Press release

In-Depth Analysis of the Commercial Banking Market: Growth Opportunities, Key Trends, and Forecast 2025-2034

"What industry-specific factors are fueling the growth of the commercial banking market?The rising demand for financial services is expected to drive the growth of the commercial banking market. Financial services encompass a wide range of activities aimed at managing money and facilitating financial transactions. Factors such as economic growth, changing consumer needs, and regulatory environments are fueling the demand for financial services. Commercial banks provide essential financial products and services that support businesses and contribute to economic stability. For instance, according to YCharts in July 2024, U.S. commercial and industrial loans increased from $2.493 trillion in January 2023 to $2.759 trillion in January 2024, indicating a growing demand for financial services and driving the commercial banking market's growth.

Get Your Commercial Banking Market Report Here:

https://www.thebusinessresearchcompany.com/report/commercial-banking-global-market-report

What Is the projected market size and growth rate for the commercial banking market?

The commercial banking market has expanded rapidly in recent years. It will grow from $3841.58 billion in 2024 to $4415.27 billion in 2025, reflecting a compound annual growth rate (CAGR) of 14.9%. This growth is linked to increased global trade, greater digitization in banking, rising cybersecurity concerns, a focus on environmental, social, and governance (ESG) criteria, and improved bank profitability.

The commercial banking market is expected to grow rapidly, reaching $7614.19 billion by 2029 with a CAGR of 14.6%. Growth factors include improved economic stability, integration into global markets, a growing need for business loans, rising interest rates, and the increasing demand for financial services and internet banking. Trends to watch include technology advancements, such as ATMs, AI and machine learning for customer service enhancement, fintech collaborations, and cloud technology integration.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18539&type=smp

What new trends are reshaping the commercial banking market and its opportunities?

Major companies in the commercial banking market are focusing on launching innovative fintech platforms to improve operational efficiency and provide seamless digital banking experiences. A fintech platform leverages technology to deliver financial services more efficiently. For instance, in May 2024, FIS Global launched Atelio, a fintech platform designed to offer advanced core banking, payments, and digital banking capabilities. Atelio helps businesses with a variety of financial functions, including fraud prevention, cash flow forecasting, and customer behavior analysis.

What major market segments define the scope and growth of the commercial banking market?

The commercial banking market covered in this report is segmented -

1) By Products: Syndicated Loans, Capital Market, Commercial Lending, Treasury Management, Project Finance, Other Products

2) By Function: Accepting Deposits, Advancing Loans, Credit Creation, Financing Foreign Trade, Agency Services, Other Functions

3) By Application: Construction, Transportation And Logistics, Healthcare, Media And Entertainment, Other Applications

Subsegments

1) By Syndicated Loans: Loan Syndications For Corporates, Loan Syndications For Governments

2) By Capital Market: Debt Capital Market (Dcm), Equity Capital Market (Ecm)

3) By Commercial Lending: Small Business Loans, Large Corporate Loans, Working Capital Loans

4) By Treasury Management: Cash Management Solutions, Liquidity Management, Payment Processing Solutions

5) By Project Finance: Infrastructure Project Financing, Energy Project Financing, Real Estate Project Financing

6) By Other Products: Trade Finance, Foreign Exchange Services, Deposit Products

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18539

Which region dominates the commercial banking market?

North America was the largest region in the commercial banking market in 2024. The regions covered in the commercial banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Which key market leaders are driving the commercial banking industry growth?

Major companies operating in the commercial banking market are JPMorgan Chase & Co., Bank Of America Corporation, Agriculture Bank Of China, Wells Fargo & Company, HSBC Holdings PLC, Citigroup Inc., BNP Paribas Group, Capital One Financial Corporation, Barclays Bank PLC, Standard Chartered PLC, The PNC Financial Services Group Inc., ICICI Bank Limited, Axis Bank Limited, Kotak Mahindra Bank Limited, Santander Bank N. A, RBL Bank Ltd., Crédit Agricole S.A, China Investment Corporation, TD Bank N.A., First Busey Corporation

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=18539&type=smp

What Is Covered In The Commercial Banking Global Market Report?

•Market Size Forecast: Examine the commercial banking market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the commercial banking market for a structured understanding.

•Key Players Overview: Analyze major players in the commercial banking market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the commercial banking market.

•Segment Contributions: Evaluate how different segments drive overall growth in the commercial banking market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the commercial banking market.

•Industry Challenges: Identify potential risks and obstacles affecting the commercial banking market.

•Competitive Landscape: Review strategic developments in the commercial banking market, including expansions, agreements, and new product launches.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release In-Depth Analysis of the Commercial Banking Market: Growth Opportunities, Key Trends, and Forecast 2025-2034 here

News-ID: 3923624 • Views: …

More Releases from The Business research company

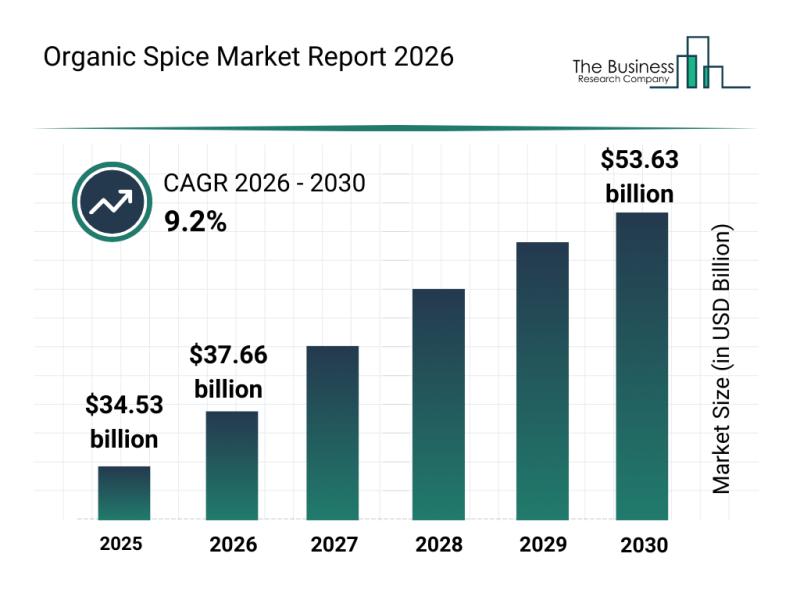

Segmentation, Major Trends, and Competitive Analysis of the Organic Spice Market

The organic spice industry is poised for remarkable expansion as consumers increasingly prioritize health and sustainability in their food choices. With growing demand for organic and non-GMO options, the market is set to evolve significantly in the coming years. Let's explore the current market size, influential players, key trends, and segment outlook shaping this dynamic sector.

Organic Spice Market Size and Projected Growth

The organic spice market is forecasted to…

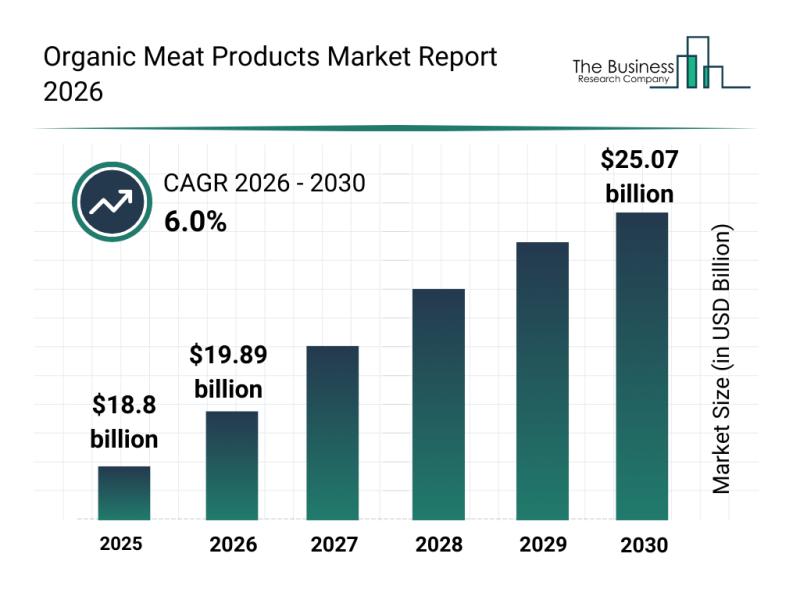

Competitive Landscape: Leading Companies and New Entrants in the Organic Meat Pr …

The organic meat products market is on track for significant expansion over the coming years, driven by growing consumer interest in health-conscious and sustainably sourced foods. As demand for organic options rises, this sector presents promising opportunities for producers and retailers alike. Below, we explore the market's size, major players, key trends, and important segments shaping its future.

Projected Market Size and Growth of the Organic Meat Products Industry

The…

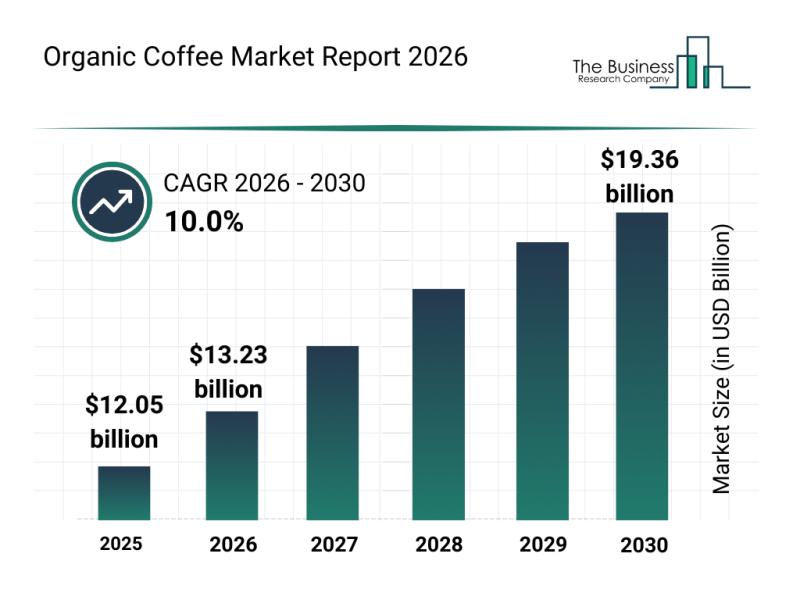

Future Projections: Key Trends Shaping the Organic Coffee Market Until 2030

The organic coffee market is gaining significant traction as consumers increasingly seek beverages that are both flavorful and sustainably produced. With growing awareness of environmental impact and health benefits, this sector is set for remarkable expansion over the coming years. Let's explore the current market size, key influences, prominent players, emerging trends, and the main segments shaping the future of organic coffee.

Forecasted Growth Trajectory of the Organic Coffee Market …

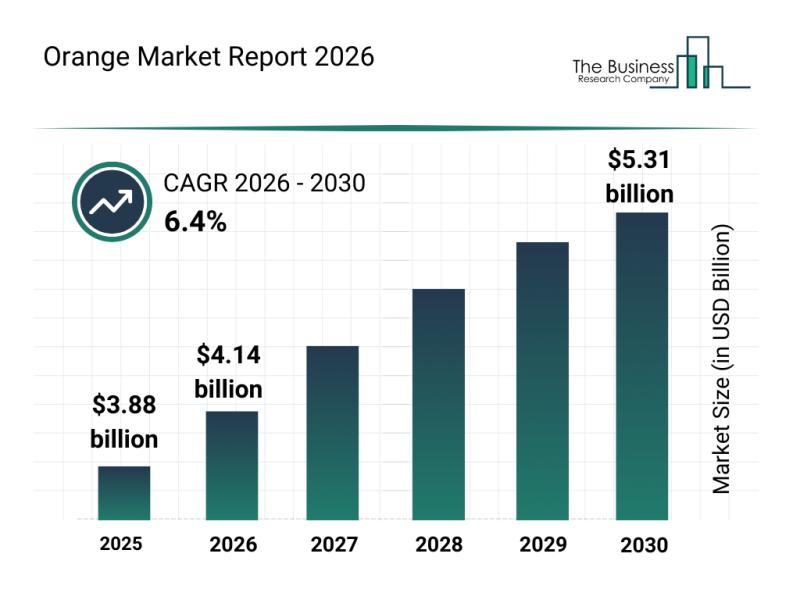

Orange Market Analysis: Segmentation, Major Trends, and Competitive Overview

The orange market is positioned for substantial expansion in the coming years, driven by shifting consumer preferences and advancements in production and distribution. With growing health consciousness and technological improvements, this sector is set to make notable strides through 2030. Below is an exploration of the market's size, key players, influential trends, and segment breakdowns that define its current and future landscape.

Projected Growth and Market Size of the Orange Industry…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…