Press release

Microfinance Market Growth is Driven by Financial Inclusion | Key Players: FINCA International, ASA International, Opportunity International, BancoSol and Equitas Small Finance Bank.

The Global Microfinance Market reached USD 217.6 billion in 2022 and is expected to reach USD 483.6 billion by 2030, growing with a CAGR of 10.5% during the forecast period 2024-2031.The Microfinance market report provides in-depth insights and analysis on key market trends, growth opportunities, and emerging challenges. With a commitment to delivering actionable intelligence, DataM Intelligence empowers businesses to make informed decisions and stay ahead of the competition. Leveraging a combination of qualitative and quantitative research methods, the company offers comprehensive reports that help clients navigate complex market landscapes, drive strategic growth, and seize new opportunities in an ever-evolving global market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/microfinance-market?ophp

Microfinance refers to the provision of small loans and financial services to individuals or small businesses in underserved areas. The microfinance market is growing, fueled by the increasing focus on financial inclusion, the demand for entrepreneurial support in developing regions, and the rise of digital platforms that make micro-lending more accessible.

Forecast Growth Projected:

The Global Microfinance Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Market Dynamics

✦ SME Growth Drives Expansion of Microfinance Institutions in Developing Countries

The rapid growth of SMEs worldwide is expected to accelerate the expansion of microfinance services in developing nations, where traditional infrastructure often lags behind. SMEs, crucial for job creation and economic development, face challenges in securing credit from established financial institutions. Microfinance institutions not only provide essential funding but also offer valuable support in business growth and development. They help SMEs diversify, access new markets, and strengthen their operations.According to an Investopedia study, small and medium enterprises account for approximately 95% of the global economy. Additionally, the International Finance Corporation estimates that nearly 40% of formal micro, small, and medium enterprises in developing countries face unmet financial needs totaling US$5.2 trillion annually.

Microfinance Market Growth Drivers

✦ Increasing focus on providing financial services to underserved populations

✦ Rise of mobile and digital banking platforms is making microloans more accessible to people in remote areas

✦ Microfinance institutions are playing a critical role in providing credit to small businesses and entrepreneurs

List of the Key Players in the Microfinance Market:

Grameen Bank, SKS Microfinance, BRAC, Compartamos Banco, Bandhan Bank, FINCA International, ASA International, Opportunity International, BancoSol and Equitas Small Finance Bank.

Key Developments in Microfinance Market

✦ In August 2023, Light Microfinance, a Gujarat-based NBFC (Non-Banking Financial Company), formed a strategic partnership with Chennai-based fintech firm IppoPay to enhance digital lending services for micro, small and medium enterprises (MSMEs) in rural and semi-urban micro-markets across Tamil Nadu andhra Pradesh, Telangana and Karnataka. IppoPay, backed by investors like Coinbase Ventures and Better Capital, specializes in offering payment solutions to approximately 400,000 merchants. The collaboration capitalizes on Light Microfinance's lending expertise and IppoPay's fintech platform, enabling the provision of MSME loans.

✦ In April 2023, AGAM International, a UK-based FinTech company, partnered with Bangladesh's Micro Finance Institution, SBK Foundation, to introduce the first Sharia-based digital microcredit product in Bangladesh. The Sharia finance product is aimed at individuals and small businesses in need of financial resources but lacking the collateral or credit history typically required for traditional loans.

✦ In March 2023, Leegality, a document infrastructure platform, launched Local Language eSign Interfaces to facilitate the expansion of digital paperwork processes, particularly in the micro-lending and banking sectors. The financial industry has witnessed a surge in the adoption of digital document execution, including electronic signatures and digital stamping, in recent years. Microfinance Institutions (MFIs), which serve customers with limited access to financial services, can benefit from Leegality's solution.

Make an Enquiry for purchasing this Report @ https://www.datamintelligence.com/enquiry/microfinance-market?ophp

Segment Covered in the Microfinance Market:

➡ By Service (Group and Individual Micro Credit, Leasing, Micro Investment Funds, Insurance, Savings and Checking Accounts, Others)

➡ By Provider(Banks, Non Banks)

➡ By Institution (Joint Liability Group, Self-Help Group, Grameen Bank Model, Rural Cooperatives)

➡ By End-User (Personal, Commercial)

Research Methodology:

Our research methodology combines both qualitative and quantitative approaches to provide you with a thorough market analysis. We begin by gathering data from trusted industry reports and databases (secondary research), followed by primary research through surveys and interviews with key experts. We then apply advanced statistical tools to analyze the data, uncover trends, and assess market dynamics. Additionally, we use market segmentation and Porter's Five Forces analysis to evaluate competition. This approach ensures that the insights we provide are reliable, actionable, and tailored to support your decision-making process.

This Report Covers:

✔ Go-to-market Strategy.

✔ Neutral perspective on the market performance.

✔Development trends, competitive landscape analysis, supply side analysis, demand side analysis, year-on-year growth, competitive benchmarking, vendor identification, Market Access, and other significant analysis, as well as development status.

✔Customized regional/country reports as per request and country level analysis.

✔ Potential & niche segments and regions exhibiting promising growth covered.

✔ Analysis of Market Size (historical and forecast), Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM), Market Growth, Technological Trends, Market Share, Market Dynamics, Competitive Landscape and Major Players (Innovators, Start-ups, Laggard, and Pioneer).

Regional Analysis for Microfinance Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Top-down and bottom-up approach for regional analysis

➡ Porter's five forces model gives an in-depth analysis of buyers and suppliers, threats of new entrants & substitutes and competition amongst the key market players.

➡ By understanding the value chain analysis, the stakeholders can get a clear and detailed picture of this Market

Speak to Our Senior Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/microfinance-market?ophp

Frequently asked questions:

➠ What is the global sales value, production value, consumption value, import and export of Microfinance market?

➠ Who are the global key manufacturers of the Microfinance Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

➠ What are the Microfinance market opportunities and threats faced by the vendors in the global Microfinance Industry?

➠ Which application/end-user or product type may seek incremental growth prospects? What is the market share of each type and application?

➠ What focused approach and constraints are holding the Microfinance market?

➠ What are the different sales, marketing, and distribution channels in the global industry?

For Direct Purchase: https://www.datamintelligence.com/buy-now-page?report=microfinance-market?ophp

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market Growth is Driven by Financial Inclusion | Key Players: FINCA International, ASA International, Opportunity International, BancoSol and Equitas Small Finance Bank. here

News-ID: 3924676 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

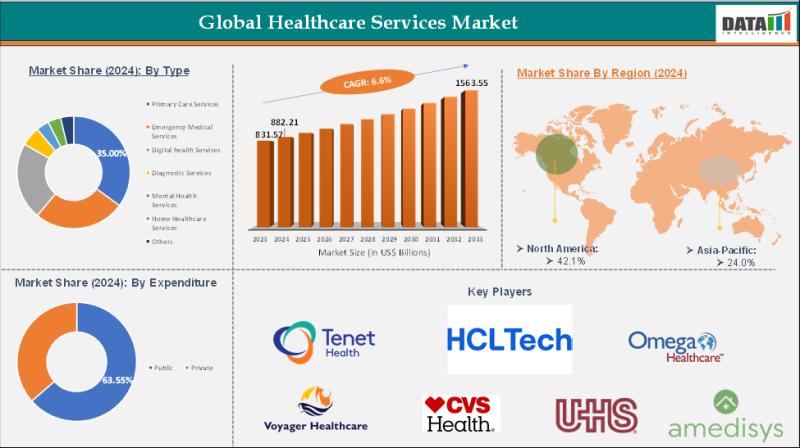

Healthcare Services Market to Reach US$ 1,563.55 Billion by 2033 | CAGR 6.6% | K …

The global healthcare services market reached US$ 831.57 Billion in 2023, rising to US$ 882.21 Billion in 2024, and is projected to reach US$ 1,563.55 Billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033. The global healthcare services market is witnessing substantial growth driven by demographic, technological, economic, and policy factors. The rising prevalence of chronic diseases and an aging population is fueling the demand…

United States Novel Drug Delivery System Market 2026 | Growth Drivers, Trends & …

Market Size and Growth

Global Novel Drug Delivery System Market reached US$ 12.6 billion in 2022 and is expected to reach US$ 55.7 billion by 2030, growing with a CAGR of 21.2% during the forecast period 2024-2031.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/novel-drug-delivery-system-market?sb

Key Development:

United States: Recent Novel Drug Delivery System Developments

✅ In February 2026, the FDA approved Eli Lilly's multi‐dose KwikPen version…

United States Steel Wire Rope Market 2026 | Growth Drivers, Trends & Market Fore …

Market Size and Growth

Global Steel Wire Rope market is expected to reach at a high CAGR during the forecast period 2024-2031.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/steel-wire-rope-market?sb

Key Development:

United States: Recent Industry Developments

✅ In May 2025, WireCo launched a new plastic‐coated steel wire rope called Boomfit, designed for adjustment rope use in telescopic cranes, crawler cranes and large tower cranes, enhancing operational…

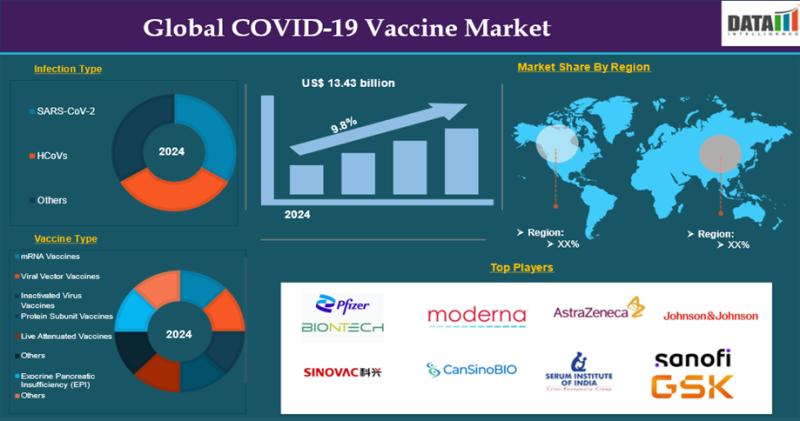

COVID-19 Vaccine Market Set to Hit US$ 29.98 Billion by 2033 | Rising Demand for …

Leander, Texas and Tokyo, Japan - Feb.24.2026

The Global COVID-19 Vaccine Market reached US$ 13.43 billion in 2024 and is expected to reach US$ 29.98 billion by 2033, growing at a CAGR of 9.8% during the forecast period 2025-2033, according to DataM Intelligence research.

The COVID‐19 Vaccine Market has played a pivotal role in controlling the global pandemic, with widespread immunization campaigns driving vaccine production, distribution, and administration efforts worldwide. Strong government…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…