Press release

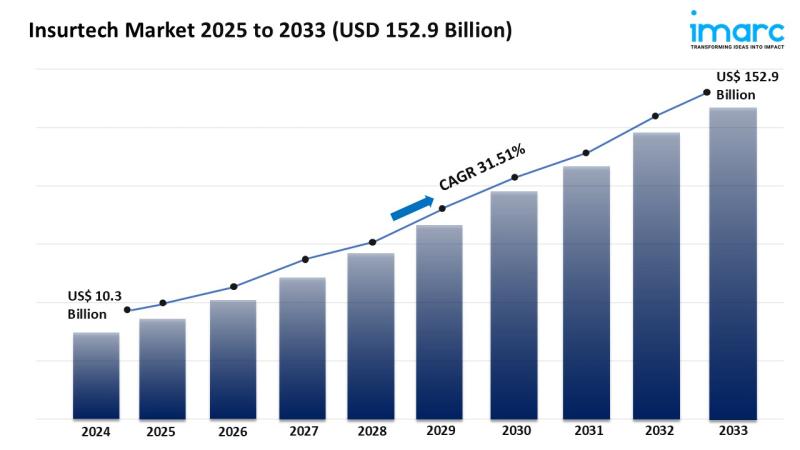

Insurtech Market Size to Hit USD 152.9 Billion by 2033 | With a 31.51% CAGR

Market Overview:The Insurtech Market is experiencing rapid growth, driven by Technological Advancements, Changing Consumer Expectations, and Regulatory Environment. According to IMARC Group's latest research publication, "Insurtech Market Size, Share, Trends, and Forecast by Type, Service, Technology, and Region, 2025-2033", The global insurtech market size was valued at USD 10.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.9 Billion by 2033, exhibiting a CAGR of 31.51% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/insurtech-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Factors Affecting the Growth of the Insurtech Industry:

● Technological Advancements:

The insurtech industry is growing fast, mainly due to new technology. Artificial intelligence, machine learning, and big data help insurance companies work better. They improve customer experiences and create more tailored insurance products. This tech helps insurers assess risk accurately, automate underwriting, and spot fraudulent claims efficiently. Insurtech firms are using blockchain for secure and clear transactions. As these technologies improve, they change the industry, sparking innovation and market growth.

● Changing Consumer Expectations:

At present, the insurtech sector is responding to shifting consumer expectations around the world. Consumers today want convenience, transparency, and personalized services. Insurtech companies use digital platforms and mobile apps for on-demand insurance solutions. This lets customers buy, manage, and file claims easily. Real-time data and telematics devices help insurers create policies based on individual usage and preferences. By customizing their offerings to match consumer needs, insurtech firms drive industry growth.

● Regulatory Environment:

The regulatory landscape greatly impacts the growth of the insurtech industry. As the insurance sector shifts to digital, governments and regulators worldwide are making changes. Regulations are updating to match insurtech innovations. They focus on data security, consumer protection, and fair competition. A clear regulatory environment helps startups and established insurers enter the market more easily. Strict or unclear regulations can slow market growth. To thrive in this changing sector, insurtech companies must navigate these regulatory challenges well.

Buy Full Report: https://www.imarcgroup.com/checkout?id=3636&method=1670

Leading Companies Operating in the Global Insurtech Industry:

● Clover LLC

● Damco Group

● DXC Technology Company

● Insurance Technology Services

● Majesco (Aurum PropTech Limited)

● Oscar Insurance Corporation

● Quantemplate

● Shift Technology

● Travelers Companies, Inc.

● Wipro

● ZhongAn Online P&C Insurance Co. Ltd.

Insurtech Market Report Segmentation:

By Type:

● Auto

● Business

● Health

● Home

● Specialty

● Travel

● Others

Based on the type, the market has been classified into auto, business, health, home, specialty, travel, and others.

By Service:

● Consulting

● Support and Maintenance

● Managed Services

On the basis of the service, the market has been divided into consulting, support and maintenance, and managed services.

By Technology:

● Blockchain

● Cloud Computing

● IoT

● Machine Learning

● Robo Advisory

● Others

Cloud computing accounts for the largest market share due to its scalability, cost-efficiency, and ability to provide insurers with seamless access to data and applications, enabling streamlined operations and enhanced customer experiences.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America's dominance in the insurtech market is attributed to its robust technological infrastructure, high adoption rates of digital solutions, and well-established insurance industry, making it a fertile ground for the growth of insurtech companies.

Ask Analyst fore Sample Report: https://www.imarcgroup.com/request?type=report&id=3636&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market Size to Hit USD 152.9 Billion by 2033 | With a 31.51% CAGR here

News-ID: 3924493 • Views: …

More Releases from IMARC Group

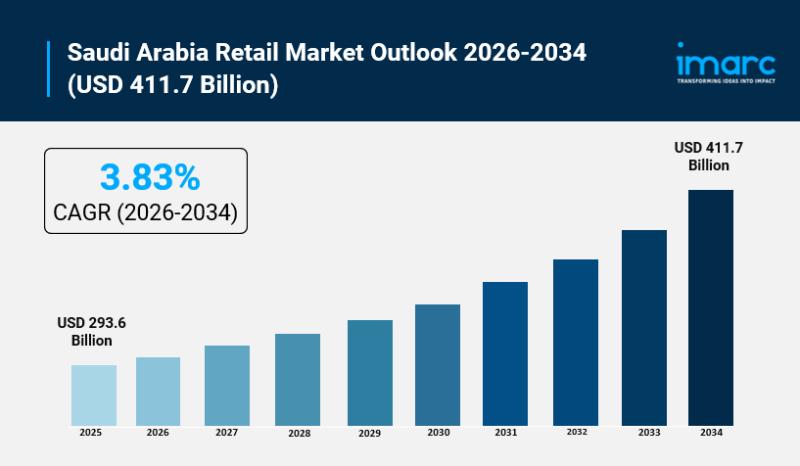

Saudi Arabia Retail Market Size to Surge to USD 411.7 Billion by 2034 | CAGR of …

Saudi Arabia Retail Market Overview

Market Size in 2025: USD 293.6 Billion

Market Size in 2034: USD 411.7 Billion

Market Growth Rate 2026-2034: 3.83%

According to IMARC Group's latest research publication, "Saudi Arabia Retail Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 411.7 Billion by 2034, exhibiting a…

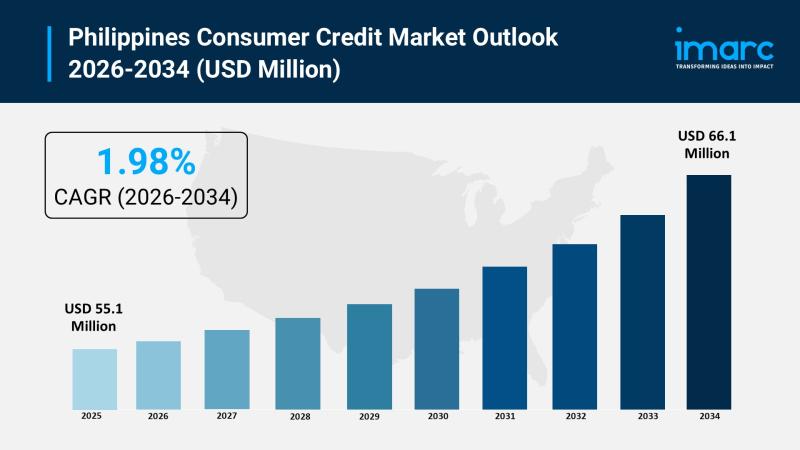

Philippines Consumer Credit Market 2026 | Worth USD 66.1 Million by 2034

Philippines Consumer Credit Market Overview:

The Philippines consumer credit market size reached USD 55.1 Million in 2025. The market is projected to reach USD 66.1 Million by 2034, exhibiting a growth rate (CAGR) of 1.98% during 2026-2034. The market is expanding steadily as rising financial inclusion, mobile-first lending platforms, and Buy Now Pay Later adoption bring formal credit to previously underserved Filipinos. Fintech innovation, neobank growth, and supportive BSP regulatory frameworks…

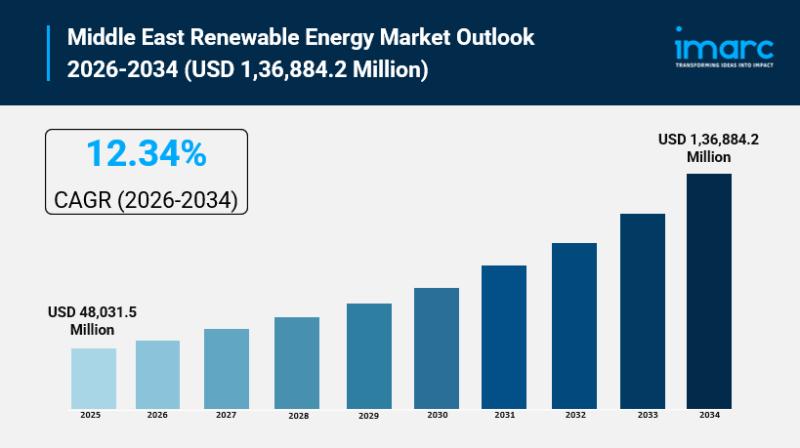

Middle East Renewable Energy Market Size to Hit USD 1,36,884.2 Million by 2034 | …

Middle East Renewable Energy Market Overview

Market Size in 2025: USD 48,031.5 Million

Market Size in 2034: USD 1,36,884.2 Million

Market Growth Rate 2026-2034: 12.34%

According to IMARC Group's latest research publication, "Middle East Renewable Energy Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East renewable energy market size was valued at USD 48,031.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,36,884.2 Million by…

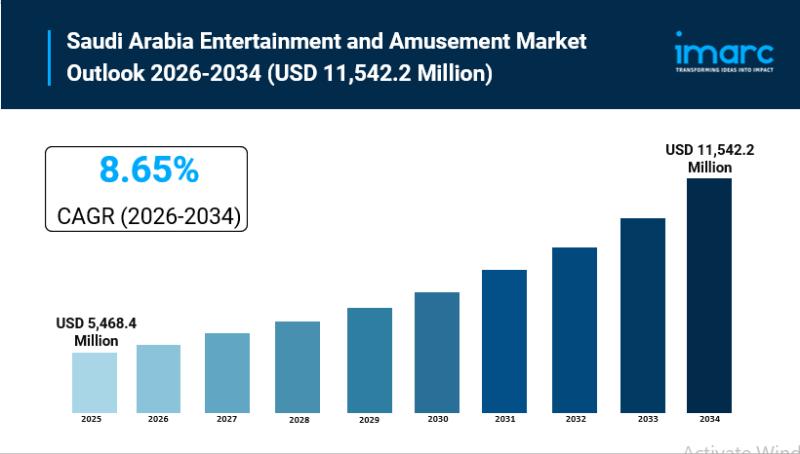

Saudi Arabia Entertainment and Amusement Market Size to Reach USD 11,542.2 Milli …

Saudi Arabia Entertainment and Amusement Market Overview

Market Size in 2025: USD 5,468.4 Million

Market Size in 2034: USD 11,542.2 Million

Market Growth Rate 2026-2034: 8.65%

According to IMARC Group's latest research publication, "Saudi Arabia Entertainment and Amusement Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Saudi Arabia entertainment and amusement market size reached USD 5,468.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,542.2 Million…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…