Press release

Online Payment Fraud Detection Market to Reach USD 25.1 Billion by 2032 | Persistence Market Research

The online payment fraud detection market is experiencing rapid growth as digital transactions become increasingly prevalent. The rise of e-commerce, mobile banking, and online payment platforms has made fraud detection a crucial component of financial security. According to market research, the global online payment fraud detection market is projected to reach USD 25.1 billion by 2032. This article provides an in-depth analysis of market trends, key investment areas, competitive landscape, and regional insights that are shaping the industry.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/33078

Market Trends and Growth Drivers

The online payment fraud detection market is driven by several key factors, including:

• Increased Digital Transactions: The growing adoption of digital payment methods, including credit cards, digital wallets, and cryptocurrencies, has led to a rise in fraudulent activities.

• AI and Machine Learning Integration: Advanced technologies are being leveraged to enhance fraud detection capabilities by identifying patterns and anomalies in real-time transactions.

• Regulatory Compliance: Governments and financial institutions are enforcing strict regulations to ensure secure transactions, driving demand for robust fraud detection solutions.

• Rising Cybersecurity Threats: The increasing sophistication of cybercriminals necessitates advanced fraud detection mechanisms to protect consumers and businesses.

Competitive Landscape

The online payment fraud detection market is highly competitive, with major players continuously innovating to stay ahead. Some of the key companies analyzed in the market report include:

• Mastercard

• Visa

• PayPal

• FICO

• RSA Security

• Experian

• FraudLabs Pro

• Kount Inc.

• Signifyd

• Sift Science

These companies are investing in artificial intelligence, predictive analytics, and cloud-based solutions to enhance their fraud detection capabilities.

Market Segmentation Analysis

The online payment fraud detection market is segmented based on:

By Solution Type:

• Fraud Analytics

• Authentication Solutions

• Tokenization

• Encryption

By Deployment Mode:

• On-Premises

• Cloud-Based

By End-User:

• Banking & Financial Services

• E-commerce

• Retail

• Healthcare

• Telecommunications

Regional Analysis

North America:

North America is expected to dominate the online payment fraud detection market due to the high volume of digital transactions and stringent regulatory frameworks. The U.S. and Canada are leading adopters of AI-driven fraud detection systems.

Europe:

Europe follows closely, with countries like Germany, the U.K., and France implementing strong cybersecurity measures to combat fraud. The region is also witnessing significant investment in fintech solutions.

Asia-Pacific:

The Asia-Pacific market is growing rapidly, driven by increasing smartphone penetration and the expansion of digital payment platforms in countries like China, India, and Japan.

Latin America, Middle East & Africa:

These regions are emerging as potential growth markets due to the increasing adoption of e-commerce and financial inclusion initiatives.

Future Outlook and Opportunities

The future of the online payment fraud detection market looks promising, with continuous advancements in AI and big data analytics expected to enhance fraud prevention mechanisms. Companies are increasingly adopting multi-layered security approaches, including biometric authentication and behavioral analytics, to mitigate risks. The increasing adoption of blockchain technology in payment systems is also anticipated to add an additional layer of security.

Conclusion

The online payment fraud detection market is set for significant expansion, driven by technological advancements, regulatory pressures, and the rise of digital transactions. As fraudsters become more sophisticated, the demand for advanced fraud detection solutions will continue to rise, ensuring the security of online financial ecosystems worldwide.

Explore the Latest Trending "Exclusive Article":

https://www.linkedin.com/pulse/global-socks-market-growth-trends-opportunities-vgfmf

https://www.linkedin.com/pulse/proteomics-market-overview-future-prospects-2033-9bpdf

https://www.linkedin.com/pulse/comprehensive-insights-global-wool-market-zfzte

https://www.linkedin.com/pulse/comprehensive-insights-internet-things-iot-market-heg2e

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Fraud Detection Market to Reach USD 25.1 Billion by 2032 | Persistence Market Research here

News-ID: 3923181 • Views: …

More Releases from Persistence Market Research

India Aluminum Beverage Can Market Size to Reach US$ 0.8 Bn by 2032 - Persistenc …

The India aluminum beverage can market is undergoing a significant transformation, driven by changing consumer lifestyles, rising urbanization, and a noticeable shift toward sustainable and convenient packaging formats. Aluminum beverage cans are increasingly preferred across carbonated soft drinks, energy drinks, sports beverages, alcoholic drinks, and ready-to-drink juices due to their lightweight structure, portability, fast chilling properties, and superior recyclability. In India, where on-the-go consumption is accelerating rapidly, aluminum cans are…

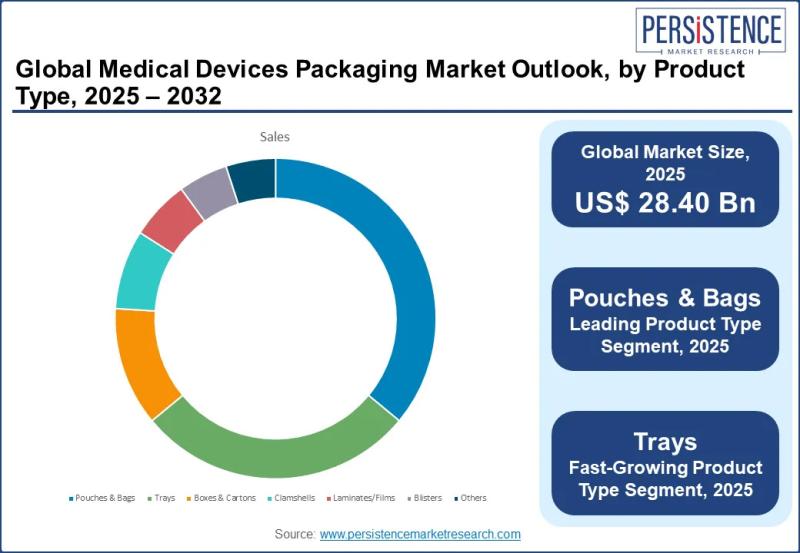

Medical Devices Packaging Market Size to Reach US$ 41.57 Billion by 2032 - Persi …

The medical devices packaging market plays a vital role within the global healthcare ecosystem, acting as a protective and regulatory bridge between manufacturers and end users. Medical device packaging refers to specialized materials and formats designed to safeguard medical instruments, implants, diagnostic tools, and consumables throughout storage, transportation, and clinical use. These packaging solutions are engineered to maintain sterility, prevent contamination, ensure ease of handling, and comply with strict regulatory…

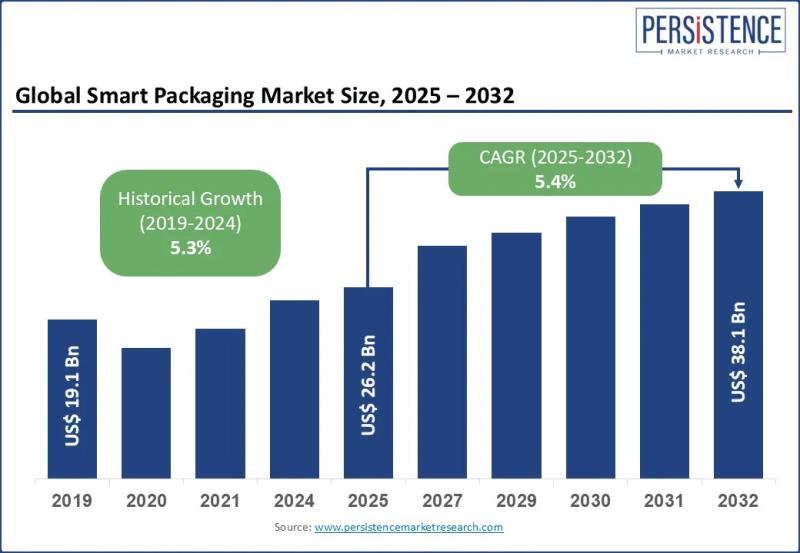

Smart Packaging Market Size Valued at US$ 26.2 Bn in 2025, Projected to Reach US …

The smart packaging market is rapidly transforming the global packaging landscape by integrating advanced technologies with traditional packaging materials to deliver enhanced functionality, traceability, and consumer engagement. Smart packaging refers to packaging systems embedded with features such as sensors indicators QR codes RFID tags and data tracking mechanisms that monitor product condition authenticity and movement across the supply chain. These solutions are increasingly adopted as businesses shift from passive containment…

Football Equipment Market Set for Strong Global Growth Through 2032

The global football equipment market continues to display resilient growth driven by rising participation in football across all age groups, expanding commercial opportunities, and technological advancements in sports gear. The industry is expected to grow from an estimated US$ 18.7 billion in 2025 to approximately US$ 24.1 billion by 2032, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

➤ Download Your Free Sample & Explore Key…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…