Press release

Consumer Mobile Payments Soar to US$3.84 Trillion by 2031, 28.9% Growth | Persistence Market Research Analysis

The consumer mobile payments market has experienced significant growth, driven by the increasing reliance on smartphones, digital wallets, and contactless payment systems. As consumers increasingly shift towards mobile solutions for everyday transactions, the market is witnessing rapid expansion. The transition from traditional payment methods, such as cash and cards, to mobile payments is reshaping the global retail and financial landscape. This article provides a detailed analysis of the market, its growth drivers, trends, and future projections.The global Consumer Mobile Payments Market is projected to grow from USD 2.98 trillion in 2024 to USD 3.84 trillion by 2031, at a 28.9% CAGR. The market is driven by the increasing adoption of smartphones, rising digital transactions, and the growing preference for contactless payments. Advancements in fintech, secure payment gateways, and government initiatives promoting cashless economies further fuel growth. The expansion of e-commerce, peer-to-peer transfers, and mobile wallets is enhancing convenience and accessibility, making mobile payments a crucial component of the global financial ecosystem.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/14995

Overview of the Market

The consumer mobile payments market refers to the use of smartphones, digital wallets, and mobile applications for making purchases or transferring funds. The market has evolved considerably with the rise of e-commerce, enabling consumers to make quick and secure payments from the convenience of their mobile devices. According to recent reports, the market is expected to grow exponentially, fueled by factors such as the adoption of smartphones, enhanced mobile payment security, and the shift towards cashless economies. The rapid growth of e-commerce platforms has played a critical role in driving mobile payment adoption, offering consumers a seamless shopping experience.

Key growth drivers for this market include the increasing use of smartphones, the rise of contactless payment solutions, and the growing preference for digital transactions. The adoption of mobile wallets such as Apple Pay, Samsung Pay, and Google Wallet, along with the implementation of mobile point-of-sale (mPOS) systems by retailers, is further boosting the market's growth. Among the leading geographical regions, North America and Asia-Pacific are witnessing the highest adoption rates due to the widespread use of smartphones and high internet penetration rates in these regions. Moreover, developing economies are seeing a rapid surge in mobile payment adoption, driven by the increased availability of mobile devices and internet access.

Key Highlights from the Report:

• The global consumer mobile payments market is projected to experience significant growth over the forecast period.

• E-commerce boom and the push toward a cashless economy are key drivers for market expansion.

• Contactless payment solutions such as mobile wallets and NFC technology are becoming increasingly popular.

• North America and Asia-Pacific regions are expected to dominate the market in terms of adoption and revenue.

• Retail is the leading industry segment driving the growth of the mobile payments market.

• Increased demand for mobile payment solutions is being driven by the millennial generation's preference for mobile-based transactions.

Market Segmentation

The consumer mobile payments market can be segmented into various categories, including end-use industry, payment method, and geographic region. The market is primarily divided into retail, hospitality, IT and telecommunications, BFSI (Banking, Financial Services, and Insurance), healthcare, and media & entertainment industries. Among these, the retail sector dominates the market, accounting for the largest share of mobile payments transactions due to the widespread adoption of contactless payment methods.

Another important segmentation is based on the mode of payment. The most common modes of payment include remote payments, peer-to-peer (P2P) payments, m-commerce (mobile commerce), proximity payments, near-field communication (NFC), and barcode-based payments. Remote payments and P2P transactions have seen significant growth, as they allow users to transfer funds instantly via mobile applications, such as Venmo, PayPal, and Google Pay.

Regional Insights

North America

In North America, particularly in the United States, the consumer mobile payments market has seen substantial growth due to the widespread adoption of smartphones and digital payment solutions. Major players, such as Apple, PayPal, and Samsung, have contributed to the proliferation of mobile payments through their respective platforms. Furthermore, the increasing consumer demand for faster and more secure payment methods is driving the growth of the market in this region.

Asia-Pacific

The Asia-Pacific region is expected to witness the fastest growth in the consumer mobile payments market. This region benefits from a high smartphone penetration rate and a large number of mobile-first consumers. Countries such as China, India, and Japan are leading the way in adopting mobile payments, with platforms like Alipay and WeChat Pay becoming integral to daily life. In addition, developing economies in the region are experiencing a surge in mobile payment adoption, further boosting the market's growth potential.

Market Drivers

One of the primary drivers of the consumer mobile payments market is the rapid increase in smartphone usage. As smartphones become ubiquitous, mobile payments have become more accessible, allowing consumers to complete transactions conveniently through mobile apps. Additionally, the rise of e-commerce has created a demand for seamless online and offline payment methods, which mobile payments fulfill perfectly. The contactless nature of mobile payments also enhances consumer convenience, reducing transaction times and eliminating the need for physical cash or cards.

Another important factor contributing to the market's growth is the growing consumer preference for digital wallets. These wallets offer increased security, efficiency, and ease of use compared to traditional payment methods. Major mobile payment platforms are also continuously upgrading their security features, including biometric authentication and tokenization, to enhance trust and mitigate security concerns.

Market Restraints

Despite its rapid growth, the consumer mobile payments market faces challenges, particularly regarding security. High-profile security breaches and concerns about data theft have led to hesitance among some consumers in fully embracing mobile payment solutions. As mobile payments rely heavily on digital platforms and cloud-based systems, any vulnerability in these systems can lead to significant financial losses and damage to consumer trust.

Additionally, the lack of universal standards for mobile payments can create interoperability issues between different platforms and devices, hindering the growth of the market. Some consumers and merchants may be reluctant to adopt mobile payments due to concerns about compatibility or transaction fees.

Market Opportunities

The consumer mobile payments market presents significant opportunities for growth, particularly in developing regions. As mobile internet penetration increases in countries like India, Brazil, and Southeast Asia, there is a vast untapped potential for mobile payment solutions. Mobile-first consumers in these regions are increasingly relying on smartphones for everyday transactions, creating a growing market for mobile payment services.

Another opportunity lies in the expansion of mobile payment solutions into new industries, such as healthcare and education. By enabling payments for medical services or tuition fees via mobile platforms, these sectors can improve customer satisfaction and streamline payment processes.

Reasons to Buy the Report

✔ Gain a comprehensive understanding of the consumer mobile payments market's current landscape and future growth prospects.

✔ Analyze key market trends, growth drivers, and challenges in the industry.

✔ Discover valuable insights into the regional performance of the market and identify emerging opportunities.

✔ Understand the segmentation of the market, including payment methods, end-use industries, and geographic regions.

✔ Evaluate the competitive landscape, including the key players in the market and their strategic initiatives.

Frequently Asked Questions (FAQs)

How Big is the Consumer Mobile Payments Market?

Who are the Key Players in the Global Consumer Mobile Payments Market?

What is the Projected Growth Rate of the Market?

What is the Market Forecast for Consumer Mobile Payments for 2032?

Which Region is Estimated to Dominate the Consumer Mobile Payments Industry through the Forecast Period?

Company Insights

Key Players:

• Apple Inc.

• Samsung Electronics Co., Ltd

• PayPal Holdings, Inc.

• Fiserv, Inc.

• Google Inc.

• Square, Inc.

Recent Developments:

1. Apple Pay expanded its services to include more countries, increasing its global reach.

2. Samsung introduced new security features, including biometric authentication, to enhance the security of mobile payments on its platform.

Conclusion

The consumer mobile payments market is on the brink of significant expansion. With growing adoption of smartphones, the rise of e-commerce, and the increasing preference for contactless payment methods, the market is expected to continue its rapid growth in the coming years. Key players are investing in improving security and expanding their offerings to tap into emerging regions, particularly in Asia-Pacific. By understanding the key trends, drivers, and challenges, businesses can make informed decisions in this dynamic and fast-paced industry.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Consumer Mobile Payments Soar to US$3.84 Trillion by 2031, 28.9% Growth | Persistence Market Research Analysis here

News-ID: 3927161 • Views: …

More Releases from Persistence Market Research

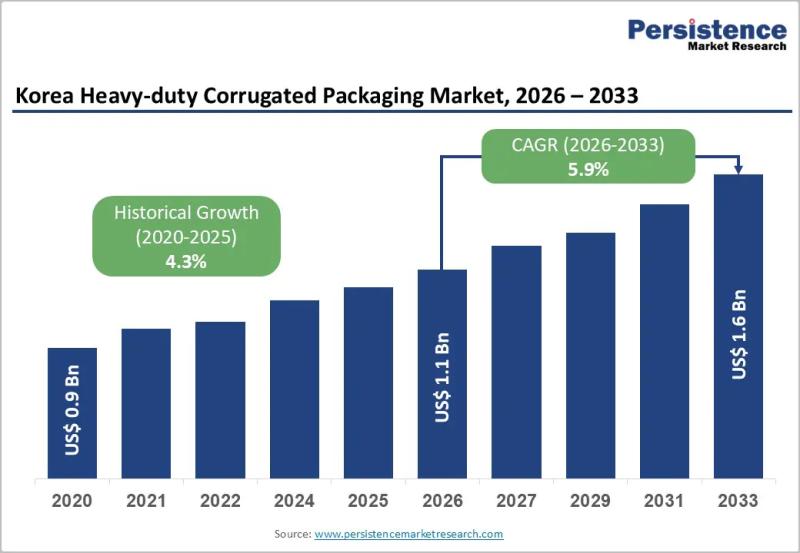

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…