Press release

Key Influencer in the Financial Protection Market 2025: Rising Digital Financial Transactions Fueling Growth In Financial Fraud Detection Software Market Driver

Which drivers are expected to have the greatest impact on the over the financial protection market's growth?The rising volume of digital financial transactions is expected to drive the growth of the financial protection market. Digital financial transactions, which occur electronically through online platforms or mobile devices, are increasing due to the convenience and accessibility of digital banking services. Financial protection technologies safeguard these transactions by identifying and preventing fraudulent activities. In March 2024, the GSM Association reported that global mobile money accounts reached 1.75 billion in 2023, reflecting a 12% increase from 2022. The rise in digital financial transactions is boosting the financial protection market.

Get Your Financial Protection Market Report Here:

https://www.thebusinessresearchcompany.com/report/financial-protection-global-market-report

What is the future CAGR of the financial protection market, and how will it impact industry expansion?

The financial protection market has experienced strong growth in recent years. It will increase from $65.29 billion in 2024 to $69.68 billion in 2025, at a CAGR of 6.7%. The growth is attributed to regulatory reforms, demographic shifts, economic challenges, technological advancements, healthcare reforms, and rising consumer awareness of financial risks.

The financial protection market will grow to $89.18 billion by 2029, with a CAGR of 6.4%. This growth is driven by digital transformation, rising cyber threats, the adoption of parametric insurance, ESG product expansion, AI integration in insurance, and the growth of microinsurance in emerging markets. Trends include personalized insurance through big data, sustainable and ESG products, blockchain integration for secure transactions, and growing cyber insurance demand.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18610&type=smp

What are the most significant trends transforming the financial protection market today?

Key companies in the financial protection market are introducing comprehensive solutions like all-in-one financial protection products to improve customer experience, streamline processes, and provide all-encompassing coverage for various financial risks. An all-in-one solution combines multiple financial safeguards, such as insurance, investment, and risk management. For example, in February 2023, Guardian Life Insurance Company, based in the U.S., introduced SafeGuard360, which provides various insurance options like life, disability income, and critical illness insurance, ensuring comprehensive financial protection for policyholders.

Which key market segments comprise the financial protection market and drive its revenue growth?

The financial protection market covered in this report is segmented -

1) By Type: Long Term Financial Protection, Short Term Financial Protection

2) By Policy Coverage: Payment Protection, Mortgage Payment Protection

3) By End-Users: Men, Women

Subsegments:

1) By Long Term Financial Protection: Life Insurance, Long-Term Disability Insurance, Retirement Plans (Pensions, Annuities), Critical Illness Insurance, Permanent Health Insurance, Long-Term Care Insurance

2) By Short Term Financial Protection: Short-Term Disability Insurance, Short-Term Health Insurance, Accidental Death And Dismemberment (Ad And D) Insurance, Temporary Income Protection Plans, Travel Insurance (Emergency Medical, Trip Cancellation), Unemployment Insurance

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18610

Which geographical regions are pioneering growth in the financial protection market?

North America was the largest region in the financial protection market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the financial protection market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the leading players fueling growth in the financial protection market?

Major companies operating in the financial protection market are Ping An Insurance (Group) Company of China Ltd., Cigna Corporation, Allianz SE, MetLife Inc., Dai-ichi Life Holdings Inc., China Pacific Insurance (Group) Co. Ltd., Nationwide Mutual Insurance Company, Prudential Financial Inc., American International Group, Tokio Marine Holdings Inc., Zurich Insurance Group, Sompo Holdings Inc., Mapfre S.A., Hartford Financial Services Group Inc., AIA Group Limited, Aflac Incorporated, Lincoln National Corporation, Sun Life Financial Inc., Principal Financial Group, Samsung Life Insurance, Manulife Financial Corporation, FWD Group, Great-West Lifeco Inc., Legal & General Group plc, Standard Life Aberdeen plc, Aviva plc

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=18610&type=smp

What Is Covered In The Financial Protection Global Market Report?

•Market Size Forecast: Examine the financial protection market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the financial protection market for a structured understanding.

•Key Players Overview: Analyze major players in the financial protection market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the financial protection market.

•Segment Contributions: Evaluate how different segments drive overall growth in the financial protection market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the financial protection market.

•Industry Challenges: Identify potential risks and obstacles affecting the financial protection market.

•Competitive Landscape: Review strategic developments in the financial protection market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Influencer in the Financial Protection Market 2025: Rising Digital Financial Transactions Fueling Growth In Financial Fraud Detection Software Market Driver here

News-ID: 3922902 • Views: …

More Releases from The Business Research Company

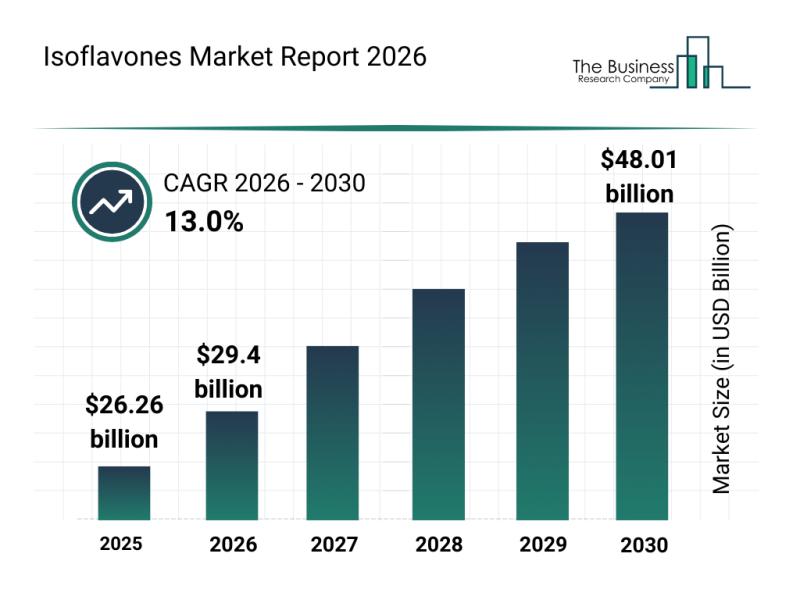

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

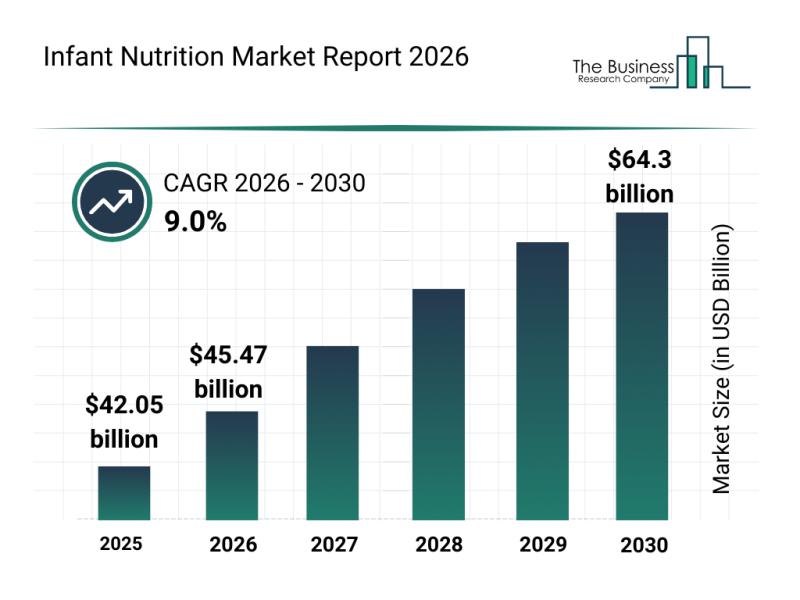

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

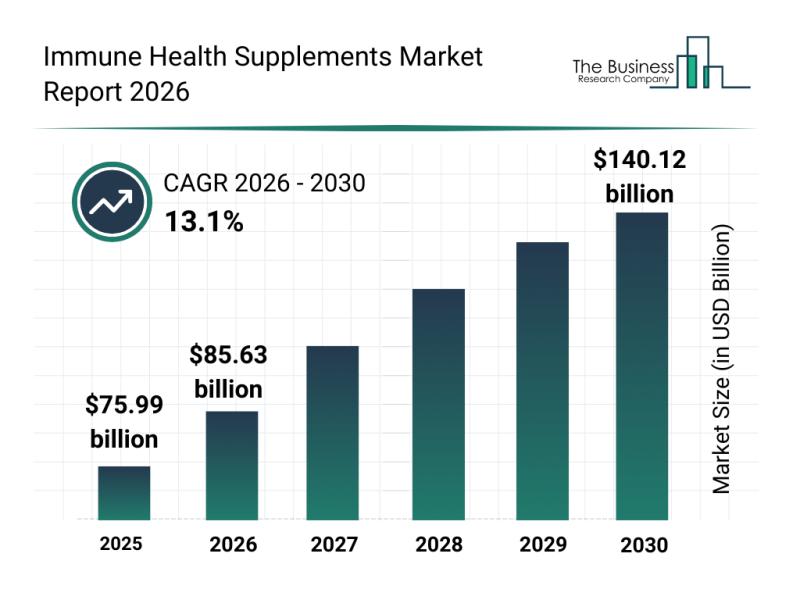

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

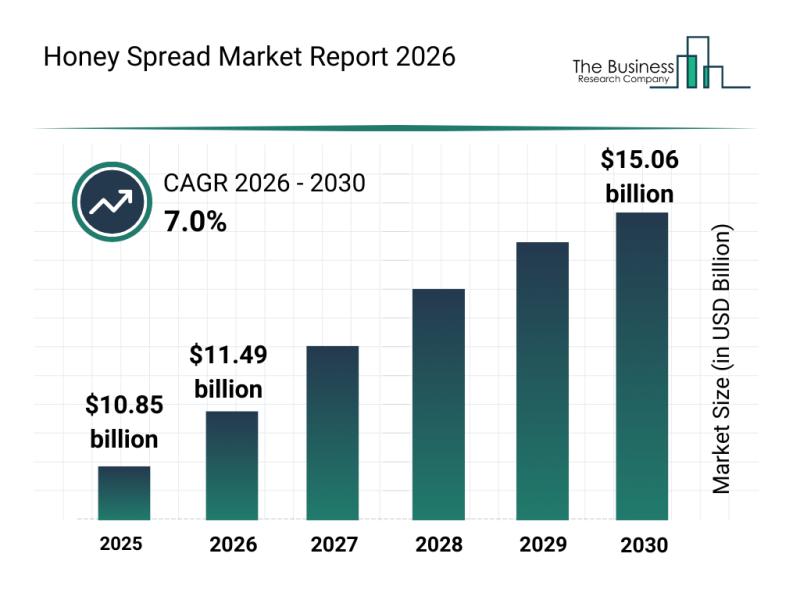

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…