Press release

Prominent Augmented Analytics In Banking, Financial Services And Insurance (BFSI) Market Trend for 2025: AI-Powered Solutions Enhance Decision-Making And Personalization In BFSI Sector

How Are the key drivers contributing to the expansion of the augmented analytics in banking, financial services and insurance (bfsi) market?The proliferation of data volume is anticipated to fuel the expansion of augmented analytics in the banking, financial services, and insurance (BFSI) market in the future. Data volume refers to the quantity of data stored, processed, and governed within a system or database. As digitalization continues to spread, advancements in areas such as IoT, big data analytics, and cloud computing contribute to the production of enormous amounts of real-time data from various sources. The vastness of data helps augmented analytics in delivering more thorough insights and precise forecasts, thereby strengthening risk management, consumer behavior studies, and BFSI market trend analysis. This also allows firms in the BFSI sector to offer more customized services by examining customer interactions and preferences, which in turn heightens satisfaction. For instance, in December 2022, the SODA Foundation, a US open-source initiative, reported a sharp rise in the yearly data growth, from 700 terabyte (TB) in 2021 to 2,208 terabyte (TB) in 2022, for an average end-user organization. This represents a threefold surge in data volume within a single year. Consequently, the escalating data volume is spurring the growth of augmented analytics in the BFSI market.

Get Your Augmented Analytics In Banking, Financial Services And Insurance (BFSI) Market Report Here:

https://www.thebusinessresearchcompany.com/report/augmented-analytics-in-banking-financial-services-and-insurance-bfsi-global-market-report

What growth opportunities are expected to drive the augmented analytics in banking, financial services and insurance (bfsi) market's CAGR through 2034?

The market size for augmented analytics in banking, financial services and insurance (BFSI) has seen rapid growth in recent years. It's projected to increase from $2.61 billion in 2024 to $3.32 billion in 2025, with a compound annual growth rate (CAGR) of 27.0%. The significant expansion during the historic period is a result of growing regulatory needs, increased data volumes, the need for immediate insights, the shift towards digital banking, enhancement of customer experience, and the improvement in fraud detection.

The market size of augmented analytics in banking, financial services, and insurance (BFSI) is predicted to witness massive growth in the coming years, reaching $8.52 billion in 2029 with a compound annual growth rate (CAGR) of 26.6%. This expected expansion during the forecast period is due to several factors such as the development of open banking initiatives, integration of blockchain for enhanced transaction security, introduction of quantum computing applications, predictive analytics application for managing economic instability, and improved cybersecurity analytics. The forecast period is also likely to see some significant trends such as growing acceptance of explainable AI for regulatory adherence, expansion of AI-based customer insights, incorporation of augmented reality for virtual financial consulting, rise in AI-driven fraud detection systems, utilization of natural language processing for automating customer service, and creation of AI-powered investment advisory services.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18230&type=smp

What are the emerging trends shaping the future of the augmented analytics in banking, financial services and insurance (bfsi) market?

Leading companies in the augmented analytics industry for banking, finance, and insurance (BFSI) are creating cutting-edge solutions that incorporate artificial intelligence (AI) powered data analytics, aimed at enhancing decision-making processes and personalizing customer experiences. Here, AI-powered data analytics refers to the application of AI to quickly and effectively analyze large quantities of data. This helps financial institutions to discover trends, spot irregularities, and predict outcomes with increased accuracy. For example, in March 2024, TransUnion, a US-based comprehensive credit protection service, introduced OneTru. This solution integrates diverse data and analytic resources connected to credit risk, marketing, and fraud prevention into a singular, layered, and unified ecosystem. This allows TransUnion to offer a more precise, all-encompassing, and compliant view of consumers across various use cases. OneTru utilizes AI and machine learning to form knowledge graphs that enhance identity resolution by linking structured data like offline IDs with unstructured data such as behavioral details and device attributes. This enhances fraud detection and reduces false alarms.

Which growth-oriented segments of the augmented analytics in banking, financial services and insurance (bfsi) market are leading the industry's development?

The augmented analytics in banking, financial services and insurance (BFSI) market covered in this report is segmented -

1) By Type: Solution, Service

2) By Deployment Model: On-Premises, Cloud-Based

3) By Organization Size: Large Enterprises, Small And Medium-Sized Enterprises (SMEs)

4) By Application: Risk Management, Fraud Detection and Prevention, Customer Analytics, Compliance Management, Performance Management, Other Applications

Subsegments:

1) By Solution: Advanced Analytics Solutions, Data Visualization Tools, Artificial Intelligence (AI) And Machine Learning (ML) Solutions, Natural Language Processing (NLP) Solutions, Cloud-Based Analytics Platforms

2) By Service: Consulting Services, Integration And Deployment Services, Support And Maintenance Services

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18230

What regions are leading the charge in the augmented analytics in banking, financial services and insurance (bfsi) market?

North America was the largest region in augmented analytics in the banking, financial services, and insurance (BFSI) market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the augmented analytics in banking, financial services and insurance (BFSI) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What companies are at the forefront of innovation in the augmented analytics in banking, financial services and insurance (bfsi) market?

Major companies operating in the augmented analytics in banking, financial services and insurance (BFSI) market are Microsoft Corporation, Dell Technologies, accenture*, International Business Machines Corporation, Goldman Sachs, Oracle Corporation, SAP, Salesforce.com inc., NTT DATA Inc., Fiserv Inc., Experian Information Solutions Inc., Red Hat Inc., SAS Institute Inc., Hitachi Vantara LLC, NICE Actimize, Teradata, Informatica Inc., FICO, TIBCO, Cloudera Inc., Domo Inc.

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=18230&type=smp

What Is Covered In The Augmented Analytics In Banking, Financial Services And Insurance (BFSI) Global Market Report?

•Market Size Forecast: Examine the augmented analytics in banking, financial services and insurance (bfsi) market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the augmented analytics in banking, financial services and insurance (bfsi) market for a structured understanding.

•Key Players Overview: Analyze major players in the augmented analytics in banking, financial services and insurance (bfsi) market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the augmented analytics in banking, financial services and insurance (bfsi) market.

•Segment Contributions: Evaluate how different segments drive overall growth in the augmented analytics in banking, financial services and insurance (bfsi) market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the augmented analytics in banking, financial services and insurance (bfsi) market.

•Industry Challenges: Identify potential risks and obstacles affecting the augmented analytics in banking, financial services and insurance (bfsi) market.

•Competitive Landscape: Review strategic developments in the augmented analytics in banking, financial services and insurance (bfsi) market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Prominent Augmented Analytics In Banking, Financial Services And Insurance (BFSI) Market Trend for 2025: AI-Powered Solutions Enhance Decision-Making And Personalization In BFSI Sector here

News-ID: 3922889 • Views: …

More Releases from The Business Research Company

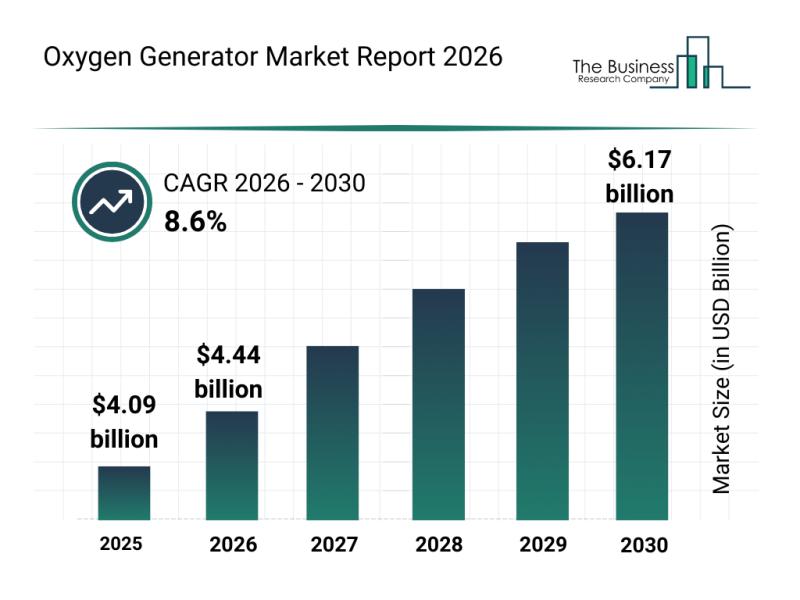

Worldwide Insights: The Rapid Development of the Oxygen Generator Market

"The oxygen generator market is positioned for significant expansion over the coming years, driven by diverse industrial and healthcare demands. With advancements in technology and increasing applications across various sectors, this market is set to witness robust growth as it adapts to evolving needs and innovations.

Projected Expansion and Market Size of Oxygen Generators Through 2030

The oxygen generator market is anticipated to grow steadily, reaching a value of $6.17 billion…

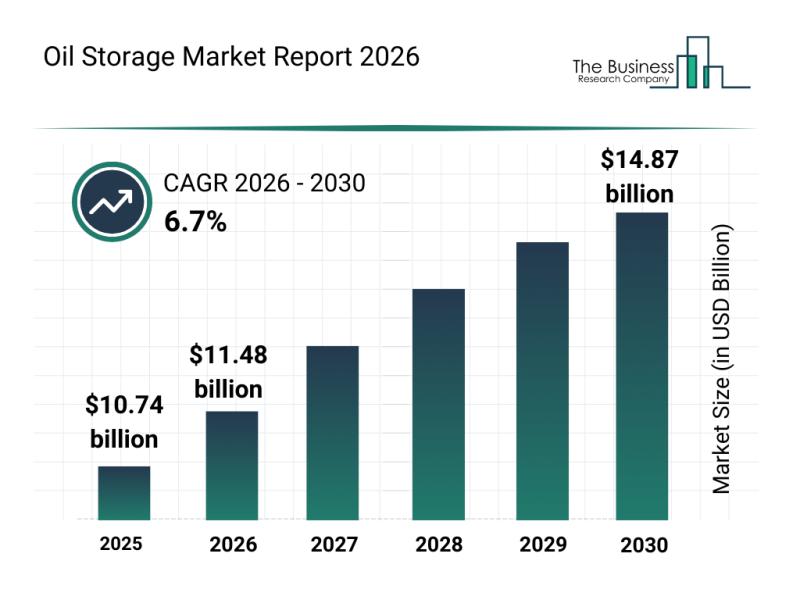

Segmentation, Major Trends, and Competitive Overview of the Oil Storage Market

"The oil storage sector is poised for notable expansion in the coming years, driven by increasing global energy needs and infrastructure development. As demand for efficient and secure storage solutions grows, the market is evolving with advanced technologies and strategic initiatives designed to meet the challenges of modern oil consumption and reserves management. Here's an overview of the market size, key players, emerging trends, and segmentation that define this industry's…

Worldwide Trends Examination: The Fast-Paced Development of the Motion Control M …

The motion control market is poised for significant expansion as industries increasingly adopt advanced automation technologies. With rising investments and technological breakthroughs, this sector is set to transform manufacturing and related fields by 2030. Let's explore the market's size, leading companies, emerging trends, and segment forecasts to understand its evolving landscape.

Expected Growth and Market Size of the Motion Control Market by 2030

The motion control market is on track for…

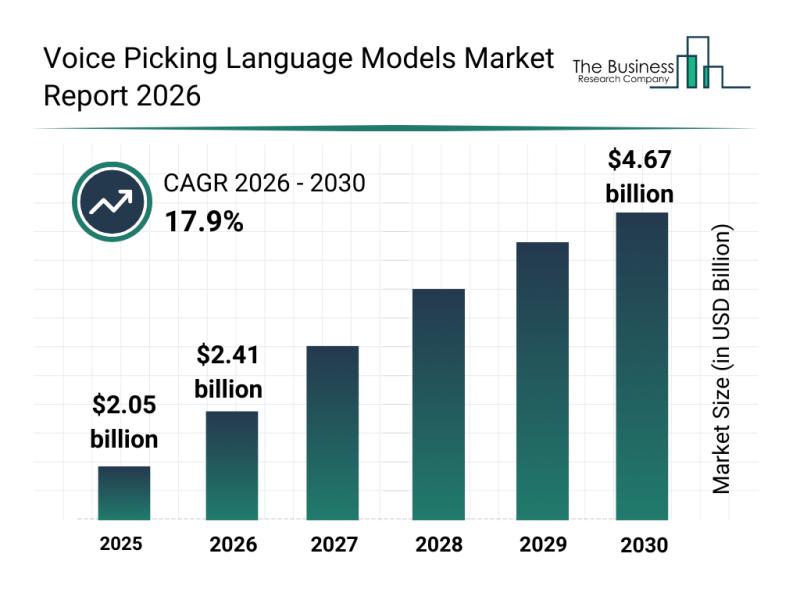

Global Trends Overview: The Rapid Evolution of the Voice Picking Language Models …

The voice picking language models market is poised for significant expansion in the coming years, driven by technological advancements and increasing adoption in logistics and warehouse environments. This sector is rapidly evolving as businesses prioritize efficiency and accuracy in their operations. Let's explore the market's size, growth factors, key companies, segmentation, and emerging trends shaping its future.

Projected Market Size and Growth Trajectory for the Voice Picking Language Models Market …

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…