Press release

Currency Management Market Set to Reach $830.18 Billion by 2029 with 15.2% Yearly Growth

Which drivers are expected to have the greatest impact on the over the currency management market's growth?The rise in international trade is expected to propel the currency management market forward. International trade, driven by globalization and technological advancements, allows the exchange of goods and services between nations. Currency management ensures smooth financial transactions across different currencies, minimizing costs and managing exchange rate risks. According to the World Trade Organization, global trade in goods and services reached $31.0 trillion in 2022, an increase from the previous year. Therefore, the growth of international trade is fostering the growth of the currency management market.

Get Your Currency Management Market Report Here:

https://www.thebusinessresearchcompany.com/report/currency-management-global-market-report

What is the future CAGR of the currency management market, and how will it impact industry expansion?

The currency management market has grown rapidly in recent years. It will grow from $407.61 billion in 2024 to $470.84 billion in 2025, with a CAGR of 15.5%. Economic crises, changes in financial regulations, emerging derivatives markets, political instability, and inflation have all contributed to this growth.

The currency management market is projected to reach $830.18 billion by 2029 at a CAGR of 15.2%. The market growth is attributed to blockchain technology integration, climate change policies, central bank digital currencies, global trade agreements, and market speculation. Trends include ESG focus, real-time data, hedging techniques, market uncertainty, and customization.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18559&type=smp

What are the most significant trends transforming the currency management market today?

Companies in the currency management market are adopting digital currency management systems to streamline operations and offer advanced solutions for managing digital currencies. For example, in June 2024, the Universal Digital Payments Network (UDPN) Alliance launched a platform that includes tokenized deposit and stablecoin management systems, along with digital asset tokenization tools. This platform helps financial institutions manage assets securely while ensuring regulatory compliance.

Which key market segments comprise the currency management market and drive its revenue growth?

The currency management market covered in this report is segmented -

1) By Exchange Type: Floating Currency Exchange, Fixed Currency Exchange

2) By Hedge Type: Portfolio Hedging, Share Class Hedging, Benchmark Hedging

3) By Application: Commercial And Investment Banks, Central Banks, Multinational Corporations, Other Applications

Subsegments:

1) By Floating Currency Exchange: Spot Market, Forward Market, Swaps Market, Currency Futures, Currency Options

2) By Fixed Currency Exchange: Pegged Currency Systems, Currency Board Systems, Managed Float Systems, Dual Exchange Rate Systems

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18559

What regions are at the forefront of currency management market expansion?

North America was the largest region in the currency management market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the currency management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the leading players fueling growth in the currency management market?

Major companies operating in the currency management market are BNP Paribas SA, The Goldman Sachs Group Inc., Canadian Imperial Bank of Commerce (CIBC), State Street Corporation, Northern Trust Corporation, Macquarie Group, Giesecke+Devrient GmbH, Loomis AB, Pacific Investment Management Co (PIMCO), Wise PLC, Russell Investments Group LLC, Ebury Partners HK Ltd, Mesirow Financial Holdings, Inc., De La Rue Plc, Argentex Group PLC, Metzler Bank, Acumatica Inc., Kantox Ltd, Glory Global Solutions Inc., Ecount Inc, Aston Currency Management, Rhicon Currency Management Pte Ltd, Convera Holdings LLC, Adrian Lee & Partners

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=18559&type=smp

What Is Covered In The Currency Management Global Market Report?

•Market Size Forecast: Examine the currency management market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the currency management market for a structured understanding.

•Key Players Overview: Analyze major players in the currency management market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the currency management market.

•Segment Contributions: Evaluate how different segments drive overall growth in the currency management market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the currency management market.

•Industry Challenges: Identify potential risks and obstacles affecting the currency management market.

•Competitive Landscape: Review strategic developments in the currency management market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Currency Management Market Set to Reach $830.18 Billion by 2029 with 15.2% Yearly Growth here

News-ID: 3923209 • Views: …

More Releases from The Business Research Company

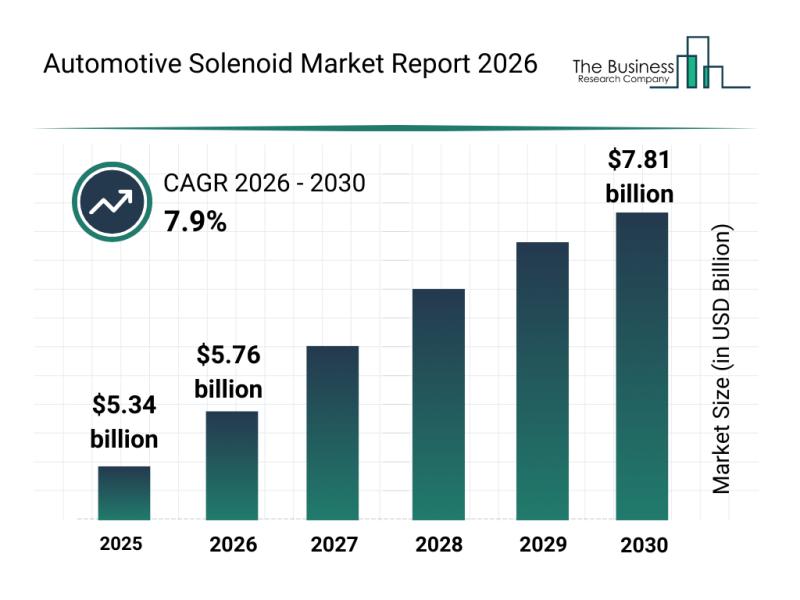

Leading Companies Fueling Growth and Innovation in the Automotive Solenoid Marke …

The automotive solenoid market is on the verge of significant expansion as advancements in technology and vehicle electrification continue to accelerate. Increasing integration of smart systems and the growing demand for efficient, eco-friendly automotive solutions are set to drive this market's development through the end of the decade.

Expected Growth Trajectory for the Automotive Solenoid Market by 2030

The automotive solenoid market is projected to reach a valuation of $7.81 billion…

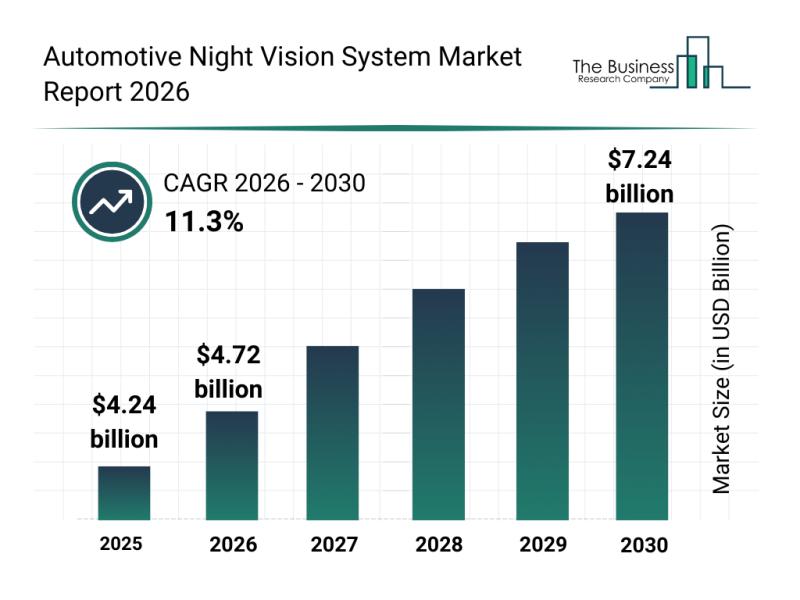

Automotive Night Vision System Market Analysis: Major Segments, Strategic Develo …

The automotive night vision system market is set to experience significant expansion over the coming years, driven by technological advancements and growing safety demands. As vehicle manufacturers continue to integrate more sophisticated safety features, this market shows promising potential for rapid growth and innovation through 2030.

Projected Expansion of the Automotive Night Vision System Market Size Through 2030

The market size for automotive night vision systems is anticipated to reach $7.24…

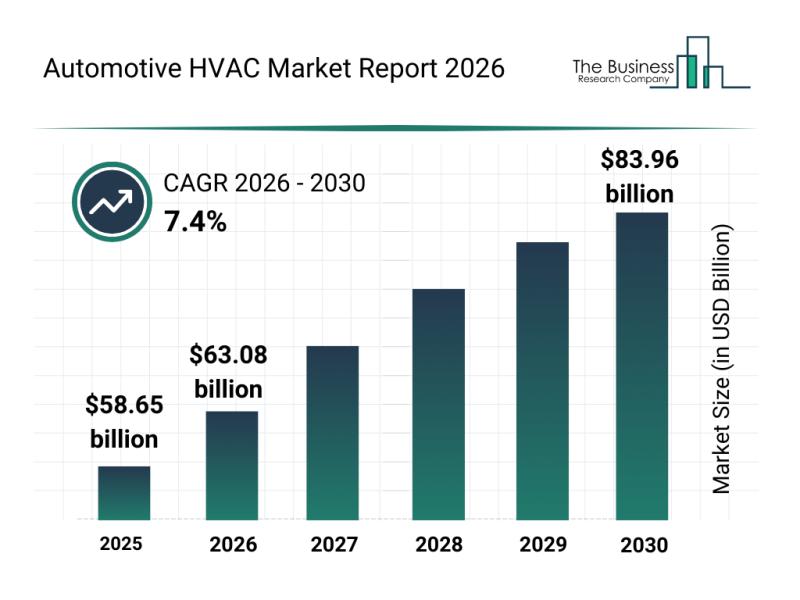

Segment Analysis and Major Growth Areas in the Automotive HVAC Market

The automotive HVAC market is on a trajectory of significant growth as vehicle climate control systems evolve with advanced technologies. Innovations aimed at improving energy efficiency and passenger comfort are driving the sector forward, setting the stage for substantial expansion through 2030. Let's explore the current market size, key players, influential trends, and detailed segment insights shaping this dynamic industry.

Automotive HVAC Market Size and Growth Outlook Through 2030

The automotive…

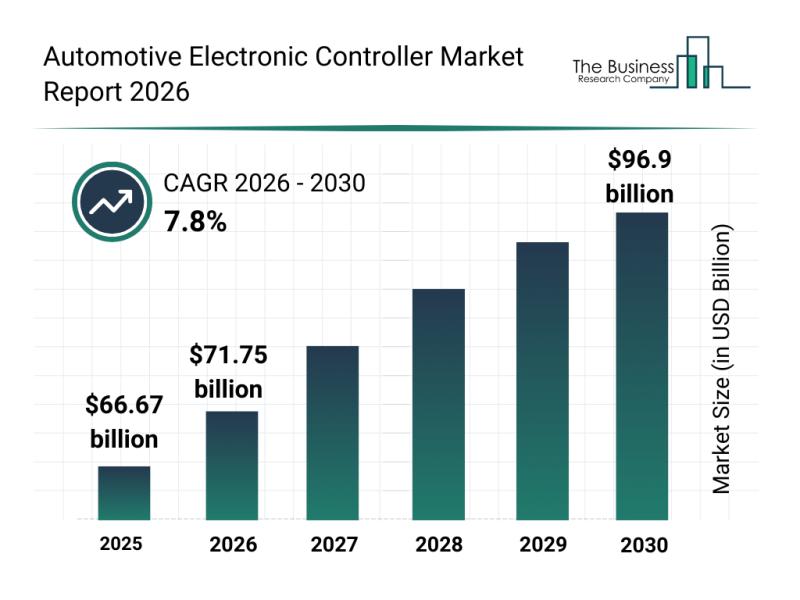

Key Strategic Developments and Emerging Changes Shaping the Automotive Electroni …

The automotive electronic controller market is on track for impressive expansion as technology continues to transform the automotive sector. With the industry embracing smarter and more connected vehicle systems, the demand for advanced controllers that manage and optimize vehicle functions is rapidly increasing. Below, we explore the market's projected growth, key players, notable trends, and the main segments shaping this dynamic field.

Projected Market Size and Growth of the Automotive Electronic…

More Releases for Currency

Application House Launches Salesforce Native Currency App for Smarter Currency C …

Application House, a leading Salesforce consultancy partner, has announced the launch of its groundbreaking Currency Conversion App, built to redefine the way organizations manage multiple currencies within Salesforce.

Designed for global enterprises grappling with complex financial reporting and fluctuating exchange rates, the Currency conversion app eliminates manual processes. With automatic updates, zero setup and integration into Salesforce, it is ideal for non-technical users and businesses handling multi-currencies.

One App…

Crypto-Currency and Cyber-Currency Market to Witness Stunning Growth with Bitcoi …

HTF MI recently introduced Global Crypto-Currency and Cyber-Currency Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Bitcoin, Ethereum, Binance, Tether, Ripple, Cardano, Solana, Polkadot, Chainlink, Stellar, Dogecoin, Shiba…

Currency Research Announces Digital Currency Awards and Fintech Innovation Showc …

Currency Research (CR), a leading organizer of premier conferences for the currency and payments community, is inviting innovators in the digital currency space to submit nominations for the Advancement in Digital Currency Awards and to apply to participate in the Digital Currency Fintech Innovation Showcase. Both initiatives will take place as part of CR's annual Digital Currency Conference, a gathering of global policymakers, regulators, and technology and innovation experts, which…

Crypto-Currency and Cyber-Currency Market Outlook 2021: Big Things are Happening

Global Crypto-Currency and Cyber-Currency Market Research Report with Opportunities and Strategies to Boost Growth- COVID-19 Impact and Recovery is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Crypto-Currency and Cyber-Currency Market. Some of the key…

Crypto-Currency and Cyber-Currency Market is Dazzling Worldwide Post Pandemic

The 2018 study has 299 pages, 78 tables and figures. Worldwide markets are poised to achieve continuing growth as the advantages of digital currency move away from the drug dealers and the criminals to mainstream activities like supply chain management and IoT communications. Cyber currency is useful in marketing and branding.

The value of Bitcoin is very volatile. The number of payments that can be handled is low.…

Crypto-Currency and Cyber-Currency Market Checkout the Unexpected Future 2024

Researchmoz added Most up-to-date research on "Crypto-Currency and Cyber-Currency: Market Shares, Strategies, and Forecasts, Worldwide, 2018 to 2024" to its huge collection of research reports.

The 2018 study has 299 pages, 78 tables and figures. Worldwide markets are poised to achieve continuing growth as the advantages of digital currency move away from the drug dealers and the criminals to mainstream activities like supply chain management and IoT communications. Cyber…