Press release

Growing Dependence On Machinery Driving The Growth Of The Market Due To Increasing Automation And Technological Advancements: A Key Factor Shaping the Future of the Malfunction Insurance Market in 2025

Which drivers are expected to have the greatest impact on the over the malfunction insurance market's growth?The escalating reliance on machinery is predicted to spur the expansion of the malfunction insurance market. This increasing dependency is due to amplified automation, technological progress, and an escalating demand for accuracy and efficiency in various industries. Malfunction insurance safeguards machinery by offering economic protection against unforeseen failures, encompassing the expenditures of repair or replacement, and assures minimal interruptions in operations, enabling firms to uphold efficiency and productivity. For instance, data from the International Federation of Robotics, a professional non-profit organization based in Germany, indicated that as of September 2024, the global number of robots functioning in factories amounted to 4,281,585 units, a 10% enhancement from the prior year. Consequently, this growing reliance on machinery is invigorating the expansion of the malfunction insurance market.

Get Your Malfunction Insurance Market Report Here:

https://www.thebusinessresearchcompany.com/report/malfunction-insurance-global-market-report

What is the future CAGR of the malfunction insurance market, and how will it impact industry expansion?

The size of the malfunction insurance market has seen a speedy expansion in the past years. It's projected to rise from $46.82 billion in 2024 to $52.01 billion in 2025, showing a compound annual growth rate (CAGR) of 11.1%. Several factors have driven growth in the previously noted period, including the growing dependency on intricate machinery, improvements in data analytics, a surge in industrial automation, a rising use of IoT devices, and heightened awareness of risk management.

Anticipations point to a swift expansion of the malfunction insurance market in the coming years, with predictions indicating a surge to $78.46 billion by 2029, boasting a compound annual growth rate of 10.8%. The growth projected in the forecast period can be linked to the incorporation of AI and machine learning, the implementation of blockchain technology, an increase in digitalisation, mounting demand for extensive coverage, and the proliferation of smart contracts. The future also sees key trends such as advanced risk assessment technologies, an uptick in the use of predictive analytics, the development of customised policies, the growth in automated claims processing, and the broadening scope of telematics-based insurance.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=21510&type=smp

What are the most significant trends transforming the malfunction insurance market today?

Key players in the malfunction insurance market are honing in on forming strategic alliances to boost risk assessment capabilities, increase their market presence, include cutting-edge technologies, enhance customer service, and provide tailored insurance solutions. These strategic cooperations enable insurance companies to exploit data analytics, diagnostics powered by AI, and monitoring based on IoT to more efficiently anticipate and avoid equipment breakdowns, thereby lowering claim expenses and augmenting policyholder contentment. For instance, in September 2022, Koop Technologies, an American insurtech firm with expertise in risks related to autonomous vehicles and robotics, teamed up with CJ Coleman, a British insurance organization, and syndicates of Lloyd's from London to debut the sector's inaugural Robotics Errors and Omissions (E&O) insurance product. This partnership gives businesses leveraging robotics and autonomous technologies liability coverage against system breakdowns and operational mistakes. It caters to the rising demand for specialized insurance offerings as automation and robotics grow increasingly commonplace in numerous industries.

Which key market segments comprise the malfunction insurance market and drive its revenue growth?

The malfunction insurance market covered in this report is segmented -

1) By Insurance Type: Standalone Insurance, Add-On Insurance, Group Insurance, Customized Insurance

2) By Coverage Type: Mechanical Breakdown, Electrical System Failures, Operational Error Insurance, Comprehensive Coverage, Replacement Insurance

3) By Distribution Channel: Direct-to-Consumer (D2C), Broker-Based, Banks And Financial Institutions, E-commerce Platforms, Corporate Partnerships

Subsegments:

1) By Standalone Insurance: Appliance Malfunction Insurance, Electronics Malfunction Insurance, Vehicle Malfunction Insurance, Industrial Equipment Malfunction Insurance, Home Systems Malfunction Insurance

2) By Add-On Insurance: Extended Warranty Coverage, Accidental Damage Coverage, Power Surge And Electrical Failure Coverage, Mechanical Breakdown Coverage, Parts And Labor Coverage

3) By Group Insurance: Corporate Equipment Malfunction Insurance, Employee Device Protection Plans, Business Continuity Equipment Coverage, Group Fleet Malfunction Insurance, Industrial Machinery Breakdown Insurance

4) By Customized Insurance: Tailored Commercial Equipment Malfunction Insurance, Industry-Specific Malfunction Insurance, Subscription-Based Malfunction Insurance Plans, Pay-Per-Use Malfunction Insurance, On-Demand Malfunction Coverage

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=21510

What regions are at the forefront of malfunction insurance market expansion?

North America was the largest region in the malfunction insurance market in 2024. The regions covered in the malfunction insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the leading players fueling growth in the malfunction insurance market?

Major companies operating in the malfunction insurance market are AXA SA, Zurich Insurance Group, Munich Re, Nationwide Mutual Insurance Company, The Chubb Corporation, Tokio Marine Group, Swiss Re, Liberty Mutual Insurance Company, Aviva PLC, QBE Insurance Group, CNA Financial, Allianz Partners, Factory Mutual Insurance Company, RSA Insurance Group, HUB International Limited, Hiscox Ltd, Acuity, A Mutual Insurance Company, HDFC ERGO General Insurance Company Limited, Universal Sompo General Insurance Co.Ltd, Grinnell Mutual, MagMutual LLC, Aditya Birla Insurance Brokers Ltd, Generali Group, MICA (Mutual Insurance Company of Arizona), Insureon, IFFCO-Tokio General Insurance Company Limited, Zensurance Brokers Inc., Thimble, Branco Insurance Group

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=21510&type=smp

What Is Covered In The Malfunction Insurance Global Market Report?

•Market Size Forecast: Examine the malfunction insurance market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the malfunction insurance market for a structured understanding.

•Key Players Overview: Analyze major players in the malfunction insurance market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the malfunction insurance market.

•Segment Contributions: Evaluate how different segments drive overall growth in the malfunction insurance market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the malfunction insurance market.

•Industry Challenges: Identify potential risks and obstacles affecting the malfunction insurance market.

•Competitive Landscape: Review strategic developments in the malfunction insurance market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growing Dependence On Machinery Driving The Growth Of The Market Due To Increasing Automation And Technological Advancements: A Key Factor Shaping the Future of the Malfunction Insurance Market in 2025 here

News-ID: 3934813 • Views: …

More Releases from The Business Research Company

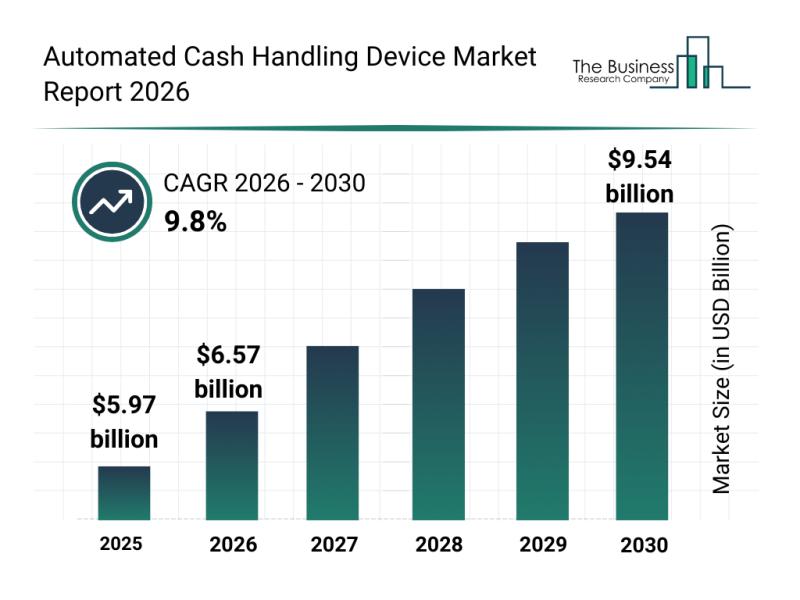

Analysis of Key Market Segments Driving the Automated Cash Handling Device Marke …

The automated cash handling device market is rapidly evolving as businesses seek more efficient ways to manage cash transactions. With innovations aimed at improving speed, accuracy, and security, this sector is set to witness significant growth driven by technological advancements and increasing demand across various industries. Let's explore the market value projections, key players, emerging trends, and primary segments shaping this industry's future.

Projected Growth and Market Value of the Automated…

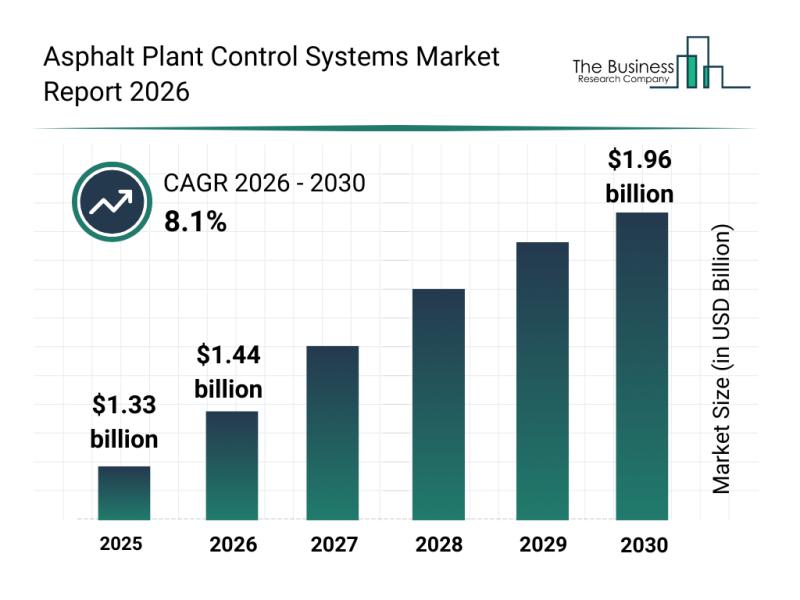

Top Companies and Competitive Dynamics in the Asphalt Plant Control Systems Mark …

The asphalt plant control systems market is on the cusp of significant expansion as infrastructural advancements accelerate globally. With increasing emphasis on efficiency, sustainability, and digital transformation, this sector promises to play a crucial role in modern road construction and related activities in the coming years. Let's explore the market size projections, key players, emerging trends, and notable segments shaping this industry.

Projected Market Size and Growth Path for Asphalt Plant…

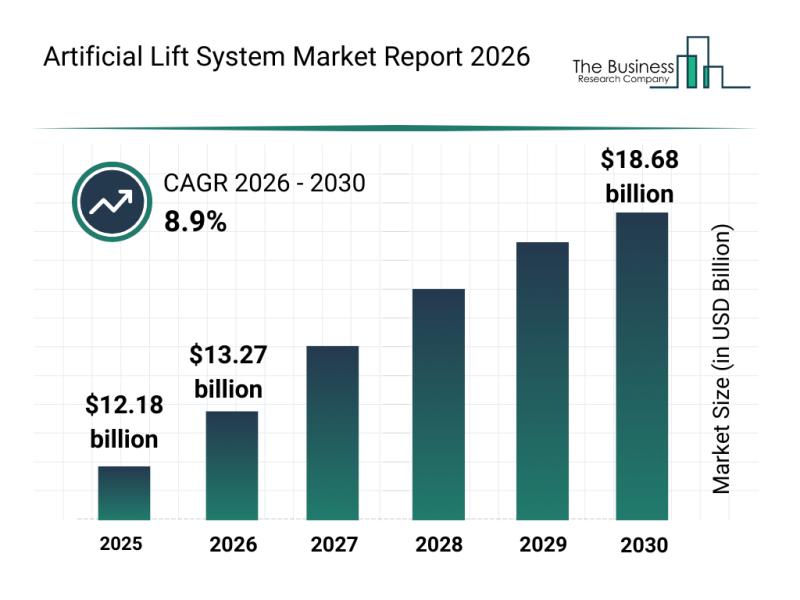

Future Perspectives: Key Trends Shaping the Artificial Lift System Market Until …

The artificial lift system market is positioned for notable expansion over the coming years, driven by technological advancements and evolving industry demands. This sector plays a critical role in enhancing oil and gas production efficiency, and its development is closely linked to innovations that optimize lifting processes and reduce operational costs. Let's explore the market size projections, key players, emerging trends, and the main segments shaping this industry up to…

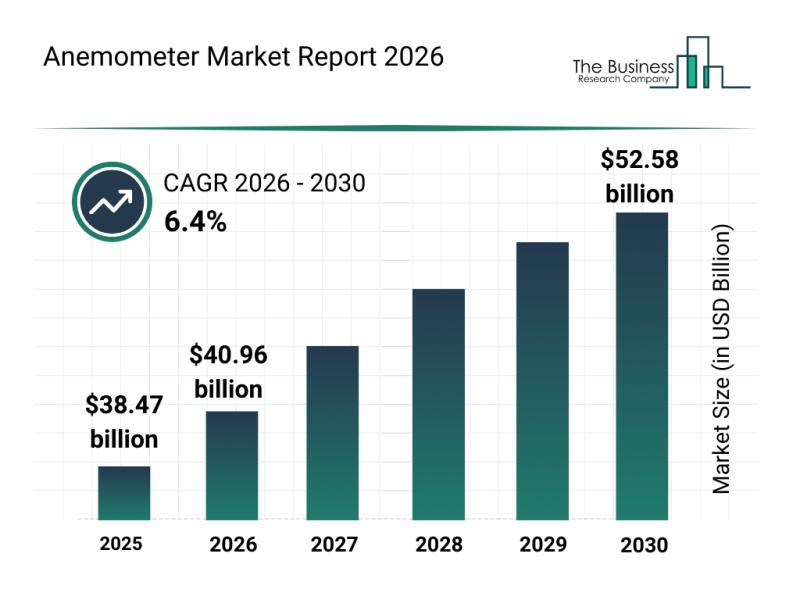

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the An …

The anemometer market is on the brink of significant expansion, driven by advancements in technology and heightened demand for precise environmental data. This sector is set to benefit from growing investments in renewable energy and smart monitoring systems, promising a robust outlook as we approach 2030. Below is a detailed overview of the market's size, key players, trends, and segment-wise insights that define its current and future trajectory.

Strong Growth Predicted…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…