Press release

SouthStar Capital Provides $750,000 Accounts Receivable Facility to Pennsylvania-Based Manufacturer

Image: https://www.abnewswire.com/upload/2025/03/eb70bf42db6b56895fdec1faacc5aef2.jpgSouthStar Capital is pleased to announce the funding of a $750,000 A/R Facility for a Pennsylvania-based manufacturer specializing in smart electrical technology systems. The company, experiencing cash flow challenges due to delayed customer payments and a growing client base, needed immediate working capital to maintain operations and keep supplier payments on track.

The manufacturer, responsible for installing energy-efficient systems in schools and businesses, was billing between $250,000 and $500,000 per month. However, with two large unpaid invoices totaling $400,000, cash flow constraints put production at risk and threatened to stall project timelines.

SouthStar's A/R solution provided immediate access to capital by leveraging the company's outstanding invoices, ensuring the business had the working capital needed to operate smoothly. With this $750,000 Factoring Facility, the manufacturer secured the financial stability needed to support growth and drive continued innovation in the smart electrical technology sector.

About SouthStar

SouthStar Capital is a nationwide commercial finance company with a 16-year track record of excellence, innovation, and customer satisfaction. We specialize in providing comprehensive, customized working capital solutions, including Accounts Receivable Financing, Asset-Based Lending, Purchase Order Financing, Equipment Leasing, Government Contracting, Invoice Factoring, and Payroll Funding. Our non-traditional approach to funding allows us to cater to a wide range of businesses, from startups seeking growth financing to established companies needing enhanced cash flow.

For more information, visit southstarcapital.com

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: SouthStar Capital

Contact Person: Becca Ripley

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=southstar-capital-provides-750000-accounts-receivable-facility-to-pennsylvaniabased-manufacturer]

Phone: (843) 800-8339

Address:840 Lowcountry Blvd

City: Mount Pleasant

State: SC 29464

Country: United States

Website: http://www.southstarcapital.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SouthStar Capital Provides $750,000 Accounts Receivable Facility to Pennsylvania-Based Manufacturer here

News-ID: 3930593 • Views: …

More Releases from ABNewswire

Schaefer and Company Expands Indoor Remodeling Services in Troy and Surrounding …

Schaefer and Company announced the expansion of its indoor remodeling services in Troy, Ohio and surrounding communities. The contractor now provides layout redesign, material and finish upgrades, entry door installation, and window replacement. With detailed planning and homeowner collaboration, each project improves comfort, energy efficiency, and visual appeal while delivering durable, long-term value.

Troy, OH - February 27, 2026 - Schaefer and Company announces the expansion of its indoor remodeling services,…

How Desert Auto Works Auto Repair Shop Is Setting a New Standard for Honest Vehi …

Desert Auto Works in Mesa, AZ delivers honest vehicle repair, fair pricing, and expert diagnostics at 310 E Southern Ave, earning long-term trust from Mesa drivers.

Trust has always been hard to find in the automotive service industry. Many drivers in the Mesa, AZ area have dealt with unnecessary upsells, unclear pricing, and repairs that never seem to stick. Desert Auto Works [https://desertautoworks.com/] at 310 E Southern Ave is changing that…

Womeng Machines Boost Your Production Capacity with HighEfficiency Diaper Making …

Quanzhou Womeng Intelligent Equipment Co., Ltd. is a leading Chinese manufacturer of high-quality diaper, adult diaper, baby pull-ups, sanitary pad, underpad, soaker pad, lady pant, and pet diaper machines. Offering full automatic, full servo, and customized production lines, Womeng provides turnkey solutions, training, installation, and after-sales support to help global buyers achieve efficient, reliable, and cost-effective hygiene product manufacturing.

In today's competitive hygiene products market, efficiency, quality, and reliability are the…

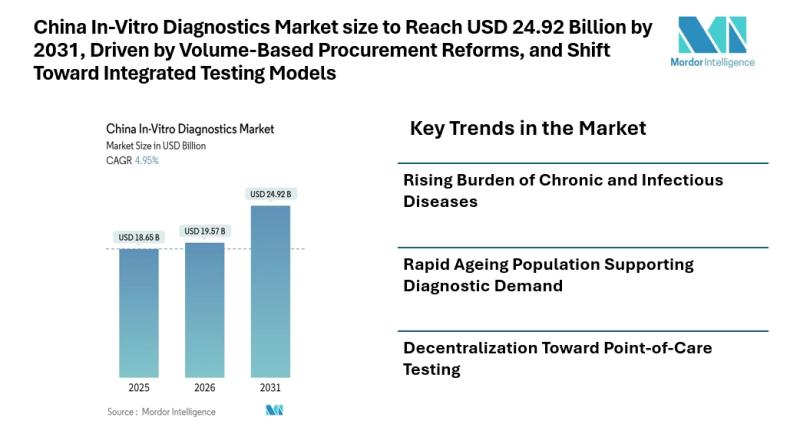

China In-Vitro Diagnostics Market size to Reach USD 24.92 Billion by 2031, Drive …

Mordor Intelligence has published a new report on the china in-vitro diagnostics market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the china in-vitro diagnostics market size [https://www.mordorintelligence.com/industry-reports/china-in-vitro-diagnostics-market?utm_source=abnewswire] is projected to reach USD 24.92 billion by 2031, growing from USD 19.57 billion in 2026 at a CAGR of 4.95% during the forecast period. The china in-vitro diagnostics market size reflects steady expansion supported by…

More Releases for SouthStar

SouthStar Powers Flooring Firm's Distribution Expansion with $500K

This deal was referred to SouthStar by an existing client and structured to support the company's renewed growth and expanding working capital needs.

The business, which specializes in concrete flooring maintenance, surfacing, and polishing, primarily services large commercial and industrial spaces such as national retail distribution centers. With demand for warehouse flooring projects accelerating, the company needed a dependable source of liquidity to cover payroll, purchase materials, and keep operations moving.

Although…

SouthStar Capital Delivers Working Capital Boost to Functional Beverage Startup

SouthStar Capital is proud to announce the funding of an Accounts Receivable (A/R) Facility for a fast-growing omnichannel CPG company specializing in functional coffee and herbal tea blends. This early-stage company recently began receiving recurring purchase orders from a national retail chain and needed a reliable capital partner to support ongoing growth.

After successfully fulfilling smaller orders, the company is now scaling production to meet increased demand. With invoices on Net…

SouthStar Funds $2M A/R Facility for Industrial Equipment Manufacturer

SouthStar Capital, LLC is pleased to announce the funding of a $2 million Accounts Receivable facility for a Charlotte-based manufacturer of industrial battery handling systems. Serving several Fortune 500 companies nationwide, the business was in search of a reliable working capital solution after their long standing line of credit with a major bank was not renewed.

With customer payment terms ranging from Net 30 to Net 60 and large system orders…

SouthStar Capital Funds $2MM Facility for Expanding Lighting Solutions Company

Charleston, SC - SouthStar Capital, LLC is pleased to announce the funding of a $2 million combined Purchase Order (P/O) and Accounts Receivable (A/R) Facility for a lighting solutions company preparing for nationwide expansion. Specializing in commercial and residential lighting design, procurement, and distribution, the company is projected to generate $50 million in revenue from a new contract to supply lighting for up to 15,000 units.

Previously working with multiple financing…

SouthStar Capital Funds A/R Facility for Growing West Coast Construction Firm

Image: https://www.abnewswire.com/upload/2025/04/79d613e09986e7c62b7ce28aec64262b.jpg

As the company rapidly expanded operations-particularly in water, storm, and sewer utility upgrades, as well as generator substation renovations-it needed faster access to working capital to support growth. With projected sales increasing from $1.66 million in 2024 to a $3.5 million target for 2025, cash flow gaps caused by 40-day payment terms and milestone billing cycles became a barrier to scaling.

SouthStar Capital provided a strategic A/R Factoring solution, allowing…

SouthStar Capital Provides $100,000 Accounts Receivable Facility to Stabilize St …

Image: https://www.abnewswire.com/uploads/911a474343589a1527163df1d67a8eca.png

SouthStar Capital is excited to provide a $100,000 Accounts Receivable (A/R) facility to support the launch of a newly established staffing company. The company was spun off from a successful medical staffing business, which thrived during the COVID-19 pandemic by meeting the urgent demand for medical personnel. However, as the pandemic's impact lessened, the original business faced a slowdown, with one major debtor accounting for 80% of their accounts…