Press release

Supply Chain Finance Market Growth is Driven by Liquidity Management Needs | Prominent Players: J.P. Morgan Chase, HSBC, Standard Chartered, Wells Fargo, Banco Santander

The Global Supply Chain Finance Market reached USD 1.5 billion in 2022 and is expected to reach USD 4.0 billion by 2030, growing with a CAGR of 13.0% during the forecast period 2024-2031.The Supply Chain Finance market report provides in-depth insights and analysis on key market trends, growth opportunities, and emerging challenges. With a commitment to delivering actionable intelligence, DataM Intelligence empowers businesses to make informed decisions and stay ahead of the competition. Leveraging a combination of qualitative and quantitative research methods, the company offers comprehensive reports that help clients navigate complex market landscapes, drive strategic growth, and seize new opportunities in an ever-evolving global market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/supply-chain-finance-market?ophp

Supply chain finance refers to the use of financial products and services to optimize the flow of capital within a company's supply chain, enabling suppliers to receive early payments. The supply chain finance market is growing due to the increasing complexity of global supply chains, the demand for liquidity management, and the need for more efficient payment systems for businesses.

Market Dynamics

✦ Growth of SMEs

The expansion of SMEs worldwide is expected to drive the growth of the supply chain finance market. The International Finance Corporation estimates that approximately 40% of formal micro, small, and medium enterprises in developing countries face an unmet financing gap of US$5.2 trillion each year. This financing challenge is especially prominent in regions such as Southeast Asia, Latin America, and the Caribbean.

Growth Driver-Supply Chain Finance Market

✦ Need for liquidity management

✦ Global supply chain complexities

✦ Technological advancements

List of the Key Players in the Supply Chain Finance Market:

Citibank, J.P. Morgan Chase, HSBC, Standard Chartered, Wells Fargo, Banco Santander, BNP Paribas, Deutsche Bank oracle and Taulia.

Key Developments in Supply Chain Finance Market

✦ In March 2023, Energy Company Eni has introduced a Sustainable Supply Chain Finance Program aimed at promoting sustainable development within its energy supply chain. Through this initiative, Eni's suppliers are given the opportunity to request advanced payment of invoices if they commit to sustainable development practices. Eni's digital platform, Open-es, facilitates supplier participation by focusing on environmental, social and governance (ESG) performance improvement

✦ In August 2023, Emirates Development Bank and Trade Capital Partners have joined forces to introduce supply chain finance and working capital solutions for Small and Medium-sized Enterprises in UAE. By leveraging the expertise of EDB and the platform provided by Trade Capital Partners, the partnership aims to extend financing solutions to a broader range of businesses, aligning with UAE's emphasis on supporting SME growth and fostering innovation. The partnership with EDB will offer substantial support to this ecosystem and provide trade finance alternatives that can contribute to the expansion of these growing businesses.

Make an Enquiry for purchasing this Report @ https://www.datamintelligence.com/enquiry/supply-chain-finance-market?ophp

Segment Covered in the Supply Chain Finance Market:

➠By Provider (Banks, Trade Finance Houses, Others)

➠By Offering (Letter of Credit, Export and Import Bills, Performance Bonds, Shipping Guarantees, Others)

➠By Application (Domestic, International)

➠By End-User (Large Enterprises, Small and Medium-sized Enterprises)

Research Methodology:

Our research methodology combines both qualitative and quantitative approaches to provide you with a thorough market analysis. We begin by gathering data from trusted industry reports and databases (secondary research), followed by primary research through surveys and interviews with key experts. We then apply advanced statistical tools to analyze the data, uncover trends, and assess market dynamics. Additionally, we use market segmentation and Porter's Five Forces analysis to evaluate competition. This approach ensures that the insights we provide are reliable, actionable, and tailored to support your decision-making process.

This Report Covers:

✔ Go-to-market Strategy.

✔ Neutral perspective on the market performance.

✔Development trends, competitive landscape analysis, supply side analysis, demand side analysis, year-on-year growth, competitive benchmarking, vendor identification, Market Access, and other significant analysis, as well as development status.

✔Customized regional/country reports as per request and country level analysis.

✔ Potential & niche segments and regions exhibiting promising growth covered.

✔ Analysis of Market Size (historical and forecast), Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM), Market Growth, Technological Trends, Market Share, Market Dynamics, Competitive Landscape and Major Players (Innovators, Start-ups, Laggard, and Pioneer).

Regional Analysis for Supply Chain Finance Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Top-down and bottom-up approach for regional analysis

➡ Porter's five forces model gives an in-depth analysis of buyers and suppliers, threats of new entrants & substitutes and competition amongst the key market players.

➡ By understanding the value chain analysis, the stakeholders can get a clear and detailed picture of this Market

Speak to Our Senior Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/supply-chain-finance-market?ophp

Frequently asked questions:

➠ What is the global sales value, production value, consumption value, import and export of Supply Chain Finance market?

➠ Who are the global key manufacturers of the Supply Chain Finance Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

➠ What are the Supply Chain Finance market opportunities and threats faced by the vendors in the global Supply Chain Finance Industry?

➠ Which application/end-user or product type may seek incremental growth prospects? What is the market share of each type and application?

➠ What focused approach and constraints are holding the Supply Chain Finance market?

➠ What are the different sales, marketing, and distribution channels in the global industry?

Purchase this premium report: https://www.datamintelligence.com/buy-now-page?report=supply-chain-finance-market?ophp

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market Growth is Driven by Liquidity Management Needs | Prominent Players: J.P. Morgan Chase, HSBC, Standard Chartered, Wells Fargo, Banco Santander here

News-ID: 3924763 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Bio-Imaging Technologies Market to Reach US$ 17.60 Billion by 2031 | CAGR 15.3% …

Market Overview

The Global Bio-imaging Technologies Market reached US$ 5.94 billion in 2023 and is projected to reach US$ 17.60 billion by 2031, growing at a CAGR of 15.3% during 2024-2031. Bio-imaging technologies enable non-invasive visualization of biological processes, allowing researchers, clinicians, and pharmaceutical developers to observe live cellular and molecular events with minimal interference. These technologies provide critical 3D structural information and functional insights for applications in drug discovery, diagnostics,…

United States Green Coatings Market to Grow at 4.1% CAGR by 2031; Asia-Pacific L …

Market Overview

The Global Green Coatings Market is projected to grow at a CAGR of 4.1% during the forecast period 2024-2031. Green coatings are increasingly used for decoration and surface protection across industries such as industrial, automotive, and packaging coatings, with demand surging particularly in the Asia Pacific region.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/green-coatings-market?Juli

Green coatings are formulated from natural and renewable sources…

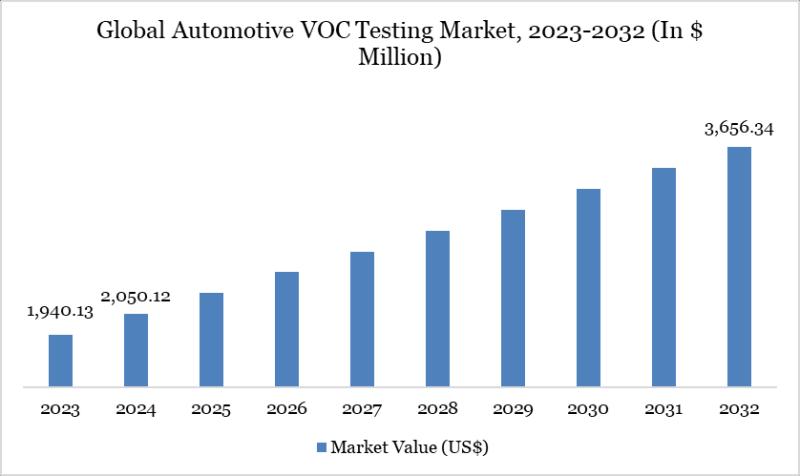

Automotive VOC Testing Market to Reach US$ 3,656.34 Billion by 2032 at 7.5% CAGR …

Market Overview

The Global Automotive VOC Testing Market reached US$ 2,050.12 million in 2024 and is projected to reach US$ 3,656.34 million by 2032, growing at a CAGR of 7.5% during the forecast period 2025-2032. The market growth is driven by increasingly stringent environmental regulations, growing consumer awareness about vehicle emissions, and the automotive industry's commitment to sustainability and low-emission vehicles.

Get a Free Sample PDF Of This Report (Get Higher Priority…

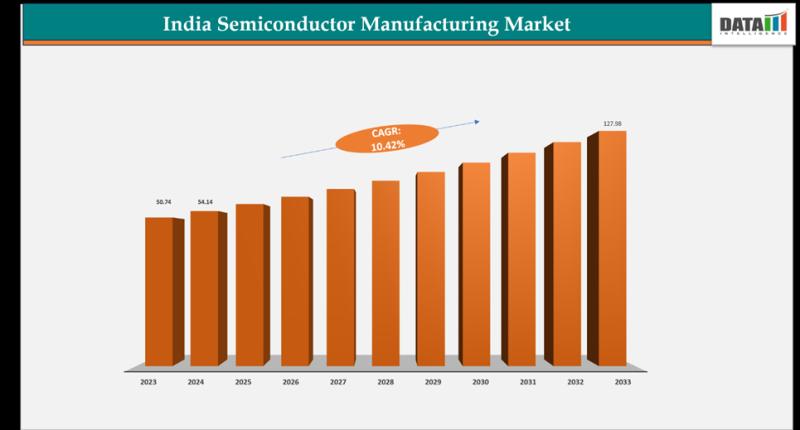

India Semiconductor Manufacturing Market to Reach US$ 132.11 Billion by 2033 at …

Market Overview

The India semiconductor manufacturing market reached US$ 49.41 billion in 2023, rising to US$ 54.14 billion in 2024, and is projected to reach US$ 132.11 billion by 2033, growing at a CAGR of 10.42% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/india-semiconductor-manufacturing-market?Juli

The market growth is being fueled by:

Rising domestic demand for electronic devices, including smartphones, laptops, consumer electronics,…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…