Press release

Automotive Usage-based Insurance Market to Reach US$ 270.3 Bn by 2032 - Persistence Market Research

Overview of the Automotive Usage-Based Insurance MarketThe global automotive usage-based insurance market is poised for significant growth. As of 2025, the market is estimated to reach a value of US$ 69.8 billion, with projections indicating it will grow at a CAGR of 21.3% to reach US$ 270.3 billion by 2032. The primary growth drivers behind this expansion include the increasing adoption of connected vehicles and telecommunications technologies. The integration of telematics allows insurers to monitor driving behaviors in real time, offering personalized insurance premiums that align with actual vehicle usage. Moreover, rising concerns about road safety, fuel efficiency, and the increasing demand for customized pricing models have made UBI a more attractive option for both insurers and consumers alike.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/29038

The leading market segment is the pay-how-you-drive (PHYD) model, which is expected to capture a dominant 46.8% market share in 2025. This model benefits from the increasing affordability and availability of telematics technology, allowing insurers to track driving behaviors in real time. As for geographical dominance, North America is set to lead the market, accounting for 36.4% of the market share in 2025, driven by the widespread adoption of telematics technology and government-backed initiatives to improve vehicle safety and data transparency.

Key Highlights from the Report

• The global automotive usage-based insurance market is set to reach US$ 69.8 billion by 2025.

• The pay-how-you-drive (PHYD) model is projected to dominate the market with a 46.8% market share in 2025.

• North America is expected to hold a 36.4% market share in 2025, owing to its advanced telematics infrastructure.

• Passenger vehicles are projected to hold a 68.5% share in 2025, driven by high consumer demand for personalized insurance.

• The market is growing at a CAGR of 21.3% from 2025 to 2032.

• Companies like Progressive Insurance and Allstate are leading the charge with new UBI program innovations.

Market Segmentation

• By Type

The automotive UBI market is segmented by the type of pricing model adopted by insurers. Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD) are the most popular models. PAYD charges drivers based on the number of miles driven, while PHYD adjusts premiums according to driving behavior. The PHYD model is especially gaining traction as it uses telematics to track real-time driving data, offering customers incentives for safe driving habits.

• By Vehicle Type

The market is also segmented by vehicle type. Passenger vehicles are projected to dominate the market, holding a 68.5% share in 2025. This is largely due to the growing consumer interest in personalized insurance products that offer discounts based on driving habits. The increasing adoption of connected vehicles equipped with telematics devices is making UBI more accessible to a larger number of consumers. Additionally, the commercial vehicle segment is expected to grow as fleet management companies seek more efficient ways to monitor driver behavior and manage insurance costs.

Regional Insights

• North America

North America is set to continue its dominance in the automotive UBI market. With the widespread use of telematics in vehicles and strong government support for data-driven insurance models, the region is expected to account for 36.4% of the market share in 2025. The U.S. is a key player, as more than 25 million vehicles were telematically connected in 2023. Companies like Progressive and Allstate are leveraging telematics technology to provide real-time feedback and cost savings for UBI consumers, further accelerating market growth.

• Europe

Europe is also a significant player in the global UBI market, with an anticipated 28.7% market share in 2025. The region benefits from strict regulations regarding vehicle safety and insurance, including mandatory technologies like eCall in the European Union and ERA-GLONASS in Russia. The adoption of embedded telematics systems in vehicles, along with initiatives from companies like AXA Insurance and Generali, is further driving growth. Europe's focus on sustainability, safety, and personalized insurance solutions positions it as a leading region for UBI adoption.

Market Drivers

The primary drivers of growth in the automotive usage-based insurance market are technological advancements and increasing consumer demand for personalized insurance products. Telematics technology, which allows insurers to gather real-time data on driving behavior, is the backbone of UBI programs. As the technology becomes more affordable and widespread, more consumers are opting for usage-based insurance policies. Moreover, government initiatives and regulatory support for telematics in regions like North America and Europe are accelerating UBI adoption.

Additionally, increasing concerns regarding safety are driving the adoption of UBI. Insurance companies that offer UBI can reward safe driving, thereby promoting better road behavior. This has led to higher customer retention, increased profitability, and a reduction in accident rates, which makes UBI an attractive solution for both insurers and consumers.

Market Restraints

Despite the significant growth potential, the automotive UBI market faces several challenges. One of the key barriers is the increasing risk of data breaches. With telematics systems collecting sensitive driving data, concerns regarding data privacy and security have emerged. High-profile data breaches in the insurance industry have made consumers wary of adopting UBI policies. Additionally, the regulatory landscape is still evolving, with inconsistent rules across different states and regions complicating the implementation of UBI programs.

Another restraint is the complexity of telematics installation in older vehicles. While newer vehicles come equipped with telematics devices, many older models do not. This creates a gap in the market, as consumers with older vehicles may be less inclined to adopt UBI programs unless the installation process becomes more straightforward.

Market Opportunities

There are several growth opportunities in the automotive usage-based insurance market. Smartphone integration in the automotive sector is one such opportunity. With the increasing adoption of smartphones globally, insurers can leverage smartphone-based UBI systems to lower installation costs and enhance accessibility. Mobile apps equipped with GPS and sensors can accurately track driving behavior, providing a more cost-effective way for consumers to adopt UBI policies.

Additionally, regulatory support for technology-driven insurance models is expected to continue fueling the market. Governments in North America and Europe are increasingly mandating the use of telematics in vehicles, and insurance companies are adapting their products accordingly. This regulatory backing helps drive innovation and ensures the long-term growth of the UBI market.

Frequently Asked Questions (FAQs)

• How Big is the Automotive Usage-based Insurance Market?

• Who are the Key Players in the Global Market for Automotive Usage-based Insurance?

• What is the Projected Growth Rate of the Automotive Usage-based Insurance Market?

• What is the Market Forecast for the Automotive Usage-based Insurance Market in 2032?

• Which Region is Estimated to Dominate the Automotive Usage-based Insurance Industry through the Forecast Period?

Company Insights

Key players in the automotive usage-based insurance market include:

• Progressive Corporation

• Allstate Corporation

• State Farm Mutual Automobile Insurance Company

• Liberty Mutual Insurance

• Nationwide Mutual Insurance Company

• American Family Insurance

• Esurance

• Metromile

• Root Insurance

• Aviva

Recent Developments

• In October 2023, Progressive Insurance partnered with General Motors to integrate OnStar telematics into its Snapshot UBI program.

• In November 2023, Allstate introduced Drivewise+, an advanced telematics solution combining safety warnings and accident prevention features.

With the automotive usage-based insurance market expected to continue its growth trajectory, the integration of telematics, smartphone technology, and government support is paving the way for significant industry transformation. Companies are positioning themselves to meet consumer demand for personalized and tech-driven insurance solutions, making this market an exciting area of development in the coming years.

Explore the Latest Trending "Exclusive Article" @

• https://apnewswire.hashnode.dev/high-purity-alumina-market-sees-rising-demand-in-electronics

• https://apnewswire.quora.com/High-Purity-Alumina-market-Poised-for-Strong-Expansion-by-2032-1

• https://issuu.com/fmrresearch/docs/high_purity_alumina_market_rises_with_increased_sm

• https://apnewsmedia.stck.me/post/865983/High-Purity-Alumina-Market-Strengthens-with-Green-Energy-Adoption

• https://hackmd.io/@apnewswire/r1ka2uc31g

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Usage-based Insurance Market to Reach US$ 270.3 Bn by 2032 - Persistence Market Research here

News-ID: 3930197 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

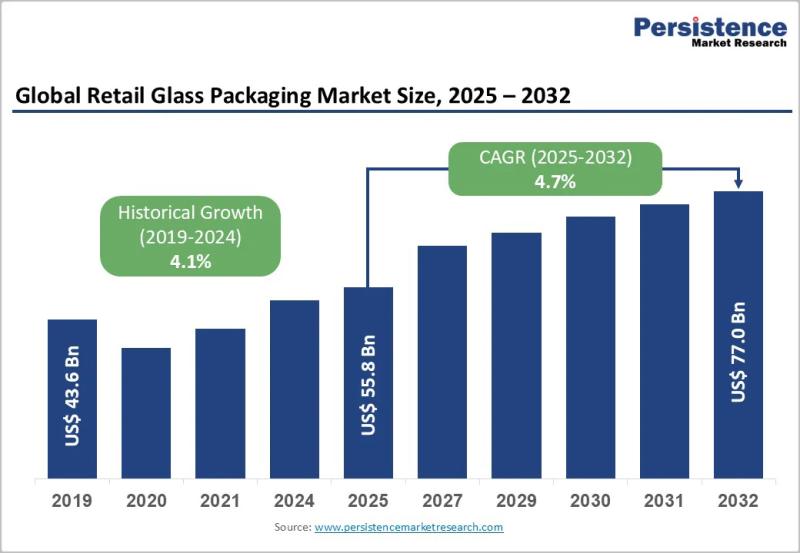

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…