

Many travel insurance companies have moved to digital platforms that allow customers to purchase policies, manage claims, and access support services online or through mobile apps. Digital platforms provide convenience, accessibility, and real-time updates, improving the overall customer experience. In September 2022, insurtech startup, InsuranceDekho, expanded its service offering by launching travel insurance on its online platform. The company has partnered with leading insurance organizations such as Reliance General, Bajaj Allianz, ICICI Lombard, and others to offer travel insurance services on a regular basis

Innovative Coverage for Adventure Travel

With rise in popularity for adventure travel and extreme sports, insurers are developing specific insurance options for activities such as hiking, diving, and skiing. These policies provide comprehensive protection against injuries, property damage, and trip disruption associated with adventure travel. In October 2021, Travel Insured International, Inc. launched cruise travel protection plan that provides coverage up to $50,000 in accidental & sickness medical expense and up to $250,000 in medical evacuation coverage. It also provides protection for missed cruise connection, cruise disablement, and cruise diversion.

Future Outlook for Market

The future of the travel insurance market is expected to evolve significantly due to various factors that are changing the travel landscape. Technological advances, changing consumer behaviour, and global events such as the COVID-19 pandemic are driving the market growth. Technological advancements are revolutionizing the way users purchase, manage, and report travel insurance. Mobile apps, AI-powered chatbots, and digital platforms provide convenience and personalization, enhancing the overall customer experience. Consumer inclination towards travel insurance is also changing. Higher awareness of the health and safety issues caused by the pandemic has highlighted the importance of comprehensive protection. Travelers are increasingly looking for policies that offer protection against unexpected events, including medical emergencies, cancellations, and trip interruptions.

Partnerships with airlines, travel agencies, and online platforms are anticipated to further expand distribution channels and reach a wider audience. In addition, rise in educational initiatives are expected to play a key role in increasing consumer understanding and awareness of the benefits and options of travel insurance. Overall, the future of the travel insurance market lies in innovation, adaptability, and customer-focused solutions that meet the changing needs of travelers in an increasingly complex global environment. Get in touch with AMR analysts for more information.

Top Trending Reports:

Online Payday Loans Markethttps://www.alliedmarketresearch.com/online-payday-loans-market-A157231

Extended Warranty Markethttps://www.alliedmarketresearch.com/extended-warranty-market

Consumer Electronics Extended Warranty Market https://www.alliedmarketresearch.com/consumer-electronics-extended-warranty-market-A14248

Cryptocurrency Market https://www.alliedmarketresearch.com/crypto-currency-market

Blockchain in Insurance Market https://www.alliedmarketresearch.com/blockchain-in-insurance-market-A11767

EV Insurance Market https://www.alliedmarketresearch.com/ev-insurance-market-A47384

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Understanding Travel Insurance: Market to Surpass $106.8 Billion with 20.1% CAGR | Coverage & Claims Analysis here

News-ID: 3935577 • Views: …

More Releases from Allied Market Research

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

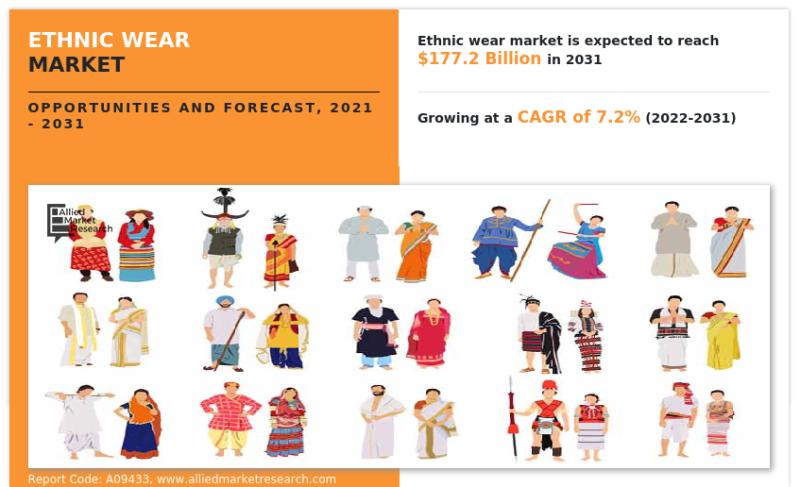

Ethnic Wear Market Forecasting Essentials: Interpreting CAGR and USD Projections …

According to a new report published by Allied Market Research, titled, "Ethnic Wear Market," The ethnic wear market size was valued at $89.3 billion in 2021, and is estimated to reach $177.2 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The market for ethnic wear is mostly driven by the rising number of fashion influencers across the globe. It is difficult to overlook the importance of…

$8.9+ Billion Commercial Janitorial Equipment Market Value by 2031 with a 4.6% C …

According to a new report published by Allied Market Research, titled, "Commercial Janitorial Equipment Market," The commercial janitorial equipment market size was valued at $5.7 billion in 2021, and is estimated to reach $8.9 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. There has been a surge in the number of restaurants, hotels, and hospitals across the globe, which further contribute to the demand for…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…