Press release

Blockchain in the Energy Industry Forecasted to Grow at a 25.6% CAGR, Surpassing US$ 37.4 Bn by 2032 | Persistence Market Research

The integration of blockchain technology into the energy industry has emerged as a transformative development, helping streamline operations, increase transparency, and reduce costs across various sectors. Blockchain, initially known for its use in cryptocurrency transactions, is now finding significant applications in energy trading, supply chain management, and decentralized energy systems. The market for blockchain in the energy industry is expected to grow at an impressive compound annual growth rate (CAGR) of 25.6%, surpassing US$ 37.4 billion by 2032. This substantial growth is fueled by the increasing need for secure, transparent, and efficient systems to manage the complexities of energy transactions and distribution.The key drivers of this market include the increasing demand for transparency, the need to optimize energy management, and the growing adoption of decentralized energy models. Blockchain offers the energy industry a solution to improve the traceability of transactions, enhance grid management, and enable peer-to-peer energy trading. The leading segment in this market is energy trading, where blockchain's ability to provide secure, real-time, and decentralized transactions is revolutionizing how energy is bought and sold. Geographically, North America is leading the charge in blockchain adoption in the energy sector, largely due to its robust infrastructure, significant investments in technology, and forward-thinking regulatory frameworks.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/33754

➢Key Highlights from the Report

• Blockchain in the energy industry is expected to surpass US$ 37.4 billion by 2032.

• The market is projected to grow at a 25.6% CAGR between 2025 and 2032.

• Energy trading is the leading segment, driving blockchain adoption in the sector.

• North America holds the largest market share due to advanced infrastructure and regulations.

• Increasing demand for transparency and efficiency in energy management is boosting market growth.

• Blockchain's role in decentralized energy systems is expected to expand significantly.

➢Market Segmentation

The blockchain in the energy industry market is segmented based on application, technology type, and end-user. The major applications of blockchain in the energy sector include energy trading, grid management, supply chain monitoring, and decentralized energy solutions. Among these, energy trading is expected to dominate the market, as blockchain offers a secure and efficient way to conduct peer-to-peer energy transactions. With the rise of renewable energy sources, blockchain's ability to enable transparent, real-time trading is a major draw for energy providers and consumers alike.

In terms of technology, blockchain solutions for energy applications are primarily categorized into public blockchain, private blockchain, and hybrid blockchain models. Public blockchain solutions are more decentralized and transparent, which is ideal for energy trading and peer-to-peer transactions. Private blockchain solutions, on the other hand, are more suited for grid management and supply chain applications where privacy and control are prioritized. End-users of blockchain in the energy industry include utility companies, energy producers, and consumers, each benefiting from the transparency, efficiency, and cost-saving capabilities that blockchain provides.

✅ Regional Insights

North America leads the global blockchain in the energy industry market, with the United States and Canada adopting blockchain technology rapidly within their energy sectors. The region's strong technological infrastructure, regulatory support for innovation, and focus on reducing energy costs and enhancing grid management are driving blockchain adoption. North America is also home to several energy trading platforms that have incorporated blockchain for greater transparency and efficiency, further boosting the growth of the market.

The European market is also witnessing significant growth in the blockchain energy sector, particularly driven by the European Union's focus on renewable energy integration and sustainable practices. Several European countries, including Germany and the Netherlands, are adopting blockchain for energy trading platforms and decentralized energy management systems. Moreover, blockchain is being integrated into the region's efforts to reduce carbon emissions and improve energy efficiency, with many governments and energy organizations exploring blockchain's potential for a more transparent and decentralized energy market.

✅ Market Drivers

One of the major drivers of blockchain adoption in the energy industry is the increasing need for transparency in energy transactions. Traditional energy trading systems often involve multiple intermediaries, leading to inefficiencies, delays, and higher transaction costs. Blockchain's decentralized nature allows for secure, transparent, and real-time tracking of energy transactions, eliminating the need for intermediaries. This reduces transaction costs, increases trust among parties, and ensures the authenticity of data, which is crucial in energy trading.

Additionally, blockchain offers a solution for efficient grid management. Blockchain-enabled smart grids can help automate energy distribution, monitor energy consumption, and predict energy demands more accurately. By utilizing blockchain, utilities can better manage energy resources and reduce inefficiencies caused by power outages or supply-demand imbalances. The integration of blockchain into grid management will lead to more reliable, cost-effective, and sustainable energy systems, driving the market's growth.

✅ Market Restraints

Despite its numerous advantages, the adoption of blockchain technology in the energy industry faces several challenges. One significant restraint is the high initial cost of implementation. Setting up blockchain systems requires significant investment in infrastructure, technology, and training, which can be a barrier for smaller companies or energy providers with limited budgets. Additionally, the complexity of blockchain technology and the need for skilled professionals to manage and maintain these systems can further complicate widespread adoption.

Another challenge is regulatory uncertainty. Although blockchain holds immense potential for transforming the energy industry, many countries have yet to establish comprehensive regulations regarding its use in energy trading and grid management. The lack of standardized frameworks could create hurdles in the global expansion of blockchain-based energy solutions. Furthermore, energy markets are often highly regulated, and integrating blockchain into existing regulatory structures may take time and require significant adjustments.

✅ Market Opportunities

The growing demand for renewable energy presents a significant opportunity for blockchain in the energy sector. As renewable energy sources such as solar and wind become more prevalent, managing the distribution and tracking of energy produced by these sources becomes increasingly complex. Blockchain offers a solution for efficiently managing decentralized energy production, allowing consumers to buy and sell energy directly, and ensuring the transparency and traceability of renewable energy sources.

Additionally, the rise of decentralized energy systems, such as microgrids, presents a growing market opportunity for blockchain. Blockchain technology can facilitate peer-to-peer energy trading, allowing consumers to exchange surplus energy produced by renewable sources. This decentralized model reduces reliance on traditional utilities and provides consumers with greater control over their energy usage. The ability to securely and transparently track and verify these transactions using blockchain is a key opportunity for market players to explore.

➢Reasons to Buy the Report

✔ Comprehensive market analysis with forecasts up to 2032.

✔ In-depth segmentation of blockchain solutions in the energy industry.

✔ Identification of key market drivers, challenges, and growth opportunities.

✔ Regional analysis of blockchain adoption trends and key markets.

✔ Overview of leading players and competitive strategies in the blockchain energy sector.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/33754

➢Frequently Asked Questions (FAQs)

How Big is the Blockchain in the Energy Industry Market?

Who are the Key Players in the Blockchain in the Energy Industry Market?

What is the Projected Growth Rate of the Blockchain in the Energy Industry Market?

What is the Market Forecast for Blockchain in the Energy Industry by 2032?

Which Region is Estimated to Dominate the Blockchain in the Energy Industry Market through the Forecast Period?

➢Company Insights

Key players operating in the blockchain in the energy industry market include:

• IBM

• Infosys

• SAP

• Microsoft

➢Recent Developments:

1. Power Ledger has partnered with energy providers in Australia to deploy blockchain-based solutions for peer-to-peer energy trading, improving energy efficiency and lowering costs for consumers.

2. IBM Corporation has launched a blockchain-based energy trading platform in collaboration with major energy companies, enabling secure and transparent energy transactions across global markets.

In conclusion, the integration of blockchain technology into the energy industry is a growing trend that promises to transform energy management, trading, and distribution. With the significant potential for cost savings, improved transparency, and the rise of decentralized energy models, the blockchain market in the energy sector is poised for exponential growth. Despite the challenges, including regulatory hurdles and high implementation costs, blockchain presents a compelling opportunity for both established and emerging players to innovate and lead in the global energy market.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain in the Energy Industry Forecasted to Grow at a 25.6% CAGR, Surpassing US$ 37.4 Bn by 2032 | Persistence Market Research here

News-ID: 3928655 • Views: …

More Releases from Persistence Market Research

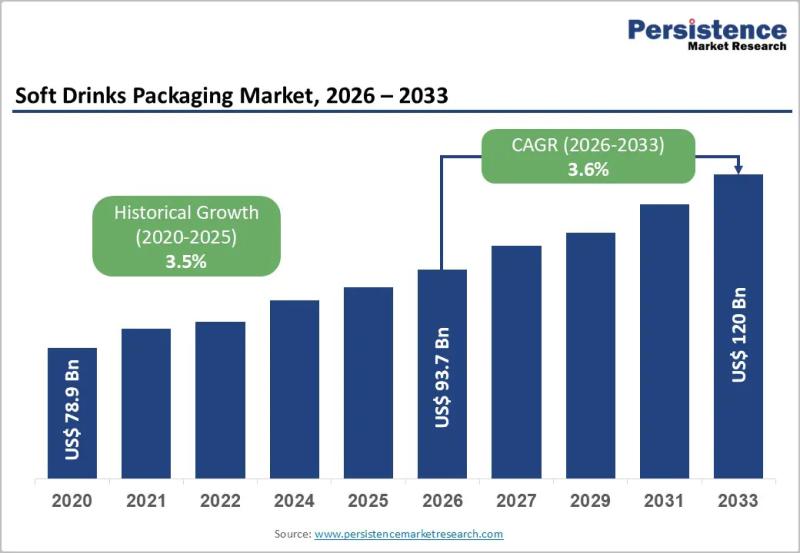

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

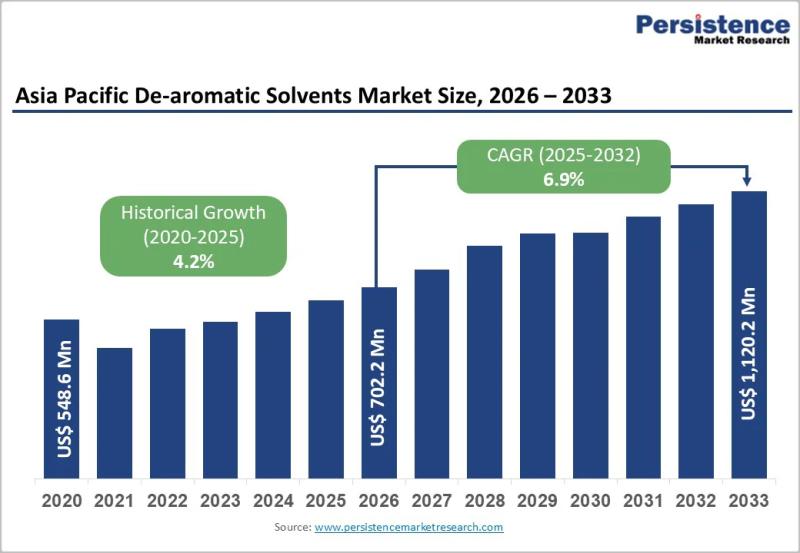

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Blockchain

Blockchain-Enabled Logistics Platforms Market Is Booming So Rapidly | Major Gian …

HTF MI recently introduced Global Blockchain-Enabled Logistics Platforms Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2033). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major companies in Blockchain-Enabled Logistics Platforms Market are:

IBM Blockchain, Oracle Blockchain, SAP Blockchain, VeChain, Modum, ShipChain, OriginTrail, Waltonchain, CargoX, Ambrosus,…

Pharmaceutical Blockchain Market to Witness Impressive Growth by 2030: IBM Block …

According to HTF Market Intelligence, the Pharmaceutical Blockchain market to witness a CAGR of 55% during the forecast period (2024-2030).The Latest published a market study on Global Pharmaceutical Blockchain Market provides an overview of the current market dynamics in the Global Pharmaceutical Blockchain space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2030. The study breaks the market by revenue and…

FinTech Blockchain Market Is Booming Worldwide | Ripple, Guardtime, Cambridge Bl …

FinTech Blockchain Market: The extensive research on FinTech Blockchain Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on FinTech Blockchain Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as market rate, estimated…

Blockchain Security Market Set for Explosive Growth | DMG Blockchain Solutions, …

Global Blockchain Security Market Growth (Status and Outlook) 2021-2026 is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Blockchain Security Market. Some of the key players profiled in the study are Oracle, IBM, Kaspersky, Gemalto,…

Impact of Outbreak of Coronavirus (Covid-19) on Blockchain in IOT Market by 2027 …

The Blockchain in IOT market is expected to garner $6000 million and rise at a CAGR of 70% during the forecast period from 2019 to 2027.

A new market report titled “Blockchain in IOT Market” has been added to the repository of Research N Reports. This report provides comprehensive assessment of the current trends, restrains and futuristic opportunities, which are anticipated to provide lucrative avenues for market proliferation. An in-depth description…

Oodles Blockchain Uses Top Blockchain Platforms To Expedite Blockchain Adoption

With an aim to leverage the blockchain technology to change the centralized system and make it decentralized, Oodles Blockchain has decided to use top blockchain platforms to develop consumer-based blockchain applications.

Oodles Blockchain, a micro-website of Oodles Technologies, developed mainly to focus on blockchain technology, is delighted to announce that it will be expanding its horizon of blockchain development services by using a few latest open source blockchain platforms like…