Press release

The Rise Of Technology In Life And Non-Life Insurance Trend: A Crucial Influence on the Life And Non-Life Insurance Market's Transformation in 2025

What Is the Expected Size and Growth Rate of the Life And Non-Life Insurance Market?The market size of life and non-life insurance has experienced robust growth in the past few years. It is forecasted to increase from $9344.18 billion in 2024 to $9834.56 billion in 2025, with a compound annual growth rate (CAGR) of 5.2%. The market expansion during the historical period is credited to factors such as demographic shifts, economic steadiness, heightened awareness of risk, and product innovation.

The market size for both life and non-life insurance is projected to maintain a stable increase in the upcoming years, surging to $11892.01 billion in 2029 with a Compound Annual Growth Rate (CAGR) of 4.9%. This anticipated growth throughout the forecasting span can be linked to a variety of factors such as global financial trends, rising environmental issues, changes in regulations, newly emerging risks, and development of infrastructure. The forecast period is also expected to see major trends like incorporation of sustainability and ESG, expansion of parametric insurance, utilization of blockchain technology, and the advent of remote risk evaluation tools.

What Factors Are Fueling Growth in the Life And Non-Life Insurance Market?

The anticipated rise in insurance coverage is likely to bolster the expansion of both the life and non-life insurance market. This increase in insurance penetration - a reference to the ratio of the insured versus the total market or population that can be insured - offers substantial benefits to both the life and non-life insurance sectors. This is because it results in enhanced financial safety, risk reduction, and a stable market, which benefits individuals, businesses, and the wider economy. For example, the United States Census Bureau, an agency of the U.S. Federal Statistical System, reported that in 2022, health insurance covered 92.1% of people, or 304.0 million, at some point in the year. This marked an increase from 91.7%, or 300.9 million insured people, in 2021, exemplifying an upward trend in insured numbers and rates. It's expected, therefore, that the upward trajectory of insurance penetration will stimulate growth in both the life and non-life insurance markets.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10812&type=smp

Which Leading Companies Are Shaping the Growth of the Life And Non-Life Insurance Market?

Major companies operating in the life and non-life insurance market include Ping An Insurance Company of China Ltd., China Life Insurance Company Limited., Allianz SE, Axa SA, Prudential plc, MetLife Inc., Muenchener Rueck Ges in Mnhn AG, Zurich Insurance Group Ltd., Nippon Life Insurance Company, The Japan Post Holdings Company Ltd., Aviva plc, AIA Group Limited., UnitedHealth Group Incorporated, Life Insurance Corporation, New York Life Insurance Company, Northwestern Mutual Life Insurance Company, Metropolitan Group Mutual Life Insurance Company, Berkshire Hathaway Inc., Cigna Corporation, State Farm Mutual Automobile Insurance Company ., Progressive Insurance Group, Allstate Insurance Group, Liberty Mutual Insurance Company, Travelers Group Companies Inc., United Services Automobile Association, Chubb Ltd., Farmers Insurance Exchange, Nationwide Mutual Insurance Company, Prudential Financial Inc., Manulife Financial Corporation, Assicurazioni Generali S.p.A. ., Legal & General Group plc, Munich Reinsurance America Inc., Swiss Reinsurance Company Ltd ., Aflac Incorporated, Tokio Marine Holdings Inc.

What Are the Major Trends Shaping the Life And Non-Life Insurance Market?

The expansion of technology is becoming a significant trend in the life and non-life insurance industry. Many top companies within this sector are concentrating on invention of new technological solutions to reinforce their foothold. For instance, in March 2023, Sure Insurance LLC, an American digital insurance provider, introduced Retrace, an e-commerce solution. This innovative technology allows online retailers to offer their customers simplified, one-click insurance and protection. It features a range of APIs (application programming interfaces) that enable online retailers to implement insurance and security for a variety of use cases. The embedded Retrace Return Shipping Protection is a groundbreaking technology that simplifies online shopping for both the consumers and retailers.

What Are the Key Segments of the Life And Non-Life Insurance Market?

The life and non-life insurance market covered in this report is segmented -

1) By Insurance Type: Life Insurance, Non-Life Insurance

2) By Coverage Type: Lifetime Coverage, Term Coverage

3) By Distribution Channels: Direct Sales, Brokers And Individual Agents, Bankers, Other Channels

4) By End Users: Corporates, Individuals, Other End Users

Subsegments:

1) By Mobile Offshore Drilling Units: Cantilever Jack-up Rigs, Slot Rigs, Mat Supported Rigs

2 By Turbine Installation Vessel: Jack-Up Turbine Installation Vessels, Floating Turbine Installation Vessels

3) By Barges: Spud Barges, Deck Barges, Crane Barges

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/life-and-non-life-insurance-global-market-report

Which Region Dominates the Life And Non-Life Insurance Market?

The countries covered in the life and non-life insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

What Is Covered In The Life And Non-Life Insurance Global Market Report?

- Market Size Analysis: Analyze the Life And Non-Life Insurance Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Life And Non-Life Insurance Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Life And Non-Life Insurance Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Life And Non-Life Insurance Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=10812

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Rise Of Technology In Life And Non-Life Insurance Trend: A Crucial Influence on the Life And Non-Life Insurance Market's Transformation in 2025 here

News-ID: 3931519 • Views: …

More Releases from The Business Research Company

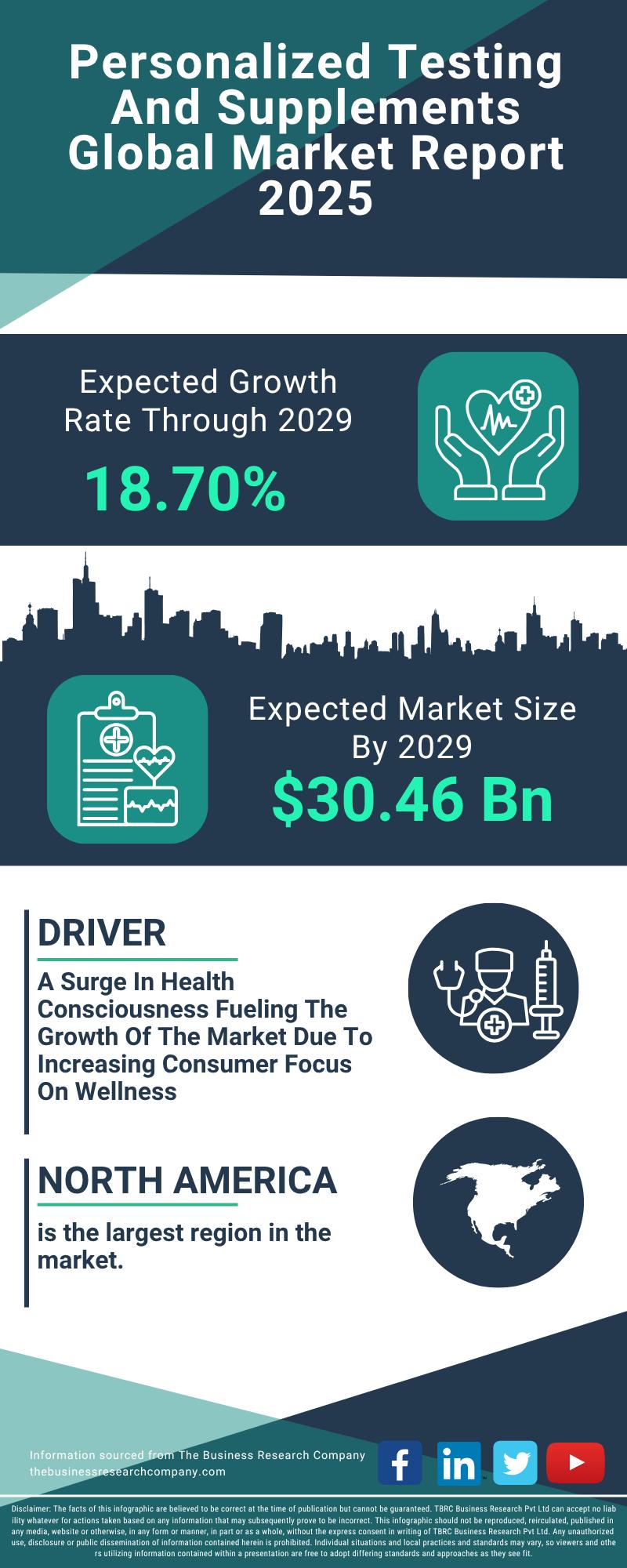

Segment Evaluation and Major Growth Areas in the Personalized Testing and Supple …

The personalized testing and supplements sector is gaining remarkable traction, driven by advancements in technology and a rising consumer focus on tailored health solutions. As more individuals seek customized wellness options, this market is set to experience substantial expansion in the coming years. Here's an in-depth look at its current valuation, key players, significant trends, and the main market segments shaping its future.

Market Valuation and Expansion Forecast for Personalized Testing…

Top Players and Market Competition in the Skin Microbiome Industry

The skin microbiome market is emerging as a significant area of interest due to growing awareness about the critical role of skin health and innovative skincare technologies. As research advances and consumer preferences shift towards more natural and science-backed products, this market is set to undergo substantial growth. Let's explore the current market size, key players, driving factors, and upcoming trends shaping the skin microbiome industry.

Projected Expansion in the Skin…

Key Strategic Developments and Emerging Changes Shaping the Upadacitinib Market …

The upadacitinib market is poised for significant expansion over the coming years, driven by advances in treatment options and increasing awareness of autoimmune diseases. This report delves into the market's current size, key drivers, major players, and the emerging trends shaping its future trajectory.

Steady Growth Expected in Upadacitinib Market Size Through 2029

The market for upadacitinib is projected to reach $2.54 billion by 2029, growing at a robust compound annual…

Analysis of Key Market Segments Driving the Alzheimer's Disease Diagnostic Marke …

The Alzheimer's disease diagnostic sector is rapidly evolving as advancements in technology and healthcare infrastructure open new possibilities for early detection and personalized treatment. With rising awareness and innovative approaches, this market is poised for significant growth in the coming years. Let's explore the current market size, key drivers, leading companies, and emerging trends that are shaping this critical healthcare field.

Projected Market Size and Growth Trends in Alzheimer's Disease Diagnostics…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…